How long can you drive with expired insurance according to the law and is it even possible?

First you need to consider how long the MTPL insurance is valid. The standard policy is valid for a year. The law identifies groups of cars for which this period may be revised:

- A car registered in another state and staying in the Russian Federation temporarily. In this case, the driver can take out insurance for a period of 5-15 days.

- A foreign car passing through the Russian Federation to another country or going for a technical inspection. Regardless of the transit period, for such situations there is compulsory motor liability insurance for 20 days.

- A car that will be permanently registered with the traffic police.

The last group includes all cars registered in the Russian Federation. The insurance period for them ranges from 3 to 12 months. In most cases, the most profitable option is to take out a policy for a year. But there are drivers who use the car only for a specific period, including:

- Persons going on long business trips, seasonal work, vacations, and so on.

- Car owners who use the vehicle only in summer, winter, and so on. Often these are people who have several cars at their disposal.

- Drivers planning to sell their car in the near future.

When purchasing insurance, the driver must note the period of use during which he plans to use the car.

Can a driver drive with expired insurance? Previously, after the expiration of the compulsory motor insurance policy, motorists received another 30 days to issue a new policy. But today this law has been repealed, so the insurance period after expiration is 0 days. In view of this, it is recommended to take care of renewing the policy one day before its expiration.

If there is no policy at all, for example, when buying a new car, the law allows 10 days for its registration. During this period, the traffic police does not have the right to issue a fine for the lack of a policy, however, in the event of an accident that occurs due to the fault of the car owner, only he will be held responsible .

Effect of compulsory motor liability insurance after the expiration of the term

You should think about renewing your policy at least a couple of days before the expiration of your car insurance contract. Otherwise, according to the new standards, the driver may be fined for violating the law on compulsory motor liability insurance. In a situation with an accident, the culprit will pay for the repair of the damaged car at his own expense.

In 2021, the validity period of compulsory motor liability insurance after its expiration is considered zero. After the end of the insurance period specified in the contract, the policy will no longer be valid. Traffic police officers now perceive expired insurance as missing. If an inspector stops a car on the road for violating the speed limit and discovers that the driver sitting behind the wheel has an invalid policy (or the absence of this document), then the license plates will not be removed and the car will not be sent to a impound lot, but you will have to pay a fine. According to Article 12.37 of Part 2 of the Code of Administrative Offenses of the Russian Federation, the amount of penalties will be up to 800 rubles.

When compulsory motor liability insurance has ceased to be valid and a new document is in the process of being produced, the fine in case of inspection will be 500 rubles. It is better to pay it on the spot, and then it is not advisable to drive the car until you receive a new policy.

You must begin purchasing or renewing your MTPL immediately as soon as the contract expires.

Is there a penalty for expired insurance?

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

What else to read:

- My car was scratched in the yard, what should I do?

- Europrotocol 2021

- How to get money instead of repairs under compulsory motor liability insurance: a detailed review

+7 (495) 980-97-90(ext.589) Moscow,

Moscow region

+8 (812) 449-45-96(ext.928) St. Petersburg,

Leningrad region

+8 (800) 700-99-56 (ext. 590) Regions

(free call for all regions of Russia)

According to the law, driving with an expired policy is equivalent to driving without it at all, so the driver is subject to liability. This violation is regulated by Part 2 of Article 1237 of the Code. In accordance with this regulatory act, a fine of 800 rubles is expected for driving with expired insurance.

Another question is whether a fine is due if the diagnostic card is expired. In this case, traffic police officers cannot collect fines, since the most important thing is to have valid insurance. However, in the event of an emergency, an overdue technical inspection may result in a refusal to pay. The insurer requests this document to ensure that the car is in good working order.

Therefore, if you have a policy and do not have a technical inspection form, a refusal to pay compensation is possible, regardless of whether the car owner is the culprit or the victim.

In this case, he will have to compensate for the costs himself. To prevent this, it is recommended to undergo a timely inspection, the price of which is unlikely to be more than 1000 rubles.

Features of contract renewal

Extension is the key to the driver’s smooth movement in a car within the country. Therefore, many vehicle owners seek to extend their compulsory motor liability insurance in advance. Legislative norms on the renewal of public contracts stipulate that the owner of a car can contact the insurance company regarding the renewal of insurance no earlier than 30 days before the expiration of the policy. You can find out more about how many days before the end of your insurance you can get a new one, as well as the timing of the procedure, here.

The new policy cost will be recalculated based on cost calculation coefficients that may have changed over the past year (or other period specified in the document). It is not necessary to contact the same insurance company - the insurer can be changed at the request of the driver.

Important! Before renewing your policy, you must undergo vehicle maintenance for compulsory motor liability insurance.

The following documents will be required:

- passport;

- driver's license;

- car passport;

- diagnostic card;

- previous policy.

If the insurer changes, you will need to additionally sign an application for concluding an insurance contract. The form will be provided by the company; the driver will only need to enter the correct data on it. If the owner of the vehicle cannot be present during the renewal, you will need a power of attorney with a list of powers of the authorized person.

The MTPL policy can also be renewed online. We talked about how to do this in a separate article.

Is it possible to tow a car with an expired MTPL?

If the insurance policy is expired and the driver needs to tow the car from one place to another, it will be a violation under the law. In this case, the optimal solution is to extend the insurance for a minimum period. This will make it possible to comply with the law, receive compensation if you are involved in an accident, and have confidence in the process of driving on the roads.

Another option in this case is to use the services of a tow truck. This solution will be appropriate if you need to move the car over a short distance.

Is it possible to save money on an MTPL policy?

According to the rules of OSAGO, you can pay for insurance in installments. In this case, payment is made in stages. The driver must pay a fee for the first 3 months with a percentage of 0.5 of the annual payment. Extension of the policy for another quarter is already taking place according to a coefficient of 0.2 of the annual insurance. The additional payment for the remaining months will be calculated at 0.3 of the annual payment. The policy renewal must be made in a timely manner, otherwise the driver will face an impressive fine and an increase in the term coefficient.

Is the KBM reset if the OSAGO renewal is overdue?

Today, to calculate the price of an insurance policy, the bonus-malus coefficient (BMC) is used, which can increase or decrease the cost of insurance depending on what the accident rate was in past periods. When determining the class, information on insurance policies that expired no more than one year before the start date of the insurance period under MTPL is taken into account. Therefore, if the policy is overdue for up to a year, the discount will be retained. If the driver is overdue for a year or more, the KBM is reset to zero.

Many drivers are interested in what to do if the discount under the contract disappears. This happens not only due to an expired policy. You can also encounter something similar when replacing your license, changing your last name, due to a technical error or an error in the information about the driver. There are three options to restore your lost bonus. The easiest way is to contact the insurer's office. In this case, it will take several days for the bonus to be restored. The procedure looks like this:

- You need to write a statement indicating your personal data, contract number, and the error that needs to be corrected. You also need to put a date and signature.

- You need to have documents with you such as a passport, a car document, a driver’s license, and a compulsory motor liability insurance policy.

- All that remains is to receive confirmation in writing. Based on the results of the visit, the authorized representative of the insurer issues a copy of the application, which indicates that the application has been reviewed and the necessary changes have been made to the RSA database.

The application can also be submitted online. To do this, you need to visit the official website of the insurer and send the appropriate request through the “Feedback” form. It indicates personal data and the essence of the complaint. It is also recommended that you include your phone number along with a request to contact you for more information.

The terms for consideration of an application by the insurance company are not specified by law.

The last way to restore the discount is to contact RSA. To do this, you need to go to the official portal of this organization and find the “Contact RSA” section there. All requirements for completing the application and the email address where you need to send the form will be indicated there.

A sample form must be uploaded to the portal, filled out, photographed or scanned, and then sent. RSA usually reviews requests as quickly as possible. Once the necessary changes have been made to the database, you will receive a notification about this by email and will be able to make a new form with a corresponding discount.

The KBM can be restored only within a year after the expiration of the insurance period. If you apply later, it will be impossible to do this, and the bonus will be reset to zero, because the insurance history will already be formed on a new one.

Insurance calculation method

The cost of the policy is regulated by the basic tariff, which is uniform for the entire territory of the Russian Federation. However, for this tariff, adjustment factors are applied, which depend on certain operating conditions of the transport.

- Territorial – depends on the place of residence of the owner. Its value can vary from 1.5 to 2, and each city has its own coefficient.

- Bonus-malus, takes into account a long period of driving without an accident. It changes annually and is assigned if there are no payments under the previous MTPL policy. Does not depend on the vehicle or insurance company, and is assigned personally to the driver. When driving for a year without violations, this coefficient is 0.85.

- Driver's age and experience. The greater the age and experience, the lower the coefficient. The maximum value is 1.7 (with age less than 22 years and experience less than 3 years).

- Limiting – depends on the number of persons included in the policy:

- up to 5 people – limited insurance, and the coefficient depends on age;

- from 5 or more drivers – OK value – 1.8.

- Engine power – and depending on the car and its horsepower:

- ≤50 – 0,6;

- from 50 to 70 inclusive – 0.9;

- from 70 to 100 incl. – 1.0;

- from 100 to 120 incl. – 1.2;

- from 120 to 150 incl. – 1.4;

- more than 150 – 1.6.

- Seasonality – depends on the time of year in which the car will be operated and ranges from 0.5 to 1.0. Applies in cases where insurance is purchased for a specific period, which is less than a year.

- Violations - if the driver has already been caught driving while intoxicated, escaping from the scene of an accident, intentionally creating an emergency, transferring a vehicle to a person not specified in the insurance, or reporting false evidence. In such cases, the coefficient is 1.5.

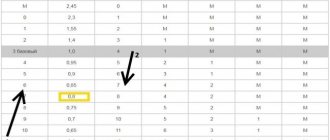

- Insurance period – from 0.2 to 1.0, depending on the duration of the insurance.

Regardless of the insurance company, the price of the policy should not change. Insurance agents do not have the right to inflate the cost of insurance or provide a discount - this is prohibited by law.

The formula itself for calculating the cost of an MTPL policy is as follows:

Price=BT*TK*KBM*KVS*OK*KMD*KS*KN*KSS , where: BT – base tariff. The remaining components of the formula are listed in the list of coefficients above, in the same order.

The basic tariff depends on the type of car, its tonnage and the number of seats for passengers. Therefore, it cannot be the same for cars, trucks, buses and other vehicles. For passenger cars with a capacity of 5 people (driver + 4 passengers), the basic tariff is:

- for individuals – 1980 rubles;

- for LLC – 2375 rubles;

- for a car used as a taxi – 2965 rubles.

This tariff has been in effect throughout Russia since 2004.

If an accident occurs with expired insurance

The fine for a policy that has expired is not that large, and it is not the most dangerous consequence. The bigger problem will be an emergency situation in which a person with an expired policy finds himself. It will depend on who the driver is - the culprit or the victim.

If the culprit's insurance is expired

If the person at fault for the accident has expired insurance, he will first of all face a fine. In addition, he will have to compensate the victim for damage:

- If the period of use of the car has expired, but the insurance period is still valid, then the victim is entitled to compensation, even if he is not included in the policy. However, in the future, the insurer may assert the right of recourse and demand from the culprit compensation for losses compensated to the victim.

- If the insurance period has expired and there is no valid policy at all, the culprit himself must compensate the losses to the victims. A receipt may be required. In the absence of compensation, the victim can sue the perpetrator in court.

As you know, compulsory motor liability insurance does not imply payment to the culprit of the accident.

If the victim's insurance is expired

If the policy of a person who is injured in an accident is expired, the person will receive compensation if the culprit has an MTPL policy (even if he is not included in it). Which insurance company will pay compensation depends on the following factors:

- If the period of use of the car is over, but the insurance period is still valid, then the victim, provided that a number of requirements are met, is better to contact his insurer, who will directly compensate for losses.

- If the insurance period has expired, the victim in an accident with expired insurance must contact the insurer of the person who caused the accident.

If the person at fault for the accident does not have insurance, the damages will have to be recovered from him.

Thus, expired MTPL insurance is fraught with problems for the driver. In this case, he is obliged to pay a fine. And although its size is not very large, it is recommended to buy and renew the policy on time. Otherwise, in the event of an accident on the road, you may encounter serious problems and receive a refusal from the insurer to pay compensation.

What happens after the deadline?

According to Art. 1 of the Federal Law “On Compulsory Motor Liability Insurance”, under a compulsory insurance contract, the insurer, having received money from the policyholder in a certain amount (calculating it is a separate story), assumes the following obligation: in the event of an insured event, pay the victim or several victims in an accident money, in damages account. The upper limit of payments is limited by law, but that is not the point.

If the contract expires, the insurer’s obligation to compensate the victim for damage will not be relevant, because the company that issued the MTPL policy undertakes to comply with the agreements during the period of validity of the policy.

Thus, if a driver whose insurance is expired causes an accident, he will have to pay for the damage out of his own pocket. The insurance company rightly noted that at the time the incident occurred, there were no agreements.

In addition, according to the Russian Federation Traffic Regulations, driving a vehicle without insurance is an administrative offense for which the relevant Code provides for liability.

Video on the topic:

Catalog of insurance companies in Russia

By following the link , you can familiarize yourself with the catalog of insurance companies in the Russian Federation offering compulsory motor vehicle insurance services. Description of organizations, current financial indicators, ratings, reviews and other information. If you have already had a positive or negative experience with compulsory motor liability insurance of any insurance company, leave your feedback. Thank you!

Link again. Also, be sure to write your comment below. What do you think about the topic of this material? Or maybe you have questions? Ask!

What needs to be done?

To form a new act, you will need to perform a certain sequence of actions.

You will need to collect the following documents:

- a statement indicating the need to draw up an agreement;

- a document through which the identity of a citizen is confirmed;

- papers indicating the completion of the auto registration procedure.

The application form is issued by employees of the insurance company. The client enters the data manually. When the data of several citizens is entered into the insurance, you will need to provide passports for each of them. In addition to the presented list, you need to collect a diagnostic card. This act includes information that reflects the technical condition of the vehicle. It is envisaged that you will be able to undergo an inspection when you contact any service station.

The legislation provides for situations when a citizen is not required to provide such a certificate. This applies to cases of purchasing a new vehicle. It was established that the car was released no more than 3 years ago. In addition, it is necessary to prepare driver's licenses for all citizens who are planned to be indicated on the paper. In a situation where a citizen does not undergo the procedure in question independently, he is required to issue a power of attorney. You will need to contact a notary office.

IMPORTANT !!! After collecting the listed acts, the company is contacted and a document is generated. Certain difficulties may arise. A citizen needs to take into account the inadmissibility of signing a blank form, even without taking into account that the insurance company employees assure that the correct data will be entered there.

You will need to carefully check everything that is written in the act in question. It often happens that insurance company employees do not pay attention to this, which can lead to future non-receipt of compensation for an accident.

Also, you don’t need to listen to a representative of an insurance company when he says that you can reduce the power of a vehicle or increase the length of service. Otherwise, it is the citizen who will be responsible for providing false information in the documentation.