A car pawnshop is an institution that provides financial services based on the principle of pledging a car. If you need funds and have a spare car, a car pawn shop can be a great option for getting a loan or loan. Here are a few key aspects to know about operating a car pawnshop:

1. Principle of Operation: A car pawnshop issues a loan secured by a car. You bring your car to a pawn shop, they evaluate its value, and they give you funds in the amount of a certain percentage of this value. Typically, after the loan is repaid, the car is returned to the owner.

2. Car Valuation: The car pawnshop evaluates the car, determining its current market value. The assessment depends on the make, model, year of manufacture and technical condition of the car.

3. Interest Rate and Terms: The terms of a car pawnshop loan include the interest rate for the use of funds and the loan term. Typically, the interest amount includes both a fixed percentage and appraisal and service fees.

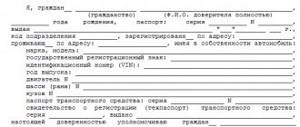

4. Documents and Rules: To obtain a loan, you will need to provide documents confirming ownership of the car, your identity and other necessary information. It is also important to familiarize yourself with the terms and conditions of the pawnshop.

5. Important Points:

- The pledged car must be registered to the borrower.

- A car loan can be one of the ways to obtain funds in case of temporary difficulties.

- Defaulting on your loan could result in the loss of your vehicle.

6. Pros and Cons:

- Pros: Quick receipt of funds, minimum documents, relative simplicity of the process.

- Cons: High interest rates, risk of losing the car if payment is not made.

Before contacting a car pawnshop, it is important to carefully read the terms and conditions and assess your financial ability to repay the loan on time.