Every vehicle owner is aware that the amount of insurance for different clients may differ, even when insuring a car with the same company. Sometimes the amount increases due to incorrect data entered by the insurance employee. There may be information failures in the database of the Russian Union of Auto Insurers (RSA). To fix the problem, you need to make adjustments. Therefore, for many car enthusiasts, information is relevant about what to do: changed your license, how to make changes to the RCA?

What is electronic compulsory motor liability insurance?

The electronic version of OSAGO is an analogue of a paper policy, having the same legal force. Every vehicle owner can purchase it using the Internet. To do this, you will need to register and log into your personal account on the official website of the insurance company. There you can fill out a form and send your application to the organization for consideration.

The entire process is carried out remotely; personal presence in the office is not required. The finished version is sent by e-mail and can be used in this form without printing. It is enough to present it to the traffic police officer on your smartphone or tablet. Basic facts about the electronic version of OSAGO:

- This is an innovation that has become available to vehicle owners since 2015.

- Not all companies provide this service. Online sales are available on the websites of Alfastrakhovanie, VSK, RESO-Garantiya, Renaissance-insurance.

- The appearance of e-OSAGO is no different from the paper prototype, but some companies provide it in black and white format for easy printing on any printer.

- The policy received by email has a unique series and number that is not repeated. It also contains your first and last name, place of residence, and vehicle information.

- The electronic format has the same legal force as the regular version; there are no significant differences in their use. Only the design method differs.

Many drivers are afraid to issue an electronic policy via the Internet, as there is a high risk of falling for scammers. They create websites copied from the official portals of insurance companies and sell fake documents there. Their distinctive feature is errors in the site address and low cost of services. In some cases, it is much more profitable to apply directly on the RSA website, but there is no choice of insurer there; it is determined randomly by the program.

No insurance company or discounts

The first thing you need to do is to identify the reason for the disappearance of the discount in the unified RCA database and find out the KBM. If the reason is known, restoring the KBM under compulsory motor liability insurance will not be difficult.

The discount may disappear as a result of:

- Change of driver's license (the most common reason);

- Change of personal data (change of surname);

- At the end of the year, the insurance company did not provide information to the RSA;

- The insurance manager made a mistake during registration and sent incorrect data to the database (typo in personal data);

- When added to another insurance policy, agents equate discounts to the initial class and upload this information into a single database;

- The insurance company closed.

Insurance companies are literally disappearing from the market like mushrooms. What to do if a company that has not provided information to the unified RSA database has closed down? Is it possible to restore the KBM yourself in RSA? These questions plague many motorists who find themselves in an unpleasant situation.

The main thing is not to despair and give up. Even in such a situation, it is possible to restore the KBM after replacing rights or losing a discount. The main thing is not to wait until the contract ends. To restore the earned bonus, you will need to submit an application to the RSA for the restoration of the KBM and send it through the website.

Don't expect it to be reviewed in the shortest possible time. As a rule, the RSA employee will request additional information and check the driver's statistics for the last year.

If a car owner changed his license, didn’t know how to restore the car insurance policy, and signed up for compulsory motor insurance without discounts, he can count on a refund of the overpaid insurance premium. After drawing up the contract, you need to write a request on the RSA website, wait until the information is changed, and contact the insurance company with a request to make a recalculation.

The manager of the insurance company is obliged to accept the application, check the KBM data in the database, reissue the insurance policy and prepare an order for the return of the erroneously paid amount.

The sequence of your actions should be as follows: Let us add that a complaint of a similar nature can also be sent to the Central Bank of Russia using the Internet reception on the official website.

It should be noted that this method of restoring KBM in the database is not fast.

The process will take several months and will not necessarily bring positive results. Method No. 2: through third-party Internet services Hello! My last name was entered incorrectly in the RSA database (wrong letter).

Correcting information in the policy

"RESO-garantiya" recommends its clients to make changes to the electronic OSAGO policy as soon as circumstances requiring this arise. Some clients put it off for a long time, which leads to serious problems if an accident occurs. The auto insurance policy may be considered irrelevant and it will be impossible to receive payment. You will have to defend your right in court.

When do you need to rush to the office to change data in the RSA database?

- The policyholder changed the rights due to the expiration of the validity period, damage or loss.

- The technical condition certificate has been replaced.

- The car's license plate was replaced.

- The vehicle was transferred by gift to a relative.

- The place of registration or personal data (full name) has changed in the passport.

- One more driver needs to be added to the list.

It is necessary to notify about data changes as soon as possible. To understand when this needs to be done, except for the cases described, it is enough to pick up the policy and check whether it contains out-of-date data. If your insurance lists your old name or previous place of residence, you cannot do without contacting the company itself. This also needs to be done if there was a typo, inaccuracy, or spelling error when preparing the document.

Do I need to pay and how long to wait?

You will need to pay extra for making changes in the following cases:

- Inclusion in the list of persons allowed to drive a car will include drivers with higher coefficients of KBM and FAC. The most expensive addition is adding new players. The cost of insurance will almost double .

- Switch to unlimited insurance.

- Change of permanent registration address (when moving to a region with a higher regional coefficient). The cost of insurance can increase not only when moving from a small town to a large city. It is enough to move from the region to the regional center.

- Changing the purpose of using the car (taxi or rental).

- Increasing the validity period of the insurance contract.

- Making design changes that resulted in an increase in engine power. Before issuing a policy, the insurance company may request a certificate from the traffic police confirming that the vehicle is safe to operate on public roads.

Changes are made free of charge when changing the full name and address of permanent registration, replacing a driver's license, PTS and STS, when eliminating errors made during registration.

Paid changes are made only after checks using the RSA databases, which take from half an hour to several days (by law, the insurer is given 3 business days ). Information about new registered drivers is displayed in the system after 5 days . These days, it is advisable to carry a paper version with you (you can print it from your personal account).

What changes cannot be made to the policy?

If the question arises whether changes can be made to the electronic MTPL policy, they clarify not only what information can be adjusted, but also when this cannot be done. The following points cannot be corrected:

- Parties to the insurance contract (the company itself or an individual).

- Vehicle (the policy is issued for specific equipment, which does not change during the entire period of validity of the contract).

- Insurance period.

almost always warns its clients that it is impossible to make changes to the electronic MTPL policy regarding its validity period. After the agreed time has elapsed, the agreement is considered terminated, and a new document will need to be drawn up to continue cooperation.

Amendment principles

Changes to the OSAGO policy online must be made in a short time, although there is no strict time limit. You must contact the insurer in person or send an application to add new information to the RSA database by email.

You will need to attach scans of the following documents to it:

- Passport or other document confirming the identity of a citizen.

- Completed form (provided on the website).

- Driver's license.

- Certificate of right to transport.

- Technical condition certificate.

It is important to know! If the surname changes occurred as a result of marriage, you will also need to attach an additional certificate. Scans should be clear, without shadows, and with easily readable text. When applying in person, it is enough to have the originals with you; all copies will be made by the employee himself.

How to restore KBM online

You can change data in PCA online using special third-party services. For example, through the KBMka website. To get started, you need to indicate the driver’s full name and date of birth, and VU details. The system will perform a search to determine the bonus-malus coefficient, and if any discrepancies are detected, it will be offered to correct it for 530 rubles. (promotions are held regularly and the price is reduced).

To make changes to the RSA using the KBMka service, you need to fill out the appropriate application:

After payment has been made, changes will be made within 1-7 days. To track the current status of your order, you will receive an email with a number and a special link.

If the KBM value does not change or falls by 5% (1 step), an automatic refund will be issued.

Incorrect application of the bonus-malus coefficient deprives the driver of the accumulated discount. To correct this, a change in the data in the database of the Russian Union of Auto Insurers is required. To do this, the driver must submit a corresponding application to his insurer, and if he receives a refusal or disagrees with the decision, contact the RSA or the Central Bank of the Russian Federation.

Algorithm of actions

recommends making changes to the electronic MTPL policy when contacting the office in person. In this case, an error is eliminated, the consultant provides complete information, checks all the data provided from the originals.

The algorithm of actions for replacing key information will be as follows:

- Filling out an application. Come to the insurance company (any nearest office), fill out the form and write down all the basic information regarding the correction. Some organizations allow amendments to already issued policies exclusively at central branches.

- Collection of documents. You need a passport and driver's license, basic data on the car and a power of attorney if a representative is acting.

- Adjustment. The operator will need a few minutes to enter new information into the RSA database based on the application submitted by the policyholder. In the policy, in the “special notes” section, a record is made of changes in information.

- Receipt of the finished document. After adjustment it can be used.

As practice shows, people apply to make changes to the electronic MTPL policy in different situations. The most common of them are changing the last name and adding another driver. An additional payment will be required if the discount on the RSA base used in the initial calculation is reduced or if the new person has up to 3 years of driving experience. In other cases, adjustments are made free of charge.

Rules for submitting an application

Regardless of the place where the appeal is submitted, in order to receive the correct answer as quickly as possible, you must follow certain rules.

All information indicated in applications and forms must be reliable, so when filling out it is better to take information from the original documents.

The main text of the appeal should describe in as much detail as possible all the circumstances of the incident, the actions taken to resolve it, and the responses of the insurance company. Information must be presented in chronological order.

It is better to confirm the stated facts with evidence. To do this, you need to save all documents received from the insurance company, including notifications of acceptance of applications, official responses and others.

There are no special rules for filling out an application; the document is drawn up in any form. However, you must always accurately indicate the name and details of the organization to which the application is being submitted, and also sign the application.

When contacting the Russian Union of Auto Insurers, you should use the form specially provided for this. For each application topic, PCA offers a separate template, so you can choose the most suitable one.

Responsibility for false information

At the legislative level, there is no fine or other sanctions for using insurance with outdated information, but provided that it is real and not issued by fraudsters. But insurers often deny such policies to persons injured in an accident, or reduce the discount for accident-free driving, for example, when the driver’s license plate is replaced, but there is no notification about it.

In some cases, difficulties arise with making changes to the car title agreement. For example, after receiving a new policy, a check reveals that there are no adjustments in the database. In this case, you must contact the central office of the insurer and report the incident. If employees refuse to investigate, then the client can protect his rights in court or by contacting the RSA and the Central Bank of the Russian Federation.

Advice! If it is not possible to contact the insurance company in the near future, then you should call the technical support service, which will tell you what to do and accept an application from the client.

Making adjustments to the e-MTPL policy is necessary if the basic information in the driver’s key documents has changed. Otherwise, there is a high risk of refusal to provide compensation in the event of an accident. Therefore, you should contact the operator immediately after receiving a new passport or moving to a new place of residence. The law does not establish a strict deadline for when this must be done, but delaying the process is not in the client’s interests, since no one can foresee the occurrence of an insured event. In this situation, the culprit will have to pay for the damage from his own budget.

If you can’t enter online - step-by-step instructions

When it is impossible to make changes to the insurance through the organization’s website, the policyholder needs to follow the following algorithm :

Step #1. We collect all the documents necessary to register changes. You can find out what papers you will need on the insurer’s website, or by consulting with an insurance agent by phone.

Step #2. We visit the office of the insurance company and hand over the prepared package of documentation to the employees.

Step #3. We fill out the application on the standard form. It is also possible to write an application at home, on a standard A-4 sheet or on a form printed from the insurer’s website.

Step #4. After reviewing the submitted documents to ensure they are complete and correctly filled out, an employee of the auto insurance company makes the necessary changes to the policy.

If the policyholder cannot personally come to the office of the insurance company, he can delegate the right to include the driver in the electronic OSAGO policy to his authorized representative . The policyholder's representative will have to present to the insurance agency employees a notarized power of attorney and his passport.

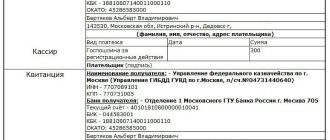

Application in writing, sample

Changes to the insurance policy are made only after receiving a corresponding application from the policyholder. Usually it is drawn up on a special form, which can be obtained at the agency’s office, or downloaded independently from the company’s website. It is also possible to write the application on a sheet of A-4 paper, observing the necessary structure.

The document being compiled must necessarily contain the following information.

Name of the insurance company to which the application is addressed, and full name. compiler. This data is indicated in the upper right corner of the sheet, in the so-called “header”.

The main text indicates the reason for the request. In this case, this is the need to add the driver to the OSAGO policy online. Here you need to provide the following information:

- FULL NAME. a person allowed to drive an insured vehicle.

- Series and number of his Russian passport. If a citizen of another country is allowed to drive, the details of the international passport or residence permit card are indicated.

- Driver's license number.

At the end of the text is a list of documents submitted along with the application. Sometimes it happens that employees of an insurance organization lose some of the accompanying papers, and it will be impossible to prove the fact of their submission without an inventory.

The date is indicated at the bottom of the sheet. The drawn up document is certified by the personal signature of the policyholder. Without this, the application has no legal force and will not be considered.

The document is drawn up in 2 copies, both of which are certified by the signatures of the policyholder and the agent, as well as the stamp of the insurance organization. One of them is given to an employee of the car insurance company, and the second copy remains with the applicant. If necessary, it will serve as confirmation of the request to make adjustments to the policy on such and such a date. After accepting the application, employees of the auto insurance company are given 3 days to review it, and 10 days to make changes to the policy.

If any incompleteness or errors are found in the submitted documents, the insurance agent is obliged to notify the client by phone or e-mail.

Providing the necessary documents

When submitting an application to add a driver to the E-MTPL policy, you must provide the insurance company employees with a set of supporting documentation . This list is established by the rules of compulsory car insurance and includes:

- Passport of the person for whom the policy is issued (insurer).

- When making changes by an official representative of the insurer, you will also need his passport and a notarized power of attorney to carry out these actions.

- An application with a request to include a person in the insurance, indicating the details of the new driver.

- Passport and driver's license of the citizen included in the policy. His personal presence is not at all necessary.

Expert opinion

Maria Skoraya

Insurance expert

OSAGO calculator

The agency usually does not accept photocopies. Copies of passports and IDs are made directly in the office, after checking the documents for authenticity. Despite the fact that the law allows 10 days to make changes to your insurance, in reality everything happens faster. The whole procedure takes one, less often two days.

The process may be delayed if unforeseen problems arise, for example, when incompleteness, errors and inaccuracies are identified in the submitted documents. As soon as all changes are made and registered in the unified RSA database, the policyholder receives an SMS or email notifying them of this. From this moment, the new driver included in the policy can begin driving the insured vehicle.

Additional payment for insurance

Simultaneously with the addition of a new driver to the insurance, the cost of the electronic policy is recalculated. This is due to the need to take into account possible risks and the likelihood of an insured event occurring due to the fault of a person newly included in the policy. When calculating these possible risks, the following factors are taken into account:

- Age and driving experience of the registered citizen. Coefficients that increase the cost of insurance are applied when the age of the new driver is less than 22 years old, and the license was obtained less than three years ago.

- Individual class KBM. For each accident-free year, the driver’s class in the bonus-malus system increases, and compulsory motor liability insurance costs him 5% less. For every road accident committed through his fault, the class of the vehicle insurance policy is reduced, and the policy is sold to such a careless driver at a higher price.

The ratio of increasing factors and the total cost of making changes are given in the table below.

| Age of the entered driver | Car driving experience | KBM coefficient | Cost (% of the base policy price) |

| Up to 22 years old | Less than 3 years | 1,8 | 80% |

| Up to 22 years old | Over 3 years | 1,6 | 60% |

| Over 22 years | Less than 3 years | 1,7 | 70% |

| Over 22 years | Over 3 years | 1 | 0% |

Receipt of a modified MTPL policy

The method for making changes to the policy depends on their nature. Minor changes to E-OSAGO are made by registering them in the unified information base of RSA. More serious adjustments require changes to the policy form itself. Such changes also include the inclusion of a new driver authorized to drive a vehicle in the electronic insurance. Additions in this situation are made in the “Special Notes” column in the printed addendum to the policy. Thus, the electronic policy is automatically transferred from digital to paper format.

The client can receive a modified policy in several ways :

- Pick it up yourself by visiting the office of the auto insurance company.

- Receive the document by registered mail.

- Order delivery by courier service.

Please note that sending registered letters and courier delivery are often not included in the list of free services of the insurance company. Therefore, you will have to pay for postage or courier delivery out of your own pocket.