Providing property as collateral is the most common form of loan security (reducing the risk of overdue debt at the bank), so banks always try to encumber the borrower’s real estate or car. This is especially true in a situation where property is purchased with borrowed funds. After the loan is repaid, it is necessary to take certain actions in order to remove the encumbrance, so many people are concerned about the question of how to remove a car from collateral with a bank, because this does not happen automatically, and the encumbrance provides for certain restrictions on transactions with property.

Why remove the encumbrance?

Types of vehicle encumbrances

An encumbrance placed on a vehicle is a restriction on the rights of its owner, expressed in the inability to dispose of the vehicle, for example, rent it out or sell it.

Encumbrance can be expressed by the following types of restrictions:

- pledge. This encumbrance is applied to ensure the fulfillment of obligations under the loan issued by the borrower, as a result of which the citizen is deprived of the right to dispose of movable property until final settlement with the lender;

- arrest. This measure is used to ensure future claims of the creditor, to force the debtor to pay the debt, and sometimes to preserve property. The arrest may be imposed by a court, law enforcement agencies or bailiffs;

- car loan This is a type of pledge, the subject of which is a car. In this case, the vehicle purchased using credit funds remains at the disposal of the bank until the amount of the debt and the interest accrued on it are repaid, and in case of non-payment, it is transferred to the ownership of the creditor.

Credit card

Another quick way. If you urgently need money to pay off a credit debt and there is a threat of your car being seized, open a credit card with a large limit. Money is withdrawn from the account, after which the money is given to the bank for repayment, and the restriction on using the car is lifted. While the grace period for debt repayment is in effect, it is necessary to sell the vehicle quickly so that interest does not accrue.

The short deadlines within which payments are made do not force you to pay additional interest. It is not always possible to obtain a large limit on a card; in this case, several credit cards are issued, from which money is withdrawn at the same time, and then the money is deposited onto the cards at the same time.

The video discusses the details of removing the arrest from the car

Checking the car for restrictions

Today, in order to check a car for certain encumbrances, it is not necessary to visit the traffic police department; this can be done without leaving home.

It is enough to have access to the Internet, through which you can visit the official website of the department. In the vehicle verification section, you must enter the data requested by the search engine.

Remember! To do this, you will need certain information from the title and vehicle registration certificate. The official website of the State Traffic Safety Inspectorate provides information about the vehicle’s registration history, its participation in an accident, whether it is wanted and whether there are any restrictions imposed on the vehicle.

The electronic option for providing this type of service does not replace the possibility of personal contact with the State Traffic Inspectorate. To do this, you need to go to the traffic police department and submit a written request for information on the vehicle of interest.

In addition, you can get information about the car in other available ways:

- request on the FSSP website. To obtain information, you will need the details of the vehicle owner and his passport details. Based on the results of the inspection, the applicant receives information about the presence (absence) of encumbrances. The provision of information is free of charge;

- contact the Credit Bureau. The databases of such bureaus contain information not only about borrowers, but also about collateral, including vehicles pledged to lenders;

- visit a notary's office. All cars transferred as collateral are entered into a special state register, to which private notaries have access. Since notary services are paid, the applicant will have to pay a certain amount for providing information. The cost of providing information will vary depending on the region of residence of the applicant.

Reasons to remove the encumbrance

The most common reason why you should remove the collateral status from a car is the difficulty of selling it. Firstly, in accordance with the provisions of the loan agreement, as a rule, the bank prohibits any transactions with pledged property, so it will be almost impossible to sell, donate, or inherit, or the fact of pledge will have to be notified to the second party in the transaction. And who will agree to purchase an encumbered car? Most likely, no one, because these are additional risks that, moreover, are not independently controlled.

Secondly, if a car has a mortgaged status, its title is kept in the custody of the bank. In such a situation, in order to complete any transaction, you will have to draw up a duplicate document, and this is the first sign of a fraudulent scheme, which again leads to difficulties with the sale or to a significant reduction in price.

Thirdly, in accordance with the requirements of the financial organization, the beneficiary under the insurance contract for the pledged property is the bank. Consequently, even after repaying the entire loan amount, if the car gets into an accident, the financial institution will receive the funds. It, of course, will not keep them, but in order to get them at its disposal it will need to spend considerable time, perhaps even defending its rights and interests in the courts.

Additional Information. As such, there is no mandatory registration of a car pledge. The State Traffic Safety Inspectorate does not mark pawned vehicles in any way. There is a register of movable property maintained by notaries, but submitting information there is voluntary.

Since lenders do not have the obligation to inform specialized authorities about the receipt of property as collateral, there is no obligation to report the opposite fact. Therefore, the borrower often has to prepare a certain package of documents and independently remove the encumbrance in various instances in order to be able to exercise his property rights in full.

Registration of a vehicle as collateral

Collateral and car loan

These types of encumbrances are removed only subject to full settlement with the creditor. As soon as the borrower makes the final payment, he has the right to return the vehicle documents stored by the lender with a note that the encumbrance has been removed.

Usually this is the original vehicle passport.

When removing an encumbrance on a car loan or other loan issued on the security of a car, you must follow a certain procedure:

- pay off your debts in full;

- contact the State Traffic Inspectorate (sometimes the bank does this on its own after closing the loan);

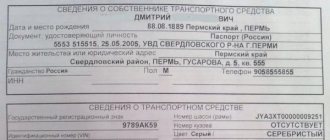

- provide a package of documents according to the list established by the department (usually a passport, a car mortgage, a title document, a certificate confirming the fulfillment of obligations to the creditor);

- Based on the results of the application, the former borrower is issued a corresponding notice of removal of the encumbrance. From this moment on, the owner of the vehicle has the right to dispose of the property at his own discretion.

Watch the video. What to do if a car is restricted:

Selling a car

Not all sellers of encumbered cars are scammers. Often the reason for the sale is the inability to repay the loan, so you have to get rid of the property. This does not always bring profit, since the car loses its original value every year. But if you need to sell a car and want to do everything right, then you should contact the bank. In most cases, banks agree to such transactions, since the main thing for them is that the loan is repaid.

There are several ways to sell a car with an encumbrance:

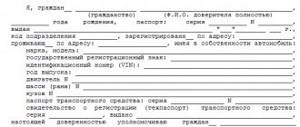

- Independent sale. In this case, the car owner finds a buyer and goes with him to the bank. The buyer must sign an agreement to repay the loan early.

- Sale by bank. This is possible if the loan amount to be repaid is equal to the market price of the car. The borrower must prove to the bank that he is no longer able to repay the debt. Then the bank begins to look for a buyer for the car. But this method has a drawback. If the proceeds from the sale are not enough, the borrower will still have to repay the loan from his personal savings.

- Auction. This method is quite popular when selling collateral vehicles. It is carried out by the borrower together with the bank by putting the car up at a special auction.

- Car showroom. There is a tendency for various car dealerships to purchase non-new cars. This happens as follows: the car is delivered to the car dealership with all the documents, and its price is determined there. Next, you should issue a power of attorney for the car dealership, and it will repay the loan. In this case, a tripartite agreement is concluded with the bank.

- Assignment of loan. This is the easiest way to sell a car. The buyer simply applies for a car loan by submitting the necessary documents to the bank.

Seized

A seizure placed on a vehicle can only be lifted by the authority that imposed it, except in cases where the actions of the official can be challenged in court. Ultimately, the possibility of lifting such a restriction directly depends on the basis for its application.

For example, if a seizure is imposed by a court as security for the plaintiff’s claims, only the court can remove it provided that the defendant fulfills the obligations assigned to him.

General procedure for removing an encumbrance in a bank

Removing an encumbrance on movable property at a bank takes place in different ways, taking into account the nuances: interest, delay time, problems with a mortgaged car, but there are two main stages:

- Repaying debt and obtaining relevant documents for this.

- The state body that carried out the registration and maintenance of the registry for the car removes the encumbrance.

The easiest way to remove the encumbrance is to contact the bank; you must have documents with you: loan agreement, passport details of the debtor, documents for the car that is pledged.

The state fee is paid upon receipt of a new certificate of ownership without a note of mortgage. The bank will meet the debtor halfway in case of financial difficulties and the impossibility of repaying the debt in the future.

If an encumbrance is placed on a car, be it by the courts, bailiffs or customs authorities, it is impossible to deregister it, undergo a technical inspection or re-register it.

The financial company gives permission to sell the car, provided that the transaction takes place with its participation to prevent fraud. Special cells are created where the buyer’s money is received; the second cell, after paying the debt, confiscates documents for transport.

This is beneficial for the borrower, since it will be possible to remove the encumbrance from the car naturally, and the price on the market for the car will be higher; part of the funds remains directly with the seller-owner. A vehicle seized for debt is urgently sold at a reduced price; these funds are not always enough to fully repay the debt.

If the car is wanted

It is worth immediately emphasizing that this type of restriction cannot be removed. However, you need to contact the State Traffic Inspectorate at least to verify the authenticity of the information.

It is possible that the vehicle was entered into the wanted database by mistake. In this case, the information will be corrected, and registration actions with the car will be allowed.

If it turns out that the car is really wanted, the car will be inspected, the information will be clarified, it will be seized and returned to the owner.

Signs of a car with an encumbrance

An inexperienced motorist is unlikely to be able to independently determine whether there is an encumbrance on the car. However, there are a number of signs indicating that the seller is hiding the true state of affairs:

- A duplicate of the registration certificate issued by the State Traffic Safety Inspectorate. It is easy to obtain based on the loss of the original and in some cases this is true. But the absence of a title should still alert a potential buyer.

- The seller purchased the car less than 3 years ago. This should also be of concern, since car loans are usually issued for exactly this period.

- If the PTS contains an entry about the purchase of a car under a commission agreement, this means that it was purchased on credit.

- A small price for a good car can be both a trick of scammers and a way for the owner to quickly get rid of a problem car.

- The seller does not have a purchase and sale agreement.

- The insurance policy states that the bank is the beneficiary. This directly points to a car loan.

How to check a car

Any buyer needs to check the car before the transaction is completed. In theory, you can contact banks, but it will take a very long time. It is generally accepted that you can check a car at the traffic police, but this is not entirely true. If you contact the traffic police, you can find out whether the car was stolen or that it is under arrest by the bailiffs. But it will not be possible to check availability in this way, since banks do not provide such information to the traffic police. Therefore, it is better to contact an expert organization that can quickly check the car and provide the necessary information. However, this method is associated with additional costs.

Legal

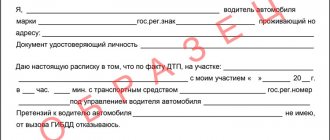

Even better if there is evidence of this. Even in their absence, if the seller does not warn that the car is secured, you should go to court.

What to ask? In the lawsuit, we ask that the pledge be terminated, and not that you be recognized as a bona fide purchaser. If the mortgagee does not encroach on your property - there is no corresponding claim, then you do not need to prove your good faith to the court.

By the ruling of the Tikhoretsky City Court dated August 19, 2014, VTB-24 CJSC was excluded from the number of defendants in the case; EOS LLC was brought in as the proper defendant, to which, in accordance with the assignment agreement of claims No. dated October 28, 2013, the right of claim was transferred debt under loan agreement No. dated August 05, 2011.

The bank took the car for debts, what should I do?

If you have money problems, you don’t need to deceive the lender and the buyer. In legal practice, there are often examples of the sale of credit cars by obtaining duplicate vehicle titles. Remember, this is illegal and entails criminal prosecution under Art. 159 (fraud).

When buying a credit car, people do not think about the consequences of a delay, which can occur at any time for reasons beyond their control. And that the relationship between creditor and debtor is regulated by Federal laws and the Civil Code, allowing financial organizations to take away property in the event of debt formation. The car is a highly liquid commodity and is classified as movable collateral. This provision of Art. 334 Civil Code of the Russian Federation. This means that the lender owns the car in full, even if the borrower makes regular monthly payments.

You may like => Find out the Address of the FSS Branch by Policyholder Number 7711

Today Sberbank provides quite attractive conditions for refinancing car loans. For example, the rate on a loan from Sberbank in exchange for a loan taken from another bank ranges from 17%. The minimum loan amount is RUB 45,000. in the Moscow bank of Sberbank and 15,000 rubles. in other regions. The maximum loan amount is 1 million rubles, and loan terms range from 3 to 60 months. The loan is issued without collateral or guarantors.

For people with low incomes, the issue of car credit may be especially relevant. For example, in the event of an unexpected need for funds, such borrowers do not have the opportunity to sell the mortgaged car until the loan is fully repaid. It is not always possible to find funds for its early repayment.

Application for termination of real estate pledge sample

Documents required to pay off a mortgage record An approximate list of documents submitted when paying off a mortgage record is as follows: Assistance in paying off a mortgage record A number of companies today offer assistance in paying off a mortgage record.

This mark must include words about the fulfillment of the obligation and the date of its execution, and must also be certified by the signature of the owner of the mortgage and certified by his seal (if there is a seal) (clause 3 of article 25 of the Mortgage Law). The mortgage registration entry is repaid within three working days (clause

How can I prove my bona fide status?

All in the same article. 302 of the Civil Code of the Russian Federation lists exceptions to the general rule of Art. 301 of the Civil Code of the Russian Federation on the reclaiming by the owner of property from someone else’s illegal possession. Thus, a vindication claim will not be satisfied if the following conditions are simultaneously met:

- the defendant acquired the claimed property for compensation from an unauthorized alienator;

- the claimed property, in turn, came to the unauthorized alienator at the will of the owner (that is, it initially left the owner’s possession at his will);

- At the time of acquisition of the property, the acquirer was in good faith.

In this part of the claim, one can also refer to Articles 3, 131,132, 137 of the Civil Procedure Code.

FULL NAME5 was the owner of the car and its ownership was documented. Accordingly, there is no doubt about the rights of gr.

The interested buyer will have to prove the circumstances of the case. To increase your chances of success, you should collect and submit a number of information:

- the buyer did not know and could not know that the seller does not have the legal authority to dispose of this vehicle and sell it;

- the buyer has previously carried out all possible procedures and performed all actions that would help identify the presence/absence of the possibility of selling the car from the defendant.

What restrictions arise due to the pledge?

The main purpose of establishing collateral for a credit car is to reduce the bank's risks in case of delay. If the borrower stops paying, the bank cannot automatically repossess the car. However, when selling the debtor's property, the pledgee has a priority right to receive proceeds from the sale.

The owner can use the pledged car without restrictions. But you can sell it or give it to another person only with the consent of the pledge holder. Naturally, the bank will most likely refuse to issue consent until the loan is fully repaid, since its risks will increase significantly.

Claim for termination of car pledge sample 2019

Info The representative of the defendant LLC "***" did not appear at the court hearing; he was duly notified of the time and place of the court hearing. The court, guided by Art. 167 of the Code of Civil Procedure of the Russian Federation, believes it is possible to consider the case at this appearance. The court, having examined the evidence presented in the case materials, comes to the following conclusion.

We recommend reading: If you understand your last name after marriage, what do you need when replacing your license?

As follows from the case materials and established at the court hearing, by the decision of the Khoroshevsky District Court of the city.

Moscow dated August 14, 2015 with S.A. Sitnikova. in favor of LLC "***" the debt was collected under agreement no.

in the amount of RUB 1,398,398.97, of which: loan debt (principal debt) – RUB 1,266,350.81; overdue interest debt - 132,039.16 rubles, car valuation costs in the amount of 3,500 rubles, expenses for paying state duty in the amount of 21,191.95 rubles, total 1,419,590 rubles.

92 kopecks

If the bank does not send a notification

An objective reason why a financial organization may not send a notification to a notary is its liquidation due to revocation of a license, bankruptcy, etc.

But even in this case, the pledgor can go to court. Based on a court decision, the car owner applies to a notary on his own. The latter checks all the details of the case, removes the deposit from the car and submits a corresponding notification to the traffic police and the Bailiff Service. Thus, regardless of who sends the notice of termination of the basis for the encumbrance, it is removed only by a notary.

If the reason for going to court was not the liquidation of a financial institution, but a deliberate evasion of obligations to terminate the pledge, the borrower may additionally apply for compensation for losses due to the presence of an encumbrance even after repaying the loan (for example, the failure of a car purchase and sale transaction due to the absence of an unreleased collateral).