Definition

The abbreviation means: compulsory motor vehicle liability insurance.

A more detailed translation of this abbreviation looks like this:

- mandatory: any vehicle on the territory of Russia must be insured;

- automobile civil liability: compensation for damage in case of an accident is made to everyone except the person responsible for the accident.

For whom the MTPL policy is mandatory and vice versa

Every car owner, including a citizen of another country, when operating a vehicle in the Russian Federation, is required to purchase an OSAGO policy . The following categories of vehicles are exceptions to this rule:

- A vehicle with a maximum speed not exceeding 20 km/h.

- Vehicles that, by law, do not have the right to be road users.

- All military equipment, except for commercial vehicles.

- Trailers and semi-trailers for passenger vehicles owned by an individual.

- Vehicles owned by foreign citizens and registered in another country. But at the same time, for such cars there is a need to issue a “Green Card” , as one of the types of civil liability insurance accepted in the international system of relations.

How is it regulated and how does it work?

Compulsory motor liability insurance is regulated by Federal Law No. 40. You can read the text of the law here: https://www.consultant.ru/document/cons_doc_LAW_36528/

OSAGO works like this: if an accident occurs through no fault of the policy owner, the insurance company compensates him for the damage.

The MTPL law provides for compensation for damage through repairs, and only in exceptional cases - in money.

Also, the law on compulsory motor liability insurance provides for a penalty for late payment of damage.

Algorithm of actions to receive the maximum payment under compulsory motor liability insurance:

- Contact the insurance company yourself, or through a representative you can trust. In this case, you need to provide documents without bank details. Thus, the insurer will not be able to make a payment ahead of time.

- Get directions to the service station and go there. The referral (or its copy) must be stamped, as well as the date of application.

- Wait no more than 3 months for the car repair to be completed: the penalty is charged at the rate of 1% per day. In 3 months approximately 90% will accumulate.

- If the repairs are delayed, file a claim for payment in cash. In this case, the owner of the vehicle will need to provide documents with bank details. In this case (including 7-10 days during which the claim will reach the accounting department), the driver is charged a penalty in the amount of 100% of the damage. The vehicle owner receives the main damage payment.

- After receiving payment for the damage in money, contact the insurance company with a special form of claim.

- If there is no payment, then you need to contact the ombudsman for compulsory motor liability insurance. He makes a decision similar to a judicial one.

Related article: Will MTPL insurance pay if the culprit is drunk at the wheel?

If the car is less than 5 years old and the mileage is less than 150,000 km, then the driver is entitled to a TTS payment.

A template for a claim for repairs instead of payment can be downloaded here: https://apretenzia.ru/documents/strakhovanie/36/?utm_source=youtube&utm_medium=algoritmosago2020&utm_campaign=docnaremont

A template for an application for payment of TTS can be downloaded here: https://apretenzia.ru/documents/strakhovanie/14/?utm_source=youtube&utm_medium=algoritmosago2020&utm_campaign=docuts

Limits of payments under compulsory motor liability insurance

Car insurance serves to compensate for damage in the following situations:

- payment of a certain amount for the repair and restoration of a car;

- compensation for harm caused to the injured person, as well as compensation for his funeral (in case of death);

- payment for additional services related to a traffic accident (for example, car towing).

It should be immediately noted that not in all cases car insurance can reimburse the full cost of restoring the car to its pre-accident condition. This is because there are certain restrictions on the maximum amount that can be paid. So, the maximum you can get for restoring a car is no more than 400,000 rubles.

This amount is the limit, and even if the damage is 450,000 or more, the insurance payment will still be 400,000. As for compensation for damage to health, the maximum is 500,000 rubles. However, it should be remembered that such a payment is accrued per person. That is, if several people were seriously injured as a result of an accident, then the total amount could be a million or even more.

What does he look like

The new model OSAGO has a QR code. It is located in the upper right corner of the paper (pink) policy. This icon is not available in electronic MTPL.

A QR code is a kind of link to an Internet page. To decrypt it, you will need a special application for your smartphone. The code needs to be photographed. After this, the program will automatically redirect the car owner to the RSA website.

The following information is displayed on the page:

- car registration number;

- VIN number;

- machine data;

- duration of the policy;

- the name of the insurer that issued the policy.

The QR code helps verify the authenticity of the policy.

Also, in the new model MTPL, in the “insurance premium calculation” column, a plate with coefficients appeared. Thanks to this, the car owner will be able to figure out which numbers make up the final amount.

In the plate that lists the persons who are allowed to drive a vehicle, you can now indicate the driver’s class in the corresponding column.

In the “Vehicle Owner” field, the following driver data is indicated: age, number of accidents and length of service. Based on your driving experience, the KBM coefficient is calculated, which affects the price of the MTPL policy.

Extended insurance

An addition to compulsory insurance is DSAGO, the amount of the insured amount of which is established by the owner of the vehicle. However, some insurance companies have restrictions on it.

To expand by registering a DSAGO, you must present a valid insurance policy, a vehicle registration certificate, and information about the number of people allowed to drive it.

Its cost varies; it is set by insurance companies, but usually it ranges from 0.15 to 0.5% of the basic sum insured.

When preparing it, the following are taken into account:

- driver age;

- number of persons driving a car;

- car model;

- year of car manufacture;

- engine power;

- basic amount of the insured amount.

When purchasing both forms of insurance, companies provide significant discounts. Concluding a DSAGO agreement is beneficial for young drivers with little driving experience and people who prefer high-speed driving.

Some insurance companies offer additional services to an extended MTPL policy, for example, car servicing by an emergency technician.

How is the policy issued?

You can apply for an insurance policy online using the aggregator website: https://oformionline.ru/.

Instructions:

- Go on the website.

- Click on the “Calculate the cost of OSAGO” button.

- Upload scans of documents: vehicle owner’s passport, car passport, diagnostic card (if the car is more than 3 years old), driver’s licenses of everyone who will be allowed to drive the car.

- Disable the switch (located in the upper right corner). This will make it easier to check the entered data.

- Fill out the form.

- Check that the entered data is correct.

- Click on the “Calculate” button.

After this, the system displays offers from insurance companies. Next, you need to select an MTPL policy and pay for it.

Insurance is sent to the specified email address within 5 minutes.

According to Russian legislation, it is not necessary to print out the MTPL policy - it is enough to have it in your mobile device.

Not all traffic police officers know about this. To eliminate the possibility of conflict with them, it is advisable to print out the policy and always have it with you.

Related article: What to do if the insurance company does not pay within 20 days

Another policy can be issued at the office of the selected insurance company.

The following documents will be required:

- petition;

- a document that proves the identity of a Russian citizen;

- PTS (STS);

- driver's license;

- diagnostic card;

- power of attorney (if the car belongs to someone else).

You can also apply for an MTPL policy on the website of the selected insurance company. This is not a very convenient method: problems begin already when registering your personal account. The document verification procedure takes 30-60 minutes. If the driver’s data does not suit the insurer, the system “transfers” him to another company’s website, and the data has to be re-entered.

What is needed to apply for a policy?

If you have never taken out insurance before, then read the mandatory list of documents that you will need to present to the insurance company:

- passport;

- vehicle registration certificate;

- certificate of registration of the vehicle;

- driver's license;

- diagnostic card - the result of a vehicle inspection if it is more than 3 years old.

If the car will be driven by other people, then you will need to additionally provide their driver's licenses.

All listed documents are submitted in originals and copies. The list provided is comprehensive, regardless of which insurance company you choose to obtain insurance from. If you want to take out an insurance policy to drive a car that is owned by another person, then a power of attorney or personal presence will be required on his behalf.

What to do in case of an accident

Procedure in case of an accident:

- Turn off the engine, turn on the emergency lights.

- Place an emergency sign at the rear of the car.

- Make sure no one is injured in the accident. If there are victims, you need to call an ambulance.

- If there are no injuries, and there are only 2 participants in the accident, then together with the second driver, determine the culprit of the accident.

- If it is impossible to identify the culprit of the accident, call the traffic police. This must also be done if the second driver does not have an insurance policy.

- If one of the drivers admits guilt, both have compulsory motor insurance, and the accident is minor, then you will need to draw up a diagram of the traffic accident (without calling the traffic police). The next stage is filling out the European protocol.

According to the European protocol, compensation of up to 100,000 rubles is expected. In Moscow (and the region) and St. Petersburg (and the region) - up to 400,000 rubles.

If a pedestrian is injured in an accident, the insurer of the person responsible for the accident will reimburse the cost of treatment and loss of salary. If the pedestrian is at fault for the accident, then he does not have the right to receive compensation under compulsory motor liability insurance.

Trailer insurance

There is no clear answer to the question about the need to draw up an MTPL agreement for a trailer. On it, disagreements arise between traffic police officers and vehicle owners, despite the existing amendments introduced to the law on compulsory motor liability insurance since March 2008.

According to the introduced standards, there is no need to conclude an agreement for a trailer installed on a passenger car.

However, it must be issued mandatory for trailers that are attached to:

- passenger cars owned by legal entities;

- trucks with different load capacities;

- motorcycles, scooters.

The cost of a trailer policy is calculated taking into account coefficients - territorial and vehicle use.

What is the responsibility under compulsory motor liability insurance?

Liability under compulsory motor liability insurance: if an accident occurs due to the fault of the policy owner, then the insurance company compensates for the damage not to him, but to other drivers injured in the accident.

Key points to remember:

- When filling out a notification of an accident, you should remember point No. 15. It is called “Note”. At this point, the driver who does not consider himself guilty of the accident must write that he does not admit guilt and has no claims. The second side writes this: “I consider myself guilty of the accident, I have no complaints.” Both drivers sign. Otherwise, you may be denied compensation for damages.

- The accident must be reported to the insurer within 5 working days. If the company fails to report the accident, according to the MTPL law, the guilty party may be subject to a recourse claim. This means that the insurance company will pay the second party involved in the accident, and will demand compensation from the first driver.

- To increase the payout limit, you need to sign up for an unlimited Euro protocol. To do this, you will need to download the “European Accident Protocol” application. It allows you to record the fact of an accident and link it to GPS data. To use the application, you need to register with State Services.

- The vehicle owner must have a valid diagnostic card. Otherwise, the MTPL law allows insurance companies to refuse payment. In the worst case, you may face a recourse claim from the insurance company. Even if the owner of the vehicle has taken out compulsory motor liability insurance with a valid policy, but it expired during the policy period, then you can get regressed.

- If drivers have a disagreement, or something else other than cars was damaged during the accident, or the health of pedestrians was harmed, you must call the traffic police.

Article on the topic: Payment for compulsory motor liability insurance policy via the Internet

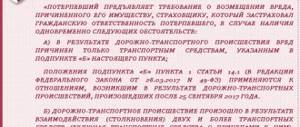

Subparagraph 1 of Article 14 of Federal Law 40 was repealed by another law - Federal Law 88 of May 1, 2021. Responsibility was removed, but the obligation remained. This is stated in paragraph 2 of Article 11.1. Federal Law 40.

When insurers refuse to pay

It must be said right away that not in all situations insurance companies are required to pay compensation. Their list is quite large, and every car enthusiast needs to know them.

So, if the car injured in the accident was driven by a driver who was not listed in the car insurance policy, then the insurance will not be paid (even if the owner of the car took out insurance according to all the rules). This situation is one of the most common. In addition, insurance does not compensate for the following types of damage:

- moral (damaged to the injured person);

- compensation for the so-called “lost profits” (for example, the driver used the car for business, but the accident resulted in downtime);

- damage caused to the car in specially designated areas for educational and training driving, as well as tracks for competitions;

- compensation for damage received as a result of the transportation of flammable, explosive and other similar cargo (except for cases where a separate contract has been drawn up for their transportation);

- compensation for damage caused to the environment.

In addition, damage received by the employee while performing his duties (in this case, the employer will pay the required amount), as well as damage caused by the vehicle while moving through the territory of the production enterprise or inside the workshop, is not subject to compensation.

Also, damage caused to architectural structures, historical values and objects related to “intellectual property” is not compensated. Well, as previously described, amounts exceeding the established maximum amount of possible compensation are not subject to compensation (they can only be recovered from the culprit of the road accident in court).

Formula for calculating compulsory motor liability insurance

When calculating the insurance policy tariff, different types of coefficients are used, which are multiplied by each other.

The calculation of compulsory motor liability insurance can be simply presented as a formula:

Policy cost = Base rate of OSAGO x Territorial coefficient x KBM x KO x Power coefficient x KVS x Period of receipt of insurance x Violation coefficient

The coefficients that make up the formula and their number may vary depending on the insurer.

Rating of insurance companies

Independent examination of insurance companies is carried out by the following organizations:

- The RA expert makes an assessment taking into account the location, amount of capital, client base, percentage of positive and negative phenomena;

- NRA, the National Rating Agency, uses information on the economic activities of companies in its assessment and pays special attention to the fulfillment of their obligations towards clients.

They compile a rating of companies in the insurance market and enter information into a database. As for the client base, their assessment is based on:

- prompt payment processing;

- quality of service, attitude towards the client;

- number of reviews on the Internet;

- reviews from acquaintances, friends, colleagues;

- number of clientele.

At the same time, the main criterion for assessing the rating is reliability, expressed by financial indicators.

The rating of the most popular insurance companies is given in the table:

| Company name | Number of applications | Number of failures | % failure | Degree of reliability |

| Allianz-ROSNO | 8 483 | 2 877 | 34% | A++ |

| National Insurance Group | 1 385 | 175 | 13% | A+ (III) |

| Russian insurance transport company | 3 134 | 336 | 11% | A++ |

| Liberty Insurance | 1 231 | 80 | 6% | A+ (II) |

| Rosgosstrakh | 220 813 | 13 097 | 6% | A++ |

| SOGAZ | 5 555 | 310 | 6% | A++ |

| Agreement | 29 619 | 1 623 | 5% | A++ |

| Surgutneftegaz | 1 720 | 90 | 5% | A+ (III) |

| Energy guarantor | 8 852 | 403 | 5% | A++ |

| MSK | 69 968 | 2 963 | 4% | A+ (III) |

| Renaissance Insurance | 11 248 | 387 | 3% | A++ |

| UralSib | 22 629 | 730 | 3% | A++ |

| RESO Guarantee | 53 327 | 1 580 | 3% | A++ |

| Ingosstrakh | 50 628 | 1 309 | 3% | A++ |

| VSK-Insurance | 47 177 | 1 213 | 3% | A+ |

| MAX Insurance | 27 006 | 549 | 2% | A++ |

| VTB Insurance | 1 398 | 16 | 1% | A+ (III) |

And in conclusion, it should be noted that the emergence of the MTPL insurance form in the insurance market makes it possible to avoid traffic conflicts, protect and protect drivers from disputes due to road accidents.

Not every insurance company meets legal requirements, so you need to take a closer look at their activities before choosing the right one.

How to calculate the loss of marketable value of a car, see the article: Loss of marketable value of a car under compulsory motor liability insurance. Find out how to calculate the cost of MTPL here.

OSAGO in the Alfastrakhovanie company is discussed in this article.

CASCO

If you know a specialist who knows insurance, ask him if the term CASCO has an abbreviation for this abbreviation?

Most will answer positively, and will even spell out the name for you:

- K – complex;

- A – automobile;

- C – insurance;

- K – except;

- O – responsibility.

However, CASCO does not have an abbreviation - it is just a myth that appeared by analogy with compulsory insurance. In fact, this type of policy cannot even be considered completely “automobile”, since there are different types intended, for example, to insure ships or even aircraft.

The rule of writing the term “CASCO” in capital letters also took root by analogy with OSAGO, although this point still remains controversial.

But since the word CASCO exists, how does the abbreviation stand for? There is no such thing, but the word actually comes from its Italian “ancestor” - casco. If you turn to the dictionary, you can see that in translation this word is translated as “board”. In fact, this is quite logical, because by purchasing additional car insurance, you are actually insuring the side of your car.

Incorrect transcript versions

Many people try to decipher CASCO on the basis of other foreign words, so the following designations may appear on the Internet:

- Cascade (English) is often translated literally because it refers to an acrobatic sequence of simulating a fall. This word is often used by people whose profession is associated with spectacular exercises - figure skaters, circus performers, etc. How is decoding used for CASCO? The logic of the supporters of this interpretation is that damage under this insurance program is only an imitation for the owner of the vehicle, because it will be restored free of charge.

- The next term has already been borrowed from the French language - casque. The translation of this word means a helmet, which was used in the equipment of the French army until the 19th century. When interpreting, they refer to the fact that this insurance policy acts only as nominal protection, but does not insure the main thing - the lives of the owner of the car and his passengers.

- The word "casco" means "skull" in Spanish. Proponents of the origin of the term precisely from this word reinforce their words by the fact that in the past, drivers in Spain actually applied a skull through a stencil to the body of their vehicle. Thus, all pedestrians were warned about its danger. And the first insurance policies issued actually had images of a skull.

All the examples described above are considered erroneous. However, it has still not been possible to reliably determine the country of origin of this term. Historians are still inclined to believe that the ancestors of the modern CASCO system were born during the Middle Ages on the Apennine Peninsula, which is why it is generally accepted that this is where this word comes from.

So we have deciphered the terms MTPL and CASCO. These are two different insurance systems, with different approaches and degrees of responsibility. They have many more differences and features, so it is better to read more about them in our thematic articles.

0

How to decipher "OSAGO"?

Literally, OSAGO means the following:

- O—obligatory;

- C—insurance;

- AG—automotive;

- About responsibility.

IMPORTANT !!! The term “mandatory” indicates that every car owner must take out this type of insurance policy, otherwise sanctions will be applied to him.

The concept of “motor civil” means that the owner of the vehicle is liable to third parties whom he caused harm while driving his car.

New in MTPL insurance

Since the entry into force of the Federal Law of the Russian Federation of April 25, 2002 No. 40-FZ, the legal act has undergone a significant number of changes and amendments. One of the main requirements for drivers is to have a valid MTPL policy. If the driver of the car has not completed this document, when stopped by a traffic police officer, he will be issued a fine of 800 rubles . If the policy is issued and is valid, but filled out incorrectly or forgotten at home, the traffic police officer will issue a fine of 500 rubles .

From November 1, 2021, the procedure for imposing a penalty for the lack of a policy has changed. If previously only a traffic police officer could “catch” a careless driver, then according to the new rules, the violator will be recorded by robotic video cameras . Data on the vehicle's registration number will be automatically transferred to the database, where it will be checked against the availability of a valid policy. If such a document is missing, the owner of the car will receive a fine by mail.

Important ! To confirm the data, the vehicle registration number will be re-verified 10 calendar days after receiving information about the violation.

Will there be an increase in the cost of compulsory motor liability insurance in 2021?

The size of compulsory motor liability insurance in 2021 will be increased by 20% in relation to the minimum and maximum prices. From September 1, 2021, insurance companies will have the opportunity to increase the initial and final rate of the base tariff by 30%.

The maximum rates, coefficients, as well as the procedure for their use by insurance companies are approved in the Directive of the Central Bank of Russia dated December 4, 2021 No. 5000-U. This document was registered with the Ministry of Justice of the Russian Federation on December 29, 2018 and can be downloaded from the link below.

Download the Directive of the Central Bank of the Russian Federation

You will have to pay for compulsory motor liability insurance in 2021 according to the formula:

basic tariff * coefficients (increasing or decreasing).

The cost of an MTPL policy is affected by the following indicators::

- basic tariff (price “from and to”);

- city of residence (the coefficient approved by the government is taken into account depending on the region of residence of the car owner);

- trouble-free discount (Bonus-Malus coefficient);

- age and length of service of the driver;

- type of policy (limited or unlimited);

- season of use of the vehicle;

- machine engine power;

- existing violations of legislation relating to insurance (in accordance with the coefficient).

The increase in the price of compulsory motor insurance in 2021 is caused by a change in the base tariff and the introduction of new coefficients based on the age and length of service of the car owner.