Chapter 28 of Section IX of the Tax Code of the Russian Federation (abbreviated as the Tax Code of the Russian Federation), as well as regional legal acts, establish the obligation of persons to whom cars are registered to pay transport tax. Find out where to get a receipt for payment of transport tax in 2021 and how to fill out a declaration from this material.

An advantageous offer from the partners of our portal - Terem Loan! Apply for a loan in the amount of up to 30 thousand rubles for a period of up to 30 days.

100% approval!

Get money

Differences in tax payment between citizens and legal entities

Taxpayers for this state fee can be not only citizens, but also organizations. However, the procedure for calculating the payment amount for individuals and legal entities has a significant difference. These differences are recorded in paragraph 1 of Art. 362 of the Tax Code of the Russian Federation , which states that:

taxpayers-organizations calculate the amount of tax and the amount of advance tax payment independently. And the amount of tax payable by individual taxpayers is calculated by the tax authorities on the basis of information submitted to the tax authorities by the authorities carrying out state registration of vehicles on the territory of the Russian Federation.

This body is the traffic police.

In this case, a vehicle tax receipt is issued and sent exclusively to citizens who, from a legal point of view, are individuals. Companies with which the car is registered are required to independently fill out a special declaration.

Individuals receive documents by regular mail, although you can also use the services of the official electronic portal of the Federal Tax Service of the Russian Federation. By logging into your personal account, a person can download and print a receipt from there. Legal entities also have access to download declaration forms in electronic form, which are then printed.

How to get a transport tax receipt for a car

According to paragraph 2 of Art. 52 Tax Code of the Russian Federation :

if the responsibility for calculating the amount of tax is assigned to the tax authority, no later than 30 days before the payment deadline, the tax authority sends a tax notice to the taxpayer.

As a general rule, the Federal Tax Service sends payment documents to each taxpayer by registered mail.

It is allowed to hand over the notice personally to the car owner against signature. Also, the notification may be sent by email after obtaining the taxpayer’s consent, and the document will be considered received from the moment the email is sent. If the Federal Tax Service of the Russian Federation sends documents by registered mail, then, according to clause 4 of Art. 52 Tax Code of the Russian Federation :

The tax notice is considered received after 6 days from the date of sending the registered letter.

However, there are times when payment documents are lost. In such a situation, there are several options to find a receipt for transport tax:

- go with the TIN certificate and identification document to the local tax office and apply for a receipt;

- log into your personal account on the State Services website, go to the official website of the Federal Tax Service - nalog.ru and log in to it using the account created on the State Services portal;

- go to the website of the Federal Tax Service of the Russian Federation, register on it or log in to your personal account and find the payment document there.

The latter method should be described in more detail and all stages of receiving documents electronically should be outlined. online service on the Tax Service website called “Payment of taxes for individuals”. There you can pay not only the fee for the car, but also for property, personal income tax, and other state duties.

To print a receipt for payment of transport tax for individuals, first on the website you need to fill out a request for the document in your personal account on the electronic portal of the Federal Tax Service of the Russian Federation. This happens as follows:

- Full name to be filled . the person obligated to pay the fee, as well as his TIN.

- The type of state duty is selected (in our case, it is a tax on a vehicle), the address where the car owner lives is entered into the form, the type of payment is indicated (direct tax, penalty, fine or accrued interest), and the amount of tax payable is entered.

- Select the method of payment (non-cash or cash).

- The document itself is being formed.

Next, you need to decide how exactly you will need to print a receipt for transport tax from the tax office website. The document is usually in PDF format, so to read it on a computer you will need Adobe Acrobat Reader, SumatraPDF or similar software. The downloaded file is opened using these programs and printed on a printer.

It is worth noting that, according to Art. 45 Tax Code of the Russian Federation :

The taxpayer is obliged to independently fulfill the obligation to pay tax.

However, the state fee can also be paid by another person. To do this, the latter needs to reflect in the payment document information about the person for whom the fee is paid.

Ways to solve the problem

How to get a receipt for payment of transport tax? You can cope with the task in different ways. The main thing is to know how to act in a given case.

You can issue, request or receive a payment for taxes on a vehicle:

- through the “Godnogo Window”;

- on the website of the Federal Tax Service of the Russian Federation.

In addition, the document can be received by mail. Namely, wait for the tax notices to be sent out. This point deserves special attention. It can confuse the modern taxpayer in Russia.

Learn more about the information contained in the notice and receipt

The Federal Tax Service of the Russian Federation, having carried out all the necessary calculations, sends a notification in an envelope about payment of the state duty with a receipt attached to it to the registration address of the car owner. Both documents are drawn up according to special rules. The notification must contain information about:

- tax authority that sent the letter (full name of the government agency, as well as background information - telephone numbers, link to the official website, email, etc.);

- taxpayer (full name of the taxpayer, information about his place of residence);

- the name of the regional fee , as well as the amount required for payment;

- period in which the state duty must be paid;

- penalties in case of ignoring the obligation or late payment (the interest rate of the penalty is indicated in detail).

A receipt for payment of transport tax from an individual contains information about:

- the owner of the car (in addition to his residence address and full name, the document also contains a tax identification number);

- the recipient (i.e. the Federal Tax Service of the Russian Federation and its bank account to which the payment will be received);

- the exact amount of the state fee ;

- the date by which the obligation must be fulfilled;

- other details (checkpoint, BIC, OKTMO, KBK, etc.).

For those who do not know what a transport tax receipt looks like, it is worth clarifying that it has recently undergone changes. Now the form has begun to be drawn up in accordance with modern requirements - a QR code , with which you can simplify the payment procedure.

By presenting the code to an ATM equipped with a scanner, the user allows the machine to read all the necessary information from it, in particular about the amount of the payment. The owner of the car will only need to enter the TIN data at the ATM. Sometimes a driver's license number as well as passport information may be required.

Public services

The State Services service will help you find out and pay the transport tax if you haven’t received a receipt. It is a convenient and functional portal that allows you to interact with any budgetary organizations.

To pay transport tax without a TIN receipt, do the following:

- Log in to the system;

- Click on the “Services” button;

- Select the “Taxes and Finance” icon and go to the “Debt” line;

- A new window will open - click on the “Get” button on the right side of the screen;

- Select the “By personal data” tab. The system will automatically enter your full name and TIN, now click on the “Find” button;

- A list of available contributions will open - select the desired option and click on the “Proceed to payment” icon;

- The details will be filled in automatically - you need to select a convenient payment instrument and complete the transaction using the confirmation code that will be sent via SMS. Full information on this method is here.

A little useful advice. The transport tax debt to the Federal Tax Service will be displayed on the main page - you can click on the icon and immediately proceed to payment.

Government services allow you to find out the presence of debts:

- Click on the “Payment” button on the top panel;

- Scroll the screen to the “Tax debt” block and click “Find”.

Let's move on - we'll look at how to pay the transport tax if you haven't received a receipt on the official website of the Department.

Filling out a transport tax return for legal entities

Organizations, regardless of their legal form, do not have to worry about receiving receipts. They have their own procedure, which consists of filling out a declaration. The company's accounting department itself calculates the amount of the fee payable, taking into account amendments to regulations.

The declaration contains several sections:

- Title page - all information about the legal entity will be entered on it.

- Section I - informs tax authorities about the payment amount that the organization is going to pay.

- Section II - indicates the procedure for calculating state duty.

If a company owns several cars, then there is no need to fill out separate declarations for each car. The document is submitted in one copy for all vehicles owned by the legal entity.

In addition, there are some features of filling out the declaration:

- The form can be filled out manually or printed.

- When choosing the manual filling method, it is prohibited to use pens with colored paste (green, red, etc.). The document is filled out using pens with blue, black or purple ink.

- Double-sided printing of the declaration is prohibited. Each section must be printed out on a separate sheet of paper. Each sheet must be numbered.

- It is not allowed to correct the data entered on the form using an eraser or a proofreader. However, if there is a need to correct old information, these changes must be certified by the applicants by their signature on the document.

- One character is entered into one cell. Space is also a symbol.

- If, when calculating the amount of the state duty, it is calculated in rubles and kopecks, the latter are not recorded. If the amount is below 50 kopecks, then it is not paid. If it is higher, then it is rounded to the nearest ruble (for example, if the total amount is 1800 rubles. 60 kopecks, then 1801 rubles are payable).

- All information is entered into the document in capital block letters.

You can learn more about how to fill out the declaration correctly in order to avoid significant errors in Order of the Federal Tax Service of the Russian Federation dated December 5, 2021 No. ММВ-7-21/ [email protected] . The same order also contains a form attached, which can be downloaded directly from the legal document.

Deadlines for payment of transport fees

Art. 363 and 363.1 of the Tax Code of the Russian Federation establish the period during which the obligation to pay state duty for a car must be fulfilled. The regulations state that the fee:

is payable by individual taxpayers no later than December 1 of the year following the expired tax period, and tax returns are submitted by corporate taxpayers no later than February 1 of the year following the expired tax period.

The state tax for cars is a regional tax, and legal entities pay it in installments every quarter, and at the end of the period they pay the final amount. According to the same article. 363 Tax Code of the Russian Federation :

The procedure and deadlines for payment of tax and advance payments of tax for taxpayer organizations are established by the laws of the constituent entities of the Russian Federation.

Knowing the deadlines is necessary because in case of delay in fulfilling the obligation, the Federal Tax Service of the Russian Federation may charge a penalty. Therefore, even if payment documents do not arrive on time for any reason, the fee must still be paid within the due date.

Property tax receipt

a notice and receipt for payment of property tax ( form PD-4 ) no later than 30 days before the deadline for payment (Article 52 of the Tax Code). The deadline for paying taxes for the previous year is December 1 of the current year. This is established by paragraph 1 of Article 409 of the Tax Code. Accordingly, you must receive the Notice and receipt by November 1. This rule applies to all regions of Russia.

Example A person is a property tax payer.

Situation 1 Tax must be paid for 2021. He must receive the notification and tax receipt (No. PD-4 (tax)) no later than November 1, 2021, and pay the tax no later than December 1, 2020.

Situation 2 You need to pay tax for 2021. He must receive the notification and tax receipt (No. PD-4 (tax)) no later than November 1, 2021, and pay the tax no later than December 1, 2021.

The same procedure applies to this tax as for transport tax. If the Tax Payment Notice was not sent to you, then you have no obligation to pay it. But tax authorities have the right to send you “forgotten” Notifications immediately for the last 3 years preceding their sending. For example, in 2021, they have the right to demand payment of property taxes and send you receipts for 2020, 2021 and 2021.

Errors in documents: what to do

Although most work is now done on a computer, government agencies employ ordinary people who can enter incorrect data into computers. Errors in calculations may arise due to incorrect indication of the engine size or its toxicity level, the age of the vehicle or the period of ownership.

Incorrect calculations may lead to an unreasonable increase in the payment amount. You can fix this error in different ways:

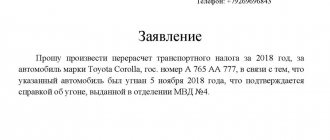

- Submit an application to the Federal Tax Service of the Russian Federation, which will clearly indicate the reasons for the inaccuracy in the calculations.

- Go to the local tax office and show the vehicle registration certificate to prove your case .

- Subsequently, civil service employees will be required to send the received information to the traffic police, which will record the new data, recalculate and send the updated information back to the tax office.

Further, the obligated person has the right to request a new document for payment if he cannot independently print out a receipt for car tax on the electronic portal of the Federal Tax Service of the Russian Federation through his personal account.