Procedure for calculating transport tax

Owning a car obliges the owner to pay a fee called transport tax to the regional treasury. This rule applies to both legal entities and individuals.

When calculating the amount of transport duty, special tariff rates are used, which vary depending on the following indicators:

- Engine power;

- Duration of operation in the reporting period;

- Regional increasing/decreasing coefficients (if a local regulation has been adopted).

The norms of environmental law in force in the Russian Federation provoke tax legislation to provide increasing coefficients for owners of vehicles whose car has been in operation for more than 10 years.

A bill is currently under consideration that plans to increase the tax on cars older than 10 years. However, the first steps in the described direction have already been taken and the transport burden has increased for owners of expensive cars, the price of which is at least 3 million rubles. The calculation of the fee within the new legal framework is based on the following indicators:

- Age of the unit;

- Level of environmental friendliness.

The older and more expensive the vehicle, the greater the burden falls on the shoulders of the owner of the unit. For example, if the car is more than 25 years old, the tax for the use of such a unit will be focused on technical inspection data and compliance with environmental standards.

Payment of transport tax on old cars in 2021

In its modern form, the transport tax appeared in 2003. The fee is charged both to car owners and to water and air transport. The need to pay a fee is specified in Art. 356 of the Tax Code of the Russian Federation. Car owners often ask the question: “Do I need to pay transport tax on cars older than 25 years?” For the answer, we turn to the Tax Code of the Russian Federation.

The tax amount on cars under 10 years old remains unchanged except in situations where the cost of the vehicle is from 10 to 15 million rubles. In this case, the increasing coefficient will be equal to 3, which can be seen in the table above. The law defines categories of citizens whose cars are older than 10 years and are subject to a tax reduced by 2 times. These are pensioners, disabled people, WWII participants, large families, Chernobyl liquidators, combat veterans. But the availability and size of the benefits provided varies greatly from region to region. For up-to-date information on a specific area, you should contact the Federal Tax Service office at your place of residence.

And here is a quote about benefits: “To receive a benefit, you need to contact the tax office at your place of permanent residence (the place of registration of your vehicle does not matter). To do this, an application is sent to the inspectorate. It should indicate that you are entitled to a benefit (give on what basis) and indicate information on the car that will be benefited (its name, license plate number, etc.). The application must be accompanied by copies of all documents that confirm your right to benefits (for example, a combat veteran’s certificate). You have the right to take the application and all documents to the inspection in person or send it by mail (preferably registered with acknowledgment of receipt).”

We recommend reading: Workers' tariff rates for 2021

8. Republic of Ingushetia.

Citizens who own a car with a capacity of up to 90 hp are exempt from the tax. With. domestic production up to 1994 (inclusive) year of manufacture, as well as a car with a power of up to 220 hp. With. domestic production up to 1976 (inclusive) year of manufacture.

There are also more exotic options. For example, in Ingushetia, benefits are given for cars with a power of less than 90 hp, but only until 1994. In Irkutsk there is a 20 percent tax discount for cars up to 150 hp, and in Karachay-Cherkessia - up to 250 hp. In the Tambov region, there are generally separate low tax rates for pensioners depending on engine power.

Typically, the tax service itself calculates the amount of the duty, based on data about the owner, the engine power of the car and the period of its operation. You can check the tax amount yourself using a special calculator on the tax service website at www.nalog.ru (for Moscow). To get a calculation for a different region, you need to find this calculator by selecting a different region.

Peculiarities

- Using an old car worth 10 million rubles or more can increase the transport fee threefold;

- If the car is subject to re-equipment or modification, as a result of which the environmental damage caused by its operation may become less, then the traffic police at the place of registration of the vehicle should be notified in a timely manner about such manipulations;

- Payment of a fee by an individual for any vehicle, regardless of the year of manufacture of the unit, is carried out on the basis of a receipt generated by the fiscal authority, and the absence (non-receipt) of such a document does not relieve the obligation to the Federal Tax Service.

Tax on a car over 30 years old

Local legislators work very heterogeneously, and sometimes show excessive severity, imposing a transport tax on everyone and everything. The corresponding norms must be sought in regional regulatory documents, in particular, the “Law on Transport”, and they practically cannot be generalized.

The evaluation system will not be simple. Judging by the data published by the Kommersant newspaper, the machine will be checked for compliance with GOST by experts accredited by the sports federation. The originality of the parts and the level of restoration will be assessed. Moreover, they plan to award penalty points for each non-original part.

May 04, 2021 klasterlaw 169

Share this post

- Related Posts

- Child benefit for low-income families in 2021 in Udmurtia

- How many hours do you need to drive in driving school 2021

- What date does discounted train travel for pensioners in St. Petersburg begin?

- EPD Moscow Clarification

Odds sizes

The majority of vehicles traveling on Russian roads have been in operation for decades, which is why the use of an increasing coefficient promises significant increases in the volume of regional budgets.

The new transport taxation provides for an increase in the tax rate not only for old, but also for new cars, in particular (only expensive vehicles become objects of the conditional tax rate):

- By 0.5 - if the car has been in use for 1 to 3 years;

- At 1.75 – operation from 5 to 10 years;

- 2 times – the car has been used for at least 10 and no more than 15 years;

- 3 times - the car is more than 15 years old.

Do not forget that the final amount of the duty will be influenced not only by the year of manufacture, but also by the engine power, so vehicles put into operation in the same period, but with different units of engine power, will be assessed by tax officials in different equivalents.

Understanding car taxes

If the vehicle is registered in the middle of the year, you need to use a more detailed formula: multiply the rate by the engine power and the number of months of ownership remaining until the end of the year, divided by the total number of months in the year. If the same 123-horsepower Rio was purchased in May, the tax for the past year will be: 123 * 25 * 8/12 = 2050 rubles.

Russia is still far from the United States with its manic attitude towards taxes, but non-payment of car taxes will not go unpunished for long either. If the required amount does not appear in the accounts of the Federal Tax Service by December 1, then first a penalty will be charged for each calendar day of delay. The formula for calculating the penalty is as follows: the tax amount is multiplied by 1/300 of the refinancing rate of the Central Bank of the Russian Federation (today it is 7.25%) and by the number of days of delay.

Check the notification. The amount of transport tax payable is indicated in the tax notice. If there is a personal account, it will only be sent there. If you do not have a personal account, the notification will be sent by mail. One month before the payment deadline, everyone must receive documents with charges and details.

The tax notice is sent to the taxpayer by mail or through a personal account on the website nalog.ru. You just need to pay the amount indicated there, and you don’t have to count anything. But this applies only to individuals: the company calculates the transport tax itself, pays it more often than once a year, and also submits a declaration.

In Crimea, the year of manufacture affects not only the auto tax for cars and trucks, but also for buses, motorcycles, snowmobiles and other vehicles. As a rule, here the tax on a new car (less than 10 years have passed since its release) is 2 times higher than on an old one (more than 20 years). Thus, the tax on a new passenger car (with a power of more than 250 hp) is calculated at a rate of 50 rubles. for each horsepower, and for the old one - only 25 rubles.

We recommend reading: Payments upon Dismissal for Military Personnel 2021

Despite the fact that a tax on old cars has not been introduced in Russia, in some regions of the country the size of the vehicle tax depends on the year the car was manufactured. This happens for the reason that the Tax Code allows the constituent entities of the Russian Federation to differentiate rates depending on the age of the vehicle.

Payment of TN by individuals and legal entities

According to the regulations of tax legislation, car owners who are individuals pay the fee based on a receipt generated by the fiscal authority. This category of taxpayers is exempt from the need to independently calculate the costs of the transportation burden and reflect it in the declaration.

Representatives of the tax service send to the taxpayer (no later than 1 month in advance) a receipt reflecting:

- The amount of the fee;

- Recipient details;

- Tariffs applied in calculation;

- Technical characteristics of the unit.

If the taxpayer has an authorized account on the official website of the Federal Tax Service, he will be notified of the timing and amount of the tax at least 90 days in advance.

Owning a car that has been in use for at least 10 years does not in any way affect the procedure for notifying the owner of upcoming costs for the specified movable property.

Legal entities, unlike individuals, are required to independently calculate the amount of the transport fee and reflect the resulting data in a special report (declaration).

Is transport tax paid if the car is more than 25 years old?

Transport tax is a state duty on all serviceable and used vehicles without exception. It is collected from individuals and legal entities who are officially their owners.

The final amount of accrued transport tax is determined not only by the legislative acts of the subject in which the vehicle is registered, but also by a set of factors such as its cost, power, and the age of the car, which is key for this article.

The older the car, the higher the vehicle tax rate.

You can determine what kind of transport tax on cars over 25 years old if you familiarize yourself with the regulations of your region.

Tax amount for cars over 25 years old

The age of the car is one of the parameters that determine the amount of transport tax. It is this that can lead to the emergence of the most serious increasing coefficients.

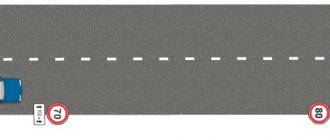

When undergoing technical inspection, old cars always undergo tests for environmental standards, which can also cause an increase in transport fees.

More on AutoLex.Net:

Luxury tax on cars in 2021, any changes?

In some cases, owners replace the engine or other components to get within the normal range. If you have carried out such manipulations, you should definitely contact the traffic police and receive the appropriate mark.

The tax office will be able to tell you exactly whether transport tax is paid if the car is more than 25 years old.

Influence of factors on transport tax

It happens that in one region payments for TN are not provided at all, but in a neighboring region the owner of a similar car will have to pay an extremely high fee. Therefore, to the question: “Is a car with a production date more than 25 years subject to transport tax?” It’s impossible to give a definitive answer. The geography of vehicle registration plays a decisive role.

Example. In the Voronezh region, old passenger cars with a production date of 25 years or more and a power of up to 100 hp. are not taxed. An extremely low tax rate has been introduced in the Altai Republic - 5 rubles per 1 hp. The size of the transport tax in Nizhny Novgorod is strikingly different, where the rate is recognized as the maximum: 25 rubles per 1 hp. In the Moscow region there are no benefits for old cars and transport tax is calculated according to general rules.

Where TN is valid, the age of the car is important for calculating the payment, since it can increase the multiplying factor. During the technical inspection process, an old car is tested for compliance with environmental standards.

IMPORTANT! Sometimes car owners change the engine and other spare parts in order to comply with the specified standards. However, after such changes are made, it is necessary to visit the traffic police department and make a corresponding entry in the PTS.