Quite often, a car is purchased by one person and operated by another.

In order not to waste time on re-registration of property rights, the legislation of the Russian Federation provides the opportunity for the owner of a vehicle to entrust the driving of the car to another person.

In this case, the question becomes relevant: who can be the insured under compulsory motor liability insurance, and whether it is possible to obtain insurance for someone other than the owner of the car.

First of all, you should figure out who the insured is in the MTPL policy. He is the person who enters into a compulsory motor liability insurance agreement with an insurance company.

The policyholder pays money for insurance and makes the necessary adjustments in the future. He has the right to change the period of use, add new drivers, receive a duplicate of the policy, and the like.

Amendments were made to the rules of compulsory motor liability insurance, the provision of the law in relation to persons who issue insurance policies has changed.

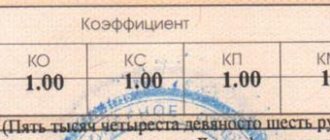

The policyholder and the owner of the vehicle are different persons under compulsory motor liability insurance. The insurance form contains two separate columns for them, which confirms the right for another person to take out the policy. This can be any driver authorized to drive a vehicle.

In accordance with the law, a party to the contract may be:

- the owner himself;

- his confidant;

- a driver who operates a vehicle by proxy;

- a close person or just an acquaintance.

Thus, the insured under the MTPL policy may not be the owner of the car. In this case, a person does not have to have a notarized power of attorney for him.

One person can be the policyholder, another can be the owner, and a third person can drive the insured vehicle.

The law does not specifically specify whether it should be an individual or an organization. Any person has the right to insure a car.

The policyholder must simply perform his simple duties:

- Provide truthful information, valid documents or photocopies thereof. They are needed for the correct calculation of the insurance premium and the conclusion of the MTPL contract.

- Make timely necessary changes to the policy if necessary during the year.

Who is the policyholder

In accordance with Art. 5 of the said federal law, legal entities and citizens who have entered into an insurance agreement with insurance companies are recognized as policyholders. The policyholder and the insurer enter into an insurance agreement between themselves.

Brobank: in this case, in relation to individuals, the law indicates the mandatory occurrence of legal capacity. The law does not describe any requirements for legal entities in this regard. Consequently, the policyholder is the client of the insurance company who has entered into an insurance agreement.

For example, in the most popular and compulsory type of insurance, which is recognized as compulsory motor liability insurance, the insured in most cases is the owner of the vehicle. In this case, the insurer is the insurance company that issued the compulsory insurance policy.

The insurer is always a legal entity that has the appropriate license to carry out insurance activities. In this regard, the law clearly indicates the inadmissibility of providing insurance services without inclusion in a special register of organizations maintained by the Russian Union of Insurers (SRO of insurers).

Who can be the policyholder

If we consider individuals, then only fully capable persons can be policyholders. According to the legislation of the Russian Federation, a person’s full legal capacity occurs simultaneously with the age of majority. Consequently, only citizens who are over 18 years old at the time of signing the contract can enter into transactions with insurance companies, brokers and other market operators.

At the age of 14-17 years, a citizen is recognized as partially capable. In certain types of insurance, he can act on his own behalf, but with the written permission of his legal representatives. The parents of a minor or his/her current guardians are most often considered as legal representatives.

In addition, foreign citizens and organizations temporarily or permanently staying in the Russian Federation can act as a client of the company. Persons who do not have Russian citizenship enjoy the full range of rights and obligations in insurance on an equal basis with citizens of the Russian Federation without any restrictions.

Also, the policyholder can be any person who is not the owner of the property and has in hand the relevant documents proving the authority to act in the interests of the owner of the insurance object. The type of insurance is also key here: for certain types of insurance, clients must meet some additional requirements.

Who cannot be an insured

Based on the above, a minor cannot act as an insured. also imposed on persons recognized by law as having limited legal capacity or completely incompetent. Such persons cannot enter into civil agreements, since they cannot give an objective assessment of their decisions and actions. In addition to the above cases, the legislation provides for the following:

- Lack of a general passport - for citizens of the Russian Federation.

- Illegal presence on the territory of the Russian Federation - for foreign citizens.

- Lack of title documents - for most types of insurance, the policyholder must present documents for the object.

- Action without notifying the owner of the object.

- Location outside the territory of the Russian Federation.

The insurance company has the right to refuse to conclude an agreement for other reasons that do not contradict current legislation. But companies rarely refuse, only in exceptional cases. Any negative decision affects the amount of profit received, so refusals are primarily not beneficial for the insurers themselves.

Information

If the pledgor is responsible only for the correctness of the information provided, then the owner bears full responsibility for the behavior of the car on the road, he is a participant in the road process. But, if the car becomes an unwitting participant in a traffic accident, the owner, and not the policyholder, receives the insured amount or its material component. Although he appoints a beneficiary. The main powers of both can be summarized as follows:

- the policyholder changes the list of drivers;

- reissues the insurance policy when the owner changes;

- extends the validity of the policy;

- terminates the insurance contract and has the right to replace the owner;

- receives the unused portion of the insurance;

- makes technical changes that arise, adjusts the purpose of using the product.

The owner’s powers are determined by the process of driving on the road, such as:

- draws up and writes a statement about the occurrence of an insured event;

- makes a decision on covering the damage - repairs or monetary payment;

- makes claims related to the duration or quality of repairs or the amount of compensation;

- signs the insurance certificate and other similar documents.

Naturally, if the policy holder and the owner are the same person, such a separation of functions does not occur.

Thus, if the owner or authorized representative gets into an accident for which he is found guilty, the insurance company is obliged to cover the expenses of the injured motorist.

In this case, the amount of damage may well be covered by payment from the insurer. If you do not issue an insurance policy in a timely manner, the traffic police inspector who discovered this defect will be required to draw up a report and issue a fine.

In this case, the question becomes relevant: who can be the insured under compulsory motor liability insurance, and whether it is possible to obtain insurance for someone other than the owner of the car.

First of all, you should figure out who the insured is in the MTPL policy.

He is the person who enters into a compulsory motor liability insurance agreement with an insurance company. The policyholder pays money for insurance and makes the necessary adjustments in the future.

Rights and obligations of the policyholder

The policyholder is a client of the company who wants to insure his property, liability, life and health, and other tangible and intangible assets. The legislation does not indicate any restrictions in terms of insurance objects. Insurance companies have complete freedom of action in this regard. In fact, the object of insurance can be any material or intangible benefit that is of a certain value to the insured. In addition, the policyholder has the following set of rights and preferences:

- Receiving compensation in the event of an insured event.

- Request for any documentation – on paper and (or) electronic media.

- Obtaining information on your insurance case.

- Involvement of experts to resolve controversial situations.

- Early termination of the agreement.

- Free choice of insurance company.

- Appeal to SRO or judicial authorities - in case of disagreements with the insurer.

Additional rights may be established in a separate agreement. The list shows only the basic preferences of the policyholder, which cannot be revised or reduced by the insurance company, regardless of the subject of the insurance agreement. The main responsibilities of the policyholder include:

- Timely payment of the insurance premium - the full cost of the policy.

- Compliance with the procedure and terms of treatment in the event of an insured event.

- Providing the insurer with complete data to calculate the amount of compensation.

- Admission of experts to the insurance object to carry out assessment activities.

- Notification of the company about any transformations of the object that directly affect its assessed value.

Additional responsibilities may be established for each type of insurance. For example, in the case of compulsory motor liability insurance, policyholders are required to comply with the deadlines for concluding an agreement. Otherwise, vehicle owners are subject to an administrative fine. With mortgage insurance, the section with responsibilities can consist of a huge number of contract clauses, each of which must be complied with without fail.

Policyholder, owner, beneficiary – one person or not

In accordance with the current procedure, the insured may not be the owner of the insurance object. It is enough to consider the example of compulsory motor liability insurance, when any person who has documents for a car can contact the insurance company. A power of attorney and other additional documents are not required - only a standard package for the car and documents of the person who contacted the insurer.

Beneficiary is the person who receives compensation in the event of an insured event. It is the owner of the insured object, unless otherwise provided by law. Consequently, the beneficiary can be either the policyholder himself or the person who legally owns the insured property.

Is it possible to legally insure a car without an owner?

By taking out a compulsory motor liability insurance policy, the driver is insured against the costs necessary to cover the damage caused to him as a result of a traffic accident. Thus, if the owner or authorized representative gets into an accident for which he is found guilty, the insurance company is obliged to cover the expenses of the injured motorist.

In this case, the amount of damage may well be covered by payment from the insurer. If you do not issue an insurance policy in a timely manner, the traffic police inspector who discovered this defect will be required to draw up a report and issue a fine.

Possible insurance schemes

In the vast majority of cases, the policyholder, owner and beneficiary are one person. A person (organization) who is the owner of an object contacts the company on his own behalf, enters into an agreement, and pays the amount of the insurance premium. The same citizen will subsequently have the right to receive insurance compensation.

Less commonly observed is a scheme in which the policyholder is not the owner, but another person is the beneficiary and owner. And it is very rare to encounter a scheme that provides for three different persons. In most cases, deprivation of the property owner's right to receive insurance compensation is associated with legal restrictions.

Example: a citizen who has the right to drive a vehicle, but is not the owner, contacts the insurance company. If an insured event occurs, this policyholder will not receive any compensation, since he, in fact, entered into an agreement with the company on behalf of the owner. When applying for compulsory motor liability insurance, this practice is considered extremely common.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Sources

- Official website of Rosgosstrakh

- garant.ru: The Bank of Russia has clarified who can be the policyholder when issuing an electronic OSAGO policy

Recommended for you

- Do cameras record the absence of a compulsory motor liability insurance policy?

- Insurance companies have lost their peace: the Central Bank introduces a new methodology for calculating the cost of damage and repairs under OSAGO

- The tariff corridor for the cost of compulsory motor liability insurance will expand

Igor Sharin Head of Content Department. Actively developed my skills in managing a large number of employees. Built the work of the copywriting department from scratch and achieved the set goals for the volume of texts. Under his leadership are authors and content managers.

(11 ratings, average: 4.8 out of 5)

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya