Customs clearance of an electric vehicle without paying duties

It is noteworthy that the Verkhovna Rada considered various bills on this topic. In particular, one of the options was Draft Law number 5494, declaring the large-scale development of the electric vehicle market in Ukraine, and dated back to December 1, already far away in 2021. This bill dealt with complete tax exemption during customs clearance of an electric vehicle in Ukraine.

However, it was not he who influenced the deputies, but draft 6776-D, on the country’s budget. It was this bill that became a full-fledged current law No. 2245 on December 7, 2017. Its essence is the exemption of the import of electric vehicles from all countries from remaining customs taxes, including excise duty and VAT.

It is noteworthy that this amendment is valid until December 31, 2018. Therefore, if you have a desire to buy and clear customs electric cars in Ukraine, then now is the most favorable time for this. The Ukrainian government rarely pleases the population with such pleasant bonuses and almost unique promotions, so you have less than a year to realize your dream of buying and clearing an electric car. Don't miss the chance.

How much does customs clearance of an electric car cost in the Russian Federation?

And so, in order to clear an electric car through customs, you will need to make the following payments:

- Customs clearance

- Customs duty

- UST or VAT (depending on who imports the electric car - an individual or a legal entity)

- Excise tax (paid if a legal entity clears customs; power up to 90 hp inclusive is not subject to excise taxes)

- Recycling collection

The cost of customs clearance of an electric car

| The price of the car does not exceed, rub. | Registration price, rub. |

| 200 thousand | 500 |

| 450 thousand | 1 000 |

| 1.2 million | 2 000 |

| 2.5 million | 5 500 |

| 5 million | 7 500 |

| 10 million | 20 000 |

| 30 million | 50 000 |

| More than 30 million | 100 000 |

Customs duty

The customs duty on passenger cars with an electric engine from September 1, 2021 to the current moment is 17%. For trucks with an electric motor, the customs duty is 15% of the value of the vehicle.

However, at the meeting of the EEC Board held on February 18, 2021, the draft decision of the EEC Council on establishing a zero rate of import customs duty of the EAEU Unified Customs Tariff for electric vehicles until the end of 2021 was supported. If it is approved, then customs clearance of electric vehicles in Russia and the EAEU will take place at a 0% rate.

Customs duty rate: either a single customs rate (UTR), or VAT + excise tax

| Electric vehicle import standards | Tax rate as a percentage of the price of an electric vehicle |

| Electric car (up to 3 years), priced no more than 8,500 euros, imported by an individual | Flat rate 54% |

| Electric car (up to 3 years), costing more than 8,500 euros, imported by an individual | Flat rate 48% |

| In other cases | VAT 20% + excise tax (see table excise tax rate) |

Excise tax rate for importing an electric car to Russia

Excise tax rate for the import of electric vehicles into the Russian Federation.

| Type of vehicle | Excise tax rate |

| Passenger cars with power up to 90 hp. With. (67.5 kW) inclusive | 0 rubles per 1 liter. With. (0.75 kW) |

| Passenger cars with power from 90 hp. With. (67.5 kW) up to 150 l. With. (112.5 kW) inclusive | 37 rubles for 1 liter. With. (0.75 kW) |

| Passenger cars with power over 150 hp. With. (112.5 kW), motorcycles with power over 150 hp. With. (112.5 kW) | 365 rubles per 1 liter. With. (0.75 kW) |

Recycling fee for electric vehicles

We calculate using the formula: US = BS*RK , where BS is the base rate (currently 20 thousand rubles); RK – calculated coefficient

Estimated recycling rate for an electric vehicle

| New | Over 3 years old | |

| Individual | 0,1 | 0,15 |

| Entity | 0,86 | 5,3 |

Read more in the article “How and who pays the recycling fee for a car?”

How to clear customs of an electric car in Ukraine 2021 with Sea Way

Our company’s specialists are ready to provide a full range of services to implement your plans. Full consultation and support of the process, starting from the purchase and delivery of an electric vehicle, ending with its customs clearance in Ukraine this year. Finding and viewing Law No. 2245 on the World Wide Web on your own is not difficult. However, use only official publications, including the Verkhovna Rada newspaper and the official government website. There is no need to carefully study the entire document. Those who are interested in purchasing and customs clearance of electric vehicles in Ukraine will need to find only seven lines. For convenience, we present them below.

The authorship of the draft law belongs to a group of deputies led by People's Deputy Howard Robert. It is noteworthy that he was the co-author of Law 3251, which made it possible to reduce the excise tax on used cars. This decision had a serious and positive impact on customs clearance of cars in Ukraine.

Today, thanks to the work of the deputy and his team, motorists in our country can buy and clear customs cars from Europe and the USA inexpensively, which allows them to save money when compared, for example, with buying a Ukrainian car.

How to clear customs of an electric car in Russia

More and more often in Russia you can see electric car models. But, since they are not made in Russia, they have to be imported from abroad. What are the rules for customs clearance of electric vehicles?

Concept

Customs clearance is the legalization of a vehicle that was imported into Russia from abroad. It implies a customs clearance procedure in accordance with the current Russian customs legislation.

Regardless of the purpose for which the electric car will be used in Russia, its owner is required to undergo the “customs clearance” procedure.

In order for the driver to have a guarantee that the vehicle will not remain in storage at customs, he must pay a customs deposit in advance. You need to go through the customs clearance procedure within one day after the car crossed the Russian border.

The “customs clearance” procedure begins with the payment of a mandatory fee.

Its value depends on who imports the vehicle into Russia:

- if this is a legal entity, then it is obliged to pay a total customs payment, which includes:

- customs duty;

- VAT;

- excise tax

- if this is an individual, then he must pay a customs fee, the amount of which is calculated using a special formula.

An electric car is a vehicle powered by an environmentally friendly engine. The method of operation is from an environmentally friendly autonomous battery that does not emit harmful substances into the environment.

Legislation

Since we are talking specifically about the customs control procedure, you need to be guided by the norms of the Federal Law of November 27, 2010 No. 311-FZ “On customs regulation in the Russian Federation” . The mandatory customs clearance fee is paid in accordance with Chapter 25.3 of the Tax Code of the Russian Federation .

Citizens and legal entities bear responsibility for violation of the rules of the customs clearance procedure in accordance with the Customs Code. If it does not specify a specific offense, then you need to contact the Code of Administrative Offenses of the Russian Federation.

The Council of the Eurasian Economic Commission decided to make a number of amendments to the legislation on the registration of imported electric vehicles. This organization also includes Russia. Three years ago, the rate on passenger electric cars was 17% , and recently it dropped to O.

Transportation Features

In order for an electric vehicle to pass the customs clearance procedure, it must be delivered to the border with Russia.

Depending on the country in which the seller of this car is located, it can be delivered:

- by plane;

- water transport;

- by road transport - trucks.

In this regard, as well as with the introduction of duty-free customs services, such electric cars began to appear more and more often on Russian roads.

Decor

Due to the fact that the legislation on the operation of electric vehicles in Russia has become somewhat more flexible, it has become somewhat easier to register its ownership in Russia.

But, you need to go through the following steps:

- make a deposit of the required amount;

- cross the border with the Russian Federation;

- register a car;

- pay all necessary payments;

- complete the procedure.

Pledge

A few days before the date of expected import of the car, the driver must pay a certain amount as a deposit. This amount guarantees that the electric car will not remain in the warehouses of the customs service forever.

You need to deposit an amount approximately equal to the cost of customs clearance.

If the approximate calculation exceeds the amount actually paid, the difference will be returned to the driver or future owner. You can deposit the amount when crossing the border towards the country where you will buy the car.

Crossing the checkpoint

When a driver with a car arrives at the border with the Russian Federation, he is assigned an individual number, given a notification, as well as a pass to enter the customs control zone.

The driver of an electric vehicle must have the following documents with him:

- Russian and foreign passports of the person who is driving and who is responsible for importing the car into the territory of the Russian Federation;

- vehicle registration certificate in a foreign language;

- documents confirming the driver’s right to import the car into the territory of the Russian Federation. These include:

- transit declaration;

- a statement containing a request for registration of a car. The amount deposited in advance into the deposit account must also be indicated here;

- a receipt indicating that the deposit was made;

- notification that the electric vehicle has arrived at the temporary storage warehouse;

- auto expert's conclusion, which indicates all technical characteristics of the vehicle;

- declaration TD-6 .

It is filled out in cases where the owner is driving the imported motorcycle. It confirms that the vehicle should be considered as accompanied baggage; An example declaration can be downloaded here.

- invoice (for a new vehicle) or bill of sale (for a used car);

- insurance (MTPL policy), issued in accordance with Russian laws.

Registration

After all documents have been verified and all payments have been made, the electric car must be properly registered. For this purpose, it is assigned a unique code in accordance with the Commodity Nomenclature of Foreign Economic Activity. All goods that can be imported into Russia from abroad have this code.

The customs officers will calculate the entire amount that must be paid when passing through customs.

To do this, they will take the exact cost of the imported electric vehicle and the year of its manufacture. You can't cheat; all this data is in the accompanying documents.

Customs payments

To clear customs you must pay:

- customs clearance fee. Its amount depends on the cost of the imported electric vehicle; For example, if its price does not exceed 200 thousand rubles , then you only need to pay 500 rubles . And so on increasingly. The more expensive the vehicle, the more the buyer will pay. To accurately calculate the duty, you can use the online calculator on the official website of the Federal Customs Service.

- customs duty. For imported electric vehicles it is equal to O; But if the car has a hybrid engine, then the duty is paid in full.

- recycling fee; It is paid by both enterprises and citizens. It is a kind of guarantee that the electric car will be used correctly and disposed of on time. Without harm to the environment, this type of transport can be used for no more than 20 years .

- VAT;

- excise tax Its price depends on the cost of the electric car.

Completing the procedure

When the verification of documents is completed, customs officials transfer the amount set aside for deposit to a special account of the customs service.

If the amount on deposit is greater than what the customs officers calculated, then the “change” will be returned to the payer.

The applicant must receive:

- payment receipt;

- customs receipt order;

- electric vehicle passport. Electronic passports will soon be issued.

These documents will need to be presented when receiving the electric car from the temporary storage warehouse and for subsequent execution of the corresponding act.

Based on these same papers, the owner of the car must register it with the State Traffic Safety Inspectorate, in accordance with Russian laws.

How much does customs clearance of an electric car cost in Russia?

To put a deposit amount as a deposit, you need to know the cost of customs clearance of an electric car. To do this, you need to know the amounts that are included in the mandatory payment.

Duty

To stimulate the import of electric vehicles from abroad, duties were reduced, or rather abolished altogether. But only for electric passenger cars.

Previously the rate was 17% . But for electric freight vehicles there was a noticeable reduction in rates - from 15% to 5%.

Tax rate

In order to understand how much you need to pay for the import of a particular electric vehicle, you need to know its exact “age.” It is listed in the documents.

The relationship between the year of issue and the amount of tax is presented in the table below:

| Import parameters | Amount of tax, % of cost |

| - age less than 3 years ; - cost less than 8.5 thousand euros ; - subject of the transaction - individuals | 54% |

| - age less than 3 years ; - cost above 8.5 thousand euros ; - subject of the transaction - individual | 48% |

| - in other cases | VAT 18% + excise tax |

Excise tax rate

The amount of excise tax depends on the power of the imported electric car.

Only legal entities pay it; this obligation does not apply to citizens.

The ratio of the excise tax rate and the power of an electric car is shown in the table below:

| Import parameter | Excise tax rate |

| — passenger car—power up to 90 hp. | 0 rubles for each hp |

| - passenger car - power from 90 to 150 hp. | 37 rubles for each hp. |

| — passenger car; — power above 150 hp. | 365 rubles for each horsepower |

Recycling collection

This payment is calculated using a special formula:

CS = BS * RK, where CS is the recycling fee, BS is the base rate;

RK – calculated coefficient.

Source: https://prokolesa24.ru/rastamozhka-jelektromobilja/

The real benefits of an electric car in numbers

Taking into account statistical data, it has been established that a car travels on average about 30 thousand kilometers per year. Average fuel consumption per hundred kilometers is 10 liters. Thus, each car owner spends more than 70 thousand hryvnia per year on fuel when using a vehicle with an internal combustion engine. These are financial flows that are directly washed out of the country.

Regarding the electric car, it can be noted that the cost of “refueling” will be from 3 to 4 thousand hryvnia per year. The calculation takes into account the average consumption of an electric vehicle of 10 kW per 100 km and the cost of a kilowatt of 1.29 UAH. This in itself is promising and relevant, and after the adoption of Law 2245, regarding electric vehicles, even more in demand help appeared both for the energy independence of our country and for reducing the burden on the environment, as well as a qualitative change in the entire transport system of the country.

Caring for the environment is the main direction of development of modern society. Most highly developed countries are planning to abandon cars running on gasoline or diesel in favor of innovative electric vehicles. Many programs have been developed to encourage the transition to environmentally friendly cars.

Customs clearance of electric vehicles in Ukraine is one of the services of our company.

Comparison of customs clearance of electric vehicles in the Russian Federation with the countries of Ukraine, Belarus and Kazakhstan

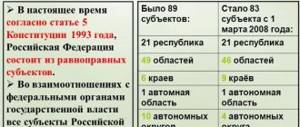

| RF | Ukraine | Belarus | Kazakhstan | ||

| Customs duty | |||||

| Import duty on electric vehicles abolished (0%) | |||||

| Tax rate for customs clearance of an electric vehicle | |||||

| Electric car (up to 3 years), the cost of which is 8500 euros maximum | 54% | ||||

| Electric car (up to 3 years), the cost of which is above 8500 euros | 48% | ||||

| In other cases | VAT 18% + excise tax | VAT 20% + excise tax | VAT 20% + excise tax | VAT 12% + excise tax | |

Ukraine

In 2015, the President of Ukraine signed the Law “On approval of amendments to “On Customs Tariffs of Ukraine” on import duties on electric vehicles.” The law came into force on January 1, 2021.

This document states that a 0% import duty rate has been established for the import of an electric vehicle (previously it was 8%) and the excise tax has been abolished (previously it was 109,129 euros for 1 car).

However, when clearing an electric vehicle through customs, car owners must still pay VAT in Ukraine in the amount of 20% of the customs price of the car.

Belarus

Until September 1, 2021, the customs clearance duty for an electric vehicle has been reset to zero, however, the VAT rate remains in effect.

For individuals, the tax on customs clearance of an electric vehicle up to 3 years from the date of manufacture in Belarus is 54% of the customs price of the car, and for cars with a period of 3 years or more - 20%.

If an electric car costs more than 8,500 euros, then the car owner pays 48% of the customs price of the car.

For legal entities, the payment amount is different - 20% of the customs price of the car. This does not depend on the year of manufacture. Legal entities also pay a disposal fee of 851.4 Belarusian rubles. for an electric vehicle less than 3 years old and 5,247 Belarusian rubles. for cars older than 3 years.

What are the advantages of electric cars?

- The main advantage is environmental friendliness, something for which the whole world values such cars. The machine does not produce hazardous emissions into the atmosphere.

- Savings: using gasoline consumes thousands per year, and powering an electric car is several times cheaper. For a 100 km distance, the car consumes about 10 kW.

- Fuel independence: By abandoning gasoline and diesel, we become energy independent of expensive resources.

- Wide choice: the range of electric car offers on the market is growing, the buyer is not limited to several models. The most famous electric cars are Tesla, but Ford and Nissan brands have already presented their samples.

Subtleties of customs clearance

Customs clearance of an electric car in Odessa provides advantages, since the legislative system is aimed at popularizing environmentally friendly transport. According to the resolution of the Verkhovna Rada, by the end of 2018 it was possible to carry out the procedure as economically as possible - without duty, VAT and excise tax. But this resolution is not the only one and not the first in the history of popularization of electric cars in the country.

In 2021, a document appeared according to which persons who cleared an electric car through customs in Ukraine were exempt from paying taxes.

Customs clearance of electric vehicles in 2021 has its own characteristics - our company will help you understand the intricacies without making mistakes. By using our services, you do not have to delve into the legal intricacies yourself - this will save time.

Customs payments

From May 4, 2021 to December 31, 2021, by decision of the Council of the EEC (Eurasian Economic Commission), customs duties on the import of electric vehicles for individuals and legal entities were zeroed out in the EAEU countries (Russia, Belarus, Kazakhstan, Kyrgyzstan, Armenia). We are talking about the category “certain types of motor vehicles with electric engines” (item 8703 80 000 2 CN FEA of the EAEU).

The amount payable for the import of an electric vehicle into Russia and its customs clearance consists of several types of mandatory contributions:

- A processing fee, the size of which is a fixed amount and directly depends on the cost of the imported vehicle.

- Customs duty (CANCELED UNTIL 12/31/2021) The car owner must also pay:

- VAT, which in 2021 is 20%;

- excise tax based on the power of the installed electric motor.

- A single tax provided only for individuals wishing to clear customs an electric car, the date of which no more than 3 years have passed since its release. If the price of the car is less than 8,500 euros, then the rate is set at 54%, if more, then 48%. Upon payment, the owner is exempt from customs duties.

- Recycling fee provided for all categories of vehicles. The amount varies depending on the purpose of the electric car (commercial or not), as well as the legal status of the purchaser (individual or legal entity).

To avoid any difficulties with customs clearance of an electric vehicle in Russia, you need to take seriously all the nuances present at each stage of this procedure.

Buying a car abroad: saving

It’s no secret that buying an electric car in the USA is much cheaper than in Ukraine. A used car undergoes customs clearance, documents are drawn up for it, after which the buyer can safely use the car.

All procedures in Ukraine will be handled by an experienced customs broker who will carry out the clearance process quickly and without problems. The tax rate for an electric car is 1 euro per 1000 W of battery capacity. There are no restrictions on the number of cars per year.

To get complete information from a professional, call our hotline number today.

European and American electric vehicle market

When thinking about buying and clearing an electric car, pay attention to:

- Tesla;

- Ford Electric;

- Nissan Leaf.

These electric cars are best purchased in the States. However, pay attention to the fact that American lighting standards are different from European ones. There are also a lot of decent options on the European market, especially since shipping an electric car from Europe is cheaper.

You can calculate the cost of customs clearance of a car, and Sea Way customs brokers will provide assistance in all processes, from selection and purchase to customs clearance and certification of an electric vehicle in Ukraine. For more complete information, call our consultants and enjoy the quality of electric vehicle customs clearance services.