What does direct compensation for losses under OSAGO mean?

Direct compensation for losses means that the driver does not have to contact the company where the person at fault received insurance. With this approach, the victim has the right to request payments by contacting the company where he executed his MTPL agreement.

What is an alternative PPV under compulsory motor liability insurance?

Showing concern for car owners who suffered losses from a collision, the authorities passed a law giving the applicant the opportunity to independently choose an insurance company to receive compensation. Thus, the victim could use both the classic option of receiving payments from the company that insured the culprit, and the alternative option of contacting his own company.

However, the adopted law did not bring the desired results. Not very conscientious insurers used it as a loophole to “football” clients. Having presented a lot of arguments, the truth of which is difficult for an inexperienced client to verify, he was redirected to another insurance company. The process could be repeated there too. Instead of the expected simplification, the situation took a completely opposite direction.

There were also cases in which the victim submitted applications to both insurance companies at once in the hope of double payments.

The right of the victim to independently choose a company to receive compensation for the restoration of a damaged car is called an alternative PPV under compulsory motor liability insurance.

What is a non-alternative PPV in compulsory motor liability insurance?

In 2014, the law on payments underwent global changes. To resolve the situation, the authorities determined the only possible way to receive payments from the insurance company after the accident.

After innovations, you should apply for compensation only to the company with which the contract was concluded. The ambiguity in the relationship between the victim and the insurer was eliminated, along with the possibility of choice.

The payment method, when an application for compensation is submitted to the office of the company with which the contract was concluded, is called the non-alternative PPV OSAGO.

What else to read:

- My car was scratched in the yard, what should I do?

- Europrotocol 2021

- How to get money instead of repairs under compulsory motor liability insurance: a detailed review

For what reasons can PES be denied?

The injured party's insurance company has the right to deny direct compensation to its client. This happens for the following reasons:

- The application was submitted to the Investigative Committee of the person responsible for the accident;

- When drawing up the accident report, traffic police officers were absent, as a result of which errors were made in the forms, and there were discrepancies in the damage statements;

- The injured party demands compensation for lost profits or moral damage;

- A traffic accident occurred during an exercise, competition or test.

- The application was submitted more than 15 days after the accident;

- A trial is underway to identify those responsible for the incident;

- The participant in the accident has “Green Card” insurance, and not a compulsory motor liability insurance policy.

What does the law say about PPV under compulsory motor liability insurance?

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 (495) 980-97-90(ext.589) Moscow,

Moscow region

+8 (812) 449-45-96(ext.928) St. Petersburg,

Leningrad region

+8 (800) 700-99-56 (ext. 590) Regions

(free call for all regions of Russia)

The updated Federal Law on Compulsory Motor Liability Insurance, for which direct compensation for losses is assigned to the company of the victim's insurer, is the main act regulating insurance payments. Law No. 40 “On Compulsory Insurance” strictly defines the order of relationships:

- for insurance companies - in what situation, which company bears the costs;

- for the client - the conditions for contacting a particular company.

Also, direct compensation for damages from compulsory motor liability insurance is indirectly influenced by:

- Articles 186, 366, 325 of the Civil Code of the Russian Federation - on issues of financial relations;

- Chapter 55 of the Civil Code of the Russian Federation - annex to the Agreement for members of the Union of Insurers;

- Order of the Ministry of Finance of 2009 is the basis for the development of general norms of Federal Law No. 40.

The introduction of updates allowed:

- stop fraudulent machinations of insurers and unscrupulous clients;

- eliminate the ambiguity of existing legislation;

- make the payment procedure easier;

- exclude unjustified refusals by the insurance company to pay the client;

- reduce the period for receiving compensation.

Conditions for non-alternative direct compensation under MTPL

The new legislation allows the victim to undergo a simplified procedure for compensation for damage by contacting the insurance office where he executed the contract. This opportunity is provided if the approved conditions of the compulsory motor insurance policy are met:

- no more than two cars were damaged, one of which belonged to the victim, and the second belonged to the initiator of the incident;

- the participants in the accident have no injuries requiring medical intervention;

- Both drivers have MTPL policies;

- The traffic police report clearly indicates the culprit of the accident.

Once you make sure that the necessary requirements are met, you can receive direct compensation under OSAGO.

The necessary conditions

It would seem that everything is clear, but not everything is so simple. In order to qualify for a PES, a number of mandatory conditions must be met. This compensation is possible in cases where:

- damage to vehicles was received directly in an accident;

- 2 were involved in the traffic accident (from 2021 - 3 or more cars, the norm is valid from September 2021);

- the participants in the accident have valid compulsory motor liability insurance policies, otherwise (if the document is expired or missing) the damage is compensated in court by the person responsible for the accident;

- damage was caused only to cars, and not to other property, there were no injured persons;

- Each of the insurers is licensed and a PES Agreement has been concluded between them.

According to Art. 14.1 of the Federal Law “On Compulsory Motor Liability Insurance”, only compliance with these conditions together gives the right to a PPV, for which the victim must submit to the Investigative Committee all the necessary documents, including a protocol from the traffic police, etc. If at least one of the listed points is not is met, then you will have to act according to the previous scheme, that is, contact the Investigative Committee of the guilty person.

In what cases can payment be refused?

Refusal to pay and direct reimbursement are completely different concepts. A company has the right to send a notice of refusal to pay if there were gross violations when submitting documents or attempts to imitate an accident. The most common legitimate reasons for denial of payments include:

- incomplete package of documents;

- lack of a valid policy;

- attempting to obtain compensation for damaged art objects;

- violation of application deadlines;

- details for crediting funds are not specified;

- False information about the situation was provided.

Justified refusal in PES

Denial of direct compensation implies that the victim will still receive insurance payments, but a simplified method is not available to him. Reasons for refusal confirmed by law include:

- the insurance company of the accident initiator has gone bankrupt or lost its license;

- the company that insured the culprit did not take part in signing the agreement on simplified payments;

- contacting a company representative office instead of the main office;

- the victim filed a claim for payments to both companies at once;

- errors were made when applying for the policy;

- the protocol does not indicate a specific culprit of the accident or several are indicated;

- the European protocol is filled with gross violations;

- the vehicle was repaired before an expert assessment of the damage was carried out;

- there are casualties in the collision;

- more than two cars were damaged;

- The insurance specialists were not able to inspect the car within the established time frame.

Reference! Direct compensation for losses under compulsory motor liability insurance is impossible if any of the established reasons occur.

Unreasonable refusal

When an insurance claim is received that involves a large amount of payments, the company does its best to get rid of the client. Commonly used reasons for unlawful refusal include:

- this law does not apply in our organization;

- We have too many applicants, contact the initiator’s company;

- Now there are temporary financial difficulties, bring your application later.

None of these reasons is a legal basis for refusal. An insurance company that uses such methods is flagrantly violating the law.

In this case, the victim must request a written refusal indicating the reason. Based on the issued document, you should contact the RAS and, possibly, the court.

Conditions under which PES is permitted

In accordance with Art. 14.1 40-FZ PVU is allowed if the accident that occurs meets the following conditions:

- there was a collision between two or more vehicles (including those with trailers);

- all participants have valid MTPL policies;

- Only the vehicle was damaged (no harm was caused to life or health).

Note! To contact your insurance company, you must comply with all of the above conditions simultaneously.

However, direct payment is not possible if:

- the application has already been sent to the culprit’s Investigative Committee;

- participants in an accident drew up a European Protocol without calling the State Traffic Inspectorate, but filled it out incorrectly or entered incomplete data;

- a claim has been made for compensation for moral damage or benefits lost as a result of the accident or harm to the environment;

- the accident occurred as a result of training riding, testing or competition;

- damaged antiques, securities, items of a religious nature or intellectual property (for example, a manuscript);

- the fact of non-compliance with traffic rules is disputed in court;

- deadlines for notifying the insurance company about the occurrence of an insured event were missed;

- other situations provided for by the agreement of the union of insurers.

You also need to take into account other nuances of the PES:

- It is impossible to receive payment from your insurance company if the submitted documents contain incorrect information (providing false information is one of the legal grounds for refusing payment).

- The victim can contact his insurer, regardless of whether he is the policyholder or not (the main thing is that he is included in the policy). Previously, to obtain a PPV, it was necessary that the applicant was also the owner of the car.

- If the amount of damage does not exceed 50 thousand rubles, and the number of participants in the accident is no more than two, a PVU is possible under the European Protocol without calling the State Traffic Inspectorate (provided that the document is drawn up correctly).

How to receive direct compensation for losses under compulsory motor liability insurance in 2021

Registration of a PES occurs in several stages. At each of them, it is important to avoid mistakes that will give the insurance company a reason to refuse. In general, the procedure for receiving direct compensation does not differ significantly from regular payments for an insured event and includes:

- collection of documents after an accident;

- transfer of the collected package to insurance employees;

- verification of the information provided by company employees;

- examination of vehicle damage;

- transfer of funds to the client's current account.

What documents to provide in order to receive direct compensation for damages from compulsory motor liability insurance?

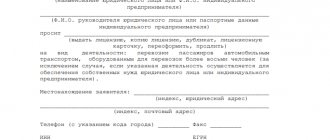

The set of papers required to receive services under a simplified procedure, in addition to the application, includes documents without which the application will be rejected. The package includes:

- passport of a citizen of the Russian Federation belonging to the applicant;

- permission to drive a certain type of vehicle;

- OSAGO;

- notification of an accident;

- confirmation of the guilt of one of the drivers from traffic police officers;

- checks and receipts for services paid in connection with the incident;

- details for transferring funds.

If the conduct of the case is entrusted to a lawyer, it is necessary to provide a power of attorney certified by a notary.

How to make an application for direct compensation under OSAGO

The application can be written either in free form or on the insurance company’s letterhead. It is better to clarify the correct form of writing directly at the company’s office. Many significant insurers provide a form to fill out when you submit a package of documents.

In most cases, forms are provided online. To download an application for direct compensation for losses under MTPL, you need to go to the official website of the insurer. If you don’t find the form on the website, it’s better to call the insurance company and find out if you can limit yourself to writing it by hand.

In any case, the application must be written in compliance with all the rules established for documents of this type. If any information is missing, the application will be returned for revision, and the victim will lose more time than planned.

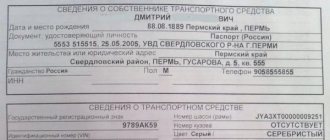

The document states:

- full name of the company with which the insurance contract was concluded;

- information about the client’s place of registration and actual residence;

- Full name of the victim;

- telephone for communication;

- a detailed description of the accident that occurred (date, location, accompanying circumstances, nature of the impact);

- structures that were notified or took part in the registration of the accident;

- Full name of the accident initiator;

- information about his car;

- number of the MTPL policy belonging to the culprit;

- information about the damaged vehicle;

- applicant's policy;

- the amount of expenses associated with the accident (payment for a tow truck, expert...);

- applicant's signature;

- date and signature of the employee who accepted the documents.

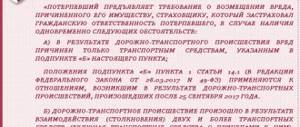

According to the law on compulsory motor liability insurance, the victim, depending on the circumstances, has the right to demand compensation for damage either from the insurer that insured the liability of the culprit of the road traffic accident (hereinafter referred to as the accident), or from the insurer that insured his (the victim) motor third-party liability (direct compensation for losses).

Insurance indemnity and direct compensation for losses

In accordance with Article 12 of the law on compulsory motor liability insurance, the victim has the right to present to the insurer a claim for compensation for damage caused to his life, health or property when using a vehicle, within the limits of the insured amount, by submitting to the insurer an application for insurance compensation or direct compensation for losses...

An application for insurance compensation in connection with harm to the life or health of the victim is sent to the insurer that insured the civil liability of the person who caused the harm. An application for insurance compensation in connection with damage to the property of the victim is sent to the insurer that insured the civil liability of the person who caused the harm, and in the cases provided for in paragraph 1 of Article 14.1 of the law on compulsory motor liability insurance, an application for direct compensation for losses is sent to the insurer that insured the civil liability of the victim.

Direct compensation for losses is compensation for damage to the property of the victim, carried out by the insurer who insured the civil liability of the victim - the owner of the vehicle (Article 1 of the law on compulsory motor liability insurance).

In other words, for compensation for property damage caused to you as a result of an accident, you should contact the insurance company where you insured your auto liability, and not the insurer that insured the liability of the person causing the harm.

Conditions for direct compensation

You can apply for insurance compensation to “your” insurer if certain conditions are met.

The victim makes a claim for compensation for damage caused to his property to the insurer who insured the civil liability of the victim, if the following circumstances exist simultaneously:

- a) as a result of an accident, damage was caused only to the vehicles specified in subparagraph “b” of this paragraph;

- b) the accident occurred as a result of the interaction (collision) of two or more vehicles (including vehicles with trailers), the civil liability of the owners of which is insured in accordance with the law on compulsory motor liability insurance (Article 14.1 of the law on compulsory motor liability insurance).

That is, compensation for losses is made by the insurer who insured the victim’s civil liability if the following conditions are met:

- if, as a result of an accident, damage was caused only to vehicles. If harm is caused to the life or health of the victim, insurance compensation is made by the liability insurer of the tortfeasor;

- if the civil liability of the owners of vehicles involved in an accident is insured in accordance with the law on compulsory motor liability insurance (the participants in the road accident have a compulsory motor liability insurance policy).

See also paragraph 1 of Article 14.1 of the Law on Compulsory Motor Liability Insurance with comments and paragraph 1 of Article 12 of the Law on Compulsory Motor Liability Insurance with comments).

Explanations of the Supreme Court of the Russian Federation on direct compensation for damage

In paragraphs 25 – 29 Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 N 58 “On the application by courts of the legislation on compulsory insurance of civil liability of vehicle owners” contains the following explanations:

Conditions for direct compensation

If vehicles are damaged as a result of their interaction (collision) and the civil liability of their owners is compulsorily insured, insurance compensation is carried out on the basis of paragraph 1 of Article 14.1 of the Law on Compulsory Motor Liability Insurance by the insurer that insured the civil liability of the victim (direct compensation for damage).

Direct compensation for damage in case of an accident involving more than two vehicles

If an accident occurred before September 26, 2017 as a result of the interaction (collision) of more than two vehicles (including vehicles with trailers), insurance payment in the form of direct compensation for losses on the basis of Article 14.1 of the MTPL Law is not made.

Causing harm to life and health excludes direct compensation for damage

Insurance compensation in connection with damage to the life and health of the victim is not provided for direct compensation of losses (paragraph two of paragraph 1 of Article 12 of the Law on Compulsory Motor Liability Insurance).

If the tortfeasor is not insured under compulsory motor liability insurance, direct compensation for losses is not made.

If the civil liability of the tortfeasor is not insured under a compulsory insurance contract, insurance compensation in the form of direct compensation for damage is not made. In this case, the damage caused to the property of the victims is compensated by the owners of vehicles in accordance with civil law (Chapter 59 of the Civil Code of the Russian Federation and paragraph 6 of Article 4 of the Law on Compulsory Motor Liability Insurance).

Who compensates for harm to life and health if the person causing the harm is not insured under compulsory motor liability insurance?

In this case, the harm caused to the life and health of the victims is compensated by the professional association of insurers (the Russian Union of Auto Insurers) by making a compensation payment, and if it is insufficient to fully compensate for the harm, by the cause of the harm (Chapter 59 of the Civil Code of the Russian Federation and Article 18 of the Law on Compulsory Motor Liability Insurance).

The insurer of the tortfeasor compensates for damage to health that the victim was previously unaware of.

The victim, after exercising in connection with damage to the vehicle the right to direct compensation for losses, has the right to apply to the liability insurer of the person who caused the damage, with a claim for compensation for damage to life and health that arose after the presentation of the claim for direct compensation for losses and which the victim did not know about at the time presenting such a requirement (clause 3 of Article 14.1 of the Law on Compulsory Motor Liability Insurance).

Compensation for damage in the event of bankruptcy or revocation of the license of the victim’s insurer

The victim, who has the right to direct compensation for losses, in the event of bankruptcy procedures being introduced against the insurer of his liability, or in the event of the revocation of the insurer's license to carry out insurance activities, has the right to apply for insurance compensation to the insurer of the liability of the tortfeasor (clause 9 of Article 14.1 of the Law about OSAGO).

When the insurer of the victim's liability provides insurance compensation, the amount of which the victim does not agree with, in the event that bankruptcy procedures are subsequently introduced in relation to the said insurer, or in the event of the revocation of its license to carry out insurance activities, the victim has the right to apply for additional payment to the insurer of the harm causer .

If, by a court decision in favor of the victim, insurance compensation is recovered from the insurer of his liability and this decision is not executed, then when the procedures applied in bankruptcy are introduced in relation to this insurer, or the license to carry out insurance activities is revoked, the victim has the right to apply for payment to the insurer of the liability of the tortfeasor harm.

If bankruptcy procedures are introduced both in relation to the victim's liability insurer and in relation to the tortfeasor's liability insurer, or if their license to carry out insurance activities is revoked, the victim has the right to demand compensation for losses through a compensation payment from the Russian Union of Auto Insurers ( paragraph 6 of Article 14.1 of the Law on Compulsory Motor Liability Insurance).

Samples of claims:

Statements of claim for recovery of insurance compensation under compulsory motor liability insurance

Claims for compensation for damage caused as a result of an accident

Problems with direct indemnity

Despite the fact that updates to the law on PES have simplified the procedure for receiving insurance payments and reduced the percentage of fraudulent attempts on the part of insurance companies and clients themselves, certain difficulties remain unresolved. The PPV does not cover cases of mass accidents and those in which there are victims. Until now, the system of mutual settlements between insurance companies remains opaque. There are also many controversial issues regarding the payment of insurance compensation.

The problem of payments for non-contact accidents

The law has a limit on the number of cars damaged in an accident. Since the phrase “two cars” is used instead of the wording “no more than two,” disputes arise in the case of a non-contact accident.

A non-contact accident means that the car is damaged, but there was no collision with another car. Legally, this situation applies to insured events, provided that the car was used for its intended purpose.

In fact, insurance companies use the wording specified in the law to refuse to transfer payments. Thus, they force victims to undergo a lengthy and troublesome judicial procedure.

Underpayments under PES

According to the current legislation, the amount established by RSA is transferred from the insurer of the accident initiator to the insurance account of the victim. In this case, the amount of compensation actually paid is not taken into account. This gives rise to the use of various fraudulent schemes by insurance companies.

As a result, the client whose car was damaged suffers. If there is a large amount of payments to be made, the company tries to underestimate it as much as possible so as not to remain at a loss. With minor damage, the same thing happens, only the company is trying to make money in this way, receiving more compensation than was paid to the victim.

On average, the amount of payments under PES is underestimated by 25-40%, which in itself is already a lot. However, recently cases of underestimation of payments by 50% have become more frequent.

The only solution for the victim is to file a claim and recover the missing funds through the court.

Offer the victim to enter into a payment agreement

As a defense against lawsuits related to underestimation of the amount of payments, insurance employees use the “Agreement to Determine the Amount of Damage.” This document defines all criteria regarding the payment of compensation, including its amount.

If the client is persuaded to sign the agreement, he loses the opportunity to recover the missing amount through the court. The document gives the insurer the opportunity to consider that it has fully fulfilled all its obligations in a particular case.

It is possible to challenge the legal validity of a document in court in rare cases. At the same time, the trial procedure itself is quite problematic.