- List of main documents

- Additional documents

- If harm is caused to health

- In case of loss of a breadwinner

- Application Form

- Document submission deadline

- Deadlines for receiving payment

- Let's sum it up

Every driver should know about the procedure for receiving compensation under the “automobile civil law”, since no one is insured against accidents on the road. In this article we will provide a list of documents for payment under compulsory motor insurance and tell you when, how to submit them and how long to wait to receive the money.

List of main documents

One of the grounds for a legal refusal of compensation is an incomplete package of documentation provided by the driver who was involved in an accident. That is why the collection of papers must be taken carefully and seriously.

The list of documents required for insurance payment is as follows:

- application for compensation;

- a copy of the driver’s personal passport, certified by a notary;

- notification of an accident;

- a certificate of an accident (you must first obtain it from the traffic police);

- a copy of the protocol (you will also have to obtain it from the State Traffic Inspectorate);

- a copy of the resolution/refusal to bring to administrative liability;

- details of the account to which the compensation will be transferred.

In addition, you will need to submit payment documents confirming the expenses incurred (for restoration work, other material expenses).

Documents for submission to the Investigative Committee

To receive payment from the insurance company under compulsory motor liability insurance, the company in accordance with clause 44 of the Rules of motor third party liability insurance dated May 7, 2003, must provide a list of documents for insurance payment under compulsory motor liability insurance:

- A certified copy of your passport;

- Vehicle registration certificate (STS) or vehicle passport (PTS);

- Details of the account to which the insurance company will have to transfer the compensation payment;

- Application for insurance payment;

- A certificate of an accident issued by a traffic police officer;

- Notification of an accident;

- Copies of the protocol and resolution (if drawn up) on the administrative offense;

- A copy of the ruling on refusal to initiate an administrative case (if drawn up).

It is important to remember that in addition to the listed documents, the damaged vehicle or its remains are also submitted to the insurance company for examination.

Additional documents

In addition to the mandatory ones, depending on the specific circumstances of the case, additional documents may be required. Thus, the insurance company in some cases requests:

- original documents for the car (PTS or STS);

- title documents for cars;

- documentary evidence of the right to receive compensation if property belonging to third parties was damaged in an accident (for example, a car leasing/rental agreement or a loan agreement with a bank);

- receipt for payment for tow truck services;

- receipt for payment for car security services prior to the examination;

- other documents confirming the right to compensation and its amount.

Also, depending on the nature and extent of the damage suffered, an additional package of documents may be required to receive payment.

If harm is caused to health

If, due to injuries received as a result of an accident, the victim has lost his ability to work and his source of income, he must submit to the insurance company:

- a certificate from a medical institution indicating the diagnosis, the nature of the injuries received and the period for which the insured is disabled;

- conclusion on the degree and type of disability (general or professional);

- a certificate of average monthly income indicating the source (salary, pension, etc.);

- other documents confirming loss of ability to work (if available).

Note! In case of harm to health, the maximum amount of payment increases from 400 thousand to 500 thousand rubles.

In case of loss of a breadwinner

If there are deaths as a result of the accident, persons entitled to receive insurance payment must submit:

- a statement which, in addition to the request for payment, contains information about family members of the deceased, as well as persons who were dependent on him;

- birth certificates of young children;

- passports of minors over 14 years of age;

- certificate of disability (if the deceased was supported by persons with disabilities);

- a certificate from an educational institution (if dependent students);

- a certificate of the need for continuous medical care (if such categories of persons were supported).

If the list received does not contain a document required to be submitted, the insurer is obliged to notify the applicant of the need to attach it by mail or by personal visit within 3 days from the date of receipt of the rest of the list.

What determines the timing of receiving compensation?

The insurer reviews the set of documents provided to the victim within 20 days (calendar days, excluding weekends and public holidays), determines the amount of insurance compensation and makes a payment (issues a referral for repair services).

If there was no progress on the part of the company within the agreed period, then the victim has every right to receive a penalty. Each day of delay (working day) is 1% of the assigned amount. To claim a penalty, the vehicle owner submits a corresponding application to the insurers.

In conclusion, it should be noted that you can receive payments under the MTPL policy on the basis of Chapters 3 and 4 of the set of rules governing compulsory motor vehicle insurance by vehicle owners.

Application Form

The legislation does not establish a special application form. If the insurance company does not have its own approved form, the application for payment is processed in a random manner.

Despite the absence of legislative norms, there are requirements for the content of the document. The application must indicate:

- personal, passport and contact details of the victim;

- date, place and time of the incident;

- circumstances of the accident (the more detailed, the better);

- application for insurance payment;

- personal information of the policyholder, his policy number and car details (make and registration plate);

- PTS details;

- date and signature of the applicant.

.

Full package of documents

The very first document that must be submitted to the insurance company is a notification of a traffic accident. This form is always attached to your policy; it is filled out at the scene of the accident together with the person at fault. In the event that you do not agree on who is at fault for the accident, you fill out the notice yourself, as you see the circumstances of the accident.

You can notify about an accident in person or send this document by fax. When drawing up a European protocol, the period for notification is 5 working days; when registering an accident by employees of the State Traffic Inspectorate or an accident commissioner, this period is 15 days. To reduce the time it takes to submit a notification, you can use email.

Next, you will need to file a claim for damages. Supporting documents must be attached to it:

- documents for the vehicle (PTS, STS);

- all documents of the injured party (passport, driver’s license);

- a properly executed certificate of a traffic accident (it must contain signatures, a seal and a stamp; certificate form No. 154);

- a protocol drawn up by employees of the State Traffic Inspectorate at the scene of an accident (a copy of the document may be submitted);

- it is necessary to attach a resolution on the decision made (if traffic police officers were present when preparing the documents), or a Europrotocol - if the damage caused is no more than 100 thousand rubles and the parties agree with the circumstances of the accident, as well as with who is the guilty party;

- current details of the injured party for the transfer of funds.

All documents must be submitted along with copies, because a statement must be prepared for all participants in the accident. Upon acceptance of your application, the insurance company must register it; your copy of the application must bear a mark indicating acceptance of the application indicating the details of the person who accepted it (full name and position), as well as the date of acceptance, signature and stamp.

It is not necessary to submit the application in person; it is quite possible to use the services of a courier or postal service. If you decide to send documents by registered mail, you must make an inventory of the attachment to confirm the presence of all necessary documents in the package.

If there are any additional circumstances in the accident that are important to the insurance company, additional supporting documents are added to the basic package of documents.

For example:

If the only breadwinner in the family died in a traffic accident, it will be necessary to confirm this fact, provide a certificate of income, a certificate of family composition, plus confirm the costs of burying the deceased, and provide a death certificate.

If the car was seriously damaged as a result of an accident, you must also provide the following documents:

- a document confirming the costs of vehicle evacuation;

- expenses for paying for a parking space or parking for a damaged vehicle.

The insurance company must reimburse such expenses immediately, without waiting for an assessment.

Document submission deadline

The insurance contract must indicate the deadline for submitting documents to receive compensation. According to clause 42 of the MTPL Rules, the maximum period for filing is 5 days. In remote regions where there are problems with transport accessibility, etc., this period can be extended to 15 days.

If the victim is late with the application for reasons beyond his control (for example, he was staying in a medical institution), he can apply to the Investigative Committee with a request to extend the deadline. If the reason for the violation is not valid, the insurance company receives a legal basis for refusing compensation, which cannot be challenged even in court.

Personal Injury Insurance Denial Claim

If the insurer refuses to pay insurance due to an injury sustained by the insured person, it is first necessary to study the grounds for the refusal. After this, you can ask clarifying questions in a telephone conversation and submit a written claim to the insurer, setting out all your arguments.

The claim is made in free form and must contain:

- name of the insurer, its address;

- data of the insured person;

- in the text of the claim it is necessary to set out the circumstances of the occurrence of the insured event, what actions were performed by the insured person when contacting the insurer, why the insurer’s refusal is illegal;

- at the end there is a date, signature and transcript of the signature.

USEFUL : see more tips and suggestions for filing a claim from our insurance lawyer at the link

Deadlines for receiving payment

Compensation must be paid within 20 days from the date of submission of documents. The report begins:

- from the date of stamping, if the application is sent by mail;

- from the date of acceptance of the application, if submitted in person.

The payment terms are distributed as follows:

- 5 working days – to inspect the car and assess the damage;

- 5 working days – for additional examination, if required;

- 10 days for paperwork.

If the deadlines are violated, the client can go to court and collect a fine from the company (0.1% for each day of delay). If the policyholder is not satisfied with the amount at which the insurance company assessed the damage he received, then it is also possible to resolve the problem through the court.

Independent technical expertise

To clarify the amount of insurance payment, companies must inspect the damaged vehicle. Based on documents received from independent experts (and the assessment cannot last more than 5 working days from the date of filing the application for payments), the amount of compensation is agreed upon and assigned.

Insurers are required to notify the driver of the place and time of the examination. The owner, in turn, provides the vehicle in accordance with the notification. If the inspection by the driver is ignored, the procedure may be postponed, and, therefore, this will affect the timing of compensation payments.

Important: if the damage caused does not allow the vehicle to become a participant in traffic, the car is inspected at its location.

Insurers who shirk their responsibilities and fail to confirm the inspection 5 days in advance may assign this responsibility to the owner. The examination will be carried out at his expense, but then the cost of the service will be included in the amount of compensation.

Let's sum it up

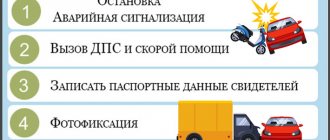

The correct list of documents is one of the prerequisites for receiving insurance payment. The sequence of actions should be as follows:

- the driver needs to write an application demanding compensation, attaching personal documents and documents for the car;

- depending on the specific case, other documents may be needed, the final list of which is provided by the insurer;

- in case of harm to health, documents confirming this fact are required;

- if the breadwinner died in an accident, members of his family and/or persons who were in his support can receive compensation for him by writing an application and attaching documents confirming the right to payment;

- the application is written in free form, indicating personal, contact and passport details, the circumstances of the accident, and the requirement for payment;

- the maximum period established for sending a list of documents is 5 days, in some regions it can be extended to 15 days (if specified in the insurance contract);

- after receiving all documents, the insurer is obliged to pay compensation within 20 days from the date of stamping the letter (if the application is sent by mail) or the day of receipt (if the application is submitted in person);

- if the policyholder fails to comply with the deadlines, compensation may be refused (unless the reason is considered valid);

- If the insurer does not comply with the deadlines, the driver can go to court and collect a fine in the amount of 0.1% of the payment amount for each day of delay.

Thus, the driver who is counting on compensation from the insurance company must take care of collecting documents at the time of the incident in order to avoid problems and delays in payment.

Other papers that are required in some individual cases

If the car or any other property of the car owner was damaged in the accident, then he will have to provide the insurers with some additional papers:

- Papers for the right to own a car or other damaged property or a power of attorney certified by a notary if the driver is not the owner of the damaged car.

- If the victim does not agree with the results of the insurers' examination, he has the right to make an independent assessment . In this case, the insurance company is sent an independent expert’s opinion on the actual extent of the damage and the cost of repairs, and a check for payment for the services of the independent examination.

- If the damaged car had to be taken away from the scene of the accident by tow truck or stored in a special place (for a fee), checks for payment for these services are provided.

- Also documents on the ownership of the damaged property, in addition to the car, and the cost of their repair or complete replacement.