Advantages and disadvantages of registration via the Internet

Before insuring a car online through the State Services portal, you need to evaluate the positive and negative aspects of remotely issuing an MTPL policy. Among the advantages are noted:

- the ability to receive services at any time, right from home, saving money on a trip to the office;

- guarantee of the reliability of the insurance company, because login through the personal account of the State Services is possible only on the websites of authorized participants of the RCA;

- selection of only those services that are necessary for the policyholder (no additional insurance products or imposition of programs);

- the ability to pay using a method from the list presented;

- saving time, since you do not need to visit the company’s representative office.

Despite the large number of good points, there are also negative aspects of the online procedure. These include:

- inability to obtain insurance for a car from the dealership (data about it is not available in the RSA database);

- possible errors during the registration process, which will lead to the invalidity of the policy if data is entered incorrectly;

- wasting time entering information if it turns out that there was a failure on the IC website;

- impossibility of applying the Europrotocol at the time of registration of an accident;

- the inability of traffic police officers to check in real time whether the policy is real or fake.

How to use electronic MTPL?

Electronic MTPL is used in the same way as a document received at the office of an insurance company on paper.

The citizen is required to:

- Immediately print out the insurance as soon as it arrives at the email address specified during registration.

- Place MTPL in your car or store it with your driver’s license.

The main thing is to always have the policy with you while driving.

If third parties are included in the insurance, they must also be given a printed copy.

- At the request of the traffic police inspector, present the electronic compulsory motor liability insurance.

Note: if the document is not presented, then traffic police officers may issue a fine of 500 rubles.

What should I show to the traffic police inspector?

Every vehicle owner must have a compulsory motor liability insurance policy with him while driving. If stopped by a traffic police inspector, the citizen will need to present a printed document.

Important: electronic MTPL has the same legal force, so there is no need to receive a document on the insurance company’s letterhead.

Subsequently, the inspector checks the presented insurance for authenticity. To do this, they make a request through the PCA database.

If a citizen does not have insurance with him, for example, the document was forgotten at home, then the driver is allowed to say:

- series and policy number;

- name of the insurer;

- validity period of the document.

Advice: it is better not to forget your compulsory motor liability insurance at home in order to avoid negative consequences, in particular, receiving a fine for driving without insurance.

Is it possible to obtain a policy through State Services?

Before purchasing car insurance through the State Services portal, you need to clarify whether this service is available. It is not included in the state list and is not available through this site. Despite this, registering in the system will help you obtain a policy. Before you apply for car insurance through State Services, you need to go to the online page of the selected insurance company. The citizen will be asked to log in to his personal State Services account, which will allow him to confirm his identity and get car insurance faster.

Main stages

To carry out MTPL insurance online through State Services, you need to follow the step-by-step instructions:

- You need to choose an insurer, familiarize yourself with the terms it offers, and go to its website.

- The system will prompt you to log in through the State Services portal. Then the citizen’s identity will be confirmed.

- Next you need to fill out an application form. It has a standard template. It contains data about the car, the owner of the vehicle, as well as drivers allowed to drive it.

- After entering the information, you need to wait. Your information will be checked within 5-10 minutes. The client is provided with a calculated amount that he needs to deposit.

- You must pay for the electronic policy. This is possible using the methods provided by the insurer.

- When payment is made, information about the policy is sent to a unified system and database of the traffic police. The policy is activated and sent to the client at the specified e-mail address.

Car insurance is issued not specifically through State Services, but on the electronic resource of the insurance company. But large organizations allow the user to log in to the portal, which simplifies the procedure.

Set of documents

To insure a car through State Services, you need to provide data from the documents. These include:

- civil passport of the person;

- a certificate confirming the registration of the car, or a vehicle passport;

- driver's license of the applicant and other persons who will be specified in the policy.

Who to contact

Car insurance through State Services is provided by various companies. It is important to choose the best option, checking that the organization is reliable.

Important! It is necessary to study the rating of insurance companies that provide services for issuing OSAGO and CASCO policies. Firms have different base rates, which affects the price of insurance.

The list of organizations is presented on the website of the Russian Union of Auto Insurers. The most popular and reliable ones include Alfastrakhovanie, Sogaz, Ingosstrakh, Reso Garantiya, Rosgosstrakh, Soglasie. They provide a guarantee of payments to their policyholders in the event of an emergency.

It is worth paying attention to several criteria:

- You need to choose organizations whose websites operate stably. If there is a failure when filling out the form, it is better not to continue. With periodic unstable operation, it can be assumed that the company is a fraudster.

- It's worth studying the rating. It is compiled based on the company's financial statements.

- Stable insurers have a large number of positive reviews from consumers. It is better to study third-party resources with feedback to exclude the fact of fraud.

- You need to pay attention to the terms and conditions of insurance. The cost of the policy and the criteria for the applicant may differ.

Entering data into the application

To insure a car through the insurance company website and State Services, you need to enter information in the submitted application form:

- car make and model;

- number of horsepower;

- year of car production;

- vehicle passport details;

- information from the state registration document;

- information from the diagnostic card;

- personal data, driver's license numbers of all drivers allowed to drive a car.

Is a digital signature required?

You can often hear information that electronic registration of compulsory motor liability insurance involves the use of a digital signature. But there is no need to use it.

Electronic digital signature is an expensive identification method. It is used in special situations.

It is not required when preparing OSAGO. It is enough to log into your personal account using your login/password. Identity verification is carried out via email.

Pros and cons of electronic MTPL

An electronic policy has not only many positive aspects, but also disadvantages that must be taken into account when applying for insurance.

The main advantages are:

- Quickly receive your policy by email.

- Possibility to print it at any time.

- You can submit an application for a document 24 hours a day.

- The application is simple to complete.

- It takes 3 to 5 minutes to check all the specified data.

- There is no need to personally visit the insurer's office.

- Experienced insurance agents will always answer any questions by phone.

- You can use a special calculator and calculate the cost of insurance.

The disadvantages of electronic policies include:

- The possibility of going to a scam site and losing the transferred funds, as well as being left with a fake document.

- Lack of complete information regarding all additional services.

- Difficulties in the event of traffic accidents.

Important: in case of a small accident, the owners of both cars will not be able to get by with drawing up a European protocol. Only a traffic police officer has the right to check the authenticity of the provided policy.

Any vehicle owner can receive an electronic MTPL. The main thing is to choose the right insurance company, enter all the necessary information in the application, and then transfer the specified funds.

Subsequently, the printed insurance should be used in the same way as a regular policy issued at the offices of the insurance company.

Blitz tips:

- be sure to call the insurance company if you encounter any difficulties or questions when applying for a policy;

- carefully enter all personal information when filling out the application;

- never transfer funds if the link provided for payment is not trustworthy;

- After receiving electronic insurance, immediately check its authenticity.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

How long does it take to prepare the policy and when can you pick it up?

The application is processed within a short period of time. Users usually spend up to half an hour on the procedure.

Important! But if the applicant does not have a personal account at State Services, then the waiting time may increase. This is due to the fact that all procedures are carried out using a verified account. It takes up to 15 calendar days to confirm your identity.

An electronic policy is issued immediately after registration. Within 15 minutes, the citizen will receive a completed document by email.

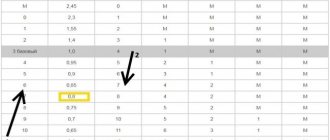

How much does the policy cost?

When visiting the portal, no additional payment is required. There is no state duty. A policy issued via the Internet will cost the same as a regular one.

You can determine the cost of insurance using the calculator on the insurance company website. After entering all the information, the system will reflect the cost.

You can pay for insurance using a payment instrument of any bank or wallet in electronic systems. When the payment goes through, the application is considered approved. The completed policy will be sent along with a memo and a receipt for payment by e-mail.

Possible problems

When registering online, there are some problematic issues:

- If an insurance policy is purchased for the first time. Owners of new cars face this. They will not be able to obtain insurance online. This is due to the fact that there is no information about the vehicle in the RSA database. In this case, you will need to personally visit the IC office and hand over a complete package of papers.

- A citizen may not have a personal account on the State Services portal. You will need to register and confirm your identity. This can be done through the MFC, official representatives, or receive a password by mail.

- There have been problems with the websites of insurance companies. You need to repeat the procedure after some time.

It is not possible to apply for compulsory motor liability insurance directly on the State Services portal. But with the help of a personal account, a citizen confirms his identity on the insurance company’s website.

What is an electronic MTPL policy?

Electronic MTPL (compulsory motor third party liability insurance) is a policy issued via the Internet and is an analogue of a paper document.

This insurance has a number of features:

- has the same legal force as a policy received in person at the office of the insurance company;

- To receive it, you need the same package of documents as for the paper version;

- simple application requirements;

- insurance is sent to your email immediately after successful transfer of funds to the insurer’s account.

Important: the only difference from the paper version is that the electronic document is not printed on a special form with a state sign.

Note: OSAGO is successfully issued in many insurance companies in the country, starting from July 1, 2015.

What does an electronic policy look like?

In appearance, electronic insurance is practically no different from the policy obtained at the company’s office.

This document displays:

- series and number;

- the name of the insurance company where the document was drawn up;

- validity;

- last name, first name and patronymic of the insured person;

The full name of the person who owns the vehicle is shown.

- Car model;

- its technical characteristics, in particular, identification number, state registration mark;

- vehicle passport;

The series and number indicated in the vehicle passport are registered.

- Full name of citizens who have the right to drive this car;

- cost and so on.

Important: depending on the insurer, the MTPL messages sent may be in color or black and white.