A traffic accident is an extremely unpleasant and very costly incident. After it, at least repair of the damaged vehicle is always required. And very often the insurance company seeks to underestimate the damage to the car in order to pay the victim less money. You can protect yourself from such arbitrariness. To do this, an independent examination of the car after an accident will be required.

What is an independent examination after an accident?

When an accident occurs, the driver first dials two numbers - these are the telephone numbers of the traffic police and his insurance company. The following actions take place right there on the spot:

- Determination of the culprit of the accident. This is necessary, since it is his insurer who will calculate the damage caused and issue the amount. Sometimes drivers insist on conducting a trace examination, since no one considers themselves to be in the wrong.

- Description of damage received by the vehicle. This is what the insurance agent does.

- An accident notification is issued.

If the damage cannot be assessed on site, the car will be sent to a service station owned by the insurance company. There, the damaged car is carefully examined for damage and the insurance company issues a final verdict on the cost of repairs.

Automotive technical examination in case of road accidents. Is it possible to challenge an auto technical examination? Read here.

Find out more about automotive technical expertise at the following link:

So what is it? This is an examination of the car, which is carried out by a disinterested person - that is, not a representative of either the insurance company or the victim.

Important! The expert should not be subject to any pressure from one side or another. Therefore, it is advisable not to settle for the companies provided by insurers, but to search on your own.

Similar damage assessments are carried out by special companies that are not related to the insurance company. The bureau for assessing the condition of the car after an accident must be chosen very carefully; attention should be paid to the following criteria:

- experience;

- availability of bureau liability insurance;

- entry of the bureau or its employees into the SRO of appraisers.

When the insurer organizes an independent examination

Part 11 of Article 12 of the law on compulsory motor liability insurance stipulates that only in the event of a dispute between the insurer and the injured driver about the nature of the damage to the car received in an accident, as well as about the amount of insurance compensation, the insurance company is obliged to organize an independent examination.

Under the wording “organize an independent examination,” the legislator provided for issuing a referral to the car owner. The insurer is obliged to agree with the injured driver on the place, date and time of the independent examination. It must be carried out within 5 working days from the moment the car is submitted for inspection to the insurer.

When the driver, after inspecting the car by an insurance company expert, does not insist on conducting an independent examination, the insurer may not conduct it. Remember that the customer pays for the independent examination. Of course, the injured driver will then recover the cost of the examination from the culprit of the accident, but first he will pay for it with his own funds.

Therefore, you should carefully read all the documents provided by the insurance company. Very often, in the inspection report or in the calculations of the amount of damage caused, it is indicated in small print that the injured participant in the accident refuses to conduct an independent examination. Yes, and you need to read all the documents before signing.

Why is an independent examination needed?

An independent examination after an accident (car examination) has the goal of setting a real price for repairing the damaged car, not underestimated by the company to reduce its costs and not inflated by the victim to increase its profits. Since underestimating the cost of insurance damage is a common practice, there is an urgent need for outside specialists.

Another problem is when to do an independent examination after an accident? You need to know that it is carried out either immediately after the accident, if the victim wants it, or after the insurers have rendered a verdict, if the price they set seems too low. An assessment of damage by a third-party company will force the insurance company to pay the amount in full either voluntarily or in court.

Carrying out this examination can protect the victim from unnecessary financial expenses. But this will take time. Most often, the victim waits five days until the insurer makes a decision, and only then contacts the appraisal company. The timing of an independent examination after an accident already varies depending on the degree of damage to the vehicle. But on average this period is two to three days. And only after this the driver will be able to receive the actual price for the repair, which he will transfer to the insurance company. There, the verdict of an independent appraiser will be considered for a maximum of ten days.

Rules

It is possible to repair a car damaged in an accident in a short time without serious consequences.

To do this, you need to follow the procedure for conducting an independent examination, guided by the Regulation of the Central Bank No. 433 of September 19, 2014.

Main functions

If there is a divergence of opinions about the occurrence of cracks or scratches and who is to blame for the breakdown of spare parts, an independent examination is necessary. The main function is not to blame one of the parties, but to reconstruct the events of the accident, take into account the maximum possible number of factors and answer all questions that arise from the parties to the accident.

- Preparation of an opinion on the current condition of the damaged vehicle at the time of the examination:

- studying the technical condition of the car;

- description of the detected damage;

- comparison of each damage with known facts about the accident (speed, direction of movement) with determination of their causal relationship;

- calculation of the amount of damage caused;

- drawing up a detailed report with an answer to each question asked.

- Upon request, an expert can calculate the market value of the car.

Documentation

To conduct the examination, make sure to collect the following documents:

- Information about the car (vehicle passport, license registration certificate, technical inspection).

- Information about the accident (certificates, protocols from the scene of the accident, a copy of the agreement from the insurer for the examination, concluded by the insurance company and the organization).

Important! To compare the damage with the accident, it is necessary to provide video footage from the scene of the incident and a detailed report.

Stages

Sequencing:

- Choose an organization that conducts the necessary examinations.

- You sign an agreement and pay for services.

- Determine the day and time of the examination.

- Notify the person at fault for the accident, the Investigative Committee and all interested parties.

- Attend the vehicle examination.

- You observe the execution of the report by an expert, each recording of damage by photography or video.

- Wait for the expert to draw up an estimate for the materials and parts that need to be replaced.

- Receive a conclusion by signing the acceptance certificate.

The right to the presence of the victim and a representative of the Investigative Committee

The law does not establish the right of the culprit of an accident to demand mandatory notification of the examination being carried out. In any case, the culprit retains the right to his own independent assessment of the damage. The personal presence of all interested parties can influence the expert’s decision through constant tension and conflict. Errors may appear in a report unknowingly.

The culprit will dispute the amount of the calculated compensation with or without agreement with the inspection. The amount of compensation is not directly dependent on his presence at the inspection.

Mandatory notification of the parties and insurers is provided for when considering a dispute in an arbitration court by the norm of Art. 5 of the Civil Code of the Russian Federation. According to the provisions of this article, sending a notification by registered mail (telegram) is mandatory.

The MTPL Law specifies the right of the insurance company to demand that the car be provided for inspection. If the Investigative Committee does not plan to conduct an examination, shifting this action to the car owner, then notification of its representatives and the culprit is necessary.

The Regulations on the Rules for Carrying out NTE of a vehicle establishes the obligation to notify the insurance company during a re-examination carried out in order to receive compensation under compulsory motor liability insurance.

Expert opinion and what to do next?

Having received the expert’s opinion, you should check the reflection of the positions:

- for what purpose was the assessment of the damaged vehicle carried out;

- personal data of the victim;

- the final size, which is enough to completely restore the car;

- documents that the expert relied on when calculating the final amount of compensation payment;

- accident information;

- information about the policies of road accident participants and their insurance companies;

- information about the expert organization and the inspection being carried out (cost, payment);

- signatures of the expert and his supervisor, seal of the organization.

The amount reflected in the resulting conclusion should be relied upon when making claims for compensation for actual damage. Such a conclusion is accepted by the judge unconditionally if the guilty party does not prove the presence of damage to the car that was not received as a result of the accident.

Types of independent examinations

Often, when a car is damaged, you cannot limit yourself to just estimating the cost of repairing the car. It may be necessary to carry out additional checks. An independent examination of damage after an accident can also be:

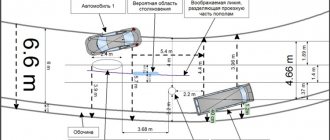

- Traceological - analysis of the accident site. Tire tracks are inspected, vehicle trajectories are analyzed and the traffic situation is assessed. This study will establish why the accident occurred and who is to blame.

- Automotive - research of the condition of cars. It also studies how the driver acted during the accident, how the car behaved on the road before the collision. Helps determine who caused the accident.

- Automotive merchandising - examines the condition of vehicles after a collision. Detects all defects, both internal and external. Estimates the amount of damage received and the cost required for repairs. Essentially, an independent examination of a vehicle after an accident.

- Comprehensive - all the above checks together. This is necessary in order to most fully assess what happened on the road and reconstruct all the events.

What's the point

The procedure for conducting an independent examination of cars is regulated by Articles 12 (parts 10 and 11), 12.1 of the Federal Law “On compulsory insurance of civil liability of vehicle owners” dated April 25, 2002 and the Rules for conducting an independent examination of the Bank of Russia. When a party injured in an accident applies for insurance compensation under compulsory motor liability insurance, the insurer is obliged to conduct an independent examination to determine the amount of payment. This procedure is often carried out by organizations that cooperate with the insurance company. In this situation, attempts to deliberately understate the amount of property damage in order to reduce the amount of insurance payment cannot be ruled out.

If a car owner disagrees with the conclusion of an expert invited by the insurer, he has the right to contact another organization and order an independent assessment of the damage caused.

Automobile examinations are also carried out at the request of investigative and judicial authorities in the presence of victims who have been seriously injured or died as a result of an accident. In this situation, an inspection is initiated not only to assess material damage, but also to identify those responsible for the incident and determine the degree of their guilt.

Carrying out an independent examination after an accident

An independent examination of a car after an accident can be ordered by the injured person at any time, as soon as he wants it. You can entrust the assessment of damage to insurance companies, but most likely in this case the price will be underestimated. And you still have to contact appraisal firms.

If the driver values his time and his own nerves, then the best solution would be to order an assessment immediately after the accident, so that if necessary, he has all the papers on hand immediately, and not wait some more time. You can call an appraiser immediately to the scene and ask him to describe the defects at the same time as the insurance agent. That is why it is better to study existing companies in advance, choose the one that inspires the most trust and write down its number so that in an emergency you will be fully armed.

How is a car damage assessed by an independent expert:

- The scene of the incident is being carefully examined. The condition of the car and the scene of the accident are recorded in photos or videos. In this case, the vehicle’s VIN code or registration number must be visible in photographs and filming.

- After this, the technical condition of the car after the incident is assessed. Based on the results of the assessment, a report is drawn up, to the conclusion of which a photo report is attached. The resulting damage will be assessed within approximately three days. The report must reflect all damage received along with the potential costs of their restoration.

- A final report is prepared. It must reflect: - the purpose of the inspection; - the amount that will have to be spent on restoring the car; — a list of norms and acts that were used by appraisers when checking the condition of the car and calculating damage; - the criteria by which the decision on damage to the vehicle was made and their justification, justification for the amount; — the cost of the appraiser’s work and materials.

The received document is transferred to the insurance agent of the company, which will have to pay insurance compensation to the victim. The agent must either agree and sign the act, or seek to challenge the expert’s opinion in court, indicating the arguments why a re-examination is needed.

How to challenge the conclusion of a forensic medical examination?

Read how to file a claim for compensation of insurance payments here.

Find out about the accident scene inspection protocol at the following link:

Average cost for the services of an assessment expert:

- on-site visit - up to a thousand rubles;

- accident inspection report, including photography – one thousand rubles;

- calculation of damage received - up to eight thousand rubles;

- sending the completed act to the client’s home – 500 rubles;

- preparing a claim – up to three thousand rubles;

- a trip with a client to an insurance company and assistance during negotiations - from 2,000 to 3,000 thousand rubles.

A separate service called “full case support” is highlighted. It includes everything related to this accident - from drawing up an inspection report to preparing a claim in court. It costs around twenty thousand rubles for an individual and thirty thousand for a legal entity.

When to do it?

As we have already indicated above, it is rational to conduct an independent assessment of the damage after you know the amount of damage. This can be done immediately after receiving an insufficient payment.

To make it easier for you to understand exactly how the examination is carried out, we suggest comparing the insurance payment procedure with further repairs of the car using this money and challenging the payment when the amount is not enough to completely restore the car.

So, if the usual payment procedure looks like this:

- insured event - road accident,

- the victim's appeal to the insurance company,

- inspection of the vehicle and calculation of the amount of compensation,

- payment or referral for repairs,

- restoration of the vehicle by the victim or service from the insurance company in case of referral for repairs.

The correct order, when an independent examination is required, will look like this:

- insured event - road accident,

- the victim's appeal to the insurance company,

- inspection of the vehicle and calculation of the amount of compensation,

- payment or referral for repairs, while the victim finds out that the amount paid is not enough to carry out repairs,

- appointment of an independent examination initiated by the victim (search for a suitable organization and payment for services), with an invitation to a representative of the insurance company,

- carrying out an examination and new calculation of the amount of damage,

- pre-trial demand based on independent expert calculations,

- if the insurer refuses to settle the dispute pre-trial, filing a claim in court,

- winning the court, the latter issuing a writ of execution, according to which the insurance company is obliged to pay the awarded amount,

- another payment from the insurance company in court (usually the difference between what was paid and what was assessed by an independent expert, as well as “bonuses”, which we will discuss below),

- restoration of the vehicle by the victim or service from the insurance company in case of referral for repairs.

Features of conducting an independent examination of compulsory motor liability insurance

An independent examination after an accident under compulsory motor liability insurance has its own characteristics:

- The insurance company is obliged to conduct an inspection and examination of a car damaged in any way as a result of an accident within five days. And the client does not have the right to refuse this, otherwise payment will not be made. Under compulsory motor liability insurance, there is a choice: to carry out an inspection or opt for an independent examination. The difference: the inspection is carried out by an employee of the company, and the examination is carried out by a third-party company. It is necessary to very carefully and meticulously read all the proposed papers and not sign if it is suddenly indicated that upon signing the client automatically agrees with the results of the inspection and refuses an independent examination. The client will be blackmailed that payment will not be made, but this is not the case, since by law he has the right to demand an independent expert assessment regarding damage to property. According to paragraph 45 of the OSAGO rules, if the client does not agree with the results of the inspection, the insurer will organize an examination at its own expense.

- An independent examination is carried out by a company with which OSAGO has entered into a cooperation agreement.

You shouldn't count on honesty. However, the amount will not be underestimated as much as with a simple inspection. Important! This point can be bypassed, as there is a small loophole in the law. If the independent examination was not carried out within five days from the date of acceptance of the documents, then the client has the right to contact absolutely any assessment company. And before sending it for examination, it is advisable to stop by a service station to independently assess the internal damage to the car. Since the MTPL appraiser may simply “not notice” them. But you cannot repair the car in any way. - Depreciation under compulsory motor liability insurance plays a significant role in assessing damage. The older the car, the lower the payment amount will be.

- If the client is not satisfied with the results of the examination, he has the right to conduct his own independent examination. It is advisable to notify the insurer and the culprit of the accident when and where it will take place. After this, a statement of claim is written, and in court it will be clarified whose assessment is more correct.

Important! After this examination, you need to hire a lawyer who can assist in preparing a claim in court. If the client wins the case, then the costs and assessment will have to be paid by the defendant.

Procedure for inspecting a damaged vehicle

The procedure for inspecting a damaged car during a traffic accident or its remains by the insurance company is prescribed in detail by paragraphs 45-48 of the Rules for compulsory motor third party liability insurance as amended by Decree of the Government of the Russian Federation of February 29, 2008 No. 131.

Thus, paragraph 45 provides that the injured driver who wishes to receive an insurance payment is obliged to provide the damaged car to the insurer to clarify all the circumstances under which the damage was caused and determine the amount of damage caused.

For this purpose, the insurance company organizes:

- inspection;

- inspection and independent examination (assessment);

- independent examination.

The insurer inspects the damaged car in a special room at the company's office.

If the car received hidden damage and deformation as a result of a “serious” accident, then the car owner may insist on an inspection at a service station (STO). The Law on Compulsory Motor Liability Insurance and the Rules of Compulsory Motor Liability Insurance stipulate that the inspection must be carried out within 5 working days from the moment the injured driver submits an application for payments and the documents attached to it, unless a different period is agreed upon. It should be remembered that the company employees will begin to count the deadline provided by law from the moment the entire list of documents is submitted.

Important nuances

The insurer organizes an independent examination by issuing a referral to conduct the event.

The MTPL rules oblige the insurer to coordinate with the injured motorist the time and place of the inspection or independent examination, taking into account the work schedule of the injured person, the insurer, the expert, as well as the deadline established by law. When the car owner was unable to provide the damaged vehicle for inspection on the agreed date, a new date and time must be agreed upon. In this case, the insurer extends the payment period by the number of days between the originally scheduled date and the actual date of inspection of the car, but not more than 20 working days.

If a car damaged in a car accident cannot independently take part in road traffic, then the car owner writes a statement addressed to the head of the branch of the insurance company to which he applied for payments, with a request to conduct an inspection or organize an independent examination at the location of the property.

The statement uses the following wording: “the nature and characteristics of the damage to the vehicle resulting from an accident exclude its presentation for inspection at the location of the insurer (or an independent examination at the location of the expert), and therefore, I request an inspection (examination) at the location of the vehicle " and the address is indicated.

Only in the case where the insurance company’s employees did not inspect the damaged car within 5 working days, the injured driver has the right not to present the car for inspection anymore and to independently order an independent examination. The insurer is obliged to take into account the results of an independent examination when calculating the amount of insurance payments.

Thus, in order not to delay receiving compensation for material damage caused in a car accident, the injured driver needs to submit the entire package of documents to the insurer within the period provided for by the MTPL law, and not agree to an inspection later than 5 working days from the date of submission of the last document. No one can oblige a car enthusiast without his good will.

When should a participant in an accident contact the insurance company?

If a traffic accident was registered with the involvement of traffic police officers, then the injured driver must visit the insurance company of the person responsible for the collision within 15 working days.

The car enthusiast writes an application for insurance payments and attaches to it a package of documents provided for by the legislation on compulsory motor liability insurance.

When participants in a car accident have drawn up a Europrotocol, the law provides for a procedure for direct compensation for losses.

Each driver must submit the Europrotocol, photographs from the scene of the accident and the required package of documents to his insurance company no later than 5 working days from the date of registration of the accident.

What documents need to be submitted to the insurer?

Clause 44 of the OSAGO Rules stipulates that the car owner attaches the following package of documents to the application for payments:

- a certificate of a traffic accident issued by a traffic police inspector;

- notification of an accident;

- OSAGO policy;

- passport of a citizen of the Russian Federation;

- driver's license;

- vehicle registration certificate;

- vehicle registration certificate;

- bank details of the account to which the insurer must transfer damage compensation.

Also, the rules stipulate that the motorist attaches to the application copies of procedural documents drawn up by police officers only in cases provided for by law.

In particular:

- protocol on administrative offense;

- decisions in a case of an administrative offense;

- determinations to refuse to initiate proceedings regarding an administrative offense.

Before submitting documents to the insurance company, you should make at least three copies of each document drawn up by traffic police officers and participants in the car accident. If possible, scan documents in color. These are the documents you will need to conduct an independent examination, file a pre-trial claim and go to court.

Features of the inspection procedure

The car owner must provide the vehicle for inspection in a clean condition.

This is necessary so that the insurer’s expert can document all the damage to the car. You should know that the inspection of a damaged vehicle is carried out without disassembly. Therefore, the expert describes only the damage that he sees. The driver should closely monitor the work of the expert. It is very important that he does not miss any damage. After signing the inspection report, it will be very difficult for the car owner, and in fact, it will be impossible to get the damage included in the document. Therefore, it is better to play it safe and invite a person who is well versed in the structure of the car to perform the inspection procedure.

The results of the vehicle inspection are documented in the inspection report document. It is signed by the insurer, the expert who conducted the inspection and the car owner. When the injured motorist does not agree with the result of the inspection, he should not rush to sign the inspection report. After all, on the basis of this document the amount of insurance payments will be calculated.

The driver must carefully read the inspection report of the damaged car. All empty lines of the document must be “blanked” - a “Z” sign is placed. This is done so that later the company employees will not be able to add anything. On the last page of the inspection report, in the “Notes” column, you can write what exactly you disagree with and sign.

If the car enthusiast completely disagrees with the results of the inspection, then this should be indicated in the notes and an independent examination should be requested there. Before handing over a document, you need to at least take a photo of it on your phone. By doing this, the driver will protect himself from the fact that insurance employees will rewrite the document.

Be sure to take a copy of the vehicle inspection report. The document will be required when ordering an independent examination, as well as when preparing a statement of claim and pre-trial claim. You should know that, according to paragraph 71 of the OSAGO Rules, insurance companies issue an inspection report only on the basis of a written statement from the injured motorist.

It is imperative that on the day when the car was inspected, the driver must write an application addressed to the head of the department of the insurance company in which his insurance case is being considered, for the issuance of a copy of the inspection report. A copy of the document is transferred by the insurer to the policyholder no later than 3 days from the receipt of a written application, which must be registered in the company office.

Is it worth doing an independent examination after an accident?

This procedure can significantly reduce the cost of repairing the damaged car. A properly conducted damage assessment increases the amount of payment that can be received from the insurance company.

Pros:

- real assessment of the damage received;

- independence of damage assessment;

- increase in insurance payments.

Minuses:

- you may have to go to court to resolve the situation if the insurer decides not to agree with the expert’s opinion;

- additional costs are required for damage assessment by appraisers;

- if the case is lost, no one will cover the costs of lawyers and evaluation;

- In the case of MTPL insurance, there are many pitfalls that only a lawyer can help you figure out.

NE cost

The price of the procedure depends on the region, the prestige of the company and other parameters. On average in Russia, NE costs about 8,000 rubles. If the court confirms the results of the inspection and obliges the insurance company to compensate for damage based on the results of an independent assessment, then the cost of the examination will also fall on the insurer. However, you should contact private specialists only if the difference in the size of the desired and available payment is more than 10-15%.

If the examination is carried out at a location specified by the customer, you will most likely have to pay extra for a technician to visit you. This is stated in the contract. If you need to deliver a completely broken down car to the company’s premises, you won’t be able to do it without a tow truck. Transportation also involves additional costs.

Conducting an independent examination is a legal method of obtaining an objective assessment of damage. With its help, you can demand real and reasonable payments from the insurance company if it initially tried to underestimate the amount of compensation.

Participation of the culprit of the accident in the examination

It has already been discussed above whether it is necessary to invite the person responsible for the accident for an examination. The method of notification is not regulated by law, but in any case, the initiator of the procedure must have confirmation that the second party to the accident was promptly informed about the date and time of the examination. This is best done by telegram or registered letter with notification.

Whether the culprit of an accident must be present at the independent examination without fail - the current legislation does not answer this question. Consequently, the initiator of the incident himself decides whether to accept the invitation or refuse. Regardless of whether the culprit of the accident is present during the examination of the car’s damage or not, he retains the legal right to challenge the expert’s conclusion.