In the Russian Federation, to drive a vehicle you must have civil liability insurance. If you drive a vehicle without a policy, you will be subject to administrative liability in the form of a fine.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Compulsory insurance was introduced in order to protect the health and property of citizens. In other words, a certain amount is paid under the policy in the event of an accident. Let's consider the features of compulsory insurance, and in particular the maximum payment indicator.

The concept of maximum payment under compulsory motor liability insurance

A fairly common question is what is the maximum amount of payments provided in the event of an accident and an issued insurance policy.

When considering the concept of maximum payment under compulsory motor liability insurance, attention should be paid to the following points:

- If the driver enters into an agreement with an insurance company, upon the occurrence of an insured event, the insurer is obliged to pay compensation. The guarantee in question is valid for the period for which the contract was drawn up. In other words, it does not matter how many times the vehicle gets into an accident during the term of the contract. If the car was driven legally, then the likelihood of receiving compensation for an insured event is high.

- The maximum payment amount depends on the expert assessment. In this case, you can use the services of independent experts, but often the insurance company insists on the work of its employee.

When considering the maximum payment indicator, it should be taken into account that it is the same for all insurance companies.

What is subject to insurance compensation in 2021:

So, in accordance with current legislation, in 2021, funds of individuals, regardless of citizenship, held in deposits and bank accounts are subject to insurance, including:

- time deposits and demand deposits, including foreign currency deposits;

- current accounts used for payments using bank (plastic) cards, for receiving salaries, pensions or scholarships, as well as regular debit cards;

- personalized savings certificates;

- funds in the accounts of individual entrepreneurs;

- from October 1, 2021, small businesses and non-profit organizations will be able to receive compensation for deposits (up to 1.4 million rubles);

- also, from October 1, 2021, reimbursement of up to 10 million rubles

will be possible in respect of funds placed in escrow accounts opened for settlements under transactions of purchase and sale of real estate or participation in shared construction, as well as in respect of funds placed in depositor accounts , in the presence of special circumstances, which include: sale of residential premises and (or) land on which a residential building or garden house is located, receipt of an inheritance, compensation for damage caused to life, health or personal property, receipt of social payments, benefits, compensation and other payments, receiving grants in the form of subsidies. The norm will also apply to funds placed in a special account (deposit) intended for the formation and use of funds from the fund for capital repairs of common property in an apartment building. - In addition, from January 1, 2021, the deposit insurance system (DIS) also applies to funds of legal entities classified in accordance with the legislation of the Russian Federation as small enterprises, information about which is contained in the Unified Register of Small and Medium-Sized Enterprises. The new version of the Federal Law provides for the insurance of funds of a small enterprise in rubles and foreign currency placed on the basis of a bank deposit agreement or a bank account in a bank that is a participant in the CVD, which has the right to attract funds from individuals as deposits.

What determines the maximum payment under the policy?

The maximum payout amount for a policy depends on a variety of factors. Moreover, almost immediately after contacting the insurance company, its employees begin to look for ways to reduce insurance compensation, since the insurer’s expenses depend on this.

Each driver is a kind of client of a company that provides insurance services. However, consumer protection is provided in all areas, including in the insurance sector. If the insurer tries to avoid costs by illegal methods, there is a penalty, which may include revocation of the license.

An independent examination becomes the basis for determining the payment amount. The following points may affect the amount of payments:

- The actual value of the property at the time of its damage. If the car was damaged, the vehicle’s inspection report becomes proof of its technical condition. In other cases, significant problems may arise in determining this indicator.

- Additional expenses are also taken into account, as is the value of the property. An example is a situation where a car needs to be transported to a parking lot or service station - the tow truck service will also be included in the costs.

- In cases where insurance compensation is carried out due to injury to health, the doctor's opinion is the main factor. At the same time, additional expenses include the purchase of necessary medications, payments to clinic staff for the provision of care services, and so on.

To ensure that the insurance company does not have the opportunity to significantly reduce the amount of compensation, you should confirm all your expenses with checks, contracts and other documents. If the reason for payments is witness testimony, the process can be significantly delayed and turn into a protracted trial.

What does the insurance cover and what is the maximum benefit?

All changes regarding the amount of insurance payments are enshrined in Federal Law No. 40 “On Compulsory Motor Liability Insurance”. Its first edition was published and came into force on April 25, 2002, the last changes were made on October 1, 2017.

According to the regulatory act, the compulsory MTPL insurance policy covers damage sustained by a vehicle as a result of an accident, and also compensates for harm caused to the life and health of people acting as the injured party. With the help of a compulsory motor liability insurance policy, it will not be possible to compensate for moral damage or obtain compensation for the culprit of the accident.

The maximum amount of payments under compulsory motor liability insurance, current in 2021:

- payment of damage (to property only) to the only injured party – 400 thousand rubles;

- compensation for harm caused to life and health – 500 thousand rubles;

- compensation for funeral expenses of a deceased participant in an accident (for distant relatives) – 50 thousand rubles;

- compensation for funeral expenses of a deceased participant in an accident (for close relatives) – 475 thousand rubles;

- compensation for damage to the property of several victims at once (regardless of the number) - 400 thousand rubles for each;

- compensation under the European protocol is 100 thousand rubles, for Moscow and St. Petersburg – 400 thousand rubles.

Maximum payout amount this year

Of course, the maximum amount depends on the specific situation, but the maximum values are established at the legislative level by Article 7 40-F3.

Considering the information regarding compulsory civil liability insurance, we note the following points:

- In the event that the driver, passengers or others suffer in an accident, the maximum insurance payment is 500,000 rubles.

- In the case where only property was damaged, the maximum payment is 400,000 rubles.

Also, the established rules for registration of compulsory motor liability insurance indicate that in the event of a death, the injured party may be paid 135,000 rubles 25,000 rubles are allocated for reimbursement of expenses for funeral services .

Another interesting point is that if damage is caused to the victim’s health during an accident, from the moment the insured event occurs, when calculating the maximum amount of payments, treatment costs, the purchase of medicines and other expenses can be taken into account.

To do this, it is enough to provide various receipts and documents to prove expenses due to injuries during an accident.

Nuances of insurance compensation for deposits

All interest due on the deposit (accrued on the day preceding the day of license revocation) is added to the principal amount of the deposit and is included in the calculation of insurance compensation. This means that if your deposit was exactly 1,400,000, then the accrued interest is not covered by the insurance compensation. A depositor who has received compensation for deposits from the Agency retains the right to receive the remaining part of the deposit from the bank in accordance with current legislation. For example, in the process of bankruptcy proceedings when a bank is declared bankrupt. If the amount of deposits in the bank exceeds the amount of insurance payments, then the remaining part of the deposits is repaid first of all as part of liquidation procedures.

Insurance compensation is calculated and paid separately for each bank.

Deposits in different branches (branches) of the same bank are deposits in the same bank. Therefore, they are subject to the general rule for calculating the amount of compensation for deposits: 100% of the amount of all deposits in the bank, not exceeding 1.4 million rubles.

Payment of compensation for deposits is made in rubles. If the deposit is placed in foreign currency, the amount of compensation for deposits is calculated in rubles at the rate established by the Bank of Russia on the day the insured event occurred.

If the bank whose license was revoked not only held your deposit, but also received a loan, please note that, as a general rule, the amount of compensation for deposits is determined based on the difference between the amount of the bank’s obligations to the depositor and the amount of the bank’s counterclaims to the depositor, arising before the day of the insured event (including loan debt). In this case, when calculating the insurance compensation, the balance of the loan debt, the amount of interest payable on the day of the insured event, as well as penalties for late repayment of the loan are deducted from the amount of deposits.

| Useful: | |

|

|

| “Deposit calculator” is a service for selecting a deposit based on the amount, term and currency of the deposit. Only current deposits and banks in Krasnoyarsk | |

How can you get the maximum amount of compensation after an accident?

There are several points that you can take into account to increase your chances of receiving maximum payouts. It is worth remembering that it is the wrong actions of victims, participants and perpetrators of an accident that become the reason why the insurance company can avoid expenses.

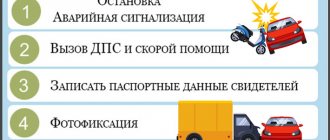

Driver actions after an accident

- You should turn off the engine and turn on the hazard warning light.

- The first steps after the driver has regained consciousness are to assess his physical condition. If everything is in order, then you need to assess the condition of other participants in the accident. If necessary, an ambulance is immediately called. If people are on the roadway, then in some situations it is necessary to pull them to the side in order to prevent a collision. Before the ambulance arrives, you must provide medical assistance yourself.

- You need to call the traffic police and tell them about the accident and where it happened.

- An emergency stop sign should be posted.

- You can avoid problems with insurance payments by calling a specialist from the insurance company with which the contract was concluded. The telephone number is indicated in the policy.

- It is forbidden to move vehicles or other objects before the arrival of traffic police officers.

- Witnesses to an accident will help you avoid most problems. Therefore, if there are passersby around, you should ask whether they witnessed the incident.

- You should take photographs of the current situation at the scene of the accident yourself.

- You need to familiarize yourself with the protocol drawn up and, if the inspector has stated everything correctly, sign it.

Necessary documents to receive insurance payment

- Fill out a statement about the accident.

- Based on the fact of the incident and the investigation, a certificate of innocence is taken from the traffic police officers. There is no point in contacting the insurance company until the proceedings are completed.

- When applying, you will be provided with a passport, driver's license and the insurance policy itself.

- The examination by the insurer must be carried out within 5 working days.

If you do not agree with the expert assessment of the insurer and the specified amount that will be reimbursed, you cannot sign the contract.

Payment terms

After 5 days have passed from the date of the proceedings, from the moment the application is submitted, the insurance company has 20 working days to fulfill its obligations to the client. These deadlines are established at the legislative level and there is no reason to exceed them.

What to do in case of refusal?

What if the insurance company refuses to pay compensation or significantly underestimates the amount of compensation?

The ways to solve this problem are as follows:

- You can contact an independent expert to assess the damaged property.

- All problems that arise between the insurer and its clients are resolved through the courts.

It is best to go to court with a lawyer who has experience, since insurance companies are represented by experienced lawyers.

Procedure for revoking a bank’s license

14 days after the occurrence of the insured event, you must come with your passport to the bank (agent bank) selected by the Agency, where you will fill out an application for insurance payment on the spot. The money will be paid in cash or transferred to the account you specified.

The addresses of agent bank branches can be found the day before the start of payments on the DIA website, by calling the Agency and agent bank hotlines, or in the local press.

If suddenly you cannot get to the agent bank, the application can be sent by mail in the order specified in the message. You can also receive payments by postal order.

According to the Federal Law “On Insurance of Individual Deposits in Banks of the Russian Federation,” the depositor has the right to apply to the Agency with a request for payment of insurance compensation before the completion of the liquidation (bankruptcy) procedure of the bank. As practice shows, the liquidation of a bank lasts at least 2 years.

If the deadline is missed at the request of the depositor, it can be restored by decision of the Agency’s board. However, it can be restored only if there are circumstances specified in the Federal Law (for example, long-term illness, business trip).

The procedure for obtaining insurance is as simple as possible. You only need to fill out an application in a special form, and also submit an identification document with which the bank deposit (account) was opened. You will be provided with information about the amount of deposits that is listed for you in the bank’s accounting records, and will also be told the amount of insurance paid to you. You can usually receive money on the day you apply.

If you have any disagreements with the registry data, you must submit additional documents to the Agency substantiating your position. If the depositor disagrees with the amount of compensation for deposits, the depositor is asked to receive the amount of compensation indicated in the register and submit to the Agency a statement of disagreement with the amount of compensation, attaching additional documents confirming the validity of the claims. The application and documents will be sent to the bank, which, within 10 days from the date of receipt, is obliged to inform the Agency about the results of their consideration.

Please note that if you are acting through a representative, then he must have a notarized power of attorney confirming his right to apply on your behalf with a claim for payment of compensation for deposits (accounts), or have a notarized power of attorney to dispose of funds in the deposits (accounts) of the principal in the bank in respect of which an insured event occurred, or a general power of attorney, which contains the authority to dispose of all your property, regardless of whether these powers of attorney contain a direct indication of the right of the representative to receive compensation for the principal’s deposits or not.

The insurance amount agreed upon with the depositor is paid by the Agency within 3 days from the date the depositor submits the necessary documents to the Agency, but not earlier than 14 days from the date of the insured event.

Payment of insurance compensation to a depositor - an individual who is not engaged in entrepreneurial activity, can be carried out at the request of the depositor either in cash or by transferring funds to a bank account specified by the depositor. Payment of insurance compensation on accounts (deposits) of individual entrepreneurs opened for business activities is made by the Agency by transferring funds to the bank account specified by the depositor, opened for business activities.

If, at the time of payment of insurance compensation, an individual entrepreneur is declared insolvent (bankrupt) by an arbitration court, such payment is made by the Agency by transferring funds to the account of the debtor used during bankruptcy proceedings in the manner established by the Agency. Assignment of the rights of claim of an individual entrepreneur to the Agency is not permitted.

Payment of compensation for deposits of a small enterprise is made by transferring funds to its bank account (bank account of the legal successor) opened with a bank or other credit organization. Payment of compensation in cash is not provided.

If, due to the fault of the Agency, the agreed compensation for deposits is not paid within the established period, the depositor is paid interest on the amount of non-payment at the refinancing rate established by the Bank of Russia.

Methods of insurance companies to reduce the amount of payments

As previously noted, insurance companies seek to reduce their costs through various tricks.

The most common points are the following:

- Conclusion of a civil insurance contract on unfavorable terms.

- Some insurance company employees arrive when called before the road accident employees and supposedly help fill out documents. In practice, they make sure that the documents will lead to a significant reduction in compensation.

- Some companies offer a certain amount immediately, without waiting for the results of the examination. It is much less than what should be paid. In other cases, the employee takes the documents and deliberately stalls for time to carry out the assessment - the owner cannot stand this and begins to restore the car, after which the assessment is carried out.

If the amount of damage in an accident is large, then it is best to hire a lawyer - he will help you avoid all the tricks on the part of the insurance company or another participant in the accident.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Free online consultation with a car lawyer

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Terms of compensation

The exact timing of compensation payments is stipulated in the Federal Law “On Compulsory Motor Liability Insurance”. According to Part 21 of Art. 12 of this normative act:

- The insurance company is given 20 working days (excluding weekends and holidays) to make a decision and to review the documents prior to this. In this case, compensation is carried out in cash or in the form of repairs at an insurance partner service station;

- to make a decision and review documents if the repair is carried out at a station chosen by the policyholder at his own discretion - 30 working days

If the specified deadlines are not met, the insurer is obliged to pay the client a penalty in the amount of 1% of the compensation amount for each day of delay. If there are several victims, then the penalty is calculated for each of them.

Is it possible to change the sum insured in an existing contract?

Considering that the CASCO policy begins to operate from the moment it is signed by both parties to the transaction, any changes to the insurance conditions are made only after they are agreed upon with the policyholder. Such amendments mainly include the correction of errors made during the conclusion of the contract.

After completing all the necessary documents, the correctness of the policy is checked by the authorized internal division of the insurance company. And if it turns out that the CASCO insurance amount is significantly overstated, then the contract is returned to the agent for correction.

The process of making amendments to an already valid CASCO policy occurs only after agreement with the policyholder. Moreover, the client may even refuse to do this. All responsibility in this case will fall on the shoulders of the insurance agent. So please know that changing the sum insured unilaterally is simply impossible.

Dear OSAGO? Restore KBM now

and stop overpaying insurers!

The service will send an application to RSA. Recovery time for KBM: from 12 hours. Find out more

What is important for a car owner to know when repairing a vehicle at the expense of compulsory motor liability insurance?

- If the service station said that it is necessary to replace a certain part or assembly, then it is strictly forbidden to use used spare parts. You have the right to demand exclusively new parts to repair your car.

- It is important to know that the vehicle repair period cannot exceed 1 month. In case of delay in restoration work, the insurer pays the owner of the MTPL a fine in the amount of 0.5% of the amount of repair work. These payments are not made if the company has agreed in advance to change the repair time frame. Such coordination takes place only through the client, and not through the service station.

- After the car is repaired, a warranty is issued - at least 6 months from the date the car is returned to the owner from restoration work.

What is deposit insurance?

This is a specially designed system that allows private investors, that is, individuals. individuals will receive the money they invested if an insured event is recognized in relation to their bank. That is, if the Central Bank revokes the license that allows the bank to operate, or the credit institution is declared bankrupt. The money that is intended to compensate for losses to depositors is taken from a special fund formed from special contributions, which all credit institutions must pay from each deposit they accept.

Deposit insurance - how much? For the first time, such a system, which allows you to return your money if problems arise at the bank, appeared in the first half of the 20th century in the USA. Initially, Americans could receive only up to 5 thousand dollars, but later this amount was increased to 100 thousand dollars. Currently this amount is 250 thousand dollars. After the introduction of such a system in the United States, other countries adopted the experience of the Americans and began to implement it at home. So at the beginning of the 21st century, a similar system also started working in our country. Its activities are controlled by Federal Law No. 177. And a special organization “DIA”, which was created in 2004, is responsible for its implementation.