"Lost" documents

After an accident, you provide the insurers with a complete set of documents about the incident. If in return the employee does not provide an inventory of the accepted papers, the payment may be postponed indefinitely. When refusing to transfer money, the insurance company will refer to the fact that it did not receive a copy of the protocol, your bank details, a certificate from the traffic police, etc. It is almost impossible to prove the opposite without an inventory - so it turns out that the insurance company does not pay for compulsory motor liability insurance.

What to do if the insurance company does not pay for compulsory motor insurance?

When handing over any documents to insurers, ask for confirmation that they accepted the papers. Such confirmation is a copy of the transferred document with a note indicating when and by whom it was accepted. The mark must be certified by a seal.

What to do if the company refuses to provide comprehensive insurance?

Insurance companies issue comprehensive insurance policies at their own discretion - they have no obligation to engage in this type of insurance. In each case, the insurance company decides how profitable it is to take out insurance.

Most often, insurers refuse CASCO insurance for the following reasons:

- the car is more than 10 years old;

- there is serious damage;

- the car has more than one owner;

- duplicate PTS instead of the original;

- car after theft;

- the policyholder has a bad credit history;

- the policyholder had previously sued the insurance company, etc.

When the insurance company refuses to provide comprehensive insurance for one of these or any other reasons (within the law), there is no point in arguing. It is better to contact another company that may agree to insure your car.

Repair at your own expense

The insurance company accepts documents and receives notification of where and when the damaged car will be inspected. Its representatives may not appear for this inspection. In this case, you provide an independent expert report, completed at your choice, to the insurance office, after which they promise to transfer the funds to you within the prescribed period and “allow” you to repair the car.

Art. 12 Federal Law 40 “On Compulsory Motor Liability Insurance” gives insurers the right to demand inspection of property damage within 20 days after the incident. If by the time of the inspection you repair the car yourself, the insurance company will refuse to pay due to the lack of damage. Even if the car owner provides documents about the repairs performed, there is no guarantee that the losses will be compensated. Again the insurance company does not pay for compulsory motor liability insurance.

What to do if the insurance company does not pay for compulsory motor insurance?

The best option is to take your time with car repairs. You should contact a car service center only after the insurer has at least partially transferred the payment under compulsory motor liability insurance. By this, he recognizes the case as insured and confirms his obligation to compensate for the damage.

Order an independent examination

.

or call the number

By clicking the “Submit” button, you automatically agree to the processing of your personal data and accept the terms of the User Agreement.

How are MTPL payments calculated?

The maximum limit of payments for compensation for damage in an accident is limited by the limits established by law :

- up to 400,000 rubles – for damage caused to the victims’ property;

- up to 500,000 rubles – for damage to the health of each of the participants in the accident;

- no more than 135,000 rubles to the heirs - for the death of a victim in an accident and up to 25,000 rubles - for ritual expenses.

Now, if there are several victims in an accident , each injured party can receive compensation within the established limits without limiting the total payment.

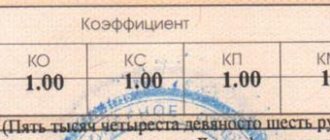

The amount of specific payments to victims is determined on the basis of special calculations.

Damage to health is assessed in the amount of lost income during the period of temporary disability, as well as the costs of treatment, care and additional nutrition, the purchase of medicines and other costs for restoring health.

But the victim needs to prove that similar medical services are not provided free of charge and medications can only be purchased on a commercial basis, and also that there was really a need for such treatment.

When compensating for property damage, payments are made according to the following scheme :

- the market value of the property in the event of its complete loss or when repair costs exceed its value before the accident;

- the amount necessary to repair and restore the property to its original condition if it is partially damaged;

- compensation for other costs incurred as a result of the accident, for example, payment for a tow truck and storage of the damaged car in the parking lot.

A common problem for participants in accidents on the road is that the insurance company underestimates payments and reduces the amount to compensate for property damage and personal injury. This is most often explained by the wear and tear of the car, which reduces the amount of compensation for the cost of spare parts, and also underestimates the cost of repair services, which are calculated in accordance with a special unified reference book.

The car was not damaged in an accident

As in the previous case, they accept your documents about the accident, but representatives of the insurer do not come for inspection. The car owner is informed that he can repair the car and is promised to transfer compensation in due time.

Then, within 20 days, the insurance company sends a letter to the client notifying him that the damage is not related to a specific accident. If the car has already been repaired, it will not be possible to prove otherwise, and the insurance company will not pay for compulsory motor liability insurance.

What to do if the insurance company does not pay for compulsory motor insurance?

You need to wait for compensation for losses and then begin repairs. Sometimes a trace examination is carried out for already repaired cars, but even its results are not always regarded by the court as evidence.

Practice

Parents whose son, who worked in the Ministry of Emergency Situations, died, came to the reception. The death occurred during work activities due to a fall from a tree. When contacting the insurance company, it was explained that payment would not be made due to the fact that the death allegedly occurred as a result of a stroke that occurred against the background of a cardiovascular disease, which was not reported to the insurer.

- However, upon examination it was established that the cause of death was due to a fall from a great height and severe bruising of internal organs. And the stroke occurred against the background of these injuries.

- First, they prepared a claim with a requirement to voluntarily pay the insurance, but there was a refusal.

- At the trial, relevant documents were presented confirming the cause of death; the insurer referred to the indication in the study about stroke and stated a direct investigative connection with it.

- At the trial, an expert was questioned, who refuted the insurance company’s arguments, and the court declared the refusal to pay life insurance illegal and collected the insurance.

Underestimated damage

Insurers may underestimate the amount of damage caused to a car in an accident. In this case, they are present at the inspection and conduct their own independent examination. The payment is calculated based on its results, and as a result, the amount of compensation turns out to be underestimated.

What to do if the insurance company does not pay for compulsory motor insurance?

If the insurance company does not pay under compulsory motor liability insurance, then you can prove your case by going to court. Our company provides legal support services. If the insurance company tries to challenge the results of the automotive technical examination (Moscow and Moscow region), our lawyers will prove the correctness of the calculations made by Invest Consulting.

Wait some more

There can be many reasons to postpone payment under compulsory motor liability insurance: checking documents by the security service, double-checking, paperwork, collecting signatures, processing transfers from accountants - insurers have nowhere to rush. Their client may wait for months for compensation for damages under compulsory motor liability insurance and not receive it.

What to do if the insurance company does not pay for compulsory motor insurance?

The deadlines for processing and transferring compensation under compulsory motor liability insurance are limited by law. After their expiration, a pre-trial claim must be sent to the insurance company. If this does not help, you need to go to court. The claim must include reimbursement of costs associated with the delay (postage, legal services, parking, examination costs, etc.). The insurance company is obliged to pay a penalty for the use of other people's funds and penalties provided for by law for delays in payment.

The cost of a lawyer's services to understate insurance payments

| Name of service | Price | |

| Initial online consultation on issues of underestimation of insurance payments | For free | Get |

| Insurance disputes over CASCO | from 7,000 rub. | Get |

| Insurance disputes under MTPL | from 7,000 rub. | Get |

| Legal protection from the insurance company when a claim is brought against you | from 8,000 rub. | Get |

Damage only on the outside

When assessing damage after an accident, representatives of the insurance company take into account only external damage (indicated in a certificate from the traffic police). The employee refuses to record internal damage, claiming that this is the task of the car service employees who will repair the car. You are offered to repair the damage and provide the insurance company with documents from the car service center to reimburse the costs. Having received them, the insurance company pays only for those damages that were recorded during the inspection (external).

What to do if the insurance company does not pay for compulsory motor insurance?

The amount of payment is calculated based on the conclusion about the amount of damage to the car in an accident. Request a copy of this document from the insurance company and submit it to independent experts for verification. If the report was drawn up with violations and does not reflect all existing damage, contact an independent automotive technical expert (Moscow and the Moscow region).

Each insurance company has many similar techniques in stock. It is important to act wisely and know your rights. The legal department will protect your interests. Since 2004, we have been conducting independent examinations after road accidents. Our experience and professionalism are a guarantee that you will receive payment under compulsory motor liability insurance on time and in full.

You can find out more detailed ways to combat these “tricks” by contacting the legal department of the expert assessment. The cost of legal advice is significantly lower than the amount by which the insurance company can underestimate the payment of compensation. And it is not comparable if you are denied compensation. Remember the popular proverb: “A miser pays twice, but a fool always pays.” Don't let us make a fool of ourselves. We win lawsuits against insurance companies.

Procedure

If you want to win your case in court and get the money you rightfully own, carefully study each step.

Insurance claim report

Before starting the court hearing, you should collect a report from the expert, where he makes an assessment and calculation of the funds that will be needed for the upcoming repairs.

Then write a statement to the insurance agent so that he will give you all the necessary materials. He is simply obliged to give them to you, according to clause 71 of the OSAGO Rules. As soon as you receive them, you must carefully check the act for the accuracy of the facts reflected there.

If the amount indicated in the act is approximately the same as what needs to be spent on repairs, it means that the low payment amount was formed as a result of calculating damage with wear and tear of the material, and this should not be the case. True, further actions are unlikely to give a positive result.

Quite often insurers do the following:

- indicate fewer hours to repair your car;

- do not include certain types of work performed;

- reduce the price of parts that will be used for further car repairs;

- do not include their cost.

If your car is completely beyond repair, insurers can inflate the price of parts by 2-3 times. This will also result in lower payouts.

Independent examination

If the report indicates all parts of the car that have undergone transformation, it is necessary to resort to a second independent examination. This should be done so that the specialist conducts a second inspection, prepares his own report and calculates the amount that will be spent on restoring the car.

An independent expert can also tell you the amount of loss of marketable value if your car is not yet 5 years old. And you can add this data to the application that you submit to the court.

When you carry out the second examination (of course, if the vehicle has not yet been restored), you should tell the insurers about this, namely, notify them of the time, date and place where the second examination will take place.

Be careful not to throw away any of the receipts for this case, as later during the trial you can attach them to the case and recover from the insurance office the amounts for each of the attached checks.

Pre-trial claim

Sample claims to the insurance company at the bottom of the page.

If a disagreement arises between the motorist and the insurance company, you must go to court, but before that you must file a pre-trial claim. In order for the court to accept it and avoid any problems, you need to take into account several basic rules when drawing up a claim.

The most important thing is to know what needs to be indicated and what not. The claim includes the following information:

- information concerning both the applicant and the insurance company;

- all data on the case with a full description of the action;

- bank account to which future payments will be made.

When filing a claim, you should duplicate it, since you will give one option to the insurance office, and the second will remain with you. Make sure that your version has a mark indicating that the claim has been accepted.

You can submit it in two ways - in person or by mail. If you are afraid that the insurer will refuse to accept the claim, send a registered letter with notification to his address. This fact will serve as evidence during the trial that the insurance agent did not want to cooperate with you and did not make contact.

The insurance company must review the claim within 5 days of receipt. If at the end of this period you receive a negative answer or you do not receive one at all, you can legally continue to go to court. If the insurer refuses your demands specified in the pre-trial claim, or simply ignores them, he will subsequently be fined 50% of the total amount specified in the lawsuit.

Complaint to RSA and FSSN

You can also prepare complaints to other authorities, such as the Union of Auto Insurers and the Federal Insurance Supervision Service.

On the official website of the RSA you can find a form for filing a complaint and download it. You can also call the toll-free line and leave your complaint that way. Or find out if there is a representative of this organization in your city and leave a complaint in person. Well, as a last resort, you can write a letter to the head office of the RSA at the address: Moscow, Lyusinovskaya street, building 27, building 3.

Don't worry or be embarrassed, because this is a completely normal step. This type of complaint has long been practiced in other countries.

It should be borne in mind that the FSSN only monitors and monitors the work of insurance offices. It does not resolve controversial situations regarding the amount of insurance payment. Therefore, there is no guarantee that this will help, but know that the work of insurance agents and the company itself will be reviewed and verified in detail.

How to calculate the amount to file a claim in court?

When submitting a statement of claim to the court, indicate in it the amount you expect to receive from the insurance company. To do this you need to know what is included:

- costs for restoration repairs, in this case based on the results of your examination;

- the cost of the independent examination itself;

- all postage costs.

True, this amount will not include funds already transferred from the insurance company. You can also reflect here the amount of moral damage that you have the right to demand from the insurance company.

As mentioned above, the insurance company will also have to pay a 50% fine for refusing to resolve the dispute voluntarily and make the payment you require.

Necessary documents for the court

While you are waiting for a response to your pre-trial claim, do not forget to collect the necessary package of documents so that you can later submit it to the court. This package includes:

- Documents for the vehicle.

- Copies from the traffic police.

- Act on the occurrence of an insured event.

- Vehicle inspection report.

- Damage assessment report.

- Statement of claim along with calculation data on separate sheets.

This must be done in advance so as not to waste either your time or the court’s time on this later.

What should you consider when filing a claim?

If you do not want to deal with this matter yourself or do not believe in your abilities, contact a lawyer. Most often, in a dispute over an insurance payment, the court satisfies the claims of the client of the insurance company in full. Usually this drags on for several months, but the client does not lose anything at all, since everything is paid by the insurance company, including legal costs.

The court may also order another forensic examination. Just one meeting is a rare occurrence, so you will have to leave work often to attend meetings. At the end of the trial, the writ of execution must be given to the bailiffs or to the bank where the debtor’s account is registered.

Now you know what to do if you haven’t paid enough under compulsory motor liability insurance, what measures to take, what documents to collect and where to go to assert your legal rights to payments for an insured event. Don’t get confused and, if necessary, go to court, because, as practice shows, in most cases it takes the applicant’s side.

Catalog of insurance companies in Russia

By following the link , you can familiarize yourself with the catalog of insurance companies in the Russian Federation offering compulsory motor vehicle insurance services. Description of organizations, current financial indicators, ratings, reviews and other information. If you have already had a positive or negative experience with compulsory motor liability insurance of any insurance company, leave your feedback. Thank you!

Link again. Also, be sure to write your comment below. What do you think about the topic of this material? Or maybe you have questions? Ask!