Transport tax is paid by all car owners. The size of the payment depends on the characteristics of the car, and is therefore calculated individually for each taxpayer. Citizens do not make payments on their own, so they receive ready-to-pay receipts from the Federal Tax Service. Different methods are used for payment, but not everyone knows how to pay transport tax through State Services. This method has many advantages, since you do not need to leave your home and there is no commission.

When is the fee paid?

Individuals who have a car receive ready-made receipts from Federal Tax Service employees. To ensure that the calculations are correct, they can use special online calculators. The receipt contains the following information:

- personal data of the payer;

- the amount that must be paid to pay the fee;

- debt and penalties;

- the deadline by which payment must be made.

Attention! Individual entrepreneurs, like individuals, do not have to independently calculate the fee and submit declarations, unlike companies.

Tax notices are sent to citizens at the end of summer, but no later than a month before the deadline for making payments. Therefore, the last documents are sent before November 1st. If citizens have not received the document by the end of December, they can contact the tax office to obtain the document or details.

If a citizen uses his personal account on the Federal Tax Service website, he does not receive notifications. The same applies to real estate tax for an apartment or other property, so you will have to receive notifications and details through this account. Car owners are required to pay the tax by December 1 of each year. Otherwise, fines and penalties will be assessed.

Notification about the object of transport taxation

If a company has not received a message about the payment of transport tax from the inspectorate, it must itself inform there about the transport it owns (clause 2.2 of Article 23 of the Tax Code of the Russian Federation).

A notification about the object of taxation must be sent to the Federal Tax Service by December 31 of the year for which the tax must be paid. It must be accompanied by copies of documents that confirm the state registration of the vehicle.

There is no need to submit a notification if the company sent an application for a transport tax benefit to the inspectorate (see letter from the Federal Tax Service dated October 29, 2021 No. BS-4-21/17770).

Read in the berator “Practical Encyclopedia of an Accountant”

Tax benefits

Payment Methods

Citizens who need to pay taxes can use different methods:

- State Services Portal. If you identify your account, you can view all taxes, debts and make payments on the website. You can pay property tax for individuals online through State Services, as well as pay transport, land taxes and other taxes. In such a situation, the portal acts as an intermediary between citizens and the Federal Tax Service. All debts are reflected in your personal account, and you can also log in through the portal on the tax service website. To do this, you do not have to visit the Federal Tax Service office to obtain temporary logins and passwords.

- Federal Tax Service website. Typically, citizens prefer to pay the transport fee on the tax office website. To do this, you need to register and log in to the site, and you will first have to come to the service branch to receive a login and password. Obtaining information about the tax amount is quite simple, since it is reflected in your personal account. Payment documentation is also generated here, and taxes can also be paid.

- Mobile bank. Many banks offer a mobile banking service that allows you to use your savings via the Internet. Here you can top up any card, transfer funds between bank accounts or pay taxes. To do this, select the tab that allows you to pay taxes or fines. You can easily find a receipt using your Taxpayer Identification Number (TIN), as well as using a barcode, details or QR. A receipt confirming timely payment will remain attached.

- Yandex.Money or other services. Some sites charge a large commission, so before paying out money, it is recommended to make sure that the chosen service is profitable.

- Personal visit to a bank or Federal Tax Service branch. Such methods are suitable for people who do not save time, and therefore are willing to allocate approximately 30 minutes or several hours, since in these organizations a significant queue often forms.

- Using ATMs. To make a payment, you need to insert a card into the device, as well as provide the correct details, which can be viewed on the notification received from the Federal Tax Service.

The choice of a specific method depends on the wishes and capabilities of the taxpayer.

Is it possible to pay without documents?

Often, receipts do not reach car owners, which is due to the negligence of tax inspectors, software failures or other reasons. Therefore, until December 1, citizens do not receive a notification containing payment details. If you fail to make a payment, large fines and penalties will be assessed, which negatively affects the finances of citizens. Therefore, it is possible to pay tax without a receipt. You can get the information you need in different ways:

- applying to the Federal Tax Service department with a passport, after which the inspection employee issues details and advises on methods of making payment;

- taxes are paid through the State Services website without entering details, but this requires an authorized personal account, and the “Federal Tax Service” section is initially selected, and then the free information service is ordered;

- through your personal account on the Federal Tax Service website, but for this you need to have a login and password.

Attention! On the service’s website you can not only get the details, but even print out a receipt.

Errors in documents: what to do

Although most work is now done on a computer, government agencies employ ordinary people who can enter incorrect data into computers. Errors in calculations may arise due to incorrect indication of the engine size or its toxicity level, the age of the vehicle or the period of ownership.

Incorrect calculations may lead to an unreasonable increase in the payment amount. You can fix this error in different ways:

- Submit an application to the Federal Tax Service of the Russian Federation, which will clearly indicate the reasons for the inaccuracy in the calculations.

- Go to the local tax office and show the vehicle registration certificate to prove your case .

- Subsequently, civil service employees will be required to send the received information to the traffic police, which will record the new data, recalculate and send the updated information back to the tax office.

Further, the obligated person has the right to request a new document for payment if he cannot independently print out a receipt for car tax on the electronic portal of the Federal Tax Service of the Russian Federation through his personal account.

Payment through State Services

Most often, citizens prefer to use the portal to pay taxes or fines. But it is important to figure out how to pay personal property tax or transport tax through State Services. It is advisable to study the step-by-step instructions to avoid mistakes.

Authorization on the portal

You can use government services on the website only after authorization. To do this, a new account is created, which is identified in the Pension Fund or Federal Tax Service department, as well as in other government agencies where you need to apply with a passport.

Attention! Some citizens are confident that the transport tax has been abolished, but in fact it will have to be paid in 2021.

Checking the correctness of the fee calculation

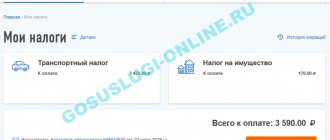

In your personal account, select the “Service Catalog” tab, where the “Taxes and Finance” item is located. A subsection called “Tax debt” is selected. This section provides information about the amount of debt.

If the information is available, then you just need to click on the “Pay” button to deposit funds. But first it is recommended to make sure that the calculation is correct. To do this, use a standard formula or online calculators.

Selecting a payment method

There is no option to pay the fee on the site itself, so a third-party method is chosen. Through the State Services portal, transport tax is paid in the following ways:

- Bank card. To do this, indicate the basic details of the available plastic. Some banks charge a fee for this transaction.

- Mobile payment. When using this option, you have to pay a commission, and its size depends on the operator.

- Online wallet. WebMoney or Yandex.Money is used for payment.

Information about the tax paid can be found in the “Payments” section. Sometimes citizens are faced with the fact that after payment the information in their personal account still does not change. Therefore, you need to wait a few days during which the money is credited.

Payment stages

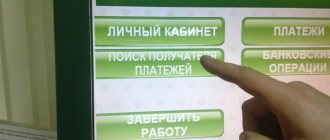

Typically, a bank card is used for these purposes, which is available to almost every person. Therefore, the following actions are performed:

- on the main page, select the “Federal Tax Service” section, after which the details of the debts are studied;

- press the item to pay off the debt;

- a payment form appears where you select a bank card;

- information about the card is entered, represented by the number, expiration date and three-digit code on the back;

- click the “Pay” button;

- an SMS with a one-time code is sent to the phone to which the card is linked, allowing you to confirm the operation;

- After confirming the payment, a new page is displayed informing you that the payment was successful.

After this, payment information is updated in your personal account within a few days.

How to get a receipt

If a person is used to paying through a terminal or bank, then he will have to receive a paper receipt. It can be requested from Federal Tax Service employees during a personal visit to the department. Additionally, you can receive a receipt in electronic form on the website of the State Services or the Federal Tax Service, after which the document is printed.

Transport tax reporting

There is no longer a need to submit transport tax returns for 2021 and subsequent tax periods. In 2021, tax inspectorates will only accept:

- declarations, including updated ones, for periods up to 2020;

- updated declarations to the declarations that organizations submitted in 2021 during reorganization.

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

Difficulties using the portal

When using the State Services portal to pay the transport fee, difficulties may arise. These include:

- lack of internet connection;

- Maintenance work is periodically carried out on the site;

- Often the portal is blocked by antivirus or other security programs;

- errors may be made when entering details;

- the money is credited within several days, so there may be a delay;

- The portal is often attacked by hackers.

In most cases, citizens do not face these problems.

Pros and cons of making payments online

Using different services on the Internet to pay taxes has advantages:

- no need to visit organizations;

- payments are often made without charging a commission;

- the process is completed within a few minutes;

- You can pay different fines or taxes using several receipts in one place.

Disadvantages include the possibility of a failure and the lack of instant transfer of funds to the Federal Tax Service. Payment of the transport fee is carried out in different ways. Often citizens prefer to use the State Services portal; for this, money is transferred from a card, as well as using electronic money or mobile payment. This method has not only advantages, but also some disadvantages.