Home/OSAGO/Compensation for vehicle insurance under MTPL in 2021

When purchasing a new car, the owner invests significant funds in the purchase. But as a result of an accident, the market value of the car may decrease significantly, so the car owner will not be able to receive an equivalent amount in the event of a sale. The proposed material discusses the features of compensation for the loss of the marketable value of a car under compulsory motor liability insurance in 2021, and whether the car owner should hope to receive it from the insurer, calculation methods, the procedure for compensation from the insurance company or the culprit of the accident, and other related issues.

When does the marketable value of a car lose under compulsory motor liability insurance?

Attention

Loss of marketable value under compulsory motor liability insurance is the difference between the price of the car before the accident and after restoration, with the elimination of damage received in the accident. Any, even the most high-quality repair is not able to eliminate defects without leaving a trace, and this will affect the value of the car in case of sale. That is why it is very important for the car owner to receive appropriate compensation from the insurance company.

According to Art. 7.1 of the methodological recommendations for forensic experts carrying out work to examine vehicles in order to determine the amount of damage, adopted in July 2013, payment of compensation for loss of marketable value of a vehicle under compulsory motor liability insurance in 2021 is possible only if the following conditions are met:

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

- a foreign-made car should not be older than five years, a domestic one - three;

- machine wear level – up to thirty-five percent;

- compensation is paid if the accident was the first for the car;

- the car owner should not be at fault for the accident;

- compensation for vehicle insurance together with other insurance payments cannot exceed the maximum possible insured amount;

- the victim must have a valid MTPL auto insurance contract;

Please note:

Compensation under CASCO is subject to payment unless a contrary condition is specified in the contract.

If the situation does not meet the above criteria, TCB will not be compensated.

What is TCB and who gets paid?

This concept itself is not contained in the legislation, but there is a method for calculating it.

The Supreme Court gives the following interpretation of the loss of commodity value:

A decrease in the value of a vehicle caused by premature deterioration of the commercial (external) appearance of the vehicle and its performance qualities as a result of a decrease in the strength and durability of individual parts, assemblies and assemblies, connections and protective coatings as a result of a traffic accident and subsequent repairs.” (Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 No. 58 (hereinafter referred to as PPVS RF No. 58 on OSAGO), paragraph 37).

In simple terms, vehicle insurance is the difference between the cost of a whole, but not damaged or painted car, and the cost of the same whole, but damaged, and then restored and painted car after an accident.

Since loss of value refers to actual damage resulting from an accident, the owner of the damaged vehicle (victim) has the right to receive this payment.

Law on loss of marketable value under compulsory motor liability insurance

Article 5 of Law No. 40-FZ “On Compulsory Motor Liability Insurance” dated April 25, 2002, defines the rules of compulsory insurance and indicates the need to compensate for actual damage to the car owner in the event of an accident.

Many insurers refuse to pay compensation for the vehicle’s vehicle under compulsory motor liability insurance, justifying this decision with subparagraph “b” of paragraph 2 of Article 6 of Law No. 40-FZ, considering the decrease in the marketable value as lost profit. However, such a statement is incorrect. The clarification of the Supreme Court, set out in plenary decision No. 58 of the said authority, adopted in December 2021, speaks in favor of the car owner. The document determines the procedure for consideration by judicial authorities of cases regarding the payment of compensation under compulsory motor liability insurance in terms of vehicle insurance.

Attention

Clause 29 of Resolution No. 58 directly confirms the need to classify the loss of marketable value after an accident as real damage to the car owner and indicates that it must be compensated by the insurer under compulsory motor liability insurance.

If the amount of damage received exceeds the maximum possible amount of payment under compulsory motor liability insurance, the victim has the right to demand compensation from the person responsible for the incident, on the basis of Art. 1064 and 1072 of the Civil Code of the Russian Federation.

Compensation for vehicle insurance under CASCO

In insurance practice, insurance companies, as a rule, refuse to indemnify policyholders for loss of marketable value (hereinafter referred to as TPV) under voluntary vehicle insurance contracts (CASCO). The question arises: are such refusals by insurers legal? Are the positions the same in courts of general jurisdiction and arbitration courts?

The Supreme Court of the Russian Federation (hereinafter referred to as the RF Supreme Court) in the “Review of certain issues of judicial practice related to voluntary insurance of citizens’ property”, approved by the Presidium of the RF Supreme Court on January 30, 2013. (hereinafter referred to as the Review), for the first time determines as correct the position of the courts, according to which the penal system is a real damage, citing the following reasoning.

According to paragraph 1 of Article 929 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), in the insurance contract the insurer compensates for losses in connection with the property interest of the policyholder.

In accordance with paragraph 1 of Article 15 of the Civil Code of the Russian Federation, persons whose rights have been violated have the right to demand compensation for losses caused to them in full, excluding cases where the law or contract provides for compensation for losses in a smaller amount.

The law includes real damage as expenses that the person whose right is violated has already made or will have to make in order to restore the violated right, as well as loss or damage to his property.

VTS is a decrease in the value of a vehicle (hereinafter referred to as the vehicle) as a result of premature deterioration in the marketable (external) appearance of the vehicle and its performance qualities due to a decrease in the strength and durability of a specific part, assembly and unit, connection and protective coating due to an accident and further repair of the vehicle .

Thus, the vehicle is a real damage, as well as the cost of repairs and spare parts of the vehicle, because a decrease in its consumer value entails a violation of the rights of the owner of the vehicle, and the insured cannot be denied compensation for the vehicle.

The RF Armed Forces in the Review actually repeats its position regarding the loss of market value, which was determined by it in relation to compulsory civil liability insurance (OSAGO) in decision No. GKPI07-658 dated July 24, 2007, left unchanged by the ruling of the RF Armed Forces dated 06 » November 2007 N KAS07-566.

At the same time, the RF Armed Forces indicate that the absence in the CASCO agreement of the risk of insurance of loss of commodity value is not a reason for refusal to satisfy the requirements of the insured (beneficiary), since in Art. 942 of the Civil Code of the Russian Federation, an insured event means a specific event for the occurrence of which insurance is provided.

The insurance contract and specific insurance rules stipulate what possible events are recognized as insurance risks for which the insurance contract is concluded (in particular, the risk “Damage”). UTI cannot be recognized as an independent insurance risk, because it is an integral part of the “Damage” risk, because upon the occurrence of an insured event, it is included in the volume of material damage.

Consequently, according to the position of the RF Armed Forces, the TTS is subject to recovery from the insurance company.

The practice of arbitration courts, on the contrary, proceeds from the priority of the terms of a voluntary insurance contract. Arbitration courts are guided by Article 421 of the Civil Code of the Russian Federation on freedom of contract and the absence of a prohibition in mandatory rules to exclude the risk of contractual insurance from insurance coverage. As an example, we can cite the decision of June 02, 2010 of the Arbitration Court of the Kirov Region in case No. A28-2557/2010, the decision of August 16, 2010 of the Second Arbitration Court of Appeal, the decision of October 29, 2010 of the FAS Volga- Vyatka district on the same case; decision of November 29, 2011 of the Arbitration Court of the Samara Region in case No. A55-17037/2011, resolution of January 30, 2012 of the Eleventh Arbitration Court of Appeal in the same case.

Thus, today, it should be recognized that there are opposing positions in the practice of arbitration courts and courts of general jurisdiction on the issue of compensation for loss of marketable value under a voluntary vehicle insurance agreement (CASCO).

Author: Yastrebov A.A.

Date: April 27, 2013

How to get the lost value of a car under compulsory motor liability insurance in 2021?

Although the law obliges insurance companies to compensate for the loss of the marketable value of a car under compulsory motor liability insurance, in reality, problems often arise with receiving such payments.

Often, insurers delay the calculation of compensation or refuse to compensate for damage. In 2021, the motorist must submit a corresponding application to the insurance company. In case of refusal, the issue will have to be resolved in court, as in most cases it happens.

When will the insurance company pay the TTS?

Insurance companies often refuse to pay the TTS, because... not interested in additional costs. Most often, the reason for refusal is non-compliance with the insured event, namely:

- the client’s car is fully functional after repair;

- there are no fatal defects on the car;

- lost profits due to TTS are irrelevant, because the insurance does not cover commercial transactions with the car.

The decision of the Supreme Court established that the vehicle insurance is compensation, the payment of which is obliged to be made by the insurance company to the owner of the vehicle. At the same time, the TTS is equal to the costs of car repairs and replacement of failed units, and is paid along with them. From this we can conclude that TC can only be obtained together with compensation for the restoration of emergency transport.

Acceptable reasons for refusal to pay TCB

However, despite the Decree and payment obligations, insurance companies always provide for a number of cases in which the insurance policy is not subject to compensation if:

- the vehicle has been in use for more than 5 (foreign cars) or 3 (domestic) years;

- mileage is more than 100 thousand km for foreign cars and 100 thousand for cars of the domestic automobile industry;

- defective areas and faulty transport mechanisms requiring repairs already existed before the accident;

- car wear and tear is 35% or 40% for foreign cars and domestic models, respectively;

- the total amount of insurance compensation exceeds repair costs by more than 20%;

All these restrictions are directly related to the calculation of the size of the control system. In some cases, when the amount of compensation cannot be clarified or it exceeds the cost of the damage item, the TTS may not be paid:

- the vehicle already had defective areas and damaged components before the accident;

- repair of a faulty part exceeds the market value of a new analogue;

- visible points of unprofessional car repair or part replacement.

For these reasons, it is important to understand that the insurance company does not have to prove the existence of an uninsured event to deny payment. It will be enough that it is impossible to establish the final cost of the vehicle. To avoid these consequences during an accident, you need to record everything down to the smallest detail.

List of insurance cases under CASCO

But there are also positive aspects in matters of payment of TCB. Insured events include not only damage to vehicles in an accident; you can count on vehicle compensation in the following cases:

- collision in the parking lot and in the yard;

- collision during an emergency stop;

- damage due to natural and man-made incidents (large hail, fallen tree, industrial fire);

- arbitrary fire of a vehicle, provided that it was not caused by faulty electrics;

- illegal actions of vandals and robbers.

Insurance companies allow car owners to independently choose in which cases they want to insure their car. For example, if a vehicle is insured only against road accidents, theft and robbery, then if it is damaged at the hands of hooligans, insurance compensation will not be paid.

Compensation for vehicle insurance is possible if you have a CASCO policy, in which vehicle insurance is considered one of the components of the “Damage” risk.

If this clause is not in the contract, then the injured car owner may well turn to the culprit of the accident with a civil claim and demand compensation for damages privately in accordance with Art. 1064 of the Civil Code of the Russian Federation.

Refund is possible if:

- the risk is covered by the policy or you intend to sue the insurance company;

- the culprit of the accident was another person;

- repair costs of at least 5% of the cost of the car;

- The car is new and meets the parameters for calculating the vehicle vehicle.

However, there have already been precedents when policyholders have sought compensation for vehicle insurance from the insurance company even if compensation for vehicle insurance was not provided for in the contract at all. But this is done only in court, since the insurer did not recognize the vehicle accident as an insured event.

For the risk of loss of value, old cars (foreign cars older than five to seven years, and domestic cars older than three years) or those that are very actively used (for example, as a taxi or for transporting goods) cannot be insured. The amount of wear and tear on the vehicle should not exceed 35-40%, depending on the country where the car was produced.

It is unlikely that the company will agree to insure for this risk a car with existing serious damage (corrosion, deformed elements, etc.). The RTS is not calculated for very minor repair work, the so-called repair of the first category of complexity. The vehicle will not be assessed if the vehicle has already been repainted in the area that requires replacement.

In all other cases, the TTC can be calculated in monetary terms. An independent expert is invited to evaluate the TTS, who prepares his opinion and determines the amount of payment.

When calculating the amount of compensation, the wear and tear of the car and parts can play a very significant role. Exceptions are CASCO policies, which initially stipulate that payments are made without taking into account wear and tear.

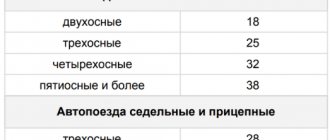

Depreciation rates in each company are different, but for market leaders it is usually 20% for the first year, 12% for the second and subsequent years. The calculation of the vehicle's vehicle rating also depends on the amount of wear: if the machine is heavily worn, then this indicator is not calculated at all.

The CASCO insurance company does not compensate for the loss of marketable value of all vehicles. Thus, payment of compensation is provided in the following cases:

- Domestic vehicles with a service life of no more than 3 years, number of kilometers traveled - no more than fifty thousand, degree of wear no more than forty percent;

- Foreign vehicles with a service life of no more than 5 years, number of kilometers traveled - no more than one hundred thousand, degree of wear no more than forty percent;

- Freight vehicles with a service life of no more than two years;

- Vehicles that have not been involved in traffic accidents;

Payments for vehicle repair may be accrued if the amount required to repair the vehicle exceeds ten percent of its original cost. If the cost of damage to the car is less than ten percent, the CASCO insurance company has the right to refuse payment.

However, in practice, insurance companies refuse to make payments, citing the fact that loss of value is not included in the list of insured events for which payments are due. To avoid such a refusal, you need to:

- At the time of concluding the insurance contract, discuss the terms of payment of insurance policy if necessary;

- Find out which of the listed insurance cases, if necessary, can be interpreted as loss of value of the car;

- Ask to familiarize yourself with insurance programs that provide payments for TTS;

- In the contract, specify the maximum/minimum amount of payments under the TTS (preferably as a percentage);

By confirming all of the above nuances at the stage of concluding the contract, the car owner will have a greater chance of receiving the required payments under CASCO insurance for vehicle insurance.

Otherwise, if the insurance company refuses to compensate for the loss of value, the vehicle owner will have sufficient grounds to file a corresponding claim in court.

A pre-trial claim is drawn up on behalf of the policyholder in the name of the insurer. In it, the dissatisfied car owner sets out the essence of filing a complaint, as well as the requirement to pay a certain amount of the TTS, which was determined by an independent appraiser (attach the document of the independent assessment to the claim). In addition, the complaint refers to a possible appeal to the court.

A sample claim for payment of TTS can be downloaded below, or downloaded from the official portal of the insurance company.

Anti-insurance - standard block

Read about how to sue an insurance company for CASCO here.

To do this, you will have to draw up a statement of claim for the recovery of vehicle insurance from the insurance company. A sample claim can be downloaded on the Internet, obtained by directly applying to the court, or drafted by seeking the help of a qualified lawyer.

Loss of commodity value (LCV) is damage caused to elements and components of transport, as well as surfaces during repairs, technical inspection or during a traffic accident, as a result of which the selling price of the car is reduced and the appearance deteriorates.

In other words, UTS is a decrease in quality and damage to the external car.

IMPORTANT! If the market value of a vehicle decreases, as well as in the event of an accident or in the absence of the culprit, insurers in court are asked to include calculations of the loss of market value in compensation for CASCO insurance.

There are several methods that are used to calculate the vehicle's vehicle technical characteristics. You can independently calculate the loss of marketable value using the methodology of the Guidance Document, however, this calculation will be of a reference nature, since no one will consider it at the official level.

Procedure for obtaining TC

If the circumstances of the accident and the characteristics of the car meet the conditions that allow the car owner to claim compensation for the lost value of the car under compulsory motor liability insurance, the algorithm for obtaining compensation is as follows:

- contact the insurer, reporting the fact of the incident and stating the need for insurance compensation;

- write the necessary application and provide the documentation required for consideration of the insured event;

- present the car for examination;

- after assessing the condition of the car, carry out repairs at a service station suggested by the insurance company;

- contact independent experts to estimate the cost of repairs, taking into account payment for specialist services and the purchase of replacement parts, the price of the car after restoration and comparison with cars of similar characteristics that have not been in an accident;

- when the results of an independent examination with a comparative analysis are received, it is necessary to submit an application to the insurer for compensation for the vehicle’s vehicle;

- If the insurance company refuses or does not provide a negative response in writing within five working days, the car owner must file a claim with the court.

The paper is drawn up in two copies, one of which, with a receipt stamp (date and incoming correspondence registration number in the Investigative Committee), remains with the car owner.

In addition to the above, in 2021 the owner of the car must first carry out the necessary pre-trial actions, without which the consideration of the case in court will not be successful. To do this, the insurer is sent a pre-trial claim outlining the claims presented and notification of the intention to go to court.

IMPORTANT

A claim should be filed only if the management of the insurance company does not agree with the proposed requirements.

How to receive payment of the vehicle insurance policy under compulsory motor liability insurance

Receiving compensation under the TTS is possible only after the injured driver contacts the insurer.

The step-by-step procedure algorithm looks like this:

- The owner of the damaged vehicle contacts the insurance company regarding the accident.

- Draw up a statement in the prescribed form.

- Collect all necessary documentation for calculating payment.

- Submit an application with supporting documents to the insurer.

- Provide the car for inspection by experts.

- After the vehicle is inspected by experts, it is repaired according to the direction received from the insurer.

- After repairs, the car owner carries out an independent assessment, which concludes with an estimate of its market price.

- A comparison is made between the price values of a restored car and a similar car that has not been in an accident.

- Based on the difference in indicators, the owner of the damaged vehicle submits a claim to the insurance company for compensation of lost commodity value.

Application for vehicle insurance under compulsory motor liability insurance, sample

A prerequisite for receiving payments for compensation of TCB is the submission of an application and a set of documents. It is not at all necessary to submit them together with the main claim for compensation for damage under compulsory motor liability insurance. The legislation sets a period of 3 years for this from the date the car gets into an accident.

sample

The application is written in free form, either on a special form or on a standard A-4 sheet. It specifies the details for the insurer to transfer the amount of money. The car owner may also require payment of compensation in cash, having received it from the company’s cash desk.

Package of documents required to be submitted along with the application:

- Certificates and copies of protocols from the traffic police about the circumstances of the accident.

- Vehicle owner's passport.

- PTS and SOP of the car.

- A valid MTPL policy.

- Diagnostic examination card.

- Machine appraisal report.

- Receipt for payment of the examination.

Required documents

Receiving compensation for vehicle vehicle technical liability under compulsory motor liability insurance in 2021 involves the need to prepare the following documentation:

- papers previously provided as a result of the accident - statements, copies of the traffic police protocol, notice, accident report, examination results;

- car owner's passport and driver's license;

- insurance contract;

- confirmation of payment of state duty;

- diagnostic card and documents for the car (PTS and STS);

- an application with a corresponding request, drawn up according to the sample provided by the insurer;

- documents on the current market value of the car, determined by an expert;

- papers indicating the cost of the appraisal examination and confirmation of its implementation.

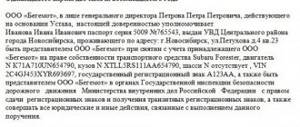

The documents are provided personally by the car owner or his authorized representative to the office of the insurance company. If, instead of the owner of the car, the papers are provided by an authorized person, his powers must be confirmed by a power of attorney.

Application to the insurance company for compensation for loss of marketable value of a car under compulsory motor liability insurance

There is no unified application form to the insurance company for compensation of loss of commodity value under compulsory motor liability insurance in 2021. Insurance companies may use their own templates for such requests. The main requirement is compliance with office work standards. An application for reimbursement of vehicle insurance is drawn up indicating the following information:

- the addressee of the application indicating the name of the structure, position, full name (right, top);

- applicant data;

- circumstances of the appeal with links to supporting documentation;

- information about the car and its estimated value after restoration;

- the amount of the recovered TTS based on the opinions of independent experts;

- bank details of the account where funds need to be transferred;

- list of attached papers.

At the end of the application, the applicant must sign indicating the full name and current date. A sample application is provided here.

Terms of payment of vehicle insurance under compulsory motor liability insurance

The law does not establish specific deadlines for filing an application for reimbursement of TCB. Therefore, by default, they are taken for 3 years - this is the time limit in force in the Russian Federation for property claims. The insurance company, after receiving a request with all the necessary documentation, is obliged within a month . When an agency, for any reason, refuses to pay compensation under the TTS, it is obliged to notify the owner of the vehicle within five days. The notice must indicate specific reasons for the refusal with reference to applicable laws.

Methods for calculating the lost marketable value of a car

Attention

A full calculation of the technical balance can only be performed by qualified experts from an organization that has a license for this type of activity. Several methods are used during the calculations. Which one to use is decided by specialists, but in most cases the Ministry of Justice is used, since it most fully satisfies the requirements of the judicial authorities.

Having studied the accepted methods, the car owner can independently calculate the amount of compensation or use an online calculator offered by one of the many sites on the Internet. But such a calculation is illegal and is used as a preliminary one to assess whether it is worth engaging experts to assess compensation - only the results of the conclusion of a certified organization are taken into account by insurers or courts.

Methodology of the Ministry of Justice

According to this method of calculating the vehicle price in 2021, the percentage of the price of a car after restoration as a result of an accident is compared to a similar one that was not involved in an accident.

The following formula is used for calculation:

C = S x ∑Ki/100 , where:

- C – part of the price of the car by which the market value decreased as a result of the incident (after restoration). This parameter needs to be set;

- C – how much the car cost before the accident;

- Ki is a special correction factor used by an expert when assessing a car.

When choosing an adjustment factor, follow the following rules:

- if, when restoring a machine, it becomes necessary to replace components connected by welding, the correction value is reduced by five times from the original value;

- Repairing parts should not cost more than replacing them;

- when eliminating defects that were not the result of an accident, the coefficient is reduced by half;

- the price of the car is reduced if, as a result of restoration, it was necessary to apply a new paint coating on the body.

The coefficient values are indicated in the tables of this methodology.

Calculation example of TCB

Below is an example of a calculation for a car that cost 600,000 rubles before the incident, if only the upper cross member of the radiator frame had to be repaired:

C = 600000 x 0.1/100 = 600 (rub.).

In the example, the amount of compensation due to the car owner will be six hundred rubles, if we use the methodology of the Ministry of Justice.

Guidance document method

The most complex technique that involves determining the price loss separately for each affected part. The following formula is used in the calculation:

In general = У1 + У2 + … + Уn , in which

У1 – Уn – the cost of restoring individual parts damaged in the accident. These characteristics are preliminarily calculated using the formula:

m

At el. = K2 x ∑K1 x Ci,

1

Where:

- coefficients K1 and K2 , respectively, are corrections that take into account the influence on the technical stability of the method of restoration and the degree of wear of parts;

- Ci is the retail price of the repaired spare part;

- m is the number of parts in need of repair or restoration.

The coefficients are taken from the tables given in the methodology.

Calculation example of TCB

An example of a calculation for minor damage to the front bumper of a car, with a part cost of 1,200 rubles:

- coefficient K1 is assumed to be 0.4, as for repair No. 1;

- K2 coefficient – 0.030 (removable body element);

- At the bump. = 0.030 x 0.4 x1200 = 14.4 rubles.

The damage indicated is minor, so the compensation amount is small. Using the above method, the TTC is calculated for each element, and the resulting values are summed up.

This technique is used for exclusive and expensive foreign-made car models.

Halbgewax method

This technique most accurately determines the value of the control unit and is used more often than other calculation methods. The formula is similar to that used in the Ministry of Justice method, but there are some differences:

Y = K / 100 x (CR + CO) , where:

- U – claim value;

- K – amendment accepted according to the table;

- CR – market price of the machine, taking into account wear and tear of elements;

- СО – repair cost for complete restoration of the car.

The coefficient used in the calculation takes into account the cost of spare parts (SM) and the amount of payment for the services of repairmen (SR). Two parameters are defined:

- A = (CO/CR) x 100%;

- B = (SR/CM) x 100%.

Calculation of UTR is advisable if the following conditions are met:

- Indicator A ranges from 10 to 90. If the price for restoring the car turns out to be incomparably less than the total cost of the car, the examination and calculation of the technical damage control will cost much more than the final compensation;

- Value B exceeds 40 - the cost of work significantly exceeds the price of spare parts and components.

An example of calculating the vehicle insurance

An example of calculating the loss of marketable value of a car under compulsory motor liability insurance, worth 600,000 rubles, two years old, if the CO is 70,000 rubles, and the SM is 20,000 rubles. (accordingly, the work will cost SR = 70,000 – 20,000 = 50,000 rubles):

- A = (70000/600000) x 100 = 11.67%;

- B = (50000/20000) x 100 = 250%;

- the coefficient for additional indicators will be 3.5;

- UTR = (3.5/100) x (600000 + 70000) = 23450 rub.

In this situation, the car owner must receive compensation in the amount of 23,450 rubles.

Definition of the concept of TCB

Loss of commercial value (LCV) of a vehicle is a decrease in the value of a vehicle caused by premature deterioration of the commercial (external) appearance of the vehicle and its performance qualities as a result of a decrease in the strength and durability of individual parts, assemblies and assemblies, connections and protective coatings due to a traffic accident and subsequent repairs (see decision of the Supreme Court of the Russian Federation dated July 24, 2007 N GKPI07-658).

Question: is the loss of marketable value taken into account when determining the amount of insurance payment (does the insurance compensation refer to actual damage or to lost profits)?

Answer: yes, loss of marketable value is taken into account when determining the amount of insurance payment.

Explanations of the Supreme Court of the Russian Federation on the classification of technical damage to real damage

By decision of the Supreme Court of the Russian Federation dated July 24, 2007 N GKPI07-658, paragraph one of subparagraph “b” of paragraph 63 of the Rules for compulsory civil liability insurance of vehicle owners, approved by Decree of the Government of the Russian Federation dated May 7, 2003 N, was declared invalid from the date the court decision entered into legal force. 263 (as amended by Resolution No. 775 of December 18, 2006), in the part that excludes the amount of loss of marketable value from the insurance payment in the event of damage to the victim’s property.

At the same time, the Supreme Court of the Russian Federation indicated:

“...In accordance with Article 15 of the Civil Code of the Russian Federation, a person whose right has been violated may demand full compensation for the losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount (clause 1); Losses are understood as expenses that a person whose right has been violated has made or will have to make to restore the violated right, loss or damage to his property (real damage), as well as lost income that this person would have received under normal conditions of civil circulation if his right was not violated (lost profits).

From the analysis of Article 6 in conjunction with paragraph 2 of Article 12 of the Federal Law “On Compulsory Insurance of Civil Liability of Vehicle Owners” it follows that if damage is caused to the property of the victim, compensation within the limits of the insured amount is subject to actual damage. This condition of the public contract of compulsory civil liability insurance of vehicle owners is directly enshrined in subparagraph “a” of paragraph 60 of the contested Rules.

Loss of marketable value is a decrease in the value of a vehicle caused by premature deterioration in the marketable (external) appearance of the vehicle and its performance as a result of a decrease in the strength and durability of individual parts, assemblies and assemblies, connections and protective coatings as a result of a traffic accident and subsequent repairs.

Thus, the loss of the marketable value of a vehicle, entailing a decrease in its actual (market) value due to a decrease in consumer properties, refers to real damage and, along with restoration costs, should be taken into account when determining the amount of insurance payment in the event of damage to the victim’s property.”

By the decision of the Supreme Court of the Russian Federation dated November 6, 2007 N KAS07-566, the decision of the Supreme Court of the Russian Federation dated July 24, 2007 was left unchanged, the cassation appeal of the Government of the Russian Federation was not satisfied.

Plenum of the Armed Forces of the Russian Federation in 2021 confirmed that the vehicle insurance is subject to compensation, including when the car is repaired under compulsory motor liability insurance

The real damage resulting from a traffic accident, along with the cost of repairs and spare parts, also includes the loss of marketable value, which is a decrease in the value of the vehicle caused by the premature deterioration of the marketable (external) appearance of the vehicle and its performance as a result of a decrease in strength and durability of individual parts, assemblies and assemblies, connections and protective coatings due to a traffic accident and subsequent repairs.

Loss of marketable value is also subject to compensation if insurance compensation is carried out within the framework of a compulsory insurance contract in the form of organizing and (or) payment for restoration repairs of a damaged vehicle at a service station with which the insurer has entered into an agreement for the repair of the vehicle, in accordance with the law. the limit of the insurance amount (See paragraph 37 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of December 26, 2017 N 58 “On the application by courts of legislation on compulsory insurance of civil liability of vehicle owners”)

The Resolution of the Plenum of the Supreme Court of the Russian Federation in 2015 (no longer in force) contained similar clarifications about the TCB:

“Loss of marketable value (LCV) refers to real damage, and not to lost profits. The real damage resulting from a traffic accident, along with the cost of repairs and spare parts, also includes the lost marketable value, which is a decrease in the value of the vehicle caused by the premature deterioration of the marketable (external) appearance of the vehicle and its performance as a result of a decrease in strength and durability of individual parts, assemblies and assemblies, connections and protective coatings due to a traffic accident and subsequent repairs.

The lost commodity value is also subject to compensation if the victim chooses a method of compensation for damage in the form of organizing and paying for the restoration of the damaged vehicle at a service station with which the insurer has entered into an agreement for the repair of the vehicle under the compulsory insurance agreement” (see clause 29 Resolution of the Plenum of the Supreme Court of the Russian Federation dated January 29, 2015 No. 2).

See also comments to Article 12 of the law on compulsory motor liability insurance

Return to the contents of the review of judicial practice: Insurance payment under compulsory motor liability insurance. Procedure, terms, claims. Arbitrage practice

What to do if payment is refused?

If the insurance company refuses to compensate for vehicle insurance under compulsory motor liability insurance, in 2021 the car owner must file a claim with the court at the location of the insurance company. The appeal must contain the following information:

- the name of the body to which the claim is filed, indicating the surname and initials of the head;

- personal information of the applicant;

- description of the circumstances of the case, taking into account the attempt to resolve the issue pre-trial;

- regulatory references confirming the legality of the application;

- requirements presented by the applicant;

- list of attached documents.

IMPORTANT

At the end of the application, the applicant must sign and indicate the date the paper was prepared. To increase the likelihood of successful consideration of the case, qualified legal assistance will not hurt.