The situation when you get into an accident is not the most pleasant. It can be even more unpleasant if the person at fault for the accident has expired compulsory motor liability insurance, because some insurance companies, in such cases, practice refusing insurance payments. Let's try to figure out how legitimate such a refusal is and how to still get compensation for damage.

The phrase “expired OSAGO” can hide two situations:

- The culprit’s MTPL agreement has expired, and he has not yet managed to conclude a new agreement.

- The culprit has expired the period of use of the vehicle specified in the MTPL agreement.

How to renew your MTPL insurance policy?

There are rules according to which concluding a new contract and renewing an MTPL policy are completely different procedures. When signing an agreement for the issuance of insurance, we may be talking about the execution of a document for the first time, or the car is transferred into the possession or temporary use of another insurer. The new owner does not have the right to issue an extension of the MTPL policy, since we are talking about a newly concluded policy.

In general, MTPL insurance is issued for one year and at the end of this period the contract is extended by issuing a policy with the previous insurer for a new term. The renewal period for an MTPL policy is not regulated by current rules, but the insurance holder is required to apply for a document renewal no later than the expiration of the policy. When renewing the policy, the following actions are performed:

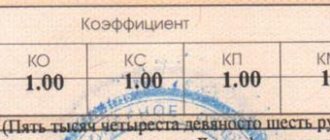

- the current coefficients are recalculated taking into account insured events that arose during previous periods, as well as the driving experience and age of the drivers;

- the premium is calculated from the tariff plans in force at the time of policy renewal;

- the client is issued a new document.

Answering the question whether it is possible to renew a car policy in advance, we can say that the client has the right to contact the insurer in advance, and the company representative, in turn, is obliged to renew the policy taking into account the validity period of the document. The extension begins to take effect from the next day after the completion of the insurance “work” . As for how many days in advance you can apply for an insurance renewal, the following options exist:

- when contacting the old policyholder, this can be done two weeks before the expiration of the old document;

- when contacting a new policyholder - a few days before the expiration of the previous policy.

It is extremely rare, but this also happens, insurance companies go to take out insurance 30 days before the end of the previous one. The document will indicate the occurrence of liability on the part of the policyholder for the “Damage” risk only after a re-inspection of the vehicle.

It should be noted that it is not possible to extend MTPL insurance for a month. It is possible to issue a policy for 15-20 days if it is necessary to transport the car or carry out the necessary maintenance. Events. The minimum period for obtaining insurance is 3 months.

Important! The Civil Code of the Russian Federation and the Federal Law “On Compulsory Motor Liability Insurance” prohibit the possibility of executing MTPL agreements with overlapping validity periods with one insurance company.

Electronic policy renewal

Today, a client can renew car insurance via the Internet. To do this, you will need to go to the insurer’s website and complete all the necessary steps. An important point is that you can renew your policy online:

- documented;

- electronic policy.

The procedure for prolonging insurance is similar to virtual registration of compulsory motor liability insurance. Today, users have access to a service that allows them to renew their MTPL policy using the previous policy number. To do this you will need to do the following:

- Log in to your personal account on the website of the insurance company (where the policy was originally received).

- Go to the “MTPL” section, and then to “Renewal”.

- Find the previous policy by series and number.

- Enter the data required to renew the document.

- Wait for information about payment for the policy to appear and transfer the required amount.

After receipt of payment, a new electronic policy will be sent to the account specified when renewing the document. Additionally, it is worth saying that you cannot renew your policy through State Services , but you can only go to the insurer’s website where the document was issued.

Extension of compulsory motor liability insurance (unsuccessful)

Hello, maybe there was a similar question, but still. Yesterday, 02/22/2013, the MTPL insurance expired, which was issued for half a year; today, 02/23/2013, I went to renew the MTPL insurance, the girl said that she did not have the right to renew, because 1 day late. If I had arrived on 02/22/13, I would have paid 30% for the extension, i.e. 1200 rub. in my case, but because... arrived on 02/23/13, the six-month OSAGO insurance was a day late, so I had to take out a new one for another half a year for the same amount as originally 70%, which amounted to 2993 rubles. He says that initially, during the “first time of insurance,” you should have been warned that it was 02/22/13 and not a day later to come to renew, otherwise you would apply for a new one with the same amount of 70%, i.e. 2993 rubles, of course, they didn’t warn me, I would have known, postponed the matter, and extended it until 02/22/13. In general, for the day of delay I overpaid almost 1800 rubles. Is she right that she did not renew the MTPL for 30%?

p.s. I asked a legal question, but maybe some of my fellow soldiers have encountered something similar?))

What is needed to renew MTPL insurance?

To extend the period of insurance use, you will need to comply with some features of the procedure, namely: perform certain actions and prepare the necessary documents. Mandatory actions must be as follows:

- The car owner will need to contact the insurance company - in person or online.

- Use the insurance policy renewal service.

- Prepare and submit the necessary documents to the insurer's representative (the list is given below).

- Pay the cost of insurance renewal.

- Get a new document.

The signing of an agreement to renew the document can only be done when the policyholder personally contacts the insurance company or his legal representative who has a notarized power of attorney. As required documents, you will need:

- Passport or other citizen's identification document.

- PTS and registration certificate for the car.

- Driver's license.

- Diagnostic card (the original is required if such a document has not been submitted previously).

It would be better to take your old policy with you to simplify and speed up the renewal procedure, although in fact this document is not required to be presented.

How much does it cost to renew car insurance?

As a general rule, insurance renewal is not a reason for benefits and discounts. For this reason, the cost of renewing the insurance policy will change only taking into account the following indicators:

- current coefficients and tariffs;

- age and driving experience of the driver.

If several drivers are allowed to drive a car at once, then the maximum possible coefficient from those determined for each person is taken into account for the calculation.

What to do if you are refused to renew your MTPL policy?

Sometimes, insurers refuse to renew insurance due to the fact that the necessary documents are missing, a technical inspection has not been carried out, or there is no old policy. In addition, there are demands that the representative of the insurance company does not have the right to make. In particular, we are talking about the following actions:

- there is no need to apply for insurance, since we are talking about the continuation of cooperation under the main agreement;

- the insurer is not obliged to draw up and issue notifications about road accidents or a list of representatives by region;

- in turn, the policyholder is not obliged to provide original documents necessary for concluding an insurance agreement if the insurer does not have such data.

In fact, all these requirements are unlawful and the user can obtain insurance by contacting the insurance company. When the policyholder refuses this action, the insurer has the right to go to court.

What does the law say?

When learning to drive, future car owners are taught that they cannot drive without insurance. However, in reality, the policy is often expired, or the driver “forgets” it at home. By law, the owner who purchased the vehicle is required to insure it within 10 days. Moreover, the MTPL policy must always be in the car and presented upon request of the traffic police officer.

An insurance option such as OSAGO is not only convenient, but also relatively inexpensive. With insurance, you protect yourself from unnecessary expenses in the event of an accident. We must not forget that when driving a car without an MTPL policy, all responsibility will fall on the driver if, for example, any damage occurs during an accident.

For example, you were involved in a traffic accident, but you did not have a compulsory motor liability insurance policy, or you simply did not take out one. Remember that in this case you will have to compensate for the material damage that was caused to other participants in the accident, unless, of course, you are determined to be the culprit.

By the way, many car owners take out an additional voluntary insurance policy in addition to their compulsory motor liability insurance policy, which expands the limit of cash payments.

Is it possible to extend the MTPL policy without a technical inspection?

Sometimes insurers require you to bring your vehicle for inspection . This condition is not considered legal, since clause 1.7 of the Rules states that the insurer itself decides on the need for technical inspection. If the car owner does not want to drive the car, then insurance must be carried out without presenting the vehicle. By analogy, the issue is with the extension of the MTPL policy. In other words, insurance agents cannot require a mandatory inspection.

Is it possible to drive with expired insurance and what could be the fine?

If you carefully study the frequency of updating the Code of Administrative Offenses, you can conclude that this phenomenon occurs quite often. On October 15, 2014, changes were made to the Code of Administrative Offenses that relate to driving a vehicle with expired insurance.

Due to the increase in prices for compulsory motor liability insurance policies, as well as taking into account Federal Law No. 40, which obliges citizens to purchase compulsory motor liability insurance, citizens began to evade this obligation in every possible way, trying to keep their money safe and sound. However, refusal to comply with state requirements may not turn out well for you.

To solve your problem, get a free LEGAL consultation RIGHT NOW:

+7 Moscow +7 St. Petersburg

Show content

What it is?

Expired insurance is a MTPL policy whose validity period has expired . It doesn’t matter whether it expired a couple of days ago or a year ago. The main thing is that in the event of a traffic accident that requires compensation for the costs of paying off your damage from the insurance company, the policy issued to you will be valid until its expiration date.

It turns out that a citizen, moving along the roads with such a document, directly violates the requirements of the law, namely Federal Law No. 40, which requires citizens to have an insurance document that is valid.

ATTENTION : That is why, if the traffic police and other law enforcement agencies establish a violation of the law, the violator will immediately be held accountable.

If the insurance runs out, what is the penalty? Driving a car with an expired insurance form today will cost citizens very little . But this does not mean that you can freely continue to move in this way in the future. What to do if your insurance is expired and what the fine may be? Legislation undergoes changes every day and it is likely that in the near future the fine will increase in size several times.

Also, traffic police officers can help you if you encounter the following situations:

- Your MTPL policy was forgotten at home. At the same time, you assure the patrol officers that it was not expired. In this situation, the police officer issues you a minimum fine for non-renewal of insurance in the amount of 500 rubles. The Code of Administrative Offenses talks about this in Article 12.37 of Part One.

- The second condition, which will also allow you to get away with a small monetary penalty, is due to the fact that you are driving a vehicle that is owned by your relative or friend, who has an insurance policy, but you are not listed in it. In this case, the fine will also be 500 rubles (read more about what size of the fine is provided if the driver of the vehicle is not included in the compulsory motor liability insurance insurance here, and from this article you will learn about what punishment you can get for driving without insurance in someone else’s car ).