OSAGO - what is it?

Compensation for damage and risks provided for in MTPL insurance is the basic principle of insurance. There is such a term as “automobile liability”, which is determined by the provision of a policy that covers the actions of its owner in relation to other participants in the road process when an insured event occurs. For example, the owner of a car caused damage to someone else’s vehicle, or because of it, other participants in the accident on the road were injured, and in this case, all losses that need to be compensated are the responsibility of the insurer directly.

There are established limits on the amounts that an insurance company can pay:

- When compensating for damage to the car—RUB 400,000.

- For compensation for damage to health—RUB 500,000.

As you can see, the amounts are quite impressive, and in order to avoid compensation, insurance companies try in every possible way to reduce them.

Receiving payments

To receive a refund, write a statement in any form. The insurer will conduct an examination or inspection of the vehicle.

In addition to the application, provide the insurer with:

- passport;

- driver's license;

- documents for the car;

- notification of a traffic accident;

- bank account details;

- a copy of the protocol on the administrative offense;

Submit the documents to the insurance company in person or send by registered mail with a list of attachments and acknowledgment of receipt.

Within 20 days, the Investigative Committee must make a decision and notify it in writing.

Who is eligible for insurance compensation?

Various incidents occur on the road, and regardless of who the MTPL policy was issued for, who was driving the car and who actually is its owner, compensation will be paid to the following representatives:

- The owner of movable property, regardless of the fact that he was driving at the time of the accident.

- A person who has a power of attorney from the owner of the vehicle to pay compensation.

- To the heirs of the car owner if he died as a result of an accident.

Such rules, according to compensation payments, apply to cases where one of the cars was damaged in an accident. But what happens if an accident affects two cars and two of their owners at once?

Here's what:

- Payment of compensation from insurance agents, the amount of which is 50% of the full insurance.

- Refusal to provide insurance payments to two participants in an accident at once, if it was not possible to establish who was at fault for the incident. This is provided for in the Civil Code of the Russian Federation in Article 1083, which states that the payment of compensation in case of an accident occurs only after the owner’s guilt and the degree of the offense have been established. And if both drivers are at fault, then identifying which of them is the culprit is quite problematic.

If two cars and their owners were damaged in an accident, and the insurance company refuses to compensate for losses, then each of the car owners can go to court to establish and protect their rights.

How to get a cash payment under compulsory motor liability insurance instead of repairs?

Let's consider legal ways to refuse a trip to a car service center:

Asked to pay extra for spare parts or labor?

- Feel free to refuse and have the right to contact an independent expert if 20 calendar days have expired from the date of reporting the insured event. You have this right by law.

If you are informed that they will not meet the deadline within 30 days:

- This happens when technicians say that parts will take a long time to arrive. Write that you do not agree and you can call the appraisers.

If they do not give you a referral to an official dealer:

- This option is suitable for owners of new cars no older than 2 years, and the insurance company offers only “unofficial” ones to choose from. Also, if there is no official dealer in the city and they don’t want to pay for a tow truck.

If the fault is mutual:

- With the “surround”, everything is clear - you will definitely be asked to pay extra, because... Only 50% refund is due.

Receiving compensation in stages

Receiving compensation occurs in two ways:

- Giving money instead of repairs.

- Carrying out restoration work on the car and paying for it.

Which method to choose is a personal decision of the applicant.

Since 2014 and to this day, there have been innovations in the rules regarding compensation payments.

First of all, the changes affected the following points:

- If the damage to a car that was caused to it as a result of an accident is estimated at 400,000 thousand rubles, then compensation is paid in full, and not in relation to the degree of damage.

- If people were injured as a result of an accident, then each of them is owed 500,000 thousand rubles.

- If, as a result of an accident, the owner of the car died, then his heirs are due compensation in the amount of up to 500,000 thousand rubles. From this amount, 25,000 thousand rubles are immediately paid to pay for funeral services. The closest relatives of the deceased receive maximum compensation, and then divide it among themselves at their discretion.

- Car wear and tear should not exceed 80%. The degree of depreciation of the car body is calculated based on the warranty date, and tire replacement occurs only after the projector dimensions have been measured. Plastic parts of the car are calculated according to the maximum level of wear, and other parts are calculated depending on the age of the car.

ATTENTION !!! If, in 2021, instead of repairs, the applicant demands compensation in cash from his insurance company, he needs to contact the inspectorate and get from them a certain certificate, which must include all the main descriptions of the incident that occurred on the road.

For example, such a certificate indicates in what state the owner of the car was at the time of the accident, was in an alcoholic state, or violated traffic rules. But these are not all the descriptions that a certificate issued by the State Traffic Inspectorate may contain. Sometimes insurance companies require you to submit, so to speak, an extended certificate for consideration, which should describe all the small details of the accident that occurred.

When does the insurance company have the right to refuse?

A number of cases when payments under compulsory motor liability insurance are not made:

- If the contract specifies a limited number of persons and at the time of the accident the driver was not included in the insurance.

- Nature has been damaged.

- As a result of the accident, damage to property or health was caused not by the vehicle, but by uninsured cargo.

- The victim demands compensation for lost profits.

- The amount of compensation is greater than the maximum amount specified in the insurance contract.

- The damage was caused as a result of educational, sports or experimental activities, during loading or unloading operations, as well as on the territory of any organization.

What is extended help?

If the insurance company requires an extended certificate, it must contain the following data:

- Information about all participants in the incident.

- Information about the place of residence of car owners, their full initials and data indicated on the driver’s license, as well as vehicle numbers.

- Evidence that at the time of the road accident, both drivers were in adequate condition and were not under the influence of alcoholic beverages or drugs.

An extended certificate takes much longer to prepare than a regular one, but this is understandable, since it also contains more information. When an applicant demands from an insurance company to compensate for damages from an accident, certain problems may arise, since the insurer has every right to demand the opinion of the judicial authorities from its client. This can happen if fraudulent manipulation is suspected.

Regression under OSAGO

The law provides for cases when the insurance company compensates the harm to the injured party, after which it can make a recourse claim and through the court recover damages from the culprit of the accident :

- the driver was under the influence of drugs or alcohol;

- the culprit fled the scene of the accident;

- the damage was caused intentionally;

- the driver does not have a license to drive the vehicle;

- the incident occurred at a time not covered by the insurance contract.

But they do not always go to the Investigative Committee court in these cases. A peaceful resolution of the situation is not ruled out.

Europrotocol and its effect

The Europrotocol gives the right to register an accident using a standard and simple form. This is acceptable if no one was injured as a result of the incident, and both participants do not mind drawing up a report. As a rule, in such cases, all problems associated with an accident are resolved directly at the place where it occurred, and the presence of the police is not required. The amount of compensation in such situations cannot be more than 50 thousand rubles, and for residents of Moscow and St. Petersburg they can reach up to 400 thousand rubles. In order for compensation to be paid to the maximum extent, participants in an accident must provide the insurance company with all the details, video or photos, in which the damage to the cars can be clearly seen, for examination.

ATTENTION !!! OSAGO has clause 3.5, which states that both participants in the accident are required to draw up a notification about the accident, even though the inspection staff also draw up a certain protocol. In this case, each driver separately fills out his notice, in which he describes all the reasons for writing it. But, if two vehicles were injured in an accident at once, and there are no disagreements between their owners, it is possible to sign only one form.

There are times when the insurance company does not agree with the facts that were provided to them by the participants in the accident, and then they need to ask for help from experts.

Application deadlines for the driver

Often companies do not comply with the deadlines for payment of insurance under compulsory motor liability insurance if the client does not apply within the time established by law. Some people count the period from the accident itself, not taking into account that it begins from the moment the application is filed. Therefore, there is no point in delaying this after troubles on the road. If the driver himself cannot do this, representation of his interests by proxy is allowed. In 2019, the allotted period for collecting documents and visiting the office in person was reduced to 5 days. Previously, it was allowed to submit them within 2 weeks.

In this case, within the allotted time, you need to contact not the insurance company of the person responsible for the accident, but the one where the contract was concluded with the victim. This is also an important point that many people forget.

Other options for action in case of an accident

In the event of an accident, you can use an additional CASCO insurance policy. It requires that an employee of the insurance company be present at the scene of the accident. A representative of the company inspects the vehicle and assesses the extent of the accident. Afterwards, he proceeds to drawing up a protocol and notifies the insurance companies whose services are used by the participants in the accident. If, in the opinion of the accident assessor, it is necessary to invite the traffic police, then they are called to the scene of the incident, also study the situation and make an approximate projection of the accident that occurred, and this may be needed by insurance companies in the future. If, as a result of assessing the accident, the culprit is found, then administrative liability and a fine are imposed on him, as well as other sanctions, depending on the specific case.

Drawing a conclusion, we can establish that in order for the insurance company to make compensation after an accident, it is necessary:

- Notify the insurance company and traffic police representatives about the incident.

- Wait until they arrive at the scene of the accident.

- Receive a certificate of an accident, which is provided by traffic police officers. It is issued at the nearest service branch.

- Collect the necessary documents and submit them to the insurance company. If the documents are submitted by the culprit of the accident himself, then he must present all the necessary papers for study no later than three days after the incident occurred. If this is not done, the company that issued the insurance may exercise its legal right and resort to recourse.

Also, the following package of documents must be supported by:

- Applicant's passport.

- Driver's license.

- An identification number.

- Passport for the car.

- Certificate from the traffic police.

- Insurance policy.

- Conclusion of medical staff.

At the request of the insurance company, you may also need a power of attorney to drive a car if the driver was not the owner himself, as well as a statement of expenses incurred after the accident, which include tow truck services.

How it works now

To find out how you can “bypass” a referral for repairs and receive monetary compensation, you need to study the methodology itself in detail. If you get into an accident, you need to contact the insurance company with the policy to file a claim. Naturally, this is only possible if the person at fault has MTPL insurance. Without a policy from the person at fault for the accident, the insurer will not provide compensation in any form. You'll have to take the other driver to court.

Based on your application, the insurance company is obliged to review the case and assess the damage. One important rule applies here - the response to your case must be generated no later than 20 days after submitting the package of documents. In this regard, many recommend submitting the application and required documents in person against the signature of the manager or sending a letter with a delivery report. This will eliminate the possibility that the insurer allegedly did not receive any information.

Next, the insurance company, in most cases, offers the victim a choice of several service stations capable of carrying out the required repairs. As a rule, these are partner technical centers or service stations owned directly by the insurer. In rare cases, drivers may offer their own options. If they satisfy the requirements of the insurance company, then the car is sent to these workshops. When a car is less than 2 years old, it must be repaired at an authorized dealership. After all the agreements, the car owner receives a referral for repairs.

In fact, the referral has a certain validity period - 1-2 weeks. Having overdue it, car owners can receive a new referral from the insurer. By contacting the specified service station with this document, the repair process begins. Auto mechanics have exactly 30 days to carry out restoration work. If the workshop violates these terms, then you are required to pay compensation for the penalty, which is calculated as 0.5% of the insured amount for each day of delay. Naturally, you will have to write a claim to the insurance company. If refused, you can safely file a lawsuit and demand compensation.

When the repair is completed on time, the driver must conduct a detailed inspection of the car and sign a work acceptance certificate. The driver has the right to refuse to sign if the quality of work does not satisfy him, and also to complain to the insurance company. If the latter does not take any action to eliminate it, it is necessary to go to court. During repair work, wear and tear of the vehicle is not taken into account. This is how the car repair process goes. As you can see, the insurer has a number of obligations. Violating them is a possible chance for the car owner to receive monetary compensation.

Payments - how to apply for them correctly

Changes made to the legislation require that an applicant for compensation apply directly to the company that insured his car. But, as with any rule, there are exceptions to this too.

The policyholder is obliged to submit a request for compensation for damage to the insurer who issued the insurance policy to him if:

- At least two vehicles were damaged in the accident.

- There was no harm to the health of those involved in the accident.

- The owners of the accident have compulsory motor liability insurance on their hands, the effect of which has not yet ended.

If all of the above conditions are not met, then the application is submitted to the company that issued the policy to the person who caused the accident.

This happens in the following situations:

- More than 3 vehicles were injured in the accident.

- The person was injured.

If the person who was found guilty of the accident did not sign a contract with the insurance company, which stipulates that all injured participants in the accident have the right to receive direct payments, then the request for compensation leads to a negative answer. What to do? Submit an application directly to your insurer, who will compensate for losses, and after that, the fund of the Russian Union of Auto Insurers will return the funds spent.

In the event that the company that took out the insurance was deprived of the right to work or was declared insolvent, then again the RSA can handle the payment of compensation.

If the culprit does not have compulsory motor liability insurance or its validity has expired, then it is necessary to sue him in court, the damage caused by him will be paid by the same RSA, and a fine will be imposed on him to pay for moral damages.

If the victim does not have compulsory motor liability insurance, and there may be several reasons for this - a new car, the old policy has expired, then he still has the right to claim compensation.

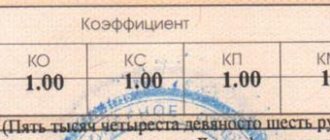

Payout limit

Amounts of maximum compensation under compulsory motor liability insurance:

- 400 thousand rubles, if the circumstances of the collision must be recorded through the GLONASS system or Mobile application. At the same time, the participants in the incident have no disagreements, and they issued a Notification of the Road Accident.

- 100 thousand rubles, if the circumstances of the accident are also recorded through the application or GLONASS, a Notice is drawn up, where the disagreements of the participants are recorded. The same limit applies if the participants have no disagreements and the circumstances are recorded only in the Notice.

Vehicle restoration and cash payment

Starting in April 2021, a provision came into force according to which the restoration of the car becomes a priority over the payment of material compensation.

To comply with all the rules for quality repairs and insurance, the company sends the owner to a licensed workshop or to a car dealer.

It is possible to have your car repaired at another service station or receive financial compensation instead of repairs by concluding an agreement between the insurer and the victim.

If you don’t like how the car was repaired, then you don’t need to sign the acceptance certificate. Point out the shortcomings to the master and demand they be corrected.

If at the first inspection you are satisfied with the quality of the repair, but during further operation it becomes clear that the repair was performed poorly, file a claim with the insurer.

If you receive a refusal to correct deficiencies, conduct an independent examination and go to court.

If the insurance company refused compensation or paid little money, write a complaint to the regulatory authorities.

Payment in lieu of repairs is assigned in the following cases:

- total loss of the car;

- the victim died as a result of the accident or became disabled;

- the cost of car restoration is more than the maximum insurance amount, and the culprit does not want to pay extra.

In cases where the insurance company has become bankrupt, the RSA (Russian Union of Auto Insurers) guarantees that the victims receive payments.

Summary

An accident is an equally unpleasant situation for both the culprit and the victim. And the first thing to do after an accident is to try to pull yourself together and strictly follow the instructions. This is the only way you can realistically assess the damage and receive fair compensation.

More…

- Where to apply for compulsory motor liability insurance for a victim after an accident

- How long can you drive without insurance after it expires?

- What does MTPL cover in case of an accident and how much damage does extended insurance cover?

- Payment under compulsory motor liability insurance or repairs, what is better to choose, who decides and how to get money

When can you receive monetary compensation?

Clause 16.1 of Art. 12 of Law No. 40-FZ provides for cases in which the driver injured in an accident will receive money:

- total loss of car;

- the cost of restoration exceeds the maximum established limit - 400 thousand rubles (100 thousand according to the Europrotocol);

- The insurance company cannot organize the restoration of the car at the service station specified when concluding the insurance contract;

- the victim died or suffered serious injury;

- the car service center with which the insurance company has an agreement to carry out repair work does not meet the established requirements;

- an agreement has been concluded between the insurer and the victim on the payment of monetary compensation;

- the victim is disabled, and he indicated the monetary form of compensation in the application.

How to get compensation

If the victim does not meet the conditions provided for in clause 16.1 of Art. 12, you can receive money by agreement with the insurer. To do this, indicate cash payment as the priority method of compensation when contacting the Insurance Company. If the insurance company does not mind, the money will be transferred to the bank details specified in the application.

The insurer also agrees to provide monetary compensation if the amount of compensation is less than the cost of repairs. For example, a service station calculated that restoring a car would cost 35,000 rubles. You can agree with the insurance company on a payment of 25,000 and take the money.

After signing the agreement for monetary compensation, it will no longer be possible to change your decision.

The period for payment of monetary compensation under compulsory motor liability insurance is 20 days from the date of contacting the insurance company with a statement about the occurrence of an insured event. If the deadlines are violated, the insurer will pay a fine of 1% of the amount for each day of delay.

Why cash payment is beneficial for the car owner

Drivers prefer to receive money for the following reasons:

- you can have your car repaired at a service center you trust;

- the possibility of personal presence during repairs;

- When saving, the extra money will remain with the car owner.

Some car enthusiasts, after receiving monetary compensation, do not repair their car at all, but simply sell it. In such cases, they are not at all interested in repairs at the expense of the insurance company.