- 1. Why can’t the culprit receive payment for his car?

- 2. When can the culprit receive payment? 2.1. If the guilt is mutual

- 2.2. If there is a violation, but this is not the cause of the accident

Important facts from the article

- OSAGO covers the driver's liability, not his property. That is why, in standard cases, the culprit cannot receive compensation for damage.

- But the insurance company pays to the culprit in 2 certain, but rare situations.

- If you hit your own car with another car of your own, then in this case there will be no compensation.

OSAGO insures the driver's liability. That is why this type of insurance is called “automobile liability”. This means that you are protected by the relevant organization from the risk of compensation for damages if you are at fault in various road incidents called road traffic accidents. That is, the insurance company compensates for the harm you cause to the victim for you. But in certain cases, under compulsory motor liability insurance, the insurance company will also pay the culprit of the accident. In this article we will find out in what cases the violator receives an insurance payment and why it is impossible to receive compensation in ordinary cases.

What does mutual fault mean in an accident in 2021?

On the one hand, everything is very simple. This is the case when all participants in the accident are recognized as its culprits... Even if to varying degrees.

On the other hand, you will not find the very definition of the term “mutual guilt” in any law or regulatory act of Russia:

- not the most important law - Federal Law-40 On Compulsory Motor Liability Insurance (OSAGO) contains a definition of the term mutual fault in an accident,

- There is no such thing in the Civil Code,

- neither in the traffic rules, of course, nor in other legal acts.

However, the legislation of 2021 quite clearly regulates all issues related to this. And 2 cases are considered “reciprocal”:

- when the guilt of one or another participant in the accident could not be established (this is not a completely correct case from the point of view of the legal field, and it should be appealed in court),

- when all drivers are found to be at fault for an accident, this situation is most often called mutual fault.

In this case, it does not matter how many cars were involved in the incident: 2 or more. If, for example, 10 cars were involved in an accident, then this accident can be called mutual only when all 10 are determined to be at fault in this incident - which, of course, is very rare.

And if, for example, there are 3 participants in the incident, but only two of them are found guilty, then the accident itself is not mutual, but the fault of these two drivers.

Who decides that guilt is mutual?

Exclusively the judge. Here we will dispel one of the most common misconceptions among car enthusiasts. Traffic police officers on the road under no circumstances have the right to establish mutual fault in an accident. Moreover, they do not find anyone guilty at all, and you will not find such a right for a police officer in any law.

Only the court has the authority to establish guilt in incidents. And it is the judge who, with his decision, summarizes the degree of guilt of the persons involved in the accident.

However, this does not mean that all consequences arising from the “mutual agreement” in the form of compensation for harm also go through the court. Not at all. If none of the participants in the incident appeal to the judicial authority, then the payment will simply be in equal shares. We'll talk more about this below.

With “reciprocation”, no one owes anyone anything - is this true?

No it is not true. Thus, Article 1064 of the Civil Code of the Russian Federation establishes the obligation to compensate for damage caused by illegal actions.

Was there any harm caused in a mutual accident? Yes, it was caused. Illegal actions? Exactly like that! Whose illegal actions? All participants in the accident.

It follows from this that with “reciprocity” in 2021, the rule that none of the drivers pays others and simply restores their car themselves does not work. On the contrary, from the norm of Article 1064 of the Civil Code of the Russian Federation it follows that each of the participants is both a victim and a culprit. Accordingly, he also compensates for the harm. However, not in full, but according to the degree of guilt.

Judicial practice: not every violation entails a reduction in compensation!

However, please note that in a situation where all participants are recognized as culprits (traffic police officers), the accident is not always considered mutual. Because not every violation is the cause of the accident.

Let's explain it more simply. The legislation of 2021 has 2 measures of liability for a particular violation:

- administrative or criminal - established by the state,

- civil – in the form of compensation for damage caused by such a violation.

For example, a driver ran a red light and caused an accident. In this case, he bears 2 measures of responsibility:

- pays a fine of 1,000 rubles for driving on a red (or yellow) light,

- compensates for the damage for another car that he drove into (or his MTPL insurance does this).

So, if there is a violation of traffic rules, for example, administrative punishment, if it is included in the current Code of Administrative Offenses of the Russian Federation, will occur in any case. But not every violation entails civil liability.

Let's return to the above example again. Let’s assume that the second driver was without a valid insurance policy (while the first one crashed into him after entering the intersection at a red traffic light). But this will no longer entail mutual guilt in this accident.

Everything is very simple here. In case of a road accident, for there to be consequences in the form of civil liability, a cause-and-effect relationship between the violation and damage to the property or health of other persons must be established. Is there such a connection if the participant in the accident does not have compulsory motor liability insurance? No. Just as it will not exist, for example, if the driver was drunk, fled, was not wearing a seat belt, and the like.

Thus, a mutual accident can only happen if both traffic violations committed caused the accident. This is exactly what the Supreme Court thinks. In judicial practice there is Determination No. 24-КГ18-17, where the Supreme Court stated literally the following:

At the same time, the fact that participants in a traffic accident are brought to administrative responsibility is not an unconditional basis for imposing civil liability on them for damage caused as a result of actions (inaction) for which they were held administratively liable.

Thus, the mere presence of a protocol and/or a traffic police resolution on the part of the second participant is not a basis for admitting mutual guilt in an accident. His responsibility for the damage caused appears only in the case where such a violation became the cause of the incident.

Insurance payment to the culprit of an accident under CASCO?

If the driver has a CASCO insurance policy, then the degree of his guilt in the traffic accident is not so important. The insurance payment to the culprit of the accident will be assigned in any case, in accordance with the terms of the signed insurance contract. Each insurance company has its own list of conditions that must be met when submitting information about an incident.

Often, a driver tries to save on the cost of insurance by choosing a cheaper CASCO option, and without reading the full rules for providing the service. Insurers, in turn, reduce the cost of the policy by introducing a deductible. This means that when an insured event occurs, the victim (even if he is also the culprit) will not be paid the entire amount of damage, but minus a certain part. According to the contract, this part can be calculated either in a fixed monetary amount or in the form of a proportion relative to the total damage.

It is worth noting that the presence of CASCO insurance does not cancel the driver’s obligation to insure his liability under MTPL, because these two types of insurance do not overlap. CASCO insures the car itself against damage, theft, destruction, and OSAGO insures the driver’s liability for damage to third parties and their property.

Who pays in the case of a “reciprocity”?

Now let’s find out exactly how payments are distributed when all drivers involved in an accident are mutually responsible.

What if both drivers have MTPL insurance?

So, in this situation, both drivers will receive insurance compensation. But what will the calculation be and which insurer will pay compensation?

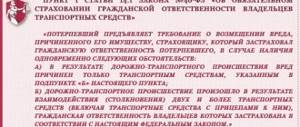

Everything is very simple. Paragraph 22 of Article 12 of the Law on Compulsory Motor Liability Insurance establishes that in this case the payment will be either in equal shares according to the number of participants, or in inverse proportion to the degree of guilt of each of them.

Again, this statement requires some explanation.

- In the event that an accident was registered using a European protocol or by traffic police officers, and the drivers agreed with this, no one went anywhere further to appeal or establish the degree of guilt, then the insurance companies of both participants will pay the victims in equal shares according to the number of these same participants. For example, if 2 cars are involved in an accident, then both of their owners will receive half the calculated damage to their cars. If 3, then 1/3 of the full refund.

- However, if the guilt in a given incident was determined by a court decision, then it, as a rule, also establishes the degree of guilt of each driver. And in this case, each victim receives compensation to the extent that he is not guilty.

In exactly the same way, the provisions of this provision in Article 12 are explained in the judicial practice of the Supreme Court in paragraph 46 of the Resolution of the Plenum No. 58.

For example, one of the drivers did not give way when leaving the adjacent territory, and the other was driving in reverse in violation of traffic rules. The traffic police inspectors arrived and issued both warrants for violations. Moreover, if both of them had not applied to the court for a decision to establish the degree of guilt, then they would have been paid 50% of the damage. But one of the drivers filed a lawsuit, which considered that the one who did not give way was 70% at fault, and the one driving in reverse – 30%. And then the insurance compensation will be calculated as follows:

- Let’s say the damage to a car that did not give way is calculated at 100,000 rubles, in this case he will receive only 30,000 rubles, since he is 70% at fault - that is, the percentage of guilt is deducted from the amount of damage,

- and the damage to the car moving backwards is determined to be 40,000 rubles, and he receives 28,000 rubles (40,000 minus 30% of his degree of guilt in this mutual accident).

However, there is an important subtlety here when the blame in court can fall entirely on the one who was moving in reverse - we will discuss this topic below when describing the procedure for appealing a “reversal”.

If one of the participants in the accident does not have a policy?

Everything is simple here too. Anyone who did not have MTPL insurance applies for damages to the insurance company of the second participant. And the one who has the policy applies directly to the causer of harm, since the latter does not have liability insurance.

But even in the absence of insurance, liability is subject to compensation, inversely proportional to the degree of guilt. That is, here everything works exactly the same as in the example above, only this percentage is reimbursed not by the insurer if the participant does not have a compulsory motor liability insurance policy, but by the tortfeasor himself from his own pocket.

Nuances

Unfortunately, more and more often there are situations when, when registering a traffic accident, the compulsory motor liability insurance policy of the at-fault participant turns out to be invalid, or his liability is not insured in principle. The administrative fine for such an oversight is small (800 rubles, according to Article 12.37 of the Code of Administrative Offenses of the Russian Federation), but in this case the innocent driver faces a big problem of how to compensate for the damage caused to him. Federal Law-40 “On Compulsory Motor Liability Insurance” does not regulate such a situation, i.e. here you should be guided by the Civil Code of the Russian Federation and contact the culprit directly, and then go to court.

If, in the event of an accident, harm was caused to the health of the victim, and the person causing the harm does not have a compulsory motor liability insurance policy, or fled and was not found, then in this situation the law is on the side of the victims. They can receive a compensation payment from the RSA by submitting the appropriate set of documents.

What threatens the participants in the event of a “reciprocity”?

Everything is the same, the same if the accident was ordinary with one culprit. In any case, administrative liability will be imposed for any violation of the Rules. But the civil one - as we found out - will already be partially responsible for the accident.

Let's take a convenient tabular look at the differences between a standard incident and an accident with mutual fault.

Liability comparison table for ordinary and mutual accidents

| Responsibility | Standard Alarm | Mutual incident |

| Administrative | The decree will be issued to the participant who is at fault for the accident (for example, he drove into the rear of the car in front). | Resolutions are issued to all participants. |

| Civil, if no one went to court | The causer of harm or his insurance company compensates the damage to the victim. | All drivers are at the same time not only the perpetrators, but also partly the victims. Therefore, they receive partial refunds - in equal shares according to the number of participants. |

| Civil, if the court has established the degree of mutual guilt | — | Each victim receives a payment according to the degree of his innocence. For example, if the court found your fault to be 20%, then you will receive 80% of the calculated damages. |

If there is an accident with injuries or death?

Above, we considered exclusively administrative and civil liability in case of accidents. We deliberately did not complicate the explanations and examples, because if there was a mutual accident in which harm was caused to health or life, then everything works exactly the same here. It’s just that each culprit will be responsible for his violation as the cause of the victims. But there is an important nuance here - depending on who suffered:

- if the second driver, then the first one is responsible for this (since one is not allowed to bear responsibility for harm caused to oneself),

- if, for example, a pedestrian, then both are motorists.

If the culprit has a fake policy

There are two possible solutions to the problem. If a fake policy is provided on the official letterhead of the insurance company, the Supreme Court of the Russian Federation obliges the transfer of compensation. It does not take into account whether the driver actually took out a policy.

If the form is fake, you will have to negotiate payment personally with the guilty party. If the problem cannot be resolved, only contacting the traffic police for auto analysis and legal proceedings will help.

Based on the information received, it becomes clear what to do if you get into an accident without insurance. If the culprit does not have a policy, there will be a lengthy trial. With an adequate response and ability to make contact, compensation is paid relatively quickly. In court, the amount of compensation can be significantly increased through punitive damages.

What to do if a mutual accident occurs?

Of course, formalize it. The procedure here is exactly the same as in any other accident, as prescribed by paragraphs 2.5-2.6.1 of the traffic rules:

- stop the vehicles immediately and do not move them,

- put up an emergency sign and turn on the emergency lights,

- call the traffic police (if there are injured/dead or there is no opportunity or desire to draw up a European protocol).

But many car owners may have questions regarding further actions. Although in this case there is nothing special. So, let's find out the further procedure in case of mutual fault in the incident.

Important note!

- This article describes the basic principles of how legislation works. Meanwhile, in judicial practice everything depends on specific circumstances.

- In 96% of all cases there are subtleties that can affect the outcome of the entire case.

- Therefore, we recommend entrusting the matter to professionals who will study your business and select the right winning strategy.

The TonkostiDTP website employs professional road accident lawyers with experience in all major types of disputes (MTPL, guilt, administrative penalties).

Ask a lawyer

or get a free consultation by calling the hotline: 8.

Which insurance company should I contact?

In its own way, if the conditions for this prescribed by Article 14.1 of the Federal Law on Compulsory Motor Liability Insurance are met:

- Only cars were damaged

- all participants have valid MTPL policies,

- in an accident there was interaction (direct collision, not non-contact) of cars.

Thus, it does not matter whether the accident was mutually blamed or whether the culprit is one participant. The rules for direct claims are not affected by this and, if the conditions for this are met, you must contact your insurance company.

Please note that if the above criteria are met, you do not have the right to choose where to go for payment, but the obligation to go only to your insurer. And vice versa, if at least one of the criteria is not met (for example, you do not have compulsory motor insurance or there was a non-contact accident), then only contact the insurer of the other participant.

Will I be paid or sent for repairs?

The form of compensation for damages also does not depend on liability and fault. In case of a mutual accident, the same rules apply: by default, the insurer is obliged to issue a referral for repairs, and payment is due if the conditions from clause 16.1 of Article 12 of the Federal Law 40 are met:

- in the accident there were victims with moderate or severe harm to health or deaths,

- there was a total loss of the car,

- if the victim is disabled,

- if, according to the calculation, the amount of damage exceeded the maximum limit in compulsory motor liability insurance,

- if the victim and the insurance company have entered into a payment agreement by mutual consent,

- and also if the insurer does not have car services that meet the requirements of the law (in the same article 12).

Will I have to pay extra?

We found out that even if you were both at fault in an accident, you may be sent for repairs. But what if the amount of compensation is not full? Is it really possible that the car will only be repaired halfway?!

Not at all! But the insurer is not obliged to pay extra from its own funds. In this case, the service station will either completely restore your car for your additional payment, or there will be a cash payment. That is, you have the right to pay extra for a complete repair - it is a right, not an obligation. This is what subparagraph “d” of paragraph 16.1 of Article 12 of the Federal Law on Compulsory Motor Liability Insurance tells us.

Thus, in case of a rim accident, you can choose:

- payment in money

- or pay extra and your car will be completely repaired.

But for obvious reasons, the law does not provide for partial restoration of the car.

How do I know if I have been paid enough?

So, you filed a claim with the insurer, and as a result, you were paid a certain amount of money. But how can you understand that everything was calculated correctly for you and that you weren’t deceived by not paying extra? After all, you already know that the amount of damage will be reduced by the share of guilt. But we didn’t see any specific amounts.

So see them! The fact is that clause 4.23 of the Insurance Rules obliges the insurance company to familiarize you with the results of the calculation, issuing a copy of the report upon its readiness within 3 days from the date of your written request.

And it is in the act that you will see both the full amount of damage without deducting interest, and after deduction, and you will be able to understand whether the insurance company has underestimated the payment.

What to do to receive payment under compulsory motor liability insurance if you are at fault

If a traffic accident occurs, you should never panic. It is important to soberly assess the situation and act according to the established procedure. It is established in paragraph 2.5 of the Traffic Rules:

- Stop the car, turn on the hazard lights, turn off the engine and put up a warning triangle. In low light conditions, you should wear a reflective vest. Such actions are designed to prevent another accident.

- If there are victims, they must be provided with first aid and call an ambulance.

- Report the incident to the traffic police. You can call the traffic police from a landline phone or payphone at number 02; when using a mobile phone, you need to call 112. The number may differ for different mobile operators. It could be 002, 020 or 902.

- Notify your insurance company about the accident. To do this, you need to call the number indicated in the policy. This must be done immediately.

- The vehicle and objects related to the accident must not be moved until the police arrive. Inspect the vehicle, write down information and contact details of possible witnesses.

- Preferably record the details of the incident through photography and video.

If you decide to take photos, they must meet the following requirements:

- Overall plan. It should show the damaged cars and the road. It should be easy to see from the photograph whether this place is a parking lot, a busy street, or a residential building's courtyard.

- Take photos of the road surface, flying glass and broken parts, and braking distances.

- Take general photos of the front, back and side. Car license plates are false to be visible.

- Take close-up photos of the damage.

How to challenge mutual guilt?

Absolutely the same as if the fault was only yours. Here you need to understand what exactly you want to challenge:

- if the accident itself is reciprocal (that is, so that only the other participant is at fault), then you need to appeal the decision made against you,

- if there is a degree of guilt, then you file a lawsuit to establish it, where you give arguments.

Subtlety, when it is not possible to challenge the “mutual relationship”, but it is necessary!

Mutual guilt is very often admitted by inspectors who do not want to understand the intricacies of the legislation - specifically traffic rules. Here we will look at a situation where one of the drivers is charged with an offense for failing to give way to another.

Meanwhile, in judicial practice the rule “the violator has no advantage” has long been established. This means that the obligation to give way to someone who does not have the right to move is eliminated. Let us give the legislative basis for this statement.

- The very term “give way” from the traffic rules requires giving way only to those who have priority.

- Meanwhile, priority is also defined there as “preemptive right to traffic.”

- So, if the driver does not have the right to drive, then, in principle, he cannot have such a preferential right.

- Consequently, the other driver’s obligation to yield disappears - there is simply no violation.

This is the sequence that must be indicated in court when appealing against mutual guilt. But the main thing is to refer to the relevant judicial act, which lower courts are obliged to follow. It is precisely the sequence of interpretations of traffic rules indicated above that is given by the Supreme Court in the recent Resolution of the Plenum No. 20 (paragraph 14).

Is it possible to issue a European protocol in case of a mutual accident in 2021?

Yes. Mutual guilt in an accident does not in any way limit the right to fill out a European protocol notice without traffic police officers. But the following conditions must be met (from Article 11.1 of the law):

- Only 2 cars should be involved in an accident - no more and no less,

- both have valid MTPL insurance,

- damage was caused only to cars (not to other property or health),

- there was direct contact between the machines,

- the limit of 100 thousand rubles has not been exceeded (you will not receive more) or 400,000 if issued using the application,

- There are no disagreements regarding the circumstances of the accident.

Pay attention to the last point. In practice in 2021, it means that both participants must admit their mutual guilt. Although the law does not directly indicate this, however, insurers often refer to the admission of guilt as a disagreement.

What if I have Casco?

And here everything is simple. You can simply apply under the Casco agreement and receive full compensation, regardless of your fault for the accident. This, of course, depends on the terms of such an agreement, but they almost never establish such restrictions as a mutual accident.

After applying, your Casco insurer will recover damages from the insurance company of the second party to the accident instead of you, but in the same way as you would have recovered - in the same proportion as the degree of guilt established for the second culprit.

Is it possible to simply drive away from the scene of an accident?

Based on the above, we can safely assume that it is better not to register a minor mutual accident at all. Judge for yourself - if each car has damage, for example, of 5,000 rubles, then everyone will receive half of this amount, and even at the expense of KBM, the cost of insurance will be higher over the next few years. Obviously, in total it will cost more than 2,500 rubles. Add traffic police fines for violations to this.

It turns out that it’s better not to contact anyone’s insurance company at all and not to file such an accident and just go on with your business? Almost like that, but it’s better to still file an accident and, most often, even get a fine.

The thing is that in the end it can cost more if the traffic police find out that there was an accident and you fled from it. This threatens deprivation of rights for a long period. Do you think this is unlikely? Now imagine an unscrupulous second participant in the accident, who thus decides to get rid of the “double-deal” by the fact that in the future no one will deal with the circumstances of the accident or he will hide his guilt.

That is, the possible scenario here is something like this:

- for example, you were involved in an accident due to speeding and failure to yield,

- decided to part ways, deciding that both were at fault and due to minor injuries,

- the second driver returns to the scene of the accident and calls the police,

- they file an accident and then charge you for leaving the scene of the accident,

- at the same time, the very fact of hiding, of course, does not make you the culprit, but in some cases such fraud will allow the second participant to hide his guilt (for example, give “correct” testimony and move the car).

What to do in this case? There are actually a lot of options.

- You can indeed drive away, but write a receipt that there are no casualties in this accident, and you do not need to register the incident. Traffic regulations provide such an opportunity. But please note that clause 2.6.1 of the Rules requires that for this to happen, the conditions for issuing a European protocol must be met.

- You can write a European protocol, agreeing that none of you will apply so that the MSC does not increase. Here, of course, there is also a basis for deceptive actions.

- You can file an accident with traffic police officers, but also do not contact insurance companies for payment of damages. However, in this case, the arriving officers will issue fines for violations that led to a mutual accident.

What to do if the culprit of an accident is without insurance

It is important to know how to recover damages if the person at fault for the accident does not have insurance. In this case, direct appeal to the insurance company does not apply, since there is no agreement. The victim’s policy is not relevant to the case and is not taken into account, since it only insures the vehicle in case of damage to the other party.

Many drivers are interested in what happens if I am at fault and get into an accident without insurance. In this case, it would be best to voluntarily compensate for the damage to avoid facing litigation and serious costs.

To be guaranteed to receive compensation according to the law, without resorting to lengthy legal proceedings, you can apply for CASCO insurance. This makes it possible to contact the insurer directly without taking into account the other party's policy. If the guilty driver does not intend to bear responsibility, he will have to seek a fair solution through the court.

Judicial practice in mutual road accidents

Let's, in addition to the Supreme Court, look at the practice of ordinary courts in considering such cases, looking at a couple of examples.

- In Bashkiria, the court made an interesting conclusion. In 2021, the maximum payment limit for property under compulsory motor liability insurance is 400,000 rubles. So, the judge indicated that in case of mutual guilt in an accident, the maximum amount should be taken into account not in the calculation, but in the final payment amount. That is, if the insurance company has calculated the damage at 500 thousand, and the degree of fault is 50%, for example, then it will pay 250 thousand, and not 50% of the maximum limit - that is, 200 thousand.

- In the Tula region, the court made a decision in the case of an accident when 2 cars were moving in reverse and collided. At the same time, they violated clause 8.12 of the traffic rules. The current Code of Administrative Offenses of the Russian Federation does not provide for punishment for this violation. Therefore, the inspectors who arrived issued a ruling refusing to initiate a case. Based on this refusal, one of the participants tried to challenge mutual guilt. However, this failed, since the court found that both violations led to the accident, and the refusal to initiate a case does not entail the abolition of guilt.

- We recommend reading in full another interesting court decision in the Kemerovo region. There is a non-contact accident with an attempt by the victim to contact his insurance, and an appeal of mutual guilt, when the driver was accused of speeding (and the other was accused of changing lanes).

When is the person at fault for an accident entitled to insurance compensation?

Speaking about the insurance payment to the culprit of the accident, we can distinguish 3 scenarios:

- the guilty driver is not paid anything (under the MTPL policy);

- the participant who is at fault for the accident is awarded partial compensation (under the MTPL policy, most often after a court decision);

- the initiator of the accident is paid the full cost of the damage (if there is a CASCO policy and a number of conditions are met).

The OSAGO Law notifies that in the event of an accident, a monetary payment is due to the participant who is innocent of the incident. That is, if both participants have only standard MTPL policies, then the person responsible for the accident will not receive any financial compensation. In addition, the next time you purchase a policy, an increased bonus-malus coefficient will be applied to such a driver, and insurance will cost more.

For this reason, some drivers prefer not to formally register minor accidents, even using the “Euro protocol”, but try to resolve the issue on the spot. For young drivers with little experience, being guilty of an accident can increase the cost of your next compulsory motor liability insurance policy by 1.5 times.