What is a green card for a car?

A green card for a car is an international agreement where countries around the world mutually recognize the policy, which creates certain rules that clearly describe the points that any car owner is responsible for their transport.

Back in 1950, a global conference was held in the capital of England, where systemic rules and standards for Green Cards, which all car owners must comply with, were reviewed and adopted.

This insurance system is valid in 50 countries.

Green Card Insurance Conditions

There are certain rules and conditions for obtaining a Green Card. First of all, all necessary documents must be in perfect order; they will be strictly checked for authenticity.

The documents must be as follows:

- Any documentary proof of identity, preferably a passport.

- A document that will indicate the right to a car.

- A document that confirms the registration of the car. It is issued by an authority that has carried out a full check of a car of any category, after which it has been registered.

Note! When you receive a Green Card, it becomes valid for a period of two weeks to one year.

Insurance programs and tariffs

The Green Card policy for any vehicle can be issued for a period from 15 days to 1 year . Within this interval, the division step is 1 month. This means that if you plan to stay abroad for 35 days, you will have to issue a policy for at least 2 months.

In the Russian Federation, it is possible to obtain two types of “Green Card” depending on the region of the planned trip:

1) A policy valid in the territory of three countries neighboring the Russian Federation: Belarus, Moldova, Ukraine;

2) A policy valid in all countries of the association.

Tariffs for Green Card policies are the same for all insurance companies that are members of the association. They are established by the Russian Union of Insurers in agreement with the Ministry of Finance.

The final cost of a specific Green Card policy depends on three components:

- Type of policy by region (three neighboring countries or all countries of the association);

- Type of vehicle;

- Insurance period.

Examples of the cost of policies in 2021, depending on the above factors, are given in the table:

| Policy validity period | Three countries: Belarus, Moldova, Ukraine | All Green Card countries |

| Cars | ||

| 15 days | 700 rub. | RUB 2,060 |

| 1 month | 940 rub. | RUB 3,930 |

| Trucks and tractors | ||

| 15 days | 1,200 rub. | RUB 3,440 |

| 1 month | RUB 1,590 | 6,560 rub. |

Important: From January 1, 2015, tariffs for Green Card policies in Russia change once a month. Therefore, before visiting an insurance company, it is better to check by phone or on the company’s website the actual cost of the policy.

What is a Green Card?

The international type of motorist insurance, called the “Green Card” because of the color of the form on which the document is printed, has existed in the legal space of Europe for almost 60 years. At first, only the countries of the so-called old Europe took part in the program, then other states, including Asian and African ones, began to join them. Today, this international policy operates on the territory of almost fifty states.

In fact, the Green Card is an international analogue of motor vehicle insurance, relieving a foreign driver of the need to compensate for damage if he gets into an accident in a foreign country.

This is quite convenient, because each state has its own rules and prices, so the amount of damage can vary significantly. The “Green Card” eliminates headaches not only for the foreign motorist, but also for the second participant in the accident: if he is recognized as an injured party, the insurance company fully compensates him for losses associated with car repairs and pays for treatment (if necessary).

What is a Green Card?

What is “green carat”? As already mentioned, this is an insurance contract that is concluded between the driver and the insurance company in the event that damage to another vehicle and its owner is caused as a result of an accident.

The emergence of the “green card” goes back far into history and was first mentioned in the years after the war, when the borders of all states were not fully defined. And in order to increase the level of safety on the roads and, moreover, to prevent damage to drivers, which very often occurs within another country, the “green card” was invented. This document is required. Thanks to him, in case of an accident abroad, the injured driver receives compensation, but on the condition that the accident occurred due to the fault of a foreign citizen.

IMPORTANT !!! Today, not all countries support the Green Card program, but most of them do. There are 48 such countries in total.

The list of participating states primarily includes Europe and Russia. Some African states—Tunisia and Morocco—also participate. Middle Eastern countries also did not stand aside; the insurance program is supported by Turkey, Israel, Georgia and even Iran. Independent states are also for driver safety—Belarus and Ukraine, Moldova and Kazakhstan. Asian states that border Russia, such as China, for example, do not participate in supporting Green Cards.

International insurance is valid only for the following types of vehicles:

- Cars.

- Caravans.

- Trucks and tractors.

- Semi-trailers.

- Trailers designed for cargo vehicles.

- Trailers for tractors.

- Light ATVs, motorcycles, mopeds and strollers for them.

- All types of buses.

- All types of equipment intended for agricultural work.

There are several types of green cards. It can be valid only in the territory of individual countries or immediately and everywhere. The document form is always the same, but the price of insurance differs significantly. As a rule, in the territory of the European Union you will have to pay many times more for an insurance document.

What does a green card look like?

The green card got its name from the color of the policy. It is made on a green form with certain degrees of protection. The form has a unique number, and its counterfeit will be prosecuted by law.

The domestic form is made on Gosznak paper and has several degrees of protection, including an individual non-repeating number, RSA watermarks and metal thread.

The policy has 4 pages. When registering, the client receives three sheets, and the last one remains with the insurance company. In case of an accident, the driver gives one page to the injured person. There are no seal impressions on the first two sheets. The third and fourth pages may have the insurer's stamp, but this is not required.

In which countries is the green card valid?

Since the beginning of 1951, the Green Card agreement has been in force. The participants include 48 countries from two continents of Eurasia and Africa. If the policy is issued in one of the participating countries, then it is valid in the others.

List of countries where the Green Card policy is valid:

| Austria | Denmark | Macedonia | Slovenia |

| Azerbaijan | Israel | Malta | Tunisia |

| Albania | Iran | Morocco | Türkiye |

| Andorra | Ireland | Moldova | Ukraine |

| Belarus | Iceland | Netherlands | Finland |

| Belgium | Spain | Norway | France |

| Bulgaria | Italy | Poland | Croatia |

| Bosnia and Herzegovina | Cyprus | Portugal | Montenegro |

| Great Britain | Latvia | Russia | Czech |

| Hungary | Lithuania | Romania | Switzerland |

| Germany | Liechtenstein | Serbia | Sweden |

| Greece | Luxembourg | Slovakia | Estonia |

How to apply

The policy is issued in Russia. It can be purchased from insurance companies that are members of the Green Card Bureau. The list is posted on the website of the Russian Union of Auto Insurers (RUA). There are mini-offices of such companies at border checkpoints; I bought my card at the entrance to Estonia.

VSK Insurance House has the largest network of representatives selling Green Card policies in Russia.

Until July 1, 2021, in all countries, insurance could not be issued online and printed out yourself. The policy was issued only on a special green form. However, from July 1, 2021, a phased transition to an electronic Green Card began. Most EU countries have already switched to black and white forms.

Beware of fakes!

In Russia, the new format has not yet been adopted, and for now policies are issued on green forms. Each must have a watermark, a metallic stripe and an identification number.

To issue a card you need the following documents:

- passport;

- car registration certificate or PTS;

- application for a card.

Legal entities present company registration certificates.

Procedure for obtaining insurance

To obtain a Green Card you will need:

- Identification document of the policyholder.

- Vehicle document (registration certificate or vehicle passport).

- Fill out a special application form.

If the policy is purchased not by the owner, but by his representative, then a notarized power of attorney will be required.

Each set of policies includes four sheets. Three sheets are given to the policyholder, and the fourth is used by the seller for reporting.

The first and second sheets indicate:

- duration of the policy;

- vehicle registration number;

- transport category;

- make and model of the vehicle (in practice, the model may not be indicated);

- policyholder or owner of the car (last name, first name and address).

The third and fourth sheets additionally contain the date and place of issue of the policy, its cost, as well as cells for the signatures of the parties. Payment is made in the usual manner: to the insurer's representative by receipt, to the company's cash desk or by bank transfer.

Factors influencing the cost of insurance

A green card can cost differently. Its price depends on the following:

- What vehicle is insured for?

- What is the deadline for processing the document?

- Which country package was selected. Insurance may include packages such as, for example, “All countries” or only “CIS countries”.

It is worth remembering that tariffs are indexed every month. Therefore, in order to accurately find out the cost of insurance, you need to contact the insurance company itself, where a specialist will advise on this issue.

Registration procedure

So, we found out what a green card for a car is. You can arrange it in advance by visiting those insurance companies that are accredited for issuing, or right at the border at the representative office of a suitable company. In the latter case, you will most likely have to overpay somewhat. To find out who issues such certificates, you can visit the RSA website, which contains a list of them.

To obtain a Green card you will need the following documents:

- passport;

- PTS;

- diagnostic card (not always);

- STS;

- statement.

After paying the state fee, the driver will receive back all the documents submitted (except for the application), a reminder about what will have to be done in the event of an accident, as well as the certificate and receipt itself.

You can only get a green card for a car in the country where it is registered.

How much does registration cost?

The cost of the document is clearly established for any company that issues it. A difference in price is possible, but it depends on the following indicators:

- Car category (bus, truck/car, motorcycle, etc.).

- Scope (near abroad or all participating countries).

- Insurance period (lasts up to a year, minimum validity – 15 days).

As a rule, the cost of a “green policy” purchased for visiting neighboring countries is several times cheaper than the same document, but intended for traveling around European countries.

Tariffs for obtaining a green policy are recalculated monthly, which is due to the need to calculate its amount depending on the ruble exchange rate. The obtained figures must be agreed upon with the Ministry of Finance of the Russian Federation. That is why a Green card is issued no earlier than 30 days before traveling abroad.

At the moment, tariff rates before visiting the company can only be viewed on the RSA website.

What are the terms and conditions of insurance?

The international Green Card program operates under certain conditions.

As a rule, all insurance companies have the same ones:

- Insurance is issued for a car, and it indicates the person who uses the car, that is, not only the owner of the vehicle has the right to issue a Green Card;

- The Green Card protects the rights of absolutely all motorists who drive a vehicle legally;

- It is necessary to obtain insurance in advance, namely 30 days before the planned trip abroad;

- In the event that an accident occurs and a foreign person is at fault, the Russian citizen will be entitled to compensation;

- If an accident occurs and a citizen of the Russian Federation is at fault, he needs to use a Green Card and provide it not only to the foreign person injured in the accident, but also to a representative of the police service;

- The decision on the amount of insurance is made based on the maximum allowable amounts of insurance in the territory of the country where the accident occurred.

Thanks to an insurance certificate, citizens of the Russian Federation save themselves from possible problems that may arise during a trip to the border.

Where and how to apply for a Green Card

On the territory of the Russian Federation, the Green Card is issued only by the following insurance companies and their agents:

- AlfaInsurance,

- RESO-Garantiya,

- Rosgosstrakh,

- Agreement,

- ERGO,

- VSK,

- Spassky Gate,

- Zetta Insurance,

- Twenty first century.

If you live in St. Petersburg or Moscow, you can order a Green Card with home delivery from the trusted company Polis812 . St. Petersburg residents are well aware of this service, which is now available to Muscovites. Our cozy editorial staff prefers not to waste time traveling to offices and waiting in lines, so they always buy a Green Card here, which the courier delivers the next day.

To apply, just fill out a simple form, indicating the details of the car and the policyholder. The cost of the policy does not depend on the number of drivers, as in OSAGO, and is issued for a car, and anyone can drive it. You can pay for the policy immediately and schedule delivery to your home by courier.

! Until the end of the month, you can get Insurance for traveling abroad at a discount Policy812 The promotional code 5travel43 is valid for all insurance companies except Alliance and ERV (company rules prohibit giving discounts). The discount does not apply to the Green Card (the reasons are the same).

Remember:

- There are no electronic Green Card policies, only a special secure form.

- The Green Card policy form must not be filled out by hand.

How and where is insurance issued?

The “Green Card” is issued by an insurance company, and in order to find out which organizations are authorized to issue such a document, you need to visit the official portal of the RSA. As of 2021, 12 insurance institutions can issue green insurance.

IMPORTANT !!! You can apply for insurance online, without leaving your home, on the website of one of the selected insurance companies. To do this, you will need to scan and upload all the necessary documents. For example, Ingosstrakh, one of the insurance companies in Moscow, allows you to buy insurance online. As a rule, on the websites of all insurance organizations you can first calculate the cost of a “green card”, and then start processing it.

You can also get a Green Card, as they say, “offline,” that is, by personally visiting the organization that processes insurance documents.

In the event that the driver did not know in advance that he was to obtain a “green card,” he could do this right at the border. As a rule, special kiosks are installed in customs control zones, which organize the registration of “green stuff”.

Necessary documents to obtain a policy.

A green card can be obtained by individuals and legal entities. The only difference is in the list of documents provided.

To obtain a green card, insurance company employees request the following documents:

For individuals:

- Russian Federation citizen passport

- Vehicle registration certificate

- Application for concluding an insurance contract

For legal entities:

- Certificate of registration of a legal entity

- Vehicle registration certificate

- Application for concluding an insurance contract

As a rule, you can provide both originals and copies of documents. But each insurance company has its own rules for concluding contracts, and it is better to clarify this information in advance by phone. And also find out about the possibility of insurance and the availability of insurance forms. If the policy is issued through the company’s website, you will need scans of these documents, which must be sent along with the online application.

For which vehicles is a Green Card issued?

A green card is required for the following categories of vehicles:

- Buses;

- Trucks;

- Passenger transport;

- Motorcycles and sidecars;

- Trailers and semi-trailers;

- Construction and agricultural machinery

Thus, this list includes all existing vehicles. This means that no matter what the owner of the vehicle intends to drive abroad, a passenger car or a truck, he will not be able to avoid obtaining a Green Card.

What are the tariffs?

They are the same for all insurance companies. They are established by RSA, after agreement with the Ministry of Finance of the Russian Federation. The cost of insurance is affected by the euro exchange rate. Prices are recalculated monthly. The tariff period is from the 15th to the 14th.

For example, the cost of car insurance abroad for 15 days will be 2,450 rubles (for a passenger car). For a month – 4670 rubles. These are tariffs for obtaining insurance for “all countries of the system.” But, for Belarus or Ukraine, the price of car insurance will be significantly lower (you will pay a little more than a thousand rubles per month).

Prices are for 2021, but check the current cost on the RSA website using this link: find out tariffs.

In addition to coverage, the cost is affected by the type of vehicle and validity period. The minimum period for which a Green Card is issued is 15 days, the longest is a year. The policy cannot be extended. Therefore, calculate the duration of the trip as accurately as possible. The lowest tariffs are set for trailers, the highest for buses.

general information

The Green Card program unites 46 countries in Europe, Asia and Africa and is intended for a civilized solution to the issues of determining liability and compensation of insurance amounts to persons injured as a result of road traffic accidents (RTA), in which the participants are vehicles driven by foreign citizens.

For Russians, having a Green Card means the following: if they are found guilty of an accident outside the Russian Federation, the damage to the injured party will be compensated according to the auto insurance rules of the state in whose territory the accident occurred.

Official documents

Still have questions? Ask them to the manager

PRIVACY POLICY

The administration of the site rinsurance.ru (hereinafter referred to as the Site) respects the rights of Site visitors. We unreservedly recognize the importance of confidentiality of personal information of Site visitors. This page contains information about what information we receive and collect when you use the Site. We hope this information will help you make informed decisions about the personal information you provide to us. This Privacy Policy applies only to the Site and information collected by and through this site. It does not apply to any other sites and does not apply to third party websites that may link to this Site.

INFORMATION RECEIVED

The information we receive on the Site can only be used to facilitate your use of the Site. The Site collects only personal information that you provide voluntarily when visiting or registering on the Site. The term “personal information” includes information that identifies you as a specific person, such as your name or email address or telephone number. Sharing of information The Site Administration under no circumstances sells or transfers for use your personal information to any third parties. We also do not disclose the personal information you provide, except in cases provided for by the legislation of the Russian Federation.

DENIAL OF RESPONSIBILITY

Please remember that the transfer of personal information when visiting third-party sites, including the sites of partner companies, even if the website contains a link to the Site or the Site has a link to these websites, is not covered by this document. The Site Administration is not responsible for the actions of other websites. The process of collecting and transmitting personal information when visiting these sites is regulated by the document “Protection of Personal Information” or similar, located on the websites of these companies.

Close

Thank you, your application has been sent! Our manager will contact you soon!

Green card for trailer

In Russia, there is no need to insure trailers under compulsory motor liability insurance. But according to the Insurance Rules in the international vehicle liability insurance system “green card”, the trailer must be insured if this is directly established by the rules of the country to which you plan to travel. In all countries except the Russian Federation, motorists are required to insure liability for the trailer separately. Therefore, you need to take out a green card policy for the trailer of your passenger car if you plan to cross the border with it.

What to do if an insured event occurs under the Green Card?

First of all, you need to calm down and act according to the algorithm proposed by the Russian Union of Auto Insurers:

- As with any vehicle stopped in the wrong place, in the event of an accident it is necessary to turn on the emergency lights and install a danger warning sign.

- After this, report the incident to the traffic police. In the EU countries, there is a single number for notification of emergency situations - 112.

- If there are victims, call an ambulance on the same number and, if possible, provide first aid.

- If the accident occurred in a populated area, then there will probably be witnesses to the collision. Collect eyewitness contact information to later confirm your testimony.

- If possible, fill out the European Accident Statement form. To do this, ask the other participants in the accident for a document. See below for recommendations for filling out the Accident statement.

- Carefully study the papers offered by the other party. Do not sign documents if you do not understand their meaning.

- If it is not possible to fill out the European notification form or take a copy of it, record the make and registration plates of the vehicles involved in the accident. And also write down the data of trailers and semi-trailers of these vehicles.

- If the other party intends to obtain insurance compensation for damage, provide a tear-off copy of your international policy. And if it is absent, inform your opponent of the “Green Card” number. In turn, require other participants in the accident to provide information about their insurance policies in a similar way.

- It is advisable to take photographs of the accident both in general and of each vehicle separately (close-up with license plates), as well as photograph the insurance policies of other participants in the incident.

- If local laws require a traffic police inspector to draw up a report, get your copy as proof of the accident.

- Report the incident to the foreign Green Card office. Contact details and branch addresses can be found on the back of your policy. It also spells out cases when it is not necessary to inform bureau members.

- Notify your company about the occurrence of an insured event.

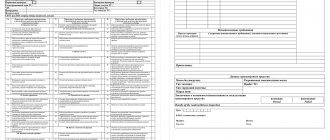

Features of filling out the European notification form Accident statement

This document is a joint statement of the participants in the accident about the circumstances of the incident. Drivers from other countries participating in the Green Card program have local notification forms. The foreign citizen fills out his part of the form in his native language, but you will have to use the Latin alphabet. The meaning of the questions can be understood by checking your memo.

Do not forget:

- In the tenth paragraph, indicate the place where the first blow fell.

- In paragraph 12, note all the circumstances of the accident that took place and, at the very bottom of the column, summarize their overall result.

- Schematically depict what happened in paragraph 13 in accordance with the previously stated circumstances of the accident.

After signing the document by all participants in the incident, send the received copy of the notice to your insurer within 15 days from the date of the accident. In this case, it is advisable to use official forms of communication confirming the fact and date of dispatch.

In addition to these rules, RSA recommends that you retain all documents confirming expenses incurred in connection with the accident. In some countries, the injured party is entitled to compensation for all associated costs.

More detailed advice can be obtained from the RSA information center. Hotline number: +7 (495) 641 2787.

And in conclusion of our review, we will consider a few more points that are useful to know for users of the Green Card international insurance system.

- Green Card policies can only be issued in the country where the car is registered.

- Insurance conditions are established by the rules of the RCA and are the same in all companies that issue this type of insurance.

- The insurance contract does not contain restrictions on the number of persons admitted to management.

- A “Green Card” issued in Russia does not replace an ordinary MTPL policy, which is necessary for moving across the territory of the Russian Federation.

- Insurance is not issued for vehicles that are not in the traffic police database. The exception is vehicles that are generally not subject to state registration under the laws of the Russian Federation.

- For cars with Transit signs, the maximum insurance period is limited to a period of 1 month.

- The Green Card program policy is issued to the applicant. In this case, the person entering into the contract may differ from the owner of the vehicle.

- The insurance contract is not concluded earlier than 30 days before the start of the policy.

- The Green Card performs exclusively the functions of compulsory motor liability insurance outside Russia and cannot replace CASCO insurance.

- Another nationality and the presence of an international policy do not exempt the culprit of an accident from criminal liability provided for by local legislation.