Home / Family lawyer / Do you need a title for insurance?

• A copy of the vehicle owner's passport • Application for insurance payment • Certificate of an accident (original), issued by the police, or a notice of an accident, filled out and signed by all participants in the accident, if the event was registered without traffic police officers • Resolution on an administrative offense case or refusal in initiating a case. It is issued to you by a police officer when registering an accident • A copy of the vehicle passport (PTS) • A power of attorney from the owner of the vehicle, if you are not the direct owner of the car, but submit an application • A copy of the driver’s license of the person who was driving at the time of the incident • Receipts for payment for expenses associated with this accident: evacuation of the vehicle, place in the impound lot, etc.

Where should you start if you are involved in an accident? If you were injured in an accident, first of all contact the insurance company no later than 5 days after the accident, and the insurance company is obliged to transfer money to you within 30 days or write a reasoned refusal to pay.

However, it also happens that some companies try to shirk responsibility and, instead of sending money or a refusal in writing, respond to the client with a notification that they have not received this or that document. This is where the bureaucratic red tape begins, which inevitably leads to a loss of time and, in the end, to the fact that unscrupulous employees of such companies still manage to evade payments.

Regarding the inspection, it is better to ask for it to be carried out immediately, because this way the damage will be recorded on a date close to the date of the accident. Yes, something may happen to the damaged car while you are waiting for documents, in which case, without photographs, it will be difficult to determine and prove the amount of damage initially caused.

However, this situation can be used to your advantage. It's no secret that most drivers still want to receive payment under compulsory motor liability insurance instead of repairs. Providing a policy with an application for payment is an almost ideal way to receive money. In this case, according to the law, you are absolutely right, but the insurer with the requirement for a certificate is wrong. And if the insurer misses the deadline for issuing directions for repairs in this case, it gives the full right to compensation in monetary terms.

Resolution, definition and/or traffic police protocol

A large number of accidents occur every day on the roads of our country, and many drivers are faced with compensation under compulsory motor liability insurance for the first time. Having become involved in an accident, victims, as a rule, do not know what documents need to be submitted to the insurance company and are often forced to either resort to the help of lawyers who tell them how to properly apply for compensation, or run between the insurer and the traffic police. But not everyone has the opportunity to turn to specialists for help, or the time, so in this article we will tell you in detail what papers and in what cases victims will need.

In this regard, most insurance companies allow you to expand your MTPL policy with a DSAGO policy (additional insurance policy). Typically, the cost of such a policy is significantly less than compulsory motor liability insurance (for example, insurance companies have promotions that allow you to issue this policy for 100 - 200 rubles), however, compulsory motor liability insurance significantly expands the insurance payment - up to 1,000,000 rubles or more. Naturally, the conditions in different insurance companies may differ significantly.

You might be interested ==> Living wage for low-income families in 2021 in Cheboksary

Will the vehicle be restored without insurance?

Be sure to take your compulsory civil liability insurance policy with you to the traffic police.

Most likely, you won’t need it at the initial stage, but it’s still worth having it with you just in case. Will the vehicle be restored without insurance Application form for the restoration of the title To restore the title, you must collect the established package of documents.

Get qualified help right now! Our lawyers will advise you on any issues out of turn.

Documents for MTPL in 2021 - what documents are needed for MTPL. Rules and procedure for registration

As soon as you buy a car that suits your taste, you can’t fully get behind the wheel right away. Once a vehicle is purchased, the driver is automatically responsible for registering and insuring his or her property.

In order to register a car, you must first take out MTPL insurance, but no later than 10 days after purchase. The Federal Law of April 25, 2002 No. 40 – Federal Law informs us about this.

When the right to own a vehicle arises (acquiring ownership of it, receiving it for economic or operational management, etc.), the owner of the vehicle is obliged to insure his civil liability before registering the vehicle, but no later than ten days after the right to own it arises. (as amended by Federal Law dated July 1, 2011 N 170-FZ)

Consequently, you can drive solely on the purchase and sale agreement, and rewrite it every 10 days, but this is not enough for full ownership of the vehicle.

According to the rules for issuing an MTPL policy, from April 1, 2015, in order to insure your movable property, you must enter into an agreement with the insurer.

Compulsory insurance is carried out by vehicle owners by concluding compulsory insurance contracts with insurers, which indicate the vehicles whose owners' civil liability is insured.

If you purchased a car for the first time, you probably have a question: what documents are needed to apply for an MTPL policy in 2018? In order to answer this question, we turn again to the relevant legislation.

note: Federal Law No. 130-FZ dated July 28, 2012 establishes that until August 1, 2015, when concluding a contract of compulsory civil liability insurance for vehicle owners, along with a diagnostic card containing information about the vehicle’s compliance with mandatory vehicle safety requirements, it is allowed to present a coupon technical inspection or a certificate of passing the state technical inspection of a vehicle, issued before the date of entry into force of this Law.

f) a diagnostic card containing information on the vehicle’s compliance with mandatory vehicle safety requirements (except for cases where, in accordance with the legislation in the field of technical inspection of vehicles, the vehicle is not subject to technical inspection or is not required, or the procedure and frequency of technical inspection inspection are established by the Government of the Russian Federation, or the frequency of technical inspection of such a vehicle is six months, as well as in the cases provided for in paragraph 3 of Article 10 of this Federal Law). (clause “e” as amended by Federal Law dated July 28, 2012 N 130-FZ)

As we see above, the list is not complicated enough, but for your convenience, we decided to list them separately.

zakon-auto.ru

Situations in life may turn out to be such that you will have to get car insurance without a title. Not all companies will insure a car that does not have a registration certificate. Car insurance implies the presence of a title and an STS of the vehicle. But some credit institutions have simplified the insurance procedure by reducing the number of required documents.

The owner of the car or the person who has a general power of attorney for it must insure the car. Otherwise, you will be refused to sell the policy.

Rosgosstrakh is the largest organization in the insurance market, which does not require the presentation of PTS at the time of registration of insurance. OSAGO can be issued by submitting three documents to the company’s office: the car owner’s passport, his valid driver’s license and the vehicle registration certificate of the insured car. If the policyholder and the car owner are different people, then both passports must be presented. The only exception is CASCO – for its registration, the presence of a vehicle title is required.

It is important to know: in order to purchase an MTPL policy, you must have a valid certificate of passing a technical inspection or an international maintenance coupon. These documents can be replaced by a vehicle diagnostic card.

If you bought a vehicle, then you have 10 days to undergo maintenance and purchase an MTPL policy, during which you can operate the car without these documents. After 10 days, you may be subject to legal penalties for driving without insurance.

Some insurance companies can issue you insurance based on a copy of the vehicle's registration certificate. It must be notarized no later than 14 days before purchasing the insurance policy. Car insurance without a title is possible. You just need to choose the right insurance company that does not require a registration certificate when selling a policy.

Such a transaction is easy to complete, but auto experts believe that buying a car from a company is complicated by some risks. The future owner should not only monitor the legality of the transaction, but also check the legal purity of the documents for the car.

avtolombard-info.ru

To register a vehicle with the State Traffic Safety Inspectorate, you must first undergo a technical inspection - get a diagnostic card (vehicles under 3 years old do not need this!), and then take out an OSAGO insurance policy (Compulsory Motor Liability Insurance)!

Moreover, according to the new traffic police inspector does not have the right to demand the presentation of a technical inspection (diagnostic card) for inspection! This means that if you have an insurance policy that you will have to present at the request of the traffic police inspector, then you also have a technical inspection!

It is impossible to issue an insurance policy according to the law without a valid MOT, but there are agents who have their own “vision” on this!

As for the payment under compulsory motor liability insurance, upon the occurrence of an insured event, in the event of your innocence in an accident, you can receive it, since the absence of a vehicle maintenance (Technical Inspection) coupon or, more precisely, a new diagnostic card is not a necessary document for the victim!

But if you are the culprit of an accident and without maintenance, then everything is horribly opposite, the insurance company will have to pay the amount of damage caused by you to the victim, and then, as a recourse, recover this amount from you, either voluntarily or in court!

And we also strongly recommend that you take out a DSAGO policy (Voluntary Motor Liability Insurance), an extension of the MTPL policy to 500,000 rubles or up to 1,000,000 rubles or up to 1,500,000 rubles, costing around 1,000 rubles!! !

*Moreover, the DSAGO policy can be issued at another insurance company than the OSAGO policy and from any date, it will simply be valid until the end of the main OSAGO policy!

*120,000 rubles in the event of an insured event may simply not be enough to pay the cost of restoration of the damaged car (cars) as a result of an accident!! !

PS It is also necessary only in a “branded” company, so that later in case of “something” there is someone to recover from!! !

And finally, in order to receive funds from the insurance company and/or the culprit of the accident (cause of harm) in full upon the occurrence of an insured event, see our website “Procedure for conducting an independent auto examination”!

Sale of diagnostic cards (technical inspection) Online technical inspection We have been working throughout Russia for more than two years and are ready to share our success with you

otvet.mail.ru

Do you need to register your car first, and then insure it, or vice versa?

To register a vehicle with the State Traffic Safety Inspectorate, you must first undergo a technical inspection - get a diagnostic card (vehicles under 3 years old do not need this!), and then take out an OSAGO insurance policy (Compulsory Motor Liability Insurance)!

Moreover, according to the new traffic police inspector does not have the right to demand the presentation of a technical inspection (diagnostic card) for inspection! This means that if you have an insurance policy that you will have to present at the request of the traffic police inspector, then you also have a technical inspection!

It is impossible to issue an insurance policy according to the law without a valid MOT, but there are agents who have their own “vision” on this!

As for the payment under compulsory motor liability insurance, upon the occurrence of an insured event, in the event of your innocence in an accident, you can receive it, since the absence of a vehicle maintenance (Technical Inspection) coupon or, more precisely, a new diagnostic card is not a necessary document for the victim!

But if you are the culprit of an accident and without maintenance, then everything is horribly opposite, the insurance company will have to pay the amount of damage caused by you to the victim, and then, as a recourse, recover this amount from you, either voluntarily or in court!

And we also strongly recommend that you take out a DSAGO policy (Voluntary Motor Liability Insurance), an extension of the MTPL policy to 500,000 rubles or up to 1,000,000 rubles or up to 1,500,000 rubles, costing around 1,000 rubles!! !

*Moreover, the DSAGO policy can be issued at another insurance company than the OSAGO policy and from any date, it will simply be valid until the end of the main OSAGO policy!

*120,000 rubles in the event of an insured event may simply not be enough to pay the cost of restoration of the damaged car (cars) as a result of an accident!! !

PS It is also necessary only in a “branded” company, so that later in case of “something” there is someone to recover from!! !

And finally, in order to receive funds from the insurance company and/or the culprit of the accident (cause of harm) in full upon the occurrence of an insured event, see our website “Procedure for conducting an independent auto examination”!

Sale of diagnostic cards (technical inspection) Online technical inspection We have been working throughout Russia for more than two years and are ready to share our success with you

otvet.mail.ru

Apply for compulsory motor liability insurance: what documents are needed for registration

Why do you need a diagnostic card? It confirms that the car has passed technical inspection and can be driven on the roads of the country.

You need to undergo an inspection and receive a diagnostic card from the OTO - technical inspection operator. You can view the register of accredited technical inspection operators on the RSA website.

It contains all the necessary information about the car and its owner. To restore STS, you need to visit the state. traffic police. How to restore a PTS without the owner: price and timing of the issue The presence of a PTS gives the owner the opportunity to dispose of this property in different ways.

A car owner who discovers the absence of a title must immediately take measures to invalidate the lost document. This will protect it from unpleasant consequences if the passport falls into the hands of fraudsters and criminals. Restoring a PTS if lost: documents, deadlines, possible problems This is: Now you can submit all documents to the reception window.

Restoration period The procedure for restoring a PTS, if no additional checks need to be carried out, usually takes a little time - 1 day. In situations where these checks are necessary, the period for obtaining a duplicate PTS can be extended to 30 days from the date of application.

As practice shows, the owner of a car is not always its real owner. Often one person buys a car, and a completely different person drives it (for example, a wife, son, other relatives, etc.). When applying for a compulsory car insurance policy in such cases, the question arises: can a person who is not the owner of the car apply for compulsory motor liability insurance? After all, there is still an opinion among drivers that a car insurance policy is always issued only to the formal owner of the car.

However, this opinion is wrong. The policyholder and the owner are different persons under compulsory motor liability insurance when taking out a policy. In the form itself, 2 separate columns are allocated for them. This means that another person can apply for compulsory motor liability insurance without the owner. This can be any driver authorized to drive a car. Thus, the presence of the owner when registering compulsory motor liability insurance is not mandatory at all.

However, his name fits into the auto insurance policy. The policyholder is the person who entered into the MTPL agreement and, accordingly, made the payment. He automatically becomes a driver included in the auto insurance policy, that is, he is covered by insurance. For the owner of a car, when applying for compulsory motor liability insurance not in the name of the owner, it is not necessary to enter the policy as a driver.

In addition, when registering compulsory motor liability insurance not for the owner of the car, all further changes to the auto insurance policy are made by the policyholder, and not the owner. That is, when the policyholder needs, for example, to add several more drivers to the car registration, then it is he who needs to go to the insurance company, and not the formal owner of the car.

It is also possible to issue a policy not in the name of the owner if you purchase compulsory motor liability insurance in electronic form.

Any driver who has a power of attorney from the owner of the car can apply for compulsory motor liability insurance without the owner of the car. This does not have to be a general power of attorney written by a notary; a handwritten version is sufficient. In addition, to register compulsory motor liability insurance under a power of attorney, the following documents are required:

- Driver's licenses of those who will drive the car (if several drivers are planned, with a limited number);

- Passport of the policyholder and a copy of the passport of the car owner;

- Car documents (car title and registration certificate);

- Previous auto insurance policy;

- Directly, the power of attorney itself to conclude the MTPL agreement.

It is not the owner of the car who can apply for compulsory motor liability insurance. But in this case, it is the owner of the car who receives monetary compensation. In this case, it is also possible not to disturb the owner under compulsory motor liability insurance by proxy. But to do this, you need to write out a notarized power of attorney, and not necessarily for the policyholder, which must include the right to receive insurance compensation.

revizorro.ru

Before going to the office of the insurance company to conclude a compulsory motor liability insurance contract, it is better to find out what documents are needed for compulsory motor liability insurance. Knowing this, you can save both time and effort. The answer to the question: “What documents are needed for compulsory motor liability insurance?”, as well as recommendations for registration, you will receive below.

In order to issue a compulsory motor liability insurance policy, you, of course, will have to provide your insurance company with a certain list of documents.

- Passed and still valid technical inspection of the vehicle. A technical inspection is completed using a diagnostic card. It is important to emphasize that there may be several options for undergoing a technical inspection. Firstly, you can undergo a technical inspection yourself at any service station that provides such services. Secondly, get examined at a service station with which your insurance company cooperates. It is important to note that if an insurer insists on undergoing an inspection at a specific company, then this is prohibited by law and since 2014, sanctions have been introduced for forcing clients to enter into additional contracts, without which they will refuse to issue an MTPL policy, in the amount of 20-50 thousand rubles. It should also be said that if you have just purchased a car, then you have only 10 calendar days to carry out a technical inspection and issue an MTPL policy, during which you are allowed to operate the car without insurance. After this time, legal sanctions may be applied to you for driving without compulsory motor insurance.

- Technical passport of the vehicle and certificate of registration. For newly purchased vehicles that have not yet been registered, it is necessary to provide a vehicle passport.

- Passport of a citizen of the Russian Federation, a foreign citizen or another document replacing a passport for foreign citizens. Here it should be said that if the policyholder and the car owner are different persons, then the passports of both are required.

- Driver license. This document must be present not only if the policy is issued for one person, but also if this is done for several persons who will fit into the insurance policy. However, if you plan to issue an insurance policy for an unlimited number of people, then rights will not be needed.

- If you are obtaining an insurance certificate for a car that you are not the owner of, then in addition to the set of documents already listed, you may also need a power of attorney. Of course, the power of attorney has already noticeably lost its position, however, if you do not have the car owner’s passport in your hands, then the power of attorney may well come in handy.

Why does the insurance company need copies of my passport and license to issue compulsory motor liability insurance?

d) a vehicle registration document issued by the body that registers the vehicle (vehicle passport, vehicle registration certificate, technical passport or technical coupon or similar documents);

We recommend reading: The Chernobyl survivor’s book was published in 1998, what does it give?

I don't understand at all. Why the hell is this necessary? They justify it by saying that I suddenly provided incorrect information? But if I provide incorrect information, this is my problem, and for the insurance company this is another reason to refuse payment. So without copies it’s more profitable for them than for me.

How to file an accident under the e-OSAGO policy

From the point of view of the law, the electronic MTPL policy is no different from the paper version. It has a number, a series, and it contains all the necessary information to register an accident.

If you have e-OSAGO, but you have not printed out and do not take the policy with you, then to register an accident you will need access to your personal account on the insurance company’s website. Make sure you always have a smartphone or tablet with Internet access at hand.

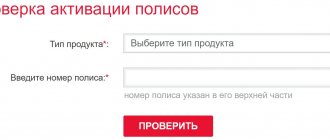

After you have issued and paid for an e-OSAGO policy, it is recommended to check its validity using the RSA database.

To check, go to the service page for viewing information about the MTPL agreement. Enter the vehicle VIN and registration plate. The result of a successful check is a report containing the policy number and company name.

If the policy data in the PCA database does not match yours or the verification did not pass at all, then most likely you were sold a fake policy. Contact the insurance company on whose behalf the policy was issued to you.

You most likely will not be able to get your money back for a fake policy. Write an application to the RSA with all the details of issuing a fake policy. At the very least, this will help block the fraudulent site and save other motorists money.

And remember that you cannot drive with a fake policy. Therefore, first of all, take out a real MTPL policy.

Pts – why does the insurance company require it and is it needed?

And then, you don’t need to think about how to find the time and desire to go home or to the bank, where you need to wait several days to receive a regular copy. Since more and more cars are purchased on credit, and banks simply do not give anything.

There is only one piece of advice: if the insurance company requires a passport for a vehicle, then you need to provide it. Original or notarized copy – it’s up to you. Today, insurance companies do not always require originals, this can also be taken into account; sometimes a simple copy lying around among the papers in your briefcase is quite enough. You don’t give it away, you provide it as proof of ownership of movable property (vehicle), and an insurance company employee will already make at least ten copies of it, as long as you agree.

Remember

- All insurance companies licensed for compulsory civil liability insurance are required to issue e-OSAGO.

- To issue an electronic policy, a motorist needs to register in his personal account on the insurer’s website and fill out an application for insurance.

- You can pay for e-OSAGO by credit card on the insurance company’s website.

- The electronic policy must be printed and taken with you.

- Check the authenticity of the site through the list on autoins.ru, and the authenticity of the policy - in the RSA service for checking information about the MTPL agreement.

A person who owns a car may not use it himself, but give it, for example, to his wife. Questions arise: “Is it possible to issue compulsory motor liability insurance not for the owner and if so, what documents are needed and does this affect the cost of the policy?” The answers to them are presented below. Contents of the article ○ How to insure a car under MTPL without the owner.

✔ For an individual.✔ For a legal entity. ○ What documents need to be provided when registering compulsory motor liability insurance without the owner. ○ Procedure for registration of compulsory motor liability insurance. ○ Taking out a compulsory motor liability insurance policy when purchasing a used car. ○ OSAGO when selling a car. ○ OSAGO for a new car. ○ How to insure a car under MTPL without the owner.

✔ For an individual. Many people believe that compulsory motor liability insurance can only be issued to the owner of the car. However, this opinion is erroneous. In fact, the owner and the policyholder are two different persons and each of them has a separate column in the policy. This suggests that yes, compulsory motor liability insurance can be issued not in the name of the owner.

The only requirement is that the person must be allowed to drive a vehicle. The cost of the policy will be the same in any case - both if it is issued to the owner of the car and if it is issued to someone else.

Only the policyholder can make changes to the policy. To do this, he will need a power of attorney from the owner.

It is not difficult to arrange it.

Cars that do not require an MTPL policy

5. Diagnostic technical inspection card , which is valid for at least 1 day. For new cars less than 3 years old, a diagnostic card is not required.

What documents are needed to obtain an MTPL policy?

If your car is not included in the above list, then you should visit the insurance company to obtain an MTPL policy. In this article, I will not give any advice on choosing an insurance company, because... It is quite difficult for an untrained person to assess the reliability of insurers.

In addition, additional requirements for payment may be made if various other expenses were incurred. You can see all these expenses and documents that need to be presented in case of an insurance event under MTPL in the Insurance Rules in Chapter 3.

Remember

- All insurance companies licensed for compulsory civil liability insurance are required to issue e-OSAGO.

- To issue an electronic policy, a motorist needs to register in his personal account on the insurer’s website and fill out an application for insurance.

- You can pay for e-OSAGO by credit card on the insurance company’s website.

- The electronic policy must be printed and taken with you.

- Check the authenticity of the site through the list on autoins.ru, and the authenticity of the policy - in the RSA service for checking information about the MTPL agreement.

Price of the procedure

Changing the PTS is a paid service, but only a state fee is charged; at the traffic police department itself and on the State Services website you will not have to pay anything besides it. Now the fee is 800 rubles, but when registering through the State Services portal, a 30% discount is provided, so the fee will be 560 rubles.

Related article: Procedure if the insurance company has paid little under compulsory motor liability insurance

What you need for car insurance

According to the law, its absence entails a fine. Execute compulsory motor liability insurance: what documents are needed for registration Before going to the office of the insurance company to conclude a compulsory motor liability insurance contract, it is better to find out what documents are needed for compulsory motor liability insurance.

The consequences of an accident are very expensive for vehicle owners. In order to minimize your own costs for restoring the operational potential of a car, it is advisable to resort to the implementation of a compulsory insurance program.

What is a car title and why is it needed?

When buying a car secondhand, you need to be careful: first of all, check the presence of the title and its authenticity. Some scammers manage to sell a credit car using a copy of the title - of course, such a transaction will be declared invalid in any court, and the rights to the new owner’s car will be revoked.

Those who buy a used car receive a title for it from the previous owner and enter their name there in the traffic police. For cars that were purchased abroad, the PTS is issued by the customs authority that authorized its import.

We recommend reading: Heating benefits for labor veterans in the Arkhangelsk region in 2021