What is a recycling fee and who pays it?

According to the Law “On Industrial Waste” No. 89-FZ of June 26, 1998, Russian citizens are required to pay this state duty when buying a car since 2012. This applies to all wheeled vehicles, self-propelled vehicles, and trailers. But there are some exceptions. Sometimes special categories of vehicles are exempt from payment.

Those who hear about this for the first time are wondering: what is the recycling fee in the PTS? Based on the definition of legislation, this is a one-time payment to the state, which is collected from citizens purchasing vehicles. Introduced to ensure the safety of the environment, ecology, health and human life from negative consequences during the operation of transport. Recording the recycling fee paid in the PTS means that this vehicle will be disposed of free of charge.

The money from the paid excise tax will be used in the future to dispose of the car according to environmental standards.

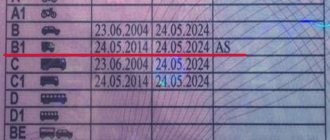

A mark is placed in the PTS about the recycling fee on the front part of the document in “Special Marks” (this is the left side of the page). When the mark is affixed, it means that the owner has paid it. If the stamp is present, this is a positive thing. This means that the owner has the right to free disposal of the machine at the end of its service life.

Due to the fact that such payment was not introduced until September 2012, purchasing vehicles with a technical equipment passport issued before this date should not be marked. Accordingly, when buying a car for which the title was issued after September 2012, it is important to know that the absence of such a mark means that the tax will have to be paid to the new owner. Before purchasing, carefully study the documents to understand what additional costs await you.

It is not possible to register movable property without paying a fee. Even if you have an official transport passport in your hands, it is considered that it was registered illegally. According to traffic rules, driving such a vehicle is permitted for 20 days. Because this is the validity period of transit numbers. After this period, the machine cannot be operated without consequences. At the first stop, the traffic police inspector will impose an administrative fine in the amount of 500 to 800 rubles. Next time, for a repeated violation, the driver will be deprived of his license for up to 3 months.

Article 24-1 of Federal Law No. 89-FZ determines who must pay excise tax:

- If the transport is imported from foreign countries to Russia (for example, driven independently from Korea to Russia). When importing for less than six months, state duty is not paid.

- If the vehicle was purchased from a seller who was exempt from payment or was not paid at all.

This state duty is paid once. If the car is manufactured by a domestic manufacturer, it is paid by the manufacturer or one of the owners. For vehicles arriving on the territory of the Russian Federation from other countries, the obligation to pay tax falls on the person who imports the vehicle.

Sometimes on domestic cars, instead of the “paid” mark, there may be another one - acceptance of obligations for disposal.

Then you need to make sure that the car manufacturer on the date of issue of the PTS was in the register of organizations for recycling products and was not excluded from there. Reasons for exemption from payment of duty:

- transport is owned by international firms and their employees, consulates and representative offices;

- The age of the vehicle is more than 30 years, if the following conditions are present: non-commercial purposes of the car and the original engine, body and frame;

- if the car was brought into Russia by the personal property of participants in the program for the voluntary resettlement of compatriots from abroad.

When purchasing a vehicle from employees of international companies and participants in the resettlement program, the buyer pays the state duty.

If it's not worth it, what does that mean? Firstly, the car owner will not be able to register his vehicle with the State Traffic Inspectorate. Secondly, the amount of money will still have to be paid to the state.

Recycling Obligations Act

The number of cars and special equipment has increased sharply in recent years. The issue of vehicle recycling has become acute. A one-time collection should ensure further processing if operation is not possible. The changes affected the legislative framework.

- When purchasing a domestic car, the passport of which was issued before September 2012, the fee is not established in accordance with the law on production and consumption waste (No. 128).

- Orders of several ministries (No. 496 of the Ministry of Internal Affairs, No. 192 of the Ministry of Industry and Energy, No. 134 of the Ministry of Economic Development) affect special PTS marks. Payment of a fee or acceptance of an obligation will need to be noted.

- Government Decree (No. 938 08/12/1994) explains the procedure for making a contribution if there are no records.

Each entry in the PTS is certified by the seal and signature of the responsible person. This responsibility has now been assigned to tax and customs officers since 2014.

Who makes the mark

In documents importing vehicles and self-propelled machines into Russia, a note indicating payment or exemption of the citizen from payment is placed by an authorized customs officer. The mark is certified by the official’s personal seal and placed in the “Special Marks” section.

What the entry might look like:

- “The disposal fee has been paid. TPO “___” (indicate the number of the customs receipt order reflecting the calculation).

- “The recycling fee is not paid” (indicated on the basis of which paragraph of Article 24.1 of Federal Law No. 89 is not paid).

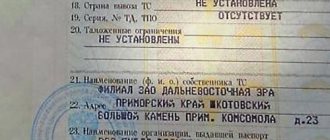

The vehicle manufacturer on the territory of the Russian Federation pays the duty and submits the necessary documents confirming the fact of payment, together with the passport of the technical equipment or self-propelled vehicles, to the tax service at the location of the manufacturer. In this case, the mark is affixed by the tax office.

Large manufacturers in Russia that produce wheeled vehicles, self-propelled vehicles and trailers for them can independently put a mark if they are included in the register.

Individuals and organizations that have not paid submit documents (PTS or PSM) to the tax office at their location or residence.

When the PTS is lost, stolen or becomes unusable, a duplicate document is issued. In this case, the duplicate is marked by traffic police officers. If it is a self-propelled vehicle - the State Technical Supervision Authority.

In what cases is information entered into the PTS?

O means that a payment has been made to the state for further disposal of the vehicle. Placing a record of payment of the recycling fee in the vehicle passport is the responsibility of the authority that issues the document. Moreover, until 2012 (during the 2010-2011 recycling program), the fee was a fixed amount equal to 3 thousand rubles and was collected directly from the owner of the vehicle upon concluding a recycling agreement, and the payment mark was not placed in the PTS. Now this responsibility lies with the domestic manufacturing plant, which makes payments and issues a vehicle passport, as well as with the Customs Service in the case of importing vehicles from abroad.

In the PTS or PSM of cars, self-propelled and other vehicles included in this category, there must be a note about payment of the recycling tax in order to subsequently register and register with the traffic police. Therefore, experts recommend that before purchasing a car, check the column with special marks in the received documents (in the PTS after 08/31/2012 or in the PSM after 02/10/2016).

Thus, such an entry must appear in the passports of all vehicles, except for those for which PTS were issued before September 1, 2012 or those that were imported from abroad by an individual independently. The last case is noteworthy in that the recycling fee must be paid by the citizen himself and no entries will be made in the PTS. He only needs to submit a package of documents and a declaration with calculations of the amount of the state tax to the Tax Service within 2 days after making the payment.

Payment order

Having figured out what the recycling fee mark on the vehicle vehicle means, who pays it and why, you should also know the payment procedure. The payment rules in paragraph 6 determine that payment is made in Russian rubles personally by the owner, by sending funds to the appropriate budget classification code with a separate payment order. The money goes to the Federal Treasury account.

You can find information about tax invoices on the Internet on the official website of the Federal Customs Service or the Federal Tax Service.

It is important to pay attention to ensure that the following fields are filled in:

- (104) – budget classification code (KBK), in accordance with the Russian budget classification system.

- (107) – code of the body administering incoming payments, consisting of 8 characters.

It is impossible to count this type of state duty into other payments.

According to clause 8 of the Payment Rules, the payer is obliged to provide a package of documents to the customs authority where the transport is declared or to the authority at the place of residence, to confirm the correct calculation of the tax:

- Calculation of the amount of duty in the prescribed form (Appendix 1 to the rules), which is filled out and signed personally by the payer.

- Copies of examinations.

- A copy of the certificate that the structure is safe.

- Copies of documents accompanying the goods (if available).

- A copy of the vehicle type approval document.

- Payment document confirming payment.

Always retain copies of submitted documents, statements, checks and payment orders for three years.

How much and who pays?

The car owner pays a one-time recycling fee. Previously, the amount was 3,000 rubles without making an entry in the PTS. Today you will have to pay if:

- importing a car;

- failure to pay the fee by the previous owner;

- exemption from payment for the seller of a personal car.

The payment amount is calculated using a special formula. The established rate is multiplied by a coefficient depending on a number of criteria. For personal vehicles the base rate will be 20,000 rubles; for special equipment and commercial vehicles it has been raised to 150 thousand.

Why is a duplicate PTS bad?

When purchasing a car with a duplicate registration certificate, you can fall for scammers. Most often this is typical for credit cars. Although for this category of vehicle the original PTS is stored in the bank that provided the money for the transaction, experienced fraudsters know how to get a replacement document.

There are also cases of attempts to sell a stolen car using a replaced vehicle passport. A fraudster, under the guise of the owner, can contact the traffic police department to restore, as if previously lost, a PTS, and by such actions receive a duplicate in his name.

Of course, not in all cases, a duplicate registration certificate indicates an “unclean” past of the car. There are legitimate cases that give rise to its issuance.

For example, the original ran out of free space to enter information about the new owner. In this case, the buyer should most likely be wary of what circumstances caused the frequent change of owners.

When is a duplicate PTS issued and what does it look like?

The owner has the right to apply to the State Traffic Inspectorate office with an application for the issuance of a duplicate PTS. You can receive it on the same day of application, except in circumstances where additional inspection of the car and verification of numbers on parts is required. In this case, obtaining a replacement passport may take up to one month.

In addition to the application, the car owner needs the following documents:

- owner's civil passport;

- certificate confirming ownership;

- a document indicating how the car was acquired - purchase, inheritance, donation;

- insurance policy;

- a certificate confirming payment of the state duty;

- explanatory note (in case of loss of the original).

The duplicate of the technical passport contains information in the “Special notes” column about the reason for issuance, for example: “Duplicate. Issued to replace the scrapped vehicle title." This is its only difference from the original. The series and number of these documents must be the same, as well as all other data in each paragraph.

The grounds for issuing a duplicate registration certificate are:

- change of personal data of the owner - last name, registration;

- the free space for recording the data of the new owner of the vehicle has run out;

- the previous PTS was lost, stolen or damaged.

On a note! In case of document theft, the best option would be not to include the registration certificate in the list of missing documents. According to the order dated April 24, 2008. A duplicate of a stolen registration certificate can only be issued after the criminal case regarding the theft has been closed.

This is often a very long search process, so you will be prohibited from using your vehicle during this entire time. It will be easier to write a statement and an explanatory note due to the loss of the original.