Features of the work of loss settlement centers

Loss settlement is a large set of activities that are carried out when an insured event occurs (for example, after an accident).

First of all, the client is required to draw up and complete an application. Then he collects the remaining documents. A package of official papers is sent to the insurance company. In Russia, the largest insurers that sell CASCO and OSAGO policies are Rosgosstrakh, Ingosstrakh, and SG URALSIB. After studying the documents provided, the insurance company determines the amount of payment. As practice shows, many clients incorrectly fill out insurance claims and are therefore denied compensation/reimbursement.

Every major insurance company has a claims settlement center. It is to this center that a package of documents is submitted with the application:

- The center accepts documents from the client or from the company that represents his interests. A reliable company that will help you achieve justice and receive an insurance payment will be “Legal Expert”.

- A commission is created in the insurance claims settlement department. Its specialists study the claim and official papers and assess the damage.

- At the last stage, the amount of insurance compensation is determined.

Highly qualified specialists will help you draw up an application and collect a package of documents. We will professionally represent your interests before the insurer. You will only need consent and several notarized documents.

Structure of filling out the application. How to fill out an application for insurance payment?

This document is filled out according to a clear template and consists of the following parts:

- The first block is the document header. It contains information about the organization to which the application is being submitted. It includes its name, the full name of the person holding a leadership position. It also contains your information.

- The next block contains information about the insured event. Here you need to indicate the reason for its occurrence and time. Next, fill in information about the license plates of the vehicles involved in the accident. This includes the contact information of the victim and the culprit of the accident, the series and number of his policy and the name of the insurance company that serves him.

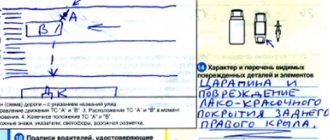

- The following is a description of the causes of the accident and the resulting damage. Here you should describe in detail the sequence of actions of the participants in the accident. Damage discovered after inspection of the vehicle or that occurred after but due to a collision is also entered in this block.

- Then you indicate the amount necessary to compensate for the damage caused to you. When completing this section, be sure to indicate the law under which you are seeking damages. In our case, this will be Law No. 40 - Federal Law, Article 14.1.

- Do not forget to indicate the bank details according to which insurance payments will be credited to you.

- The documents that you attach to your application are indicated.

- For certification, the signature and initials of the applicant are affixed.

Important! Please remember to review your completed information before submitting your application. Correcting errors in the future can take a lot of time.

Some inaccuracies or typos in the test can play into the hands of the insurance company. Once again, double-check the application for insurance payment under MTPL, a sample of which can be found on the Internet.

When may an insurer not file a claim for damages through subrogation?

On April 24, the Moscow District Arbitration Court issued a ruling in the case of the insurance company collecting damages through subrogation.

On April 9, 2015, as a result of an accident involving two cars, a Volkswagen Passat, which was insured by Insurance LLC under a voluntary comprehensive insurance agreement, was damaged. The insurer paid the car owner an insurance compensation in the amount of 135 thousand rubles.

The civil liability of the owner of another car, a Renault Latitude, was insured by Ingosstrakh Insurance Company under a compulsory insurance agreement, so the said insurer paid insurance compensation in the amount of 49 thousand rubles to Soglasie Insurance Company. Subsequently, the Renault Latitude car was transferred under a leasing agreement to the temporary possession and use of CJSC P.R. RUS", whose employee was driving the specified vehicle at the time of the accident.

Subsequently, Soglasie Insurance Company filed a lawsuit against RB Leasing LLC for damages in the amount of 86 thousand rubles. by way of subrogation. The court replaced the improper defendant with a proper one represented by CJSC “P.R. Rus", however, left the claim without consideration. The appeal upheld the decision of the trial court. Both authorities considered that the claim was filed in violation of the established Part 5 of Art. 4 of the Arbitration Procedure Code of the Russian Federation requirements due to the plaintiff’s failure to comply with the claim procedure for settling a dispute with the defendant.

The insurance company filed a cassation appeal to the district court, pointing out the incorrect application of the rules of law by the courts and the discrepancy between their conclusions and the factual circumstances of the case and the evidence available in it. According to the plaintiff, he filed a claim within the framework of tortious obligations, and the courts erroneously applied paragraph 1 of Art. 16.1 of the Law on Compulsory Motor Liability Insurance and did not take into account that the subject of the claim was a demand to recover from the defendant the difference between the insurance compensation paid by the insurer under the Compulsory Motor Liability Insurance (MTPL) and the actual amount of damage. Mandatory compliance with the claim procedure for resolving a dispute between the victim and the person responsible for the losses is not required if the insurance payment is insufficient to cover the actual damage caused to him.

Having studied the circumstances of case No. A40-74192/2018, the Arbitration Court of the Moscow District came to the conclusion that the arbitration court had no grounds for leaving the claim without consideration.

As the cassation explained, from July 12, 2021, a new version of Part 5 of Art. 4 of the Arbitration Procedure Code, according to which civil disputes regarding the collection of funds under claims arising from contracts and other transactions as a result of unjust enrichment may be referred to arbitration court after the parties have taken measures for pre-trial settlement after 30 calendar days from the date of filing the claim ( requirements), unless other terms and (or) procedures are established by law or agreement. Other disputes are referred to the arbitration court after following the pre-trial procedure for resolving the dispute, unless such a procedure is established by law or agreement. Consequently, the lower court had to find out whether a mandatory pre-trial procedure was established for the plaintiff’s claims and under what conditions, and whether there was evidence in the case of its compliance.

The cassation instance revealed that the controversial claim was submitted to the court on April 10, 2021 - after the above-mentioned version of Part 5 of Art. 4 Arbitration Procedure Code of the Russian Federation. The insurer who paid the insurance indemnity receives, within the limits of the amount paid, the right of claim that the insured has against the person responsible for the losses compensated as a result of the insurance (subrogation). The right of claim transferred to the insurer is exercised by him in compliance with the rules governing the relationship between the insured (beneficiary) and the person responsible for losses (clauses 1 and 2 of Article 965 of the Civil Code of the Russian Federation).

“From the literal interpretation of the above rules, it follows that the insurer to whom the right of claim has been transferred, when filing a claim by way of subrogation, must act as the victim would act, collecting damages from property damage from the guilty party... The insurer must comply with the requirements of regulations governing those legal relationship between the insured and the person responsible for the losses. This applies to compliance with both substantive and procedural norms contained in these acts. Thus, the mandatory claim procedure must be specified in regulatory documents or contracts regulating the activities of the victim and the person who caused the damage,” the resolution noted.

The district court noted that in the case under consideration, the subject of the claim is a requirement to recover from the defendant the difference between the insurance compensation paid by the plaintiff under a voluntary comprehensive vehicle insurance agreement and the amount of damage caused by the Ingosstrakh SPAO paid under a compulsory insurance agreement concluded with the tortfeasor.

MTPL policy from VSK: purchase and renewal online

VSK Insurance House is a successfully developing company that pays great attention to customer service. Therefore, after the rules for the mandatory issuance of policies in electronic form were established, the organization introduced such an opportunity on its website.

- Passport of a citizen of the Russian Federation.

- Passport for the insured vehicle (car or motorcycle).

- A certificate giving the right to drive a vehicle. If you need to indicate several drivers on the policy, then documents for all persons must be submitted.

- A certificate confirming the registration of the car.

- Diagnostic card or technical inspection certificate valid at the time of conclusion of the contract.

Insurance cases under CASCO and OSAGO from; VSK

- Papers issued by law enforcement agencies, from which it becomes clear: where the incident occurred, when it happened, who was involved in the accident, the injuries sustained, etc.

- Protocol and resolution on violation.

- Document confirming completion of a medical examination.

- If there is a criminal case, decisions on it.

- Receipts for vehicle towing expenses.

- Stop immediately, turn on the emergency lights and put up an appropriate sign warning about what happened. Let us remind you that it is placed at a distance of 15 to 30 meters from the car, depending on the surrounding area (city or not). Do not move any items that are related to the incident.

- Call the traffic police and call the officers. If necessary, rescue services must also be notified.

- Inform the insurance company about the accident. To do this, you can use the number 8-800-100-00-50 or 8-800-775-77-51. The dispatcher should be provided with the following information: policy; personal data of the driver and information about the vehicle; where the accident occurred and its details.

- Receive instructions on what to do next.

- Record the details and contacts of available witnesses.

- Together with the other participants in the accident, it is recommended to fill out a notification to the citizen and sign it. In this case, you should check the data provided by the other party.

- When signing the protocol, indicate in it if you do not agree with something.

You may like => The Problem of Expediency in Criminal Procedural Law

RESO-Garantiya"; Samples of Statement about an Insured Event: Accident and VHI, Download the form

In order not to waste time filling out requests at the department, you can fill out these documents in advance. You can find samples on the official website of the insurer "RESO-Garantiya" in the "Insured Event" section (reso.ru/Incase). At the moment, users can download statements for the following types of insurance:

To receive compensation for property insurance, you should prepare an application for RESO-Garantiya, a policy (a copy will do), a personal passport and documents confirming the ownership of real estate. Depending on your specific situation, you will also need to bring:

Sample application for payment of insurance compensation from the insurance company VSK

Sometimes concluding a civil liability contract with an insurance company is not as simple as it seems at first glance. Many motorists have a number of questions regarding this type of insurance. Very often, car owners are interested in the question: why do they need to write an application for insurance in the insurance company? We will try to answer this question in our article today.

How can you make this statement if most people simply don't know their odds? But every cloud has a silver lining. In our country, as they say, everything is for the people. So, this application can be completed directly at the insurance company, where the operator will help you fill out all the necessary items.

May 07, 2021 klasterlaw 32

Share this post

Related Posts

Where can I renew Green Cards for a Large Family?

List of required documents attached to the application

It is not always the same and depends on the type of insured event. In case of compensation for losses in the field of motor third party liability insurance, you need to collect the following package of documents:

- You must have a certificate of an accident issued by the traffic police. It will contain data on the number and nature of damage, as well as the culprit of the collision.

- The driver will need to make copies of the following documents: the passport of your vehicle, the certificate issued upon its registration, and the insurance policy. Don't forget to have all documents certified by a notary.

- You must also make a copy of your ID. It is also advisable to have it certified by a notary.

- Don't forget the traffic accident notice.

- If you have asked an independent appraiser to assess the damage, please attach his report to the above documents.

A sample application for insurance payment can be found on the website of the insurance company. In most cases, you can also find an example of how to fill out an application for insurance payment there.