In accordance with the Regulations on vehicle passports and vehicle chassis passports (approved by order of the Ministry of Internal Affairs of Russia No. 496, the Ministry of Industry and Energy of Russia No. 192, the Ministry of Economic Development of Russia No. 134 dated June 23, 2005) in the section “Special obligations for disposal have been accepted, No.___ in the register” (indicating the number under which the manufacturer is included in the register); “The disposal fee has been paid. TPO No. ___" (indicating the number of the customs receipt order, which indicates the calculation of the recycling fee); “The recycling fee is not paid” (the corresponding paragraph of clause and article 24.1 of the Federal Law of June 24, 1998 N 89-FZ “On Production and Consumption Waste” must be indicated, in accordance with which the recycling fee was not paid).

This means that the car dealership where you bought the car is participating in the recycling program.

When buying a vehicle, the future owner wants to save money and not spend money on additional services. Buyers have many questions when it comes to recycling obligations and notes about this in the vehicle passport.

The article answers questions about the adoption of new laws on marks in PTS, the amount of costs, and liability for non-payment.

What is written in the special notes column in the PTS?

When filling out the document, in the “Special Notes” column it is stated that a recycling fee was paid for the car or other vehicle. There may not be such amendments for only two reasons:

- The car was purchased and registered before September 1, 2012.

- The car was brought from abroad, responsibility for non-payment lies with the buyer.

If payment of funds for future processing of the car is evaded for illegal reasons, the obligation to pay falls on the new buyer, otherwise problems will arise during the technical inspection.

Attention! Information about exemption from payment and the reasons for this are indicated in strict order.

Entry into the PTS, obligations for recycling have been accepted 7 in the register

In the “Special Notes” field there should be an entry indicating that the fee has been paid, or that the fee has not been paid. First of all, you need to carefully study the vehicle passport (PTS). In the PTS, we pay special attention to the date of issue of the PTS and to the “Special Notes” section (after all, it is in this section that the mark for payment of the recycling fee is placed).

To establish that for the purposes of this order, special enforcement proceedings executed by the interdistrict department of bailiffs for special enforcement proceedings include those initiated on the basis of: 1.1.

This responsibility has been assigned to the Federal Tax Service since January 1, 2014 and, apparently, in connection with this, the Regulations on vehicle passports and vehicle chassis passports do not yet indicate what mark the Federal Tax Service should put on the payment of the recycling fee.

Who must accept the obligations for the recycling fee in the PTS, what does this mean? Special marks in PTS: what are they and how to decipher them?

This responsibility has been assigned to the Federal Tax Service since January 1, 2014 and, apparently, in connection with this, the Regulations on vehicle passports and vehicle chassis passports do not yet indicate what mark the Federal Tax Service should put on the payment of the recycling fee. Reasons for the lack of marks in the PTS may be different.

You can view the updated text of the document by clicking on the link above. I would like to immediately note that the regulation on PTS has undergone a large number of changes, but not all of them will be of interest to the average car enthusiast. Therefore, only a few of them will be considered in this article.

In practice, many buyers either avoid purchasing cars with stickers, or offer a lower price for them.

Who pays for car recycling and how much?

The payment is made at a time, for one specific car the first owner in the Russian Federation pays. In some cases, payment is made by the manufacturer:

- If the technical product is older than 30 years, but has not been used for commercial purposes (the car body parts are “original”).

- The car is registered with consuls, diplomats, and international relations organizations. This category includes both individuals and their family members.

- If a vehicle was brought to the territory of the Russian Federation from another country under a special resettlement program, then it is marked as the owner’s personal property.

It is noted that the last two points are valid until the car is purchased by another person not related to resettlement or diplomacy. The new owner is required to pay the fee by law.

The amount paid for the car is not difficult to calculate if you use the formula:

BS * K = SUM US, where:

- BS – base rate;

- K – the value of the correction factor;

- US – recycling fee.

Information about the size of the coefficient is written in the list:

- for special equipment – 150,000 rub.

- for passenger cars – 20,000 rub.

Since 2014, the obligation to pay for recycling applies to ATVs, which means that there must also be a special mark in the documents and passport.

Disposal of PTS

4. What does the PTS mean? Obligations for disposal have been accepted, number 64 in the register.

4.1. Hello! In accordance with the Regulations on vehicle passports and vehicle chassis passports (approved by order of the Ministry of Internal Affairs of Russia No. 496, the Ministry of Industry and Energy of Russia No. 192, the Ministry of Economic Development of Russia No. 134 dated June 23, 2005), one of the following entries must be in the “Special Notes” section: “Obligations for recycling have been accepted, No.___ in the register” (indicating the number under which the manufacturing organization is included in the register); “The disposal fee has been paid.

TPO No. ___" (indicating the number of the customs receipt order, which indicates the calculation of the recycling fee); “The recycling fee is not paid” (the corresponding paragraph of clause and article 24.1 of the Federal Law of June 24, 1998 N 89-FZ “On Production and Consumption Waste” must be indicated, in accordance with which the recycling fee was not paid).

This means that the car dealership where the car was purchased is participating in the recycling program.

Calculation error - who will return the money?

The recycling fee is a one-time payment. The most common mistake is paying for the same car over and over again. Since the payment amounts are not small, and in the case of special equipment and trucks – large, it is necessary to urgently contact the organization that issued the expense.

The money will be returned to your personal account if 3 years have not passed from the date of the erroneous payment. Documents needed:

- certificate of repayment;

- confirmation of payment of the fee;

- a copy of the identity document in one copy;

- original and copy of PTS.

Duplicates, fakes, troubles with PTS

After the adoption of the law and the amendment on recycling, prices rose, and cases of fraud with PTS became more frequent. Remember that a duplicate is an exact copy of the original PTS that is lost or damaged. The duplicate must have a recycling mark, otherwise problems will arise with the traffic police and you will have to pay the fee again.

User Dmitry Rogov talks in detail about the troubles that arise with PTS in his amateur videos.

Check the documents before buying a new car, keep track of dates and marks so that there are no problems, fines or unnecessary overpayments.

September 1, 2012 was the day when a fee for the recycling of motor vehicle units was established in Russia. Today, the introduction and application of this excise tax is an integral part of the purchase and sale procedure not only for cars, but also for various types of special equipment. In this article we will talk about what a recycling fee is, what the entry that is considered a special mark means, how it is calculated and whose responsibility is to pay it.

Read more: Purchase and sale of land in SNT documents

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

What does the information about the fee in the PTS say?

The recycling fee (US) is a special type of excise tax, the need for which is reflected in the Law “On Production and Consumption Waste” No. 89 (clause 1, article 24-1).

It is presented in the form of a one-time payment aimed at guaranteed recycling of the car after destruction.

This means that the state thereby takes care of the environment, obliging the manufacturer or buyer to pay in advance for future work on recycling the vehicle.

However, the lack of this information may not always be a cause for concern. There may be several reasons for non-payment of the fee:

- The passport for a Russian or imported car was issued before September 1, 2012. There is no need to pay this payment when purchasing and owning such a vehicle.

- The car is imported into the Russian Federation from abroad by the buyer. He is also responsible for paying the fee.

There is another reason that does not occur so often. The previous owner was somehow able to bypass the need to pay the fee. In turn, this responsibility falls on the buyer, since information about the existence of a collection debt will be checked during registration.

You may also encounter a situation where a new vehicle title is issued to replace the scrapped one. This is done when there are already a lot of entries in the old passport and new ones simply do not fit.

Advisor

You are buying a domestic car for which the title was issued before September 1, 2012. You can rest assured that you will not have to pay a recycling fee in accordance with the Federal Law of July 28, 2012 No. 128-FZ “On Amendments to the Federal Law “On Production and Consumption Waste” and Article 51 of the Budget Code of the Russian Federation.” The obligation to pay a recycling fee does not apply to these vehicles.

Option 2. The title for the purchased domestic car was issued during the period from September 1, 2012 to December 31, 2013.

In this case, the PTS must contain one of the following marks: a note on payment of the recycling fee; a note indicating acceptance of recycling obligations. But even if there is this mark, it is worth making sure that the vehicle manufacturer at the time of issuing the PTS was actually included in the register of organizations that accepted the obligation to dispose of it.

Who should pay and how much?

The question of who is responsible for paying this fee comes down to how the car was purchased and ended up in Russia.

For example, an ordinary citizen purchasing a vehicle must pay the fee in the following cases:

- When importing a car from outside the country and further going through all import-related procedures.

- By purchasing a car from a person who has avoided this contribution by circumventing the law, or from someone exempt from paying the tax (for example, a consulate or a foreign company).

The amount of the fee is equal to the base rate multiplied by a coefficient that consists of a number of parameters.

Today in Russia the amount of the basic tax rate is:

- 20 thousand rubles – for passenger cars used for personal purposes;

- 150 thousand rubles – for commercial vehicles and special equipment.

Since the beginning of 2014, a recycling fee has been mandatory for all other types of transport, including ATVs, which has definitely also led to an increase in prices for them. You need to make sure that after payment the PTS is stamped with a recycling stamp.

What is the responsibility if it is not paid?

Certain groups of individuals and organizations are also exempt from paying the tax:

- diplomatic missions and foreign companies, as well as their employees and family members;

- persons participating in special programs, for example, resettlement of compatriots from abroad, and their vehicles;

- owners of vehicles manufactured more than 30 years ago and retaining the original load-bearing parts of the body.

Read more: Cassation appeal against the decision of the regional court

If you do not belong to one of these categories of citizens, and the recycling fee is not paid for some reason, serious problems may arise. The first and most important problem will be the impossibility of registering a vehicle.

You will still have to pay the fee, and delaying the solution to this problem is fraught with penalties, and if detected again, with deprivation of the right to drive a car for up to 90 days, in accordance with Article 12.1 of the Code of Administrative Offenses of the Russian Federation.

Is it possible to return it back in case of an error?

We can talk about restoring the recycling fee only in cases where this payment was made due to an error, for example, in the case of a repeated payment. Of course, such situations are rare, but they should be talked about.

To receive funds, you must submit an application to the relevant authorities that received the fee, namely:

- Customs service - in cases of imported vehicles.

- Tax office - for Russian cars.

The owner of the car must have a passport of a citizen of the Russian Federation, a title for the vehicle, a document with proof of payment for the fee by the previous owner and a receipt. It would be a good idea to prepare copies of these documents in advance. You can receive and fill out a refund form on site. You should expect a response to your application within a month.

How to return the recycling fee

Situations of repeated payment of the recycling fee, although rare, do occur (if the fee was paid by the previous owner or the manufacturing company). In this case, you need to contact the authority that accepted the payment of the fee:

- For cars imported from abroad - the customs authority;

- For cars produced in the Russian Federation - tax service;

In order to return an erroneously paid fee to customs or tax authorities, you must submit an application for the return of the recycling fee.

Applications for the return of overpaid recycling fees

In addition to the application, you need to collect a small package of documents, which should include:

- Passport of the owner of the vehicle (it is necessary to make copies of its main pages in advance);

- Payment documents confirming payment of the fee (these may include receipt orders or payment orders);

- A document confirming the excess payment of the fee must be provided.

The authorized body within 30 days (meaning calendar days) must make a decision on your application regarding the return of the recycling fee, or give a reasoned refusal to return it.

Important The period during which you can apply for a refund of overpaid amounts of disposal tax is 3 years from the moment it was paid. Funds paid as a fee are not subject to indexation and are therefore returned in the same amount in which they were paid, without the accrual of any commissions, fees or indexation.

Refunds are made only by transferring funds to the bank account specified in the application.

Related topics:

Who pays To find out exactly whether an individual entrepreneur pays a trade fee on a patent, let's look at what types...

Is it possible for a vehicle passport to be comparable to a passport of a citizen of the Russian Federation? The document contains all the information about...

How are trade fees and the simplified tax system related? Trade fees (TS) are a fee established by federal legislation in...

ABOUT

In PTS issued from September 1, 2012 to December 31, 2013, you can find information with the corresponding register number that does not need to be decrypted. This entry states that the manufacturer assumes responsibility for processing this vehicle, and accordingly, the buyer no longer has to make this payment separately.

In this situation, it is necessary to check whether the manufacturer is included in the register of companies involved in recycling. If the company that accepted responsibility is no longer on this list, the car owner should keep in mind that problems will arise when registering the vehicle with the traffic police.

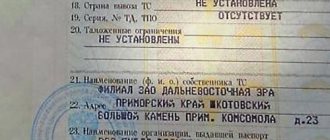

You can see what the PTS mark looks like in the photo:

What are the risks when buying a car without a mark?

In the “Special Notes” field there should be an entry indicating that the fee has been paid, or that the fee has not been paid. If there are no marks in this field, then it is recommended not to make any transactions with a car or other vehicle, since starting from September 1, 2012, PTS will not be issued without a note indicating payment of a recycling fee or exemption from payment, and after February 10, 2016, PSM will not be issued without a note about payment of the fee. Thus, such a document may simply be a fake, and the transaction will subsequently lose its legal force. It is possible that the former owner of the vehicle simply avoided paying the state tax, so the obligation to pay will fall on the new owner.

The law does not provide for penalties for failure to pay the recycling fee, but since without it it is impossible to register the car with the State Traffic Safety Inspectorate or Gostekhnadzor, fines will be assessed specifically for this offense. Operating a vehicle without registration in accordance with Article 12.1 of the Code of Administrative Offenses of the Russian Federation is punishable by a fine in the amount of 500 to 800 rubles.

If the document contains a mark indicating that payment of the recycling fee is exempt, it is recommended that you make the calculation and pay the fee yourself. When payment is made, all necessary documents must be provided to the Federal Tax Service or customs (if the car was imported from abroad). If the entire package of documents is provided, then within a day a document is issued with a note indicating payment of the recycling fee and a receipt order is issued.

Read more: How to write a sample claim to a pension fund

Thus, a special mark in the PTS confirms that the recycling fee has been paid. Without such a record, it will be impossible to register the vehicle with the State Traffic Inspectorate or Gostekhnadzor (if we are talking about self-propelled vehicles). But if it is not there, then you need to find out for what reason, since there are exceptions to the rule that allow you not to pay the state fee. If the case is an exception, then the owners of such cars should not have problems with registration.

We advise you to read: Recycling fee for ATVs and snowmobiles in 2021 0/5 (0 votes)>Mark in the title, recycling obligations have been accepted, what does this mean