Common Mistakes

Most often, errors occur when filling out the following data:

- Full name of the owner, policyholder and drivers

- Passport details of the policyholder

- Car brands

- VIN and license plate number of the vehicle

- Insurance company details

- Driver's license numbers and series

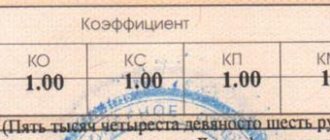

- Used in calculating coefficients

All information specified in the policy is verified by RSA. If the driver and car are already in the database, then it sends a notification to the insurer and demands correction. If insurance is taken out for the first time, then the information is recorded in the database, as usual, after which errors can only be detected when an insured event occurs. Data in the PCA always takes precedence over those specified in the policy.

In addition, the following may be considered an error:

- Filling the policy with paste of different colors or shades

- Differences in the handwriting used to fill out the policy

- Differences between the signatures and those indicated in the passports of the policyholder and the insurance company employee

- The presence of outdated or incorrect details in the policy

Mistakes made for selfish purposes

Unscrupulous policyholders seek to save on insurance premiums by providing deliberately false information regarding the following parameters:

- transport capacity;

- driving experience;

- registration in rural areas.

Such inaccuracies when filling out the policy are classified as fraudulent acts, since they imply illegal profit. When issuing an electronic policy, inaccurate information is entered by the policyholder, so he is fully responsible for his actions. Upon receipt of a paper version of the document, his responsibility can be shared with the insurer's agent, who, before signing a contractual relationship with the policyholder, must check all documentation.

Reasons for appearance

Errors in the MTPL policy can occur for three reasons:

- Negligence of the insurer or policyholder. Errors may occur when filling out a policy or transferring data to RSA

- The specified data is out of date. An error is considered to be out-of-date information in the policy - for example, when replacing a passport or driver’s license

- The intent of one of the parties. The policyholder may intentionally provide false information in order to reduce the cost of the policy, or draw up a document for a dummy person. Intentional errors may also occur on the part of the insurer - for example, he may intentionally transmit incorrect data to the RSA when applying for a policy via the Internet

Reasons for incorrect data

An error is considered to be incorrect information about the car, drivers or owner. Their reasons may be:

- Insured's inattention when filling out the online form . For example, a typo when entering the series and passport number or VIN number of the car.

- Incorrect information on the insurance company's website . There are fields where you do not need to enter information, but rather choose from the proposed options, which are already presented with an error. For example, place of registration or make of car.

- Inconsistency with the RSA database (you can read about the role of the RSA in the design of e-OSAGO here). Such fields are usually highlighted in yellow to draw the driver's attention. In this case, you can correct the error yourself, but if nothing works, you should contact the insurer directly.

Some recommendations to avoid common mistakes:

- It is better to give preference to sites where the car model is listed in accordance with the old policy or it can be specified manually.

- The driving experience field indicates the year the driver's license was issued.

- Before sending the application, check the entered data letter by letter with the original documents (passport, PTS, STS, driver’s license, etc.) What documents are needed to issue e-MTPL are described in a separate material.

What problems may arise due to errors in the policy?

If the policy contains errors, it may be invalidated at any time. This can lead to various consequences, both minor and severe:

- A traffic police officer may issue a fine for the absence of a policy if he discovers a discrepancy in information in the document or in the RSA

- If an accident occurs and the driver is found guilty, the insurance company may demand compensation for the amount of damage paid from the driver in court. Or she will refuse to compensate for damage under a policy with errors at all

- In extreme cases, the insurance policy may be considered fraudulent, and you may be accused of attempted fraud. You will have to prove that you did not intentionally provide false information

OSAGO insurance is an official financial document

The compulsory motor third party liability insurance policy is a financial document that is protected by watermarks and also has a series and number.

It is not permissible to make changes to any financial document. Therefore, do not agree to the insurance agent’s offer to correct something when registering your car license.

If an insurance company employee made a mistake when filling out the form, he is obliged to issue a new insurance document. The agent crosses out the damaged insurance and then rejects it. The motorist does not have to pay an insurance premium for a new motor vehicle license form. After all, the driver pays money not for the insurance form, but for drawing up an insurance contract.

Therefore, when contacting a car owner’s insurer, he should not be interested at all in how many times the insurance agent will rewrite the MTPL policy. Before signing the insurance, the driver needs to read it carefully and, if there are errors, omissions or other nuances, ask to rewrite the policy.

The insurance document must not contain:

- One form cannot be filled out with two different shades of ink. When the pen, which has already almost completely filled out the auto insurance form, runs out of ink (and there is no suitable shade found), then you need to rewrite the insurance. Of course, you sympathize with the employee, but you are ready to wait until they issue you a policy in accordance with all the rules. Don’t “see each other” to persuade that this is not important. Given the statistics that every fifth car license is fake, traffic police inspectors will always find fault with this. Especially when the car owner is from a “foreign” region. Do you need it? It is better to insist on your own and get a properly issued policy.

- insurance must be issued by one employee. Two handwritings on one document raise doubts about its authenticity.

- if the employee made a crossing out, then it must be drawn up accordingly, otherwise the motorist will be sent to the insurer to confirm the authenticity of the document.

Thus, the policy must be completed by one person, one color of ink, and have no errors. Only minor corrections in small quantities are allowed.

The motorist should ensure that the insurance agent fills out the policy form from his documents. Before signing the insurance, you should read everything carefully.

What to do if detected

If you discover errors after taking out your policy, you should contact the insurance company as soon as possible. You cannot make changes to the policy yourself, otherwise the document will be declared invalid. Report the problem to your insurance company and fill out a correction form.

To correct, you will need the original policy, the policyholder's passport and documents confirming the correct data. For example, if the VIN of a car was incorrectly specified, then you will need its PTS and STS. When entering new data, carefully check the policy for errors before collecting it. Amendments are made to the current policy, or a new form is filled out with current information.

The insurer will send the new information to the RSA itself—there is no need to apply there separately. At the same time, you should be careful when changing the number and series of your driver's license - if you change them, you risk losing the accrued KBM. To save it, additionally fill out an application for maintaining the coefficient with the insurance company.

How to correct an error in an electronic OSAGO policy

It is believed that the electronic database will not allow registering a document with incorrectly filled in fields. In practice, there are often cases when the policyholder makes a mistake, the program does not recognize the error and issues an MTPL with incorrect information. Not all insurance companies provide verification of entered data using the PCA database.

It is easier to correct an error in an electronic policy than in a paper one. Usually, all you need to do is log into your personal account on the insurer’s website, select the desired policy and the editing option. Specify the information that needs to be corrected and enter the current information. Upload scanned copies of documents confirming the information. After checking and making corrections, the insurance company will send the corrected document by email.

How much does it cost to correct an OSAGO policy?

According to the law, making any changes to the MTPL policy is completely free. The insurance company does not have the right to charge any fees for correcting the document.

The only exception is if the cost of the policy changes after the changes are made. In this case, you will need to pay the insurer the difference between the cost of the policy before and after the amendments.

How can I correct an error in the electronic MTPL policy?

Sometimes the car owners themselves are to blame for the mistakes they make. The lion's share of such errors occurs in cases where people took out insurance electronically. This is due to the fact that car owners enter all the data to obtain a new policy on their own, which results in errors.

Yes, there is a service that detects such inaccuracies when checking the entered data through the RCA database, but technical failures do occur, and as a result, the citizen receives insurance with an error. The likelihood of such an outcome is minimal, but it exists.

After the check has been carried out and if errors are identified at the stage of filling out the online form, the user can immediately make changes to the policy online independently and make adjustments . Only after this the service will allow you to continue processing compulsory motor liability insurance. Unfortunately, this option does not always work, since the SAR database may contain erroneous data. In such circumstances, the only correct decision is to contact the insurer, where the necessary corrections will be made, and the driver will receive a new policy.

Question answer

When do amendments to the policy take effect?

Amendments to the policy become valid on the day the amendments are made. New information is entered into the RSA within three to five days.

What to do if the insurance company does not accept an application to change data?

If the insurer does not want to correct errors in the policy, then you will have to go to court. Attach documents confirming the real data of the policyholder and drivers to the evidence.

Can I count on an insurance payment if there are typos in the policy?

The presence of typos in a document is not grounds for denial of the policy. At the same time, it is important that all information is indicated correctly in the traffic police report. The policy still needs to be corrected - this can be done at the time the insurance claim is made.

Features of such a “motor citizen”

E-OSAGO is a complete analogue of traditional OSAGO on paper, which has a number of features:

- The driver is not required to carry printed insurance. At the same time, despite the fact that the law allows this, it is still better to print out the insurance policy received by email (what does an electronic policy look like?). This will significantly speed up possible checks by traffic police officers (read more about what and how to show the traffic police inspector if you have E-MTPL).

- All responsibility for the correctness of data entry lies with the policyholder. If previously most of the fields were filled out by an insurance agent, then when applying for insurance via the Internet, all data is entered by the person purchasing the “automobile license” (how to fill out E-OSAGO correctly?).

- Yes, in the largest insurance companies there are failures in the online policy registration system. This is due to increased loads during certain peak hours, when the equipment can no longer cope with the number of requests from policyholders (details on what to do if online compulsory motor liability insurance does not work can be found here).

- When applying for insurance via the Internet, you must make sure that the insurance company is included in the RSA list and that the policyholder is on the official website of the insurance company (read what the role of the RSA in the registration of E-OSAGO is in this article). Otherwise, there is a possibility of paying money to scammers.

Sources

- vedomosti.ru: An error in filling out an MTPL policy can cost drivers dearly

- avtoguru.pro: What to do if there is an error in the MTPL policy, and how to correct it?

Recommended for you

- How is the loss of marketable value of a car considered under compulsory motor liability insurance?

- Is compulsory motor insurance necessary when moving a car?

- OSAGO: New life for an old fraudulent scheme

Victor Avdeev Head of SEO department #VZO. He has been working in the project since 2018, before that he was freelancing. Manages the work of marketers and SEO specialists. Experience working on similar projects allows him to effectively participate in the development of our service.

(12 ratings, average: 4.6 out of 5)