What to do if the traffic police fine is overdue

Check the date on the paper order. Look at the date of the ruling. If 70 days have passed, it means the fine is overdue. For example, a traffic camera noticed that a driver crossed the stop line on October 1st. Add 70 days - on December 11 the fine will be overdue.

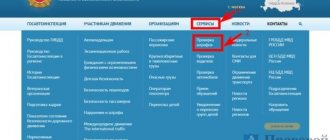

If there is no paper decision, check the date in the electronic one. If you don’t have the resolution on hand, you can check the date on the “Traffic Police Fines.”

On the main page, enter the license plate number of the car, the number of the registration certificate and license. If there is a fine, the service will display a resolution with all the data: date of violation, payment, unique number and method of recording the violation.

“Traffic police fines” show the date of violation and the period by which 70 days will pass

Check the overdue fine with the bailiffs. If the fine is overdue, check to see if it has gone to the bailiffs. You can check this on the service website.

Under the verification form there will be an “Advanced Search” button - click on it.

Next, fill in the empty fields with the data from your passport.

If the case has not yet been received by the bailiff, the following message will appear.

This means that the bailiffs have not yet initiated enforcement proceedings. However, you still need to pay the traffic police fine.

If the fine went to the bailiffs, information about the enforcement proceedings will appear. From the start of production, the driver has 5 days to pay the traffic police fine.

Pay the overdue traffic fine. If the payment deadline has passed, the driver owes money only to the bailiff service; the initial traffic police fine does not need to be paid. You can pay the fine on the Traffic Police Fines website.

UIN 322 - number of the resolution on collection from the bailiffs. UIN 188 - number of the resolution from the traffic police, on the basis of which the bailiffs issued a new

Notify bailiffs about payment. To prevent the bailiffs from starting work with the fine, it is better to bring the receipt for payment of the fine to the FSSP officer. The address and telephone number can be found on the notice from the bailiffs. If there is no notification, contact the district office of the FSSP in your city.

What is the first thing you need to know about debt terms?

So, above we promised a working method on how you can avoid paying a traffic fine. It really exists in 2021. But in order to use it, you need to understand how the deadlines for financial sanctions work regarding the obligation to pay them. And just to improve your literacy, it is better to read the following.

Once you have been issued a decree, it goes through several stages, which change your rights and obligations.

- From the day after the date when you received a copy of the decision with a fine (it doesn’t matter whether a traffic police officer handed it to you or it came by mail from the camera), the period for filing a complaint begins, equal to 10 days. It is from the date you receive the decision that this period is correctly calculated. If you have challenged it, then these 10 days turn into an even longer period - until the decision to consider your complaint comes into force, or immediately after the decision is made by the district or city court. Please note that you are not yet obligated to pay a fine during this period.

- And from the date the decision was issued (but not when you received a copy of it - do not confuse these dates), the period of 20 days begins for you to pay the fine at a discount. That is, this period includes 10 days when you are not yet obligated to pay the fine, and another 10 days after such an obligation arises.

- After entry into force (10 days), you must pay the fine (and in the next 10 days you can pay half the amount), and this period lasts 60 days.

- Upon expiration of the obligation to pay the fine, the fine is considered overdue. And this entails 2 consequences below.

- There is a separate punishment for an overdue financial sanction - under Part 1 of Article 20.25 of the Code of Administrative Offenses of the Russian Federation. It provides for one of the options: either imposing a new double fine for failure to pay the main one, or administrative arrest for up to 15 days (if the first fine was from a camera, then arrest is prohibited). But the period for bringing to justice under this rule is 3 months, after which you will no longer be able to be punished.

- And finally, within 2 years after the delay, the administrative fine can be transferred to the bailiff service for enforcement. They can write off money from your accounts and cards, at the expense of your property, or if you pay them voluntarily.

- But there is no deadline for the end of compulsory enforcement (but there are disputes that it is also 2 years - we will look into this a little below).

Now it's time to find out how this can all work in your favor...

Overdue traffic fine: consequences

If the traffic fine is not paid, the case will go to the bailiff - he will add an enforcement fee and, if the driver does not pay in this case, he will send the case to court. The judge will impose a double fine from the original, arrest or compulsory labor. Here's how it happens.

The fine will go to the bailiffs. If after 70 days from the violation the fine is not paid, the inspector will send a copy of the decision to the bailiffs. The inspector has 10 days to do this. When the bailiff receives the document, he will issue a decision on enforcement proceedings and send it to the driver. You can check the letter in the “State Post” section on State Services.

They will add 1000 rubles to the fine. After sending the document, the driver has 5 days to pay the fine, otherwise the bailiff may award an enforcement fee. If the violator misses this five-day period, he will have to pay the initial fine, plus 1,000 rubles. This is a possible punishment for failure to pay a traffic fine. He has another 70 days to do this.

The money will be debited from the account. If you miss this deadline, the bailiff will transfer the case to court. The judge will likely issue an order requiring the money to be withdrawn from the bank account.

The driver will be arrested or have his license restricted. The court may order arrest for 15 days. Failure to pay the traffic police fine on time may result in other sanctions:

- money will be deducted from your salary;

- will not be allowed abroad;

- will suspend the rights;

- will be prohibited from selling the car;

- they will send the car to the impound lot and sell it for debts - this happens during FSSP and traffic police raids on the road.

Read the detailed instructions about what will happen if you overstay the traffic police fine, what to do if the paid traffic police fine was handed over to the bailiffs, how to prove the fact of payment and appeal such a fine.

Deadlines for paying traffic fines

According to Art. 32.2 of the Administrative Code, the time for repaying debts for traffic violations has been changed to 60 days. The driver is obliged to pay a fine within the specified period from the moment the decision on an administrative offense comes into force. In accordance with clause 1.1 of Art. 32.2 non-residents of the Russian Federation are required to transfer funds within one day.

It is important to know! The period for payment of the sanction may be extended. According to Art. 30.1.3 of the Code of Administrative Offenses, the driver is given 10 days to appeal the inspector’s decision. If the citizen is satisfied with the decision, he is given 70 days from the date of the traffic violation to pay the debt.

When filing an appeal with the traffic police without considering the application in court, the payment time is 90 days in accordance with Art. 30.5 Code of Administrative Offences. If the claim is sent to a higher authority, the debt repayment period can reach 160 days.

When not to pay

The traffic police issued the violation incorrectly. Traffic police officers have regulations with their rights and responsibilities. An administrative penalty can be challenged if the inspector committed one or more violations:

- did not attract witnesses or did not record on camera information about an accident or other “road” violation for the record;

- did not indicate in the protocol all the information that is relevant to the case - the circumstances of the violation, his actions, the road infrastructure layout, the quality of the road and lighting;

- did not indicate the comments of witnesses in the protocol;

- if the decision was issued on the basis of recordings from traffic cameras, it did not take into account the technical condition of the traffic cameras, bad weather conditions, the quality of asphalt and lighting in the area;

- did not indicate in the resolution his position and surname, the date and place of the violation, the deadline and procedure for appealing.

To challenge the actions of a traffic police officer and not pay a fine, write a complaint addressed to the head of the department where the employee who made the decision works. The complaint must indicate what mistakes the inspector made and what he did not take into account when considering the case.

The driver does not admit his guilt. It happens that the camera made a mistake or the workers did not have time to remove the temporary sign, and the driver receives an erroneous fine. The most reliable way to prove your innocence is to use a video recorder or witness testimony. The recording from the camera can be attached to the complaint on a flash drive or disk.

If you did not violate, write such a complaint. The traffic police is obliged to consider it within 10 days

How is a decision made?

There are two ways to prepare a violation report:

- at the scene of the violation (issued by a traffic police inspector);

- automatically (if non-compliance with traffic rules is recorded by cameras).

In the first case, a fine is issued on the spot only when your guilt is obvious. If it is difficult to determine who is to blame for the accident and whether there was a violation, you will receive a receipt for the fine after the trial. The car enthusiast may hope that it will not take place at the right time, then he can legally refuse to pay the fine. An error in the protocol made by the inspector will also save you from having to pay.

The advent of automatic video recording of violations has led to people receiving fines by mail without the participation of inspectors or the court. In this case, it is important how long it took for you to receive notification of the violation. In addition, it is worth carefully examining the resolution, since in the photo you will be able to find evidence that you are right.

Cameras often operate with errors that can be used to avoid paying a fine.

Why can the traffic police issue a fine of 3 thousand?

This is interesting: Open relationships in marriage

Where can I view the traffic police fine?

On the website "Traffic Police Fines". On the main page of the service, fill out the fields with the car’s license plate number and registration certificate number.

Fill in the car number, STS, license and enter your email. Mail is needed so as not to miss new fines

On State Services. First, you need to register on the portal, then confirm your account. This can also be done through banking services or at any MFC. When the registration on State Services is confirmed, you can leave data about the car in your personal account. After this, information about fines will be sent to your personal account and to the email that was specified during registration.

Don't rush to pay fines

Recommendations from a former tax inspector

Lyubov ANDREEVA Published by the Moscow Accountant Magazine N6/2002

.

Every accountant is familiar with the audits carried out by the tax office. Sometimes a lot of effort and time have to be spent on proving to the tax authorities the inconclusiveness of certain facts set out in the act. It is sometimes even more difficult to explain to inspectors that penalties were applied incorrectly. Is it worth beating the tax office or is it better to try to resolve the dispute in court?

The general procedure for conducting desk and field audits by tax inspectors is enshrined in the Tax Code. This document guides the specialists of the Ministry of Taxes of Russia when determining the type of inspection, the procedure and timing of its conduct, as well as when applying tax liability based on its results. Unfortunately, quite often tax authorities “forget” about the code. Quite often, the results of inspections are recorded incorrectly, and organizations are forced to pay penalties.

What provisions of the Tax Code of the Russian Federation should an accountant remember in order to avoid the arbitrariness of tax authorities and confidently defend the interests of the organization if necessary?

Penalty for desk audit?

A desk audit is a check of the correctness of tax calculations based on submitted tax returns and calculations. It is carried out at the tax office within three months from the date of submission of the tax return or calculation.

After this period, desk audits are not carried out. In other words, if more than three months have passed, then, despite the identified error, inspectors cannot assess tax and hold the organization liable for taxation. This is stated in Article 88 of the Tax Code of the Russian Federation. It would seem that tax officials should know the provisions of the Tax Code better than anyone, but in practice they quite often violate the rules and fine organizations after the established period.

If an inspector tries to hand over to an organization’s accountant a decision on bringing tax liability with a requirement to pay tax, penalties and interest, it is better not to receive or sign this document. The refusal must be motivated by the fact that the deadline for conducting a desk audit has passed.

The inspector will be forced to agree with this argument, and the organization will avoid “tax punishment”. If an amicable agreement cannot be reached and the inspectorate nevertheless goes to court, the claim will most likely be rejected. The established arbitration practice confirms this. For example, by the decision of the Moscow Arbitration Court dated June 30, 2001

The tax inspectorate refused to satisfy the claim for a fine in the amount of 43,850 rubles based on the results of a desk audit due to the expiration of its period.

In general, the legality of penalties for desk audits is questionable even if the audit was carried out within the established time frame. The same Article 88 of the Tax Code of the Russian Federation states that for the amounts of additional payments for taxes identified as a result of a desk audit, the tax inspectorate sends a demand for payment of the amount of tax and penalties

. There is not a word in the code that a decision on bringing to tax liability must be issued.

When drawing up such a decision, the inspectorates are guided by the internal regulations developed by the Russian Ministry of Taxes for conducting desk audits, which provide for the form of the decision on bringing to tax liability. In addition, when fining for understatement of tax based on the results of a desk audit, tax authorities refer to Article 122 of the Tax Code of the Russian Federation. At the same time, they argue that in order to impose a fine, it is enough to establish the fact of non-payment or incomplete payment of the amount of tax, and it does not matter what kind of inspection it was established, desk or field.

However, arbitration courts take a different position. In resolutions dated October 23, 2000 N KA-A41/4820-00, dated May 14, 2001 N KA-A41/2195-01 and dated May 15, 2001 N KA-A41/2272-01 FAS Moscow District

recognized as unlawful the actions of tax inspectorates to collect tax sanctions for non-payment or incomplete payment of taxes revealed by desk audits. The court indicated that holding organizations accountable for desk audits contradicts the essence of this procedure and is not provided for by Article 88 of the Tax Code of the Russian Federation.

љThus, using the provisions of Article 88 of the Tax Code of the Russian Federation and the established arbitration practice, fines may not be paid, even if the tax authorities insist on it.

Let us remind you of one more point. If the tax inspector discovered an error three months after submitting the declaration, and therefore lost the right to issue a demand to the organization to pay tax and penalties, then he can “collect” these amounts based on the results of an on-site tax audit. To prevent this from happening, before such an inspection you need to have time to draw up an updated calculation and submit it to the inspectorate along with the paid amount of tax and penalties.

On-site inspection in addition to desk inspection

On-site tax audits are carried out after desk audits. Tax officials try to conduct them at least once every two years, as recommended by the Russian Ministry of Taxes and Taxes. However, if the results of a desk audit reveal serious violations, an unscheduled on-site inspection is scheduled.

An on-site audit is carried out using primary documents, order journals and other accounting registers directly in the organization. The basis for its implementation is the decision of the head of the tax office. Only with this document does the inspector have the right to begin an inspection. Therefore, if you come to an organization for an inspection, it would be useful to find out whether such a solution exists. The head of the organization should be aware of this decision. Moreover, he must sign this document. The accountant should also become familiar with the contents of the decision. It is advisable to do this before the decision is signed by the manager. It is no secret that, although the report on the results of the audit is signed by the head of the organization, the accountant bears all responsibility for the violations set out in it. If disagreements arise on certain provisions of the act, then he will also have to defend the interests of the organization in the inspection.

The decision states for what period and for what taxes the audit is carried out. The organization is audited for the three previous calendar years (Article 87 of the Tax Code of the Russian Federation). If the enterprise has not been inspected for more than three years, then the uninspected periods “fall out” and documents do not need to be submitted during this time. You can also find out from the decision whether taxes that were checked previously will not be re-checked.

| Article 87 of the Tax Code of the Russian Federation prohibits tax inspectorates from conducting repeated on-site tax audits on the same taxes payable or paid for an already audited tax period. |

If the listed conditions are violated, the head of the organization should not sign such a decision until it is brought into compliance with the Tax Code of the Russian Federation.

An on-site tax audit lasts no more than two months, except for the cases provided for in Article 89 of the Tax Code of the Russian Federation. It talks about increasing the duration of an on-site tax audit to three months by decision of the regional Department of Taxation of Russia or if the enterprise has branches and representative offices. This period can also be determined by the date the decision was signed. It is usually issued one day before the start of the inspection.

All violations identified by the on-site tax audit are described in the report. Finally, the tax sanctions that the inspector intends to apply based on the results of the audit are indicated. The report is handed over to the head of the organization no later than two months from the date of drawing up the certificate of the inspection.

Having received the report, the accountant will find out what violations were identified, how much taxes were accrued and how much of a fine the organization will pay. If the accountant does not agree with the facts set out in the act and also believes that tax penalties have been accrued incorrectly, then he has the right to submit written disagreements on individual provisions or on the act as a whole. Two weeks are given for this. If disagreements are not submitted within this period, the tax office makes a decision to bring the organization to tax liability.

Often, the inspector assesses taxes and fines because the accountant did not submit the necessary documents (although they are available). This is possible in cases where the accountant does not know that a particular tax will be audited, and the inspector did not remind him of this. Such an oversight can be corrected by submitting disagreements, and with them the necessary documents. In such cases, inspectors are reluctant to meet taxpayers halfway, and sometimes even refuse to accept documents, citing the fact that the audit is completed. Thus, they violate Article 100 of the Tax Code of the Russian Federation.

| Clause 5 of Article 100 of the Tax Code of the Russian Federation allows an organization to attach to a written explanation (objection) or, within an agreed period, transfer to the tax inspectorate documents (their certified copies) confirming the validity of the objections or the reasons for which the inspection report was not signed. |

With the help of the presented materials, you can try to resolve disagreements regarding the audit report “peacefully.” If the tax authorities do not take into account the organization’s arguments, you can contact a higher authority or the court. The territorial tax department will take the side of the organization only if the evidence is considered indisputable. Therefore, it is better to wait for the trial.

But before the trial, based on the decision made, the inspectorate will assess taxes and fines to the enterprise based on the on-site inspection report. If you are not sure that the court will side with the organization, it is better to pay taxes, because penalties are charged on them. But you can wait with penalties. This poses no threat to the organization, since no penalties are taken from fines. And in order to collect fines (if they are not paid voluntarily), an arbitration determination is needed.

Therefore, it makes sense to wait for the court’s decision to collect penalties if such a claim is filed by the inspectorate on time. According to paragraph 1 of Article 115 of the Tax Code of the Russian Federation, six months are allotted for this from the date of drawing up the inspection report. If the deadline is missed, the court does not satisfy the tax authorities’ claim. On this basis, by decisions of the Federal Antimonopoly Service of the Moscow District dated November 19, 2001 N KA-A41/6751-01, dated November 26, 2001 N KA-A40/6824-01 and dated February 15, 2002 N KA-A41/395- 02

inspections were refused to collect penalties.

In addition, in court it is possible to prove that certain penalties were applied incorrectly. This is especially true for fines for gross violation of the rules for accounting for income and expenses and objects of taxation. Resolutions of the Federal Antimonopoly Service of the Moscow District dated December 3, 2001 N KA-A40/7096-01 and dated December 14, 2001 N KA-A41/7244-01

tax inspectorates were refused to collect penalties under paragraph 1 of Article 120 of the Tax Code of the Russian Federation. In the first decision, the court considered that the organization was fined for incorrectly calculating the tax base (attributing expenses to cost), and not for failing to take into account these expenses, as indicated in the decision of the Tax Inspectorate. The second resolution rejected the claim for the reason that a gross violation of the rules for accounting for income and expenses did not lead to an understatement of the tax base.

In the resolution of the Federal Antimonopoly Service of the Moscow District dated October 29, 2001 N KA-A40/6091-01

indicated that the organization was wrongfully held liable under paragraph 2 of Article 120 of the Tax Code of the Russian Federation in the amount of 15,000 rubles. This responsibility is imposed if the accounting accounts do not reflect cash, tangible assets, intangible assets and financial investments. In this case, the organization was fined for failure to provide cash receipts, although the expenses were confirmed by sales receipts for the purchased goods.

Desk inspection after an on-site inspection?

We will try to protect organizations from yet another “invention” by the tax authorities. This practice has developed in some tax inspectorates. An on-site tax audit of the organization was carried out. However, after some time, the inspector finds an error in the declarations or information is received from the tax police that requires an audit and taxes to be assessed. An on-site inspection cannot be carried out, since Article 87 of the Tax Code of the Russian Federation prohibits repeated on-site inspections on the same taxes for an already inspected period.

Then the tax authorities conduct so-called “desk tax audits requiring documents.” At the same time, they convince organizations that the Tax Code is not violated, since the period for such an audit begins from the moment the requested documents are submitted. In addition, in some cases, mainly if the audit is carried out based on materials from the tax police, the inspector draws up a desk audit report and upon completion makes a decision on tax liability.

All this is contrary to the Tax Code. As mentioned above, a desk audit is carried out within three months from the date of submission of the tax return, and not additional documents. An act based on the results of such an inspection is not drawn up. This was repeatedly mentioned in the decisions of the Federal Antimonopoly Service of the Moscow District (dated June 20, 2001 N KA-A41/2935-01 and dated June 25, 2001 N KA-A40/3100-01).

A decision on bringing tax liability to tax liability is also not provided for by the Tax Code of the Russian Federation. However, employees of the Inspectorate for Social Security ignore these rules. There is no need to sign the act and receive a decision on such an inspection. Even if the tax inspectorate goes to court with a claim based on such an act, the collection of taxes and fines will be refused.

In conclusion, I would like to advise accountants not to follow the lead of tax authorities if they violate the rules and regulations of the Tax Code and not to sign illegal acts and decisions. Believe me, if today an accountant proves that he is right and demonstrates knowledge of the basics of the Tax Code of the Russian Federation, then tomorrow the tax inspector will be very careful with him and will not make unreasonable demands. As for arbitration courts, they are increasingly taking the side of organizations, and the number of cases lost by tax inspectorates is growing every year.

Dynamics of considered arbitration disputes with the participation of tax authorities (according to the “Bulletin of the Supreme Arbitration Court of the Russian Federation”, No. 4, 2002), in percentage:

| љ | 1999 | year 2000 | year 2001 |

Lost cases regarding the collection of sanctions, arrears and penalties | 68,7 | 80,8 | 81,7 |

Remember

- A fine is considered overdue if it has not been paid within 70 days from the date of violation.

- The consequences of an overdue traffic fine are the transfer of the case to bailiffs, to court and forced collection of money.

- To pay an overdue fine, check on the FSSP website to see if enforcement proceedings have been initiated. If not, pay the fine as soon as possible.

- If the bailiff has started the proceedings, look at the date - after 5 days from the start of the proceedings the bailiff may assign an additional fee. Then you will need to pay the amount of the fine plus a fee to the FSSP.

- If you do not pay this fine, the bailiff will refer the case to court - they may impose a double fine or arrest.

- The traffic police fine may not be paid if the inspector incorrectly completed the report or the driver has evidence of innocence. Send a complaint to the traffic police along with evidence - indications of errors or a recording from the registrar.

- You can check fines on the State Services website after registration or immediately on the “State Traffic Police Fines”.

All articles by the author: Evgeniy Lesnov

What to do if you are summoned to court for failure to pay a traffic police fine in 2021?

In a situation where you have received notification of a court hearing, you need to act as quickly and efficiently as possible. The following actions are recommended in 2021:

- If possible, pay the outstanding fine. If at the meeting you provide evidence of the fulfillment of your duty, even if it was fulfilled after the traffic police applied to the court, the application of an additional measure of liability will be refused. Receipts can be used as proof of debt payment. If the amount was transferred online, you can print out electronic versions of them.

- Prepare an objection. In it, you can indicate your disagreement with the application of additional responsibility, for example, if there was a valid deadline for missing payment.

- Prepare documents supporting the position, such as sick leave or travel documents. Other papers can be used as justification if they confirm the person’s position.

The driver can also request the application of a certain type of consequences based on Article 20.25 of the Code of Administrative Offenses of the Russian Federation. For example, if a person is in a difficult financial situation and provides papers confirming this fact, the court may choose a non-financial penalty, for example, compulsory work that the citizen can perform.

The situation may be the opposite when a fine is the preferred option. For example, a citizen being held accountable is sick and is unable to work or stay in a temporary detention center. In this case, he has the right to ask the court to impose an additional financial sanction.