Every car owner is required to have a valid MTPL policy. A unique feature of this type of insurance is the nuance that, on its basis, the insurance company of the culprit of the accident helps to compensate for the damage to the injured party during the accident. But in practice, it is much more difficult to guarantee payment after an emergency on the road.

Drivers who have signed such an agreement face a number of difficulties caused by incorrect application procedures and the list of documents required for this. Therefore, it is worth carefully studying all the features of the procedure and considering frequently occurring situations.

Procedure in case of an accident

Without accurate information about exactly when and where to go in case of an accident, the driver risks violating the rules of the insurance contract, which will complicate the claim for compensation.

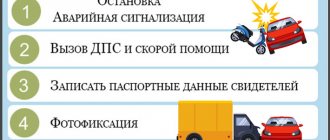

Therefore, citizens should clearly know when the culprit of an accident must notify his company, and when it is better not to do this in order to avoid filing a recourse claim under OSAGO. Thus, the owners of the car involved in an accident immediately after the incident must:

- Immediately stop the vehicle, turn on the emergency lights and put up a warning triangle. At the same time, it is prohibited to move objects that are in any way involved in the incident - it is prohibited.

- If there are injured persons, it is necessary to call an ambulance and provide emergency assistance until they arrive. In case of emergency, send accident victims to the nearest medical facility by passing or personal transport.

- When an accident impedes traffic, clear the roadway as quickly as possible. But before swapping objects that could later affect the course of the investigation, the position of the cars and related objects should be recorded in the presence of witnesses.

- Then you need to report the incident to the traffic police, write down the main contacts of witnesses and wait for the arrival of State Traffic Inspectorate officers. All documents, which will then be issued by representatives of the Ministry of Internal Affairs, may be required by drivers when receiving payments.

The ideal case is an accident where both participants in the accident have a compulsory motor liability insurance policy. Then each victim has the right to apply for payments to his own organization or a similar company of another culprit. But if both citizens do not have a compulsory insurance policy, all responsibilities for making payments fall entirely on him. If there is a related CASCO agreement, part of the funds can actually be compensated from this insurance.

Actions in the event of an insured event (accident)

What to do immediately after an accident

Stop Turn on the hazard warning lights Put up an emergency stop sign (in the city - no less than 15 m, outside the populated area - no less than 30 m); If necessary, call 112 for an ambulance or fire brigade. Call the traffic police. Call your insurance company. Write down the details of witnesses (full name, address, telephone).

What to do to apply for compulsory motor liability insurance

Complete the documents yourself

You can fill out the documents yourself if the following conditions are met: Only 2 cars are involved in the accident No one was injured Both drivers are included in the current OSAGO policies Both drivers equally assess the circumstances of the accident and damage Repairs will cost no more than 100 thousand rubles. If participants in an accident have the opportunity to record information about an accident using the special RSA mobile application “Road Accident Europrotocol” or technical control means that transmit information to the AIS OSAGO (GLONASS device), then the Europrotocol can also be issued - even if there are disagreements between the participants in the accident, but only if the amount of damage does not exceed 100 thousand rubles, - if the amount of damage ranges from 100 thousand rubles to 400 thousand rubles but in the absence of disagreements between the participants in the accident.

How to apply Take photographs of the damage at the scene of the accident Remove cars from the roadway Fill out the “Notice of an Accident” Submit the “Notice of an Accident” to the insurance company within 5 business days

Receive a referral to an authorized service or money 5 working days after submitting the application

Complete documents with the participation of traffic police representatives

If in doubt, call a traffic police inspector.

Report an accident by phone 112 Fill out the “Notice of an Accident” Take photographs of the damage Check that the inspector has listed all the damage and put all the stamps in the accident certificate Take copies of the decision or protocol Submit the documents to the insurance company within 5 working days

Receive a referral to an authorized service or money 5 working days after submitting the application

Notification of an accident

The notification of an accident is filled out at the scene of the accident - it contains information about which of the drivers is the culprit and which is the victim. Accident notification forms are issued by the insurance company every time the MTPL policy is reissued, so it is advisable to always carry at least one copy of this document with you. In fact, a notification of an accident is the only document that is filled out when filing an accident yourself. One of its most common names is “Europrotocol”. A notification of an accident must be filled out in all cases, regardless of whether the traffic police is involved in the registration or not - this will simplify the procedure for receiving payment from the insurance company.

When you can do without the participation of traffic police officers In some cases, drivers can do without the help of a traffic inspector. In Art. 11.1 of Federal Law No. 40 provides the following circumstances under which an accident can be recorded without involving the traffic police, namely: • if the accident caused damage only to vehicles and (or) their trailers; • only when registering an accident that occurred due to a collision between two vehicles; • none of the drivers, passengers or pedestrians were injured as a result of the incident; • the participants in the accident have no disagreements regarding the circumstances of the accident and the nature of the damage; • if the amount of damage does not exceed 100 thousand rubles; • both drivers have a valid MTPL policy.

If participants in an accident have the opportunity to record information about an accident using the special RSA mobile application “Road Accident Europrotocol” or technical control means that transmit information to the AIS OSAGO (GLONASS device), then the Europrotocol can also be issued - even if there are disagreements between the participants in the accident, but only if the amount of damage does not exceed 100 thousand rubles, - if the amount of damage ranges from 100 thousand rubles to 400 thousand rubles but in the absence of disagreements between the participants in the accident.

After filling out and signing the document about an accident by both parties, both copies of the notice are sent to the insurance companies where each of the participants in the accident is insured within 5 days. The victim must attach to his copy a statement of direct compensation for damages.

In what cases is the participation of a traffic police officer mandatory? The participation of traffic police officers in the registration of an accident is necessary in cases: • if the accident causes harm to life and health (even the slightest bruise or scratch on one of the participants in the accident is a reason to contact the traffic inspectors to register the accident) • participants cannot come to mutual agreement because they have different views on the causes, circumstances and outcome of the accident. At the same time, sometimes a traffic police officer gives recommendations regarding the collection of evidence to both drivers over the telephone and invites them to the department to clarify the details; • more than 2 vehicles are involved in an accident; • other property is damaged (building, pole, road sign, etc.); • the victim believes that more than 400 thousand rubles will be required to restore the vehicle; • one of the participants in the accident does not have valid MTPL insurance or owns a CASCO policy, the terms of which require an examination by traffic police officers.

Rules for filling out a notification about an accident Drivers fill out the European protocol form one by one - each fills out their part of the notification. The document contains information about insurance companies, the date and place of the accident, information about the insurance of participants, the circumstances of the accident and a description of the damage received. On the reverse side, drivers can further describe the details of the incident. A sample of a completed notice and features of its completion. It is better to fill out the document with a ballpoint pen - the pencil is easy to erase, and gel ink smears and does not print well on self-copying paper. All questions given in the document must be answered: put a tick or cross in the appropriate cell and draw a dash or cross out lines that are not related to the incident in this particular case.

Simplified registration of road accidents Questions and answers about registration of road accidents according to the “Euro Protocol” on the RSA website autoins.ru

Accident Notification form autoins.ru/

What are the deadlines for submitting documents to the Investigative Committee?

A fixed deadline for contacting the insurance company after an accident is an extremely important stage in receiving payments under compulsory motor liability insurance. It is worth remembering that in case of delay, the entire procedure can become significantly more complicated and prolonged. But if you strictly follow the standards disclosed in clause 42 of the policy rules, then the driver is obliged to notify his organization as quickly as possible. The maximum period for filing an accident report should not exceed 5 days from the date of the accident. But these 5 days are only the period for submitting an official application when registering an accident under the European Protocol. While a similar registration of an accident by traffic police officers allows you to count on payments even after 3 years.

What documents do I need to provide?

Since the payment of required insurance payments is rather of a declarative nature, it is impossible to do without collecting the necessary papers and information about the accident. According to standard requirements, the following documents are most often needed:

- car owner's passport;

- application for payment;

- certificate of accident with a list of damages;

- driver's license;

- TIN and registration certificate for the car;

- copy of the insurance policy.

Much less often, an additional list may be required, including:

- Power of attorney for a vehicle (instead of a certificate).

- Protocol on the offense.

- Resolution on the case of an offense.

- The fact of evacuation and storage of a car after an accident.

If you have decided to conduct an independent assessment of the damage, you will need to draw up an expert report with the assessment results and obtain confirmation that this inspection has been carried out. It is advisable to make copies of all mentioned papers.

Deadlines for submitting documents to the insurance company

If the accident was registered with the involvement of traffic police officers, limited periods are not provided for by law and the victim has the right to apply at any time to receive insurance compensation. But in any case, it is better to adhere to reasonable deadlines and coordinate your actions with representatives of the insurance company

The period of 5 working days is established in case of registration of an accident without traffic police officers, i.e. when drawing up the so-called European protocol. This is essentially the main document that needs to be executed, and it will be considered evidence of a traffic accident. It is expected that within five days the applicant must submit it to the insurance company along with the application.

This is provided for in Art. 11.1 Federal Law “On Compulsory Motor Liability Insurance” clause 2. In case of registration of documents about a traffic accident without the participation of authorized police officers, the notification form for a traffic accident, filled out in duplicate by the drivers of the vehicles involved in the traffic accident, is sent by these drivers to insurers who insure their civil liability, within five working days from the date of the road traffic accident.

The victim sends to the insurer who insured his civil liability his copy of the jointly completed notification form about the road traffic accident along with an application for direct compensation for losses.

What happens if you don't apply on time?

If the application deadline is missed (for example, later than 5 days), the insurer has the right to legally refuse payment. The fact of withdrawal of compensation after an accident will be provided in writing. But there are situations when the standard period can be extended on a general basis. Only for this purpose it is worth providing certain documentation that confirms the circumstances due to which there was an unexpected delay in reporting an accident:

- certificates from the hospital (if the citizen was seriously injured);

- travel document;

- tickets or copy of hotel reservation on vacation;

- confirmation of the investigation into the incident.

It is possible to submit the application and duplicate papers in a timely manner by mail or courier delivery. Based on the explanations provided to the company, it is possible to increase the initial period of treatment after an accident under compulsory motor liability insurance (from 5 days to several months).

In the absence of the listed documents, the issue with the deadline can only be resolved in court.

Who can claim insurance benefits?

In order for the culprit of an accident to be able to figure out whether he is entitled to standard payments under compulsory motor liability insurance or not, it is necessary to assess the type of accident.

Sometimes financial support is allowed only if the incident was recognized as mutual (when both drivers are equally to blame, then the party whose fault is less will receive more funds).

In other cases, when there was no refusal to consider the application, then in case of an accident, insurance is paid to the following persons who were physically injured:

- The owner of the car (even if another person was driving).

- The owner of the power of attorney for compensation from the owner of the car.

- Relatives or relatives of the deceased driver.

When both participants in an accident have only a compulsory motor liability insurance policy correctly issued, only the injured party can claim payment of insurance funds , but the culprit of the accident cannot. But the second citizen has the right to count on partial compensation if, in addition to compulsory motor liability insurance, he purchased a CASCO policy (the contract must contain a clause covering such a case from the legal side).

What other responsibilities do you have after an accident?

One important subtlety should be noted here, which is expressed in a significant flaw in the legislation in 2021 and is not directly related to obtaining compensation, however, it directly affects the possibility of losing rights.

The point is the registration of the accident itself and the ability to leave without calling the traffic police and drawing up a European protocol. Clause 2.6.1 of the Traffic Regulations allows this to be done, but under one important condition: if the conditions for issuing a European protocol from the Law on Compulsory Motor Liability Insurance are met.

That is, you can simply drive away after an accident without calling the traffic police or filling out a European protocol, but only if the conditions for filling out a notice are met. For example, if one of the participants did not have a compulsory motor liability insurance policy, then you are obliged to call the police. Otherwise, an offense will be formed under Part 2 of Article 12.27 of the Code of Administrative Offenses of the Russian Federation with deprivation of rights for up to 1.5 years.

In addition, when registering a European protocol, the person at fault for an accident cannot repair the car for 15 calendar days, except for non-working holidays, after the event, and the obligation remains to provide it at the request of the insurer within 5 working days after receiving such a request and after this period (but it is possible already repaired ). This is what paragraph 3 of Article 11.1 of the law says.

Why may insurance benefits be denied?

The list of serious reasons why an insurance company legally refuses to pay a client insurance under a compulsory motor liability insurance policy includes cases when the driver:

- intentionally damaged his vehicle;

- committed a crime that resulted in an accident;

- did not send the application within 5 days;

- forgot to fulfill obligations to establish the causes of the accident;

- did not provide traffic police officers with access to the car.

In order to avoid further misunderstandings between the car owner and the company, it is worth remembering that under the terms of the deal, the policy holder must keep his car in the condition in which it was after the accident. Some drivers neglect this rule, which results in violations of the standard terms of the contract.

The owner of the car has the right to challenge the presented decision through a lawsuit within 3 years, as well as file a complaint with the RSA. This can be done using a simple algorithm in 2 stages:

- File a formal claim with the insurer. When the victim is not satisfied with the amount of compensation or the company refuses to carry out the request altogether.

- Submit the claim to court. If the period for consideration of a pre-trial claim (20 days) against the company expires, then the driver can legally go to court.

Without an initial attempt to resolve the conflict with the company on an individual basis, the citizen’s claim will be denied. Based on the latest innovations in the law, the injured party is obliged to first file a claim with the company that issued the MTPL policy, and only then prepare applications to subsequent authorities.

How much time is given to apply?

Under MTPL insurance, you can compensate for damage caused to a vehicle or other property, harm to the life and health of citizens. Regardless of the type of damage and harm, the deadlines for submitting documents to the insurance company, claims and claims will be the same.

Find out more How the payment period for compulsory motor liability insurance is determined

When to apply within five days

The requirement to submit a notification of an accident within five days is expressly stated in the MTPL Rules and the contents of the policy. This period is given for paperwork at the scene of the accident and for victims to go to medical institutions. In addition, the insurer’s office may be located outside the place where the accident was registered, so those involved in the accident are given 5 days to comply with all formalities.

Here is how the five-day rule is observed when applying for compensatory motor vehicle liability insurance:

- the victim must submit a notice within up to five days in order to receive payment under the Europrotocol program (if this condition is violated, a refusal may be issued);

- if the notification was issued with the participation of traffic police officers, it is also necessary to transfer the documents to the insurer within 5 days (however, missing this deadline does not deprive the right to payments);

- the person at fault for the accident must notify his insurance company within 5 days, otherwise he will be subject to a recourse claim.

The Europrotocol program allows you to receive compensation under simplified rules. For this reason, the five-day period must be observed, otherwise the general payment procedure will apply. For the person at fault for delay in application, liability may arise in the form of a recourse claim.

In what cases do you need to contact your insurance company within 3 years?

The settlement of disputes in the insurance industry is subject to the general rules of limitation of actions of the Civil Code of the Russian Federation. If the insurance company refuses to pay you, or the amount of compensation is underestimated, you can achieve forced collection within three years. Here are the nuances that need to be taken into account in order to comply with the requirements of the law:

- even if the five-day deadline for contacting the insurance company is missed, this does not invalidate the general statute of limitations of 3 years;

- the statute of limitations for going to court begins to run from the moment of the accident, or from the moment the insurer refuses;

- The three-year period includes not only filing claims with the insurance company or a statement of claim in court, but also contacting the financial ombudsman.

Find out more I drank after an accident, what happens?

Judicial practice confirms that missing the five-day filing period does not deprive the right to receive MTPL compensation . However, the insurer will most likely refuse voluntary compensation, so the dispute will have to be resolved through the financial ombudsman and the court. In case of any controversial issues, it is advisable to consult an experienced insurance lawyer who will assess the situation and give recommendations on further actions.

If payments under compulsory motor liability insurance are delayed

If, having conscientiously fulfilled its obligations under the compulsory motor liability insurance agreement (providing a full set of papers and a car for inspection), the insurance company is not going to pay the required compensation within the legal period, you should send them a claim. Such a document is drawn up in free form, but in the text you should definitely indicate the policy number, the date of the accident and the date of filing the application, as well as put forward a requirement for the speedy implementation of compensation and, in addition, penalties.

The company is given exactly 20 days to review such a package of documents. If this period increases, then for each day of delay the insurer is also obliged to pay a penalty of 1% per day of the total amount of damage (if the delay in payment is not complicated by the results of the inspection). And when complaints arise about the work of the company itself, the client has the right to call RSA with a complaint.

How to make an application for insurance payment?

One of the mandatory stages of obtaining compensation under compulsory motor liability insurance after an accident is writing an application. It can be sent by registered mail to the insurer’s office or visited in person and written on the spot. A standard application form has not yet been established, so it is written in free form. But the following information must be mentioned:

- full name of the director;

- your passport details, full name and contacts;

- the amount of compensation requested;

- details for transferring funds;

- applicant's signature and date.

If you apply in person, you can pick up an application form at the company’s office and clarify all the points of interest . Along with the incoming application, you must also attach a standard package of documents. But if it is not the policy owner himself who contacts the insurer, but his representative, then in addition a power of attorney certified by a notary will be required.

How to properly notify about an insured event under compulsory motor liability insurance?

When registering an accident with police officers, paragraph 2 of Article 11 of the law does not establish in any way the form of notification to the insurer, nor the procedure, nor even specific deadlines, indicating only that this must be done as soon as possible.

Thus, formally, you can report an accident by phone, email, and even by SMS or WhatsApp or using other instant messengers.

But the main thing here is to remember the most important thing: in order to avoid consequences (which, as we found out above, in practice in 2021 there will almost never be) you must have evidence of this action.

The following methods are suitable for this:

- make a phone call only to the official number of the insurer (its branch), so that you can then get call details from your operator,

- a written notification of an accident, which you will hand over in person to the office, either in 2 copies, where one will be given back to you with a stamp confirming the acceptance of the second copy, or with a video recording,

- written notification, but sent by mail with a list of attachments and notification of delivery.

But in the case of drawing up a European protocol, the MTPL Rules clearly indicate how to notify the insurance company about an accident. This must be done by giving the original copy of your notice (European protocol) to the insurer. Here you should also remember to prove that you handed over the document.

If the European protocol is drawn up electronically?

In this case, information about the accident, as well as the electronic notification form, is submitted electronically automatically (paragraph 2 of clause 3.8 of the MTPL Rules) when you complete the registration of the accident in the application.

However, you still won’t have confirmation of sending the European protocol, so we recommend at least taking screenshots of the application while registering the accident.

How much can I receive a payment?

The MTPL policy has clearly defined limits, which are specified in Art. 7 of Law No. 40 “On compulsory insurance of civil liability of vehicle owners.” Therefore, the driver can count on compensation in:

- 400 thousand rubles, if only the car was damaged during the accident.

- 500 thousand rubles if damage is caused to both the car and the owner of the car.

In any case, the final amount of compensation is determined by an assessment of the damage, which will be carried out personally by a representative of the insurance company. If the client considers the compensation under compulsory motor liability insurance to be underestimated, then he has the right to contact independent experts and order a re-check. And when the company refuses to cover the cost of the damage at all, the driver must file a corresponding claim in court.

How long can it take to settle without going to court?

There is a misconception among car owners that compulsory MTPL insurance does not allow them to claim the required amount from the person responsible for the accident.

But such suspicions are not justified, because they often arise due to underpayments by insurance companies of the required compensation.

And few drivers also know how to go to court against the second participant in an accident for full compensation. In fact, you can file a claim in court when:

- the amount of insurance under compulsory motor liability insurance does not cover the entire amount for repairing the victim’s car, and the restoration work turned out to be higher than the limit promised under the compulsory insurance legislation;

- the driver who is at fault for the accident does not have an MTPL insurance policy at all, or the validity period of the said agreement has expired, and the agreement has been declared invalid or counterfeit, which is similar to its absence;

- There were more than 2 people involved in the road accident, so the insurance is divided by the company between all drivers, so to cover the resulting damage or harm to health, the final amount may simply not be enough for all the victims;

- there is psychological pressure, insults, discrimination, threats and other manifestations of moral harm, which a priori are not covered by insurance organizations because this is not taken into account under compulsory motor liability insurance as an insurance risk;

- the victim was performing his official duties at the moment when he got into an accident - so he has the right through the court to recover lost profits in the form of part of his earnings, which falls during the period of the accident, proceedings and hospitalization for injury;

- the culprit of the accident has not been identified in a timely manner and there are certain difficulties associated with finding one of the drivers, and this also includes emerging disputes between the parties and the insurer;

- significant damage to the victim’s vehicle was caused not while driving (the policy does not cover these risks by law), but during downtime (for example, when a car parked in a parking lot was hit).

While the insurance company or forensic expert is calculating the total amount of damage, the wear and tear of the car will still be taken into account. It is worth considering that installing additional equipment or improving modifications at the expense of the culprit is considered illegal. When a company does not pay additional compensation, the victim should file a lawsuit not against the culprit, but against the company itself.

How to write an application to the insurance company

You can submit an application to one or another insurance company in handwritten or printed form.

The text should reflect in detail the most important points of what happened:

- At the top right is the name of the company where the applicant is applying.

- From the passport, personal data of the person is entered, as well as the names of witnesses, eyewitnesses with their contact numbers.

- The circumstances of the incident and the actions of each party are described in as much detail as possible.

- The list of damage sustained by the vehicle and the health of the victim is indicated at the time of the accident.

- The requirement for insurance payment is necessary to cover damage to the car and health.

You don't have to write the text yourself. Thematic sites contain samples with tips or already filled with approximate content. Therefore, in this situation, you just need to concentrate so as not to confuse the numbers in the numbers or not to forget to indicate an important detail.

It is not always possible for participants in a collision to collect and submit a package of documents on their own. But the law is inexorable, and you need to do it within 5 days. In this case, it is possible to apply not in person, but through a representative. However, in this case, you will have to incur additional costs for registering a power of attorney with a notary.

We invite you to familiarize yourself with: A copy of the ruling on leaving the statement of claim without progress

In the case of insurance under compulsory motor liability insurance, the insurer may prescribe in its rules certain periods within which victims can apply for insurance payments. But many car owners do not comply with these deadlines: they apply a year and a half after the accident. And this is not a basis for refusing insurance payment, because...

Dear readers! In our articles we consider typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, please contact us through the online consultant form on the right or call us by phone Moscow, Moscow region St. Petersburg, Leningrad region8Other regionsOnline consultant{amp}gt;{amp}gt;It's fast and free!

The following terms are regulated under MTPL agreements:

- The at-fault driver, when registering an accident without police officers, is obliged to send a notice of the accident to his insurer within 5 days from the date of the accident, the victim must send this notice along with an application for insurance compensation within the same time frame.

- The victim, within 5 days from the date of contacting the insurer, is obliged to provide the vehicle for inspection and an independent examination.

There are no other deadlines for claims related to insured events.

At the same time, there are clarifications: if the victim files a claim with documents substantiating his claims, then the limitation period is suspended for 10 days from the date of receipt of the claim.

An example from judicial practice. The legal entity was denied claims to collect insurance compensation due to missing the statute of limitations. The accident occurred on January 12, 2015. In 2021, the plaintiff filed a lawsuit to collect insurance compensation, but indicated the wrong defendant.

What changes have been made to the legislation?

In 2021, the Central Bank made significant amendments to the law on compulsory motor liability insurance, which allegedly stipulates an increase in the cost of services by 20% and changes in the procedure for calculating the coefficient. Thanks to a fundamentally new approach to calculating payments, in the future it will be possible to regulate the cost of compensation. The first adjustments to insurance began to appear in 2021, but the final reform is planned only by 2021.

| Did not find an answer to your question? Call a lawyer! Moscow: +7 (499) 110-89-42 St. Petersburg: +7 (812) 385-56-34 Russia: +7 (499) 755-96-84 |

Therefore, in addition to the question about the deadline for submitting documents to the insurance company after an accident under compulsory motor liability insurance, citizens need to take into account the latest changes. The new version of the law allows recourse to the insurer in case of an accident involving 3 or more cars, although the earlier version of the law did not allow this. If the driver acts correctly and remembers his rights, he will receive the required financial assistance in full without any delay.

What are the consequences in 2021?

In almost all cases, absolutely none. But it’s not for nothing that we divided the method of registering an accident above - it is in this case that the consequences may differ. But let's consider in order whether there can be anything in the form of responsibility!

Refusal to pay?

Almost all legal options for refusing payment to a victim are listed in section 12 of the law. So, the reasons could be:

- failure to provide the victim's car for inspection to the insurance company,

- failure to provide a complete set of documents to receive compensation,

- if you contacted the wrong insurance company (for example, you went to file a claim with yours when there were victims in an accident and you had to go to the culprit’s insurer)

- and a small number of other cases.

However, none of the above reporting obligations is a legal reason to deny benefits in 2021. You simply will not find such reasons in the current legislation. Therefore it will be illegal.

Thus, if you are the injured party in an accident and did not have time to send the European report to the insurance company within 5 working days, then there cannot be a refusal on this basis alone. In fact, you can apply for payment within the general limitation period of 3 years.

Traffic fine?

And administrative penalties also do not threaten drivers who fail to fulfill the obligation to report an accident to the insurer.

All such sanctions are regulated by the relevant Code of Administrative Offences. Chapter 12 contains the rules of liability in the field of road traffic. And it contains only one article regarding compulsory motor liability insurance - 12.37, which provides for a fine for the absence of compulsory motor liability insurance or if the driver is not included in the current policy. But you won’t find penalties anywhere for failing to notify the insurance company after an accident.

Recourse claim from the insurance company

But this consequence can quite realistically occur. Recourse is the insurer’s requirement that you, if you are the culprit of the accident, pay him the entire amount that was compensated to the victim. That is, the insurer does not refuse compensation (it does not have such a right), but pays everything. But then he has the right to claim the full amount from the culprit.

However, such responsibility is becoming less and less common in practice every day. Let's explain what's going on here.

There is also Article 14 of the Federal Law on Compulsory Motor Liability Insurance, paragraph 1 of which contains all the circumstances in the presence of which an insurance organization has the right of recourse. These include, for example, hiding from the scene of an accident or if the culprit was drunk. But where did the failure to inform the insurer about the accident come from?

The fact is that for a long time this norm contained a subparagraph “g”, which in 2021 lost its legal force. This happened on the basis of the Law on Amendments No. 88. It was paragraph “g” that gave insurance companies the right to recover the entire amount paid to the victim from the culprit if he did not correctly notify his company about the accident and provided that the incident itself was documented using a European protocol.

Specifically, the loss of force of this paragraph occurred on May 1, 2019. But MTPL agreements concluded before this date were also subject to the law before the amendments were made. Therefore, for culprits with policies before the specified date, subparagraph “g” is relevant. But today there are no more of them left (despite the fact that the insured event under such insurance could have been until a maximum of April 30, 2021).

Therefore, in 2021, for failure to comply with the requirement of the culprit of an accident to inform the insurance company about the event, there is no fine or recourse, nor does the insurer have the right to refuse compensation to the victim in such circumstances.

Expert opinion

Dmitry Tikovenko

Automotive law expert. 7 years of experience. Areas of specialization: civil law, disputes over compulsory motor liability insurance and road accidents

Those who may be affected by regression under paragraphs. "g" clause 1 art. 14 of the Law on Compulsory Motor Liability Insurance for failure to submit a European protocol by the culprit of an accident, less and less every day. After all, the clause was removed on May 1, 2021, and the policies that were valid at that time have already expired for everyone.

But insurers, not wanting to miss the opportunity to make money, still file claims against the culprits within the statute of limitations both one year and 2 years after the accident. It is important to remember that the insurer has a right of recourse for policies that were concluded before May 1, 2021. The date of the accident does not play a role here.

If you receive such a claim, do not pay immediately, try to get the insurer to deny the claims.

Ask a Question