When do the bailiffs begin to act?

The bailiff has no right to act independently. Service employees are involved in the collection process only after receiving a writ of execution, when enforcement proceedings have begun and a writ of execution or a court order has been drawn up. After this, the borrower is given five days, during which he is offered to repay the debt on his own, and only after these days the bailiff begins to act. In this case, the amount of debt increases by 7%, that is, by the amount of the enforcement fee. Before the visit, the service employee is obliged to warn the person in writing, and restrictions are also imposed on his actions:

- the bailiff cannot come at night;

- he must come at the appointed time;

- the permissible time period is from 6 a.m. to 10 p.m.;

- an employee does have the right to forcefully open the door if it is not opened for him, but only with the permission of a superior.

Will the bailiffs take the car if it is broken?

Hello everyone, readers of my legal blog, today we will answer a topic of interest to everyone - will the bailiffs take the car if it is broken.

As usual, after reading, if you still have questions, I will be happy to answer them in x or through our legal partners online directly on the website without leaving your home.

If you need to make any changes to the material, write about this too, so that the information is more accurate and necessary.

When collecting funds to pay a debt, the bailiff must be guided by the principle of proportionality between the value of the property and the size of the debt. When is this principle violated? For example, when, to pay off a debt for electricity in the amount of 2,000 rubles, a car worth more than 1 million is seized and sold at auction.

- The court made a decision on the need to pay a certain amount to the creditor to pay off the existing debt;

- The debtor was notified of the court decision and received 5 days to voluntarily repay the debt;

- The bailiff took measures to pay the debt using funds stored in the debtor's bank accounts;

- There was not enough money in bank accounts to cover the debt, and the court issued permission to seize the debtor’s property and sell it at auction.

How should the procedure for seizing a car proceed?

Sending a notice is not the only duty of the bailiff. After the opening of enforcement proceedings, he seizes the debtor’s valuable property. This is done so that a person cannot sell his property (apartment, car) and, thus, does not evade the forced sale of property at auction to pay off the debt.

- At the beginning of the document the name and address of the court and the full name of the judge who imposed the arrest must be indicated. Below is the plaintiff's information - name, residential address, telephone number.

- Indicate the case number for which the arrest decision was made. It can be found in the office.

- The title of the application will be “Application for Cancellation of Security for Claim”

- When describing the circumstances of the case, we indicate for what reason the judge imposed the arrest, the date, the name of the judge, and we name the measures that were taken against you as a defendant. Then we provide information about the decision made, whether the claim was satisfied or rejected, the parties entered into a settlement agreement, or the case was left without consideration.

- Referring to Art. 144 we write for what reason the sanctions (arrest) should be lifted. We present all the circumstances in as much detail as possible.

- We conclude the statement with a request to cancel the measures to secure the claim, in this case arrest.

- We list the names of copies of documents attached to the application that are necessary to confirm your arguments.

Pay off the debt. If seized, the owner has about ten days to pay off the debt. If he cannot pay the debt or does not have time, then the car is sent for sale to the Russian Federal Property Fund.

The car will be sold at an open auction, in which any citizen who submits an application can participate if they wish. The amount received from the sale is transferred to pay off the debt.

If the debtor finds the money and pays off the debt, the car will be withdrawn from sale.

The most common reasons for a car being seized

Bailiffs usually seize a car for large debts. These include debt on bank loans, child support, and taxes. A lien is placed on a car that is pledged to the bank until the loan for it is repaid.

- at the request of the insurance company under compulsory motor liability insurance. The most common case is the failure to provide a European standard protocol by the person responsible for the accident;

- when the culprit of the incident does not have a car insurance policy, so he himself is responsible for the consequences.

May be confiscated in a civil case. The matter concerns not only a car loan, but also any other. But only bailiffs have the right to do this.

There is a difference between a consumer loan and a car loan. In the case of a consumer loan, the car is sold at a government auction.

The proceeds from the sale go towards repayment of the debt; the difference, if any remains, goes to the account of the defaulter.

Confiscation of a car for non-payment of a loan

Thus, FSSP employees do not have the right to just take the car. First, they must understand all the circumstances of the case and the debtor. To ensure that there is no violation of the current legislation of the Russian Federation.

- Perhaps the debtor is unable to pay the debt due to illness, treatment, or maternity leave.

- Copies of payment slips confirming monthly transfers: utilities, loans from other banks are also attached here.

- The debtor must calculate and propose a debt repayment schedule that is convenient for him, taking into account all payments. However, you should try to offer an adequate schedule, otherwise the deferment will be denied.

We recommend reading: Labor veteran in the Kursk region benefits

It is necessary to do the same if the bailiffs have seized the account into which alimony, child benefits, survivor benefits, compensation for harm caused to life and health, subsidies and other social payments were received (by law, the arrest should not apply to these cash receipts ). In this case, the debtor will have to not only draw up an application, but also prepare documents confirming that the funds on the card are social benefits.

In the first stages

The bailiff may allow the debtor to drive the seized car, or he may prohibit it. He can also seize the car and send it to a special parking lot or transfer it to the claimant for storage.

The debtor himself can leave the car for storage. In this case, the defaulter will be held liable if anything happens to the car. All these marks are also included in the vehicle seizure document.

According to the law, a person can pay only part of the obligations if he cannot pay off the debt completely. It is necessary to negotiate with the bailiff service before the seizure of property, immediately after receiving notifications of the debt.

The federal law, called “On Enforcement Proceedings” of 2021, contains an indication that bailiffs have the right to seize and sell the debtor’s property if enforcement proceedings have been initiated against him.

Who and how can seize a car?

Initially, it should be noted that when an arrest is made, the owner is strictly prohibited . However, there are exceptions.

Usually they consist in the fact that the seizure is not imposed on the property, but on the restriction in registration actions. This means that the owner himself can drive the car, but he cannot sell it or register it in the name of another person.

In this case, another person can use the property only with a notarized power of attorney.

The bailiffs themselves can make concessions if they see no other option. They refuse debtors if they have expensive property or high wages. If the debtor does not have items subject to seizure, then the bailiff may make concessions.

They cannot seize a car that belongs to a bank. It is also impossible to pick up the car if it is sold. There is another way - to donate a car free of charge. You can also arrange a rental for another person, also free of charge.

Is it possible to delay the bailiff's visit?

Yes, this is possible with the help of an application for deferment or installment plan, which is submitted during the court hearing, after the verdict is rendered. This is possible if the borrower is experiencing difficulties (sick, on maternity leave, etc.) and can confirm this. In this case, the borrower may be required to independently draw up a payment schedule that is convenient for him. But you need to understand that filing an application will not cancel the need to pay the debt, it will simply delay it. The best option is to avoid litigation. Conscientious creditors, including EOS, are interested in the client getting rid of debt and not experiencing serious inconvenience. Borrowers are offered a variety of profitable programs that allow them to pay off obligations according to an individual scheme and in a manner that is convenient for a particular client.

The bailiffs took the car

Pavel, the car was taken for your debts, or the debts of the previous owner, I believe, taking into account the fact that you did not register the car, then for the debts of the previous owner. In this case, it is necessary to contact the bailiffs about the return of this car, and if they refuse, go to court. Call us, we will work until the bailiff sells this car at auction.

Clause 3, 4 art. 69 of the Federal Law of October 2, 2007 N 229-FZ (as amended on March 6, 2020) “On Enforcement Proceedings” “Procedure for foreclosure on the debtor’s property” “3. Execution of the debtor's property under enforcement documents applies primarily to his funds in rubles and foreign currency and other valuables, including those in accounts, deposits or storage in banks and other credit organizations, with the exception of cash and precious metals debtor located in collateral, nominal, trading and (or) clearing accounts. The debtor's funds in foreign currency are levied in the absence or insufficiency of funds in rubles. Collection of precious metals located in the accounts and deposits of the debtor is applied in the absence or insufficiency of funds in rubles or foreign currency in accordance with Part 3 of Article 71 of this Federal Law. 4. If the debtor has no or insufficient funds, foreclosure is applied to other property belonging to him by right of ownership, economic management and (or) operational management, with the exception of property withdrawn from circulation and property that, in accordance with federal law, is not foreclosure may be imposed, regardless of where and in whose actual possession and (or) use it is located.” Accordingly, if you are solvent, the bailiffs will not be able to seize your car.

Also read: How a copy of a work record book is certified for a bank

Collection procedure procedure

- The court makes a decision, a writ of execution or a court order is drawn up, which is sent to the Federal Bailiff Service.

- A decision is made to initiate enforcement proceedings. A copy of this resolution is sent to the borrower so that he can review it.

- Within five days, the borrower can indicate his desire to repay the debt on his own. In this case, enforcement actions are suspended: this is a way to avoid a visit from the bailiffs. In most cases, cooperation with the lender turns out to be more profitable for the borrower than continuing the enforcement process.

- If the debtor has not decided to repay on his own, the bailiffs will initiate a search for his property. Assets (bank accounts, cars, real estate, etc.) are seized. If the amount of debt is above 30,000 rubles, bailiffs, in accordance with Law 190-FZ, have the right to impose a ban on travel outside the Russian Federation.

- are being treated in a hospital;

- The bailiff service transfers the seized property to special organizations that organize the auction.

Seizure details.

If the assets that were initially seized are not enough to pay off the debt, the bailiffs may begin confiscating personal property. A situation is possible in which the borrower’s income is seized, and up to 50% of the salary, pension or other payments are withdrawn monthly in favor of the lender. This turn of events may be scary, but don’t worry: conscientious creditors rarely resort to litigation. EOS prefers to offer its clients individual repayment terms: in this way, the borrower will not lose valuable property.

Are the actions of the bailiff who took the car away from the house without my presence legal?

7) a note explaining to the person to whom the bailiff transferred the seized property for protection or storage, his duties and warning him about responsibility for embezzlement, alienation, concealment or illegal transfer of this property, as well as the signature of the specified person;

1.1. The seizure of the debtor's property under a writ of execution containing a demand for the collection of funds, with the exception of the seizure of funds, the seizure of pledged property subject to recovery in favor of the mortgagee, and the seizure of property under a writ of execution containing a demand for seizure, is not allowed if the amount of recovery is according to enforcement proceedings does not exceed 3,000 rubles.

What a bailiff can and cannot do

The bailiff has broad powers, but they are not unlimited. Even if trouble happened in your life and you had to deal with the activities of the FSSP, remember a few important details:

- a service employee can enter an apartment without the owner’s permission only with documented permission from the senior bailiff;

- an FSSP employee does not have the right to act independently, without a writ of execution and a resolution to begin the enforcement process;

- the bailiff is obliged to introduce himself and present documents;

- broad powers do not mean permissiveness. The employee has no right to be rude, rude, threaten the borrower or otherwise show aggression. If the bailiff demonstrates such behavior, you have the right to file a complaint.

Bailiffs took the car without my participation

This happens only after the share of property has been determined, since the second spouse can assert his rights by going to court. The bailiff cannot seize half of the car; to do this, the court will have to allocate the debtor's share. The court will have to prove that the debtor used the borrowed funds for the needs of the family and took out the loan with the consent of the spouse.

Seizure of property is a compulsory measure that terminates or limits the right of use. Seizure of the debtor's property is carried out by court decision, in accordance with Art. 80 Federal Law “On Enforcement Proceedings”. Collection can be determined in many cases: alimony, debts for housing and communal services, credit debts, disputes between individuals or legal entities.

What property cannot be taken

The state seeks to protect citizens, therefore restrictions are imposed on the right to seize property: bailiffs do not have the right to take away something without which a person cannot live normally. Such property includes:

- the only housing, if it is not taken out on a mortgage (the mortgaged apartment is collateral);

- personal hygiene items, clothing and footwear, household utensils (except luxury items);

- animals used for household purposes;

- equipment necessary for professional activities, if its cost does not exceed 100 minimum wages;

- products;

- fuel;

- items that disabled people need to move;

- electronics and household appliances necessary for life (they can describe a mobile phone, but not a refrigerator);

- prizes, awards and medals.

What property is not subject to seizure by bailiffs

Content

1. What bailiffs can arrest

2. Do you want to get rid of all your debts?

3. Powers of bailiffs under the law

4. What documents must the bailiff present?

5. Can bailiffs describe property without the presence of the debtor?

The law contains an exact list of what bailiffs cannot describe. The most expensive property - an apartment, a house, the plot on which it stands - can only be seized if they act as collateral for a loan or mortgage. At the same time, they cannot even take away a mortgaged apartment if it is the only home and its value far exceeds the amount of debt.

Not subject to arrest:

- pets (not used for commercial purposes, such as breeding);

- things that are necessary to ensure minimal comfort - a bed, a stove, a refrigerator;

- fuel for heating the house in winter;

- furniture per family member - bed, table, chairs;

- professional equipment (if its price is less than 100 minimum wages);

- Food;

- personal hygiene items and clothing (except for expensive fur coats or jewelry);

- medals, state awards;

- things necessary for a disabled person - a stroller, crutches, a car, a special medical bed;

- funds in the amount of 50% coming from a single source of income.

The capabilities of the bailiffs are limited - they cannot seize social payments (pensions do not apply to them), and are also obliged to return the funds if you prove that they were transferred illegally. Things that are needed to ensure health, livelihoods, and earnings are not subject to confiscation. Maternity capital also cannot be taken away, since it is addressed to children, not parents.

What can bailiffs arrest?

The list of what bailiffs can describe is quite wide. It even includes personal items whose value exceeds 100 minimum wages. In 2021, this amount was equal to 1,213,000 rubles. Such property is recognized as luxury goods and is subject to seizure. They can describe the furniture that is in the apartment where you live.

Expert opinion

Dmitry Tomilin

The law obliges bailiffs to take into account the interests of relatives who live with the debtor. When inventorying the furniture, they cannot take away the bed on which the children sleep or chairs according to the number of residents. An extra sofa on which no one sleeps, armchairs, or a washing machine can be confiscated.

If there is a large amount of debt, for example, on mortgage loans, the collateral is confiscated and sold. They can sell the car if the debtor cannot prove that it is necessary for work or transporting children to school, clubs or treatment. The things of your relatives cannot be confiscated, but it is necessary to prove that this property belongs to them.

Do you want to get rid of all your debts?

A free consultation with our specialists will allow you to compare risks and take the first steps towards bankruptcy.

Leave a request for our company’s services and we will contact you within 15 minutes

By leaving a request you agree to the processing of your personal data

Powers of bailiffs under the law

It is important to understand what bailiffs have the right to and not to interfere with them in the performance of their official duties. If you can convince the FSSP representative of your readiness to assist, then you can voluntarily repay the debt with payments that are feasible for you.

The first thing that enforcement proceedings begin with is the search for a citizen’s accounts in Russian banks. Financial institutions are required to provide such information upon request of the FSSP. Found accounts will be frozen, and funds and proceeds will be used to pay off the debt. An indication of this is contained in Article 70 of the Federal Law “On Enforcement Proceedings”.

After the verification of ruble accounts is completed, the bailiff will look for foreign currency accounts, securities, shares and other financial assets. Only after this the recovery passes to the debtor’s property. While the process is ongoing, you can voluntarily pay off the debt.

Article 69 gives the FSSP the right to impose a penalty on the defendant’s wages. To do this, an official request is drawn up and sent to your place of official employment. In this case, your company’s accountant will transfer 50% of earnings to the bailiff. When collecting child support, compensation for damage to health, and in some other situations, 70% of income may be transferred.

If sources of income are not found, the bailiff looks for movable and immovable property. Things are described, the apartment is seized and sold at auction. The proceeds are used to pay off the debt and collect the bailiff's wages. Articles No. 99, 33 are devoted to this.

Sometimes people who received a summer cottage plot during the USSR are in no hurry to register it as their property and use the right of perpetual ownership. The bailiff can independently order cadastral work, register your land ownership, and then seize it and sell it. You will have to not only pay off the existing debt, but also pay for these works. Articles of the law No. 64, 66.

One of the extreme measures is a ban on leaving the country or driving a car. However, if the debtor has neither a license nor a foreign passport, they are ineffective.

What documents must the bailiff present?

When performing procedural actions, bailiffs must involve witnesses and witnesses. They show these people their official ID. Any citizen can contact the FSSP to check the relevance of the presented document.

When making an inventory of property, a civil servant must present:

- resolution to initiate enforcement proceedings;

- a writ of execution issued by the court, certified by the official seal.

You should not expect that the bailiff will forget about your debt. The FSSP is heavily loaded; one employee can simultaneously work on 4,000 court decisions. They try to fulfill their duties conscientiously, but even with a full 40-hour work week, it may not be your turn to pay your debt right away.

Expert opinion

Dmitry Tomilin

Bankruptcy lawyers recommend not to rely on chance; it is much more profitable to contact the bailiff yourself. You can get information about your case on the FSSP website, where it is published in the public domain. If you voluntarily pay off your debts, you will not have to pay an enforcement fee - 7% of the debt amount.

Can bailiffs describe property without the presence of the debtor?

The procedure for inventorying the debtor's property, by law, can take place in his absence. Moreover, the bailiff does not even have to receive your signature on the decree or act of seizure of property. It is enough for your relatives to let the bailiffs into the apartment. The law is silent on this issue, which means the bailiff is free to act in the absence of the debtor.

In special cases, if the debtor is determined not to allow FSSP representatives into his home, the bailiff can obtain the necessary permission from his management in advance.

However, there are situations when property is seized illegally. It may not be taken into account which relative owns the property, as well as the difficult life circumstances of the family. In this case, you can go to court with a complaint against the actions of the bailiff. As a result of the inspection, the violations will be eliminated.

How to prevent a visit from bailiffs

Fear of litigation is common among borrowers even before it begins. This is largely facilitated by some creditors and unscrupulous agencies who threaten with court proceedings and an inventory of property. Do not be afraid. When asked whether it is possible to prevent such a turn, EOS answers unequivocally in the affirmative. We try to protect our clients from visits from bailiffs; we are ready to offer individual flexible loan repayment terms - this outcome can be optimal for both the lender and the client. If you find yourself in a difficult situation, contact us, we will tell you what to do.

Seizure of property without the participation of the debtor

- Firstly, you have the right to write a written complaint to the prosecutor's office and the immediate supervisor of the bailiff.

- Secondly, the current administrative legislation gives you the opportunity to file an administrative claim in court. In your case, the requirement of this statement will be to declare the property inventory act illegal.

Question: The court found me guilty under the loan agreement. After the decision came into force, I could not immediately pay off the awarded debt. In this regard, the bailiffs came home and seized the property without notifying me. Is such an arrest considered legal without the participation of the debtor?

In what cases can a car be taken away for debts?

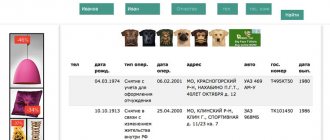

Note! Bailiffs do not immediately seize the car from the debtor. First they try to find money in the accounts. If there are not enough funds, the bailiff will seize the property. In this case, the owner has the opportunity to travel by car, but he cannot sell it. If the debt is not repaid, the bailiff moves from arrest to seizure.

According to subparagraph 7 of paragraph 1 of Article 64 of the Law “On Enforcement Proceedings”, bailiffs can seize the debtor’s valuable property, including vehicles. After this, the seized property is subject to recovery. It consists of compiling an inventory of property and seizing it for further sale. The funds received are used to pay off the debt. If there is any money left from the sale, it is transferred to the debtor.

26 Jul 2021 stopurist 1451

Share this post

- Related Posts

- When do they start paying payments to Labor Veterans in the Stavropol Territory?

- If you have a debt of 20,000 rubles, what can you arrest?

- What kind of apartments are given to large families in Omsk?

- Can I use the Ivanovo Social Card in Moscow?