Transport tax for organizations from 2021

Transport tax for legal entities refers to regional types of tax payments and is regulated at the federal level (Chapter 28 of the Tax Code), as well as local (regulatory legal acts of the authorities of the constituent entities of the Russian Federation). In accordance with stat. 356 of the Tax Code, regions approve TN rates, terms of payment, benefits and legal grounds for their application. In this case, the restrictions provided for by the Tax Code must be taken into account.

Who exactly is recognized as the taxpayer of this tax? According to stat. 357 of the Tax Code, transport tax for organizations is obligatory for payment if they own vehicles registered in the generally established order. Objects subject to taxation are listed in stat. 358. In particular, these are cars and trucks, motorcycles, buses of various sizes, boats, airplanes and helicopters, and other self-propelled vehicles of land, air and water types (clause 1 of Article 358). The list of non-taxable objects is given in paragraph 2 of the statute. 358.

Timely calculation of transport tax for legal entities is carried out separately for each object registered in the name of the owner (clause 2 of Article 362). Enterprises, unlike individuals, accrue TN on their own, including advance amounts. If the regional authorities do not approve reporting periods in a particular subject of the Russian Federation, the car tax is transferred to the budget in a single amount at the end of the year. Moreover, in accordance with the Tax Code, the tax period is a year (calendar), and the reporting period is quarters (stat. 360).

Will the transport tax for legal entities change in 2021? At the moment, there are no global innovations observed. No one canceled the TN, and the replacement with another fee also did not take place. As before, regional authorities are in charge of administration, approving final rates and payment deadlines. However, some innovations were nevertheless adopted by officials. The changes will affect owners of prestigious expensive cars worth 3-5 million rubles. The size of the increasing coefficient for them is set at a minimum level of 1.1 (stat. 362 of the Tax Code as updated by Law No. 355-FZ of November 27, 2017). Currently, the coefficient is 1.1, 1.3, 1.5.

Another change applies to the tax return form for TN, which was approved by the Federal Tax Service in Order No. ММВ-7-21/668 dated 12/05/16. The document was adopted in 2021, but in practice all legal entities are required to submit a new form when submitting information for 2021. Sections about payments to Platon, lines about the year of manufacture of the vehicle, information about the registration of the object and/or deregistration from state registration have been added to the form.

The tax on expensive cars has become lower

In fact, new vehicle tax rates in 2021 will affect expensive cars. Thus, Law No. 335-FZ of November 27, 2021, with amendments to the Tax Code of the Russian Federation, reduced the increasing coefficient for calculating the tax on cars worth from 3 to 5,000,000 rubles to a minimum value of 1.1 from 01/01/2018. Note that until 2021, such a coefficient could be used in calculations only for cars from 2 to 3 years from the year of manufacture, and according to the new rules - simply up to 3 years from removal from the assembly line (new edition of clause 2 of Article 362 of the Tax Code RF).

In addition, for other expensive cars costing from 3 to 5 million rubles, there will no longer be increasing factors of 1.3 (when 1-2 years have passed since the year of manufacture) and 1.5 (if the car is less than a year old). In fact, the coefficient of 1.1 swallowed them up.

That is, as a result, the tax for these vehicles will be 20-40 percent less from 2018. It is necessary to take into account changes when calculating transport tax from 2021.

For your convenience, here is an explanatory table of changes in transport tax from 2021:

| Average cost of a car, million rubles. | Number of years since the year of issue | Coefficient in 2021 | Coefficient from 2021 |

| From 3 to 5 inclusive | From 2 to 3 years | 1,1 | 1,1 |

| From 1 year to 2 years | 1,3 | ||

| No more than 1 year | 1,5 | ||

| From 5 to 10 inclusive | No more than 5 years | 2 | 2 |

| From 10 to 15 inclusive | No more than 10 years | 3 | 3 |

| From 15 | No more than 20 years | 3 | 3 |

Let us remind you that I apply these increasing factors only to those passenger cars that are included in a special list. It is maintained and posted on its website by the Russian Ministry of Industry and Trade. Here is the exact link for the 2021 tax season:

https://minpromtorg.gov.ru/common/upload/files/docs/Perechen_2017_dlya_publikatsii.pdf

Also see “List of the Ministry of Industry and Trade of expensive cars in 2021.”

The general transport tax rates were not affected by changes in 2021 (clause 1 of Article 361 of the Tax Code of the Russian Federation). Meanwhile, regional authorities can correct them. Therefore, you need to refer to the law of your constituent entity of the Russian Federation on transport tax.

Transport tax - tariffs

The final tariff rates are adopted by regional authorities, taking into account the maximum/minimum restrictions under stat. 361. An increase in tariffs for certain types of vehicles in the Leningrad region has already been approved. and St. Petersburg, Ulyanovsk region, Arkhangelsk, Kirov and Kostroma. To know exactly how to calculate transport tax for legal entities, you need to clarify the interest rate for vehicles registered to the company. In this case, information is taken from the current version of the regional law.

What is transport tax

According to Chapter 28 of the Tax Code of the Russian Federation, transport tax is a mandatory payment to the state, which is made by all owners of vehicles registered in the territory of the Russian Federation.

It was introduced in 2003 and refers to taxes at the regional level. The economic justification is as follows: while driving, transport causes considerable damage to the road surface and the environment, and therefore its owner must pay monetary compensation to the regional budget in order to minimize the harm. The information presented in this article is relevant for 2021. In 2021 and subsequent years, a number of bills and changes affecting this industry will come into force.

Where to pay transport tax for legal entities

Transfer of TN based on the results of the year and quarters (in case of approval of reporting periods in a separate subject of the Russian Federation) is carried out to the regional budget at the address of the vehicle location (clause 1 of Article 363). The last address for all means of transportation, except for water ones, is the address of the location of the enterprise or OP (Article 83). If an organization is obligated to pay advances under the Taxpayer Agreement, such amounts reduce the total tax for the year.

The timing of the transfer of transport fees is regulated by the regions of the Russian Federation. In this case, the final payment date cannot be approved in the subject earlier than February 1 of the next year (clause 1 of Article 363). Here is a link to the stat. 363.1, which discusses the procedure for submitting a declaration. Accordingly, in the region, the deadline for transferring TN should not be set earlier than the date of filing the declaration, that is, earlier than February 1 (clause 3 of Article 363.1).

When do you need to pay?

In Art. 360 of the Tax Code of the Russian Federation, the tax period (the frequency with which taxes must be paid) is defined as 1 year. As a rule, the Federal Tax Service starts sending out payment notices to car owners in August-September. The deadline for sending is one month before the payment deadline. The latter, by the way, is significantly different for individuals and organizations. So, according to Art. 363 Tax Code of the Russian Federation:

More on the topic: Transport tax for labor veterans

- Individuals are required to make full payments for the past year no later than December 1 of the current year (i.e., the payment for 2021 must be made by December 1, 2018).

- Organizations acting as taxpayers pay the tax in advance payments (several times a year). The number of payments, their frequency and deadlines for payment are regulated by the laws of the constituent entities of the Russian Federation.

If you have any doubts regarding payment deadlines, making advance payments or other issues related to transport tax, you can clarify them on the official website of the Federal Tax Service.

Transport tax for legal entities – payment deadlines in 2018

As a rule, the deadlines for transferring TN for reporting periods are approved before the last day of the next calendar month. For example, in the Rostov region. advances for the 1st, 2nd and 3rd quarters must be paid before 05/03/18, 07/31/18, 10/31/18. Moreover, if the last date of the month falls on a weekend or official holiday, the payment date is shifted to the first working day.

The final payment for TN for 2021 must be made by legal entities no earlier than 02/01/18. The deadlines adopted by the regional authorities are mandatory for all taxpayers. In case of violation, penalties are charged on the amount of arrears in accordance with the requirements of tax legislation for each day of delay. How is transport tax calculated for legal entities? More on this below.

Cancellation of transport tax in 2021: truth and speculation

Rumors about the abolition of the transport tax have appeared and disappeared since 2009. This is explained by the fact that:

More on the topic: Who gets the transport tax benefit?

- Before the introduction of excise taxes on fuel, the authorities promised to abolish the transport tax, but things did not go further than these promises.

- According to many motorists, this mandatory payment is not socially fair, because the calculation is carried out only taking into account the power of the vehicle, without taking into account the mileage. In other words, whether the car drives around the city for days (damaging the road surface or the environment) or sits in a garage for years, the tax amount will be the same.

The laws of individual subjects provide concessions (up to 100% benefits) for some taxpayers and vehicles of certain categories. However, there is no talk of a complete abolition of the tax in 2021. To avoid falling for the tricks of the “yellow” press, always check the information on the official websites of the relevant government agencies.

Calculation of transport tax for legal entities

The procedure for calculating TN and advances is defined in stat. 362 NK. For the calculation, indicators of the tax base of the transport facility and the current rate in the region are taken. Additionally, the values of the increasing coefficient and the coefficient of actual vehicle ownership for the tax period are taken into account. The general calculation formula is as follows:

TN = NB x St in % x PovK x FactK, where:

TN - transport tax,

NB – facility power in liters. With. (for auto),

St. in % - the rate for the object in %, valid in the region,

PovK - increasing coefficient for premium cars according to clause 2 of the stat. 362,

FactK – coefficient of actual vehicle ownership for the tax period. Calculated according to the rules of clause 3 of stat. 362.

If an enterprise has several vehicles, the tax is determined separately for each. The results of the calculations are presented to the Federal Tax Service at the place of registration of the car owner in the form of a declaration for the tax period, that is, the calendar year.

How to calculate transport tax on a car

The bulk of revenue comes from owners of cars and trucks. Therefore, it doesn’t hurt to know how tax is calculated and what amount to expect when paying it this year. The following payment procedure is established by law:

Tax amount = tax base * tax rate * increasing coefficient * (number of months of vehicle ownership/12) , where:

- The tax base is the engine power (in hp), which is stated in the registration papers.

- Tax rate is a numerical value fixed by the constituent entities of the Federation at the legislative level.

- The increasing factor is an additional increase for cars whose average cost starts from 3 million rubles. You can check whether your car is included in this list on the website of the Ministry of Industry and Trade.

Until 2021, the following increasing coefficients were in effect when calculating transport tax:

| Average cost/vehicle age (years) | Less than a year | 1-2 | 2-3 | 3-5 | 5-10 | 10-20 |

| 3-5 million rubles | 1,5 | 1,3 | 1,1 | — | — | — |

| 5-10 million rubles | — | — | — | 2 | — | — |

| 10-15 million rubles | — | — | — | — | 3 | — |

| From 15 million rubles | — | — | — | — | — | 3 |

More on the topic: Application for cancellation of a court order on transport tax

However (in connection with the release of Federal Law No. 335 of November 27, 2017), the following changes will occur for the tax period of 2021 and subsequent years:

| Average cost/vehicle age (years) | Until 3 | 3-5 | 5-10 | 10-20 |

| 3-5 million rubles. | 1,1 | — | — | — |

| 5-10 million rubles. | — | 2 | — | — |

| 10-15 million rubles. | — | — | 3 | — |

| From 15 million rubles. | — | — | — | 3 |

Are there any benefits?

As with other mandatory payments, some persons are partially or completely exempt from paying transport tax. Benefits for car owners are provided at both the federal and regional levels.

Federal benefits are specified in Art. 361.1. Tax Code of the Russian Federation. According to them, the following are completely exempt from paying tax:

- Vehicles registered in the Platon system whose permissible maximum weight exceeds 12 tons. From January 1, 2019, this benefit will no longer apply.

- Passenger cars with engine power not exceeding 100 hp. With. or 73.55 kW (for electric cars).

- Passenger vehicles converted for use by disabled people.

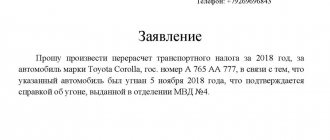

- Cars that are stolen, but only for the period until they are found, and only if there is an official document confirming the fact of theft.

As for regional benefits, their number and size are determined by the legislative bodies of the constituent entity of the Russian Federation where the vehicle is located. To find them out, we proceed according to the following scheme:

- We open a help service on the website of the Federal Tax Service.

- Fill out the form provided. We indicate the type of tax, tax period and region in which the car is located. Click the “Find” button.

- A table will appear below indicating the law (or laws) regulating this mandatory payment. Click on the word “More details”.

- Scroll down the page that opens a little and switch to the “Regional Benefits” tab. If you are interested in tax breaks only for a certain category of vehicles or taxpayers, we set the appropriate filter.

In recent years, the government has been actively encouraging motorists to purchase electric cars. Thus, in the Kaluga and Moscow regions, the transport tax for owners of such vehicles (as an experiment) has been completely abolished.

Does the individual entrepreneur pay transport tax?

Often, in their business activities, businessmen use their own transport. In this case, who is obliged to pay the TN state – an entrepreneur or a citizen? To understand the issue, you need to carefully study the registration documents for the object. Since when registering a car, the certificate indicates an individual and not an individual entrepreneur, an ordinary person also becomes a taxpayer. Consequently, the entrepreneur pays property taxes, including transport and land taxes, on behalf of the citizen, without indicating the legal status of the individual entrepreneur.

Conclusion - we looked at how transport tax is paid by legal entities in accordance with legal requirements. To remain a bona fide taxpayer, an organization must independently calculate and pay the car tax according to the rates and deadlines accepted in the region. In case of violations of regulations, administrative and tax penalties may be applied to the enterprise.