Each contract for compulsory motor liability insurance that was concluded starting September 1, 2014, recorded in the Unified System of the Russian Union of Auto Insurers. Any insurance company, after signing the contract, is required to download information no later than 1 business day. Thanks to this, anyone can check the MTPL policy for authenticity. This will avoid problems due to the actions of attackers.

Each policyholder has the opportunity to find errors or typos in the policy, as well as find out whether the insurance is genuine or counterfeit. This will help you receive payments and avoid becoming victims of fraudulent activities.

How to independently determine the authenticity of a policy

You can check the reality of a paper version of an insurance policy quite simply - this can be determined visually. But to check e-OSAGO you will have to use the Internet.

Paper

In order to be sure of the authenticity of the insurance, you need to know the characteristics that the original must have:

- The paper should be thick, have red fluff on the front side, and a protective metal strip on the back side.

- The size is approximately 5 millimeters larger than an A4 sheet.

- Filling must be done exclusively by machine.

- The certificate form was printed by Goznak JSC; this is written at the bottom of the form on the front side.

- The RSA watermarks can be seen in the light.

- The paint does not wear off.

- The insurance company's seal is clearly visible.

- The certificate has a QR code.

To read a paper certificate using a QR code , you need to install a special application on your mobile device.

Electronic

An electronic MTPL policy may be invalid under the following conditions:

- A personal account was not created at the time of concluding the contract.

- The payment to the insurance agent is transferred to a personal card or electronic wallet, and not to the organization’s current account.

- The email with the policy was not sent from the insurance company's address.

- The letter does not contain insurance rules, instructions for checking validity, or accident notification forms.

- The policy does not contain an electronic signature.

Checking the MTPL policy by number in the RSA database

It is best to check the insurance document by number on the official website. The procedure will take a short time, for this you need to prepare an insurance form, enter the required page of the RSA website and use the search engine, substituting the requested data.

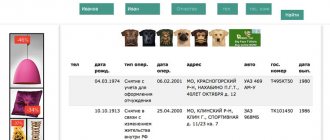

Check the policy by number in the RSA database

Moreover, the procedure is the same: for those issued at the office of the insurance company and received via the Internet, the series of documents issued remotely is the same for all documents (XXX).

After receiving a response with verification, the normal status is considered to be “with the insurer.” But don’t forget, you should also check which car this policy is registered for in order to make 100% sure that you have not been issued a duplicate or fake.

Where and how to check your insurance for authenticity

It is useful for every car enthusiast to know how to check the authenticity of an electronic OSAGO policy. To do this, you need to go to the website of the Russian Union of Motor Insurers, where you do not need to register.

The action plan is:

- Select the “ MTPL ” section on the page.

- Go to the page "Checking the MTPL policy».

- Record information in the form.

- Enter the captcha to complete the verification.

- Click on the button "Search».

In addition to your own insurance, you can check the availability of insurance from another participant in a road accident, and also find out the list of persons who are allowed to drive a vehicle under this agreement.

The policy can have several statuses:

- Is located with the policyholder (that is, information about him has not yet been transferred to the RSA).

- Lost.

- The insurance period has expired.

- Printed, but not yet submitted to the insurance company.

The only resource from which information can be used in legal proceedings. It allows you to check the validity by the policy number, as well as by car data.

FAQ

Where do fake OSAGO forms come from?

They are specially manufactured by criminals in order to fraudulently take money from the car owner.

In the event that a person - an intermediary between the insurer and the policyholder - decides to leave, he can “grab” a stack of blank forms with him.

Policy forms previously held by an insurance company that has gone through bankruptcy proceedings will also be considered counterfeit.

How to check an electronic OSAGO policy for the authenticity of the PCA?

Purchasing a virtual policy on the main website of a car insurer cannot guarantee its originality. Scammers fake not only the forms themselves, but also websites, slightly changing their name in the address bar, or replacing a Russian letter with a Latin one and vice versa.

If you went to the official website and purchased insurance through a trusted company, then your document will be entered into the automated database. Make sure of this using his details.

The series of e-OSAGO policies begins with – XXX .

How to understand that what you have in front of you is not an original document?

- The length of a true form is 5-10 mm longer than an A4 sheet;

- There are watermarks on the original document;

- The document has small specks of red;

- On the other side of the document you can see a vertical stripe of a metallic shade;

- The numbers on the form can be felt, because... they are slightly convex.

According to state car number and VIN

You can also check using the vehicle data. This helps determine whether you have insurance, as well as which insurance company issued it.

To check, you need to enter the state number, information from the PTS and STS. By indicating the last name, first name and patronymic, as well as the date of birth and driver’s license number, you can determine whether the driver is included in the insurance.

Verification procedure

The procedure for verifying the authenticity of the issued policy is carried out on the RCA website. The scheme of actions is not particularly complicated :

- First, you will need to prepare a set of documentation, including the policy itself and your passport.

- Then you need to go to the RSA website and go to the appropriate section.

- The user is presented with an online form. You will need to enter the required data there, then indicate the verification code and click the submit request button.

- After a short period of time the data will be downloaded. It is possible to get multiple results.

You can check the validity of your MTPL policy in different ways. Read about how to do this using the car number, VIN code and the number of the document itself.

There can be only one positive outcome. The issued table with data contains information that fully corresponds to the data of the policy you have in your hands.

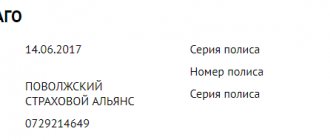

If the information matches, you can be confident in the authenticity of the MTPL policy - there is nothing to worry about. In this case, in the policy status column it must be indicated that the document is with the policyholder. The name of the insurance company, the date of conclusion of the contract and the start date of its validity along with the end date must also be indicated.

However, in some cases there may be problems resulting from the invalidity of the policy. Checking the data will allow you to find out about this in a timely manner and take the necessary measures. Ultimately, several options for a negative result may be obtained:

- Policy not found . In this case, the issued document is falsified.

- No policy was issued . Such a message from the service implies that you only have a copy of this policy. The original is kept by the insurance company.

- The policy has lost its legal force . This means that the document was issued, but later it was subject to cancellation.

- The policy has expired . Accordingly, the document became invalid from the designated time.

What to do in case of invalidity?

If you receive any of the above messages indicating that your current OSAGO policy is invalid, you should first purchase a new policy. The implementation of this measure is necessary to avoid penalties for lack of insurance.

Only then should all other actions be taken. You should contact your insurance company that issued the false policy to get clarification regarding the current situation. You can also request a refund for purchased fakes.

Situations where the policy was purchased from third parties deserve special attention. Today, more than a third of all insurance products that were purchased outside the relevant organization are counterfeit. Externally, the paper may be indistinguishable from this document . However, checking the authenticity of the policy using PCA will help determine whether the purchased document is valid.

It is difficult to protect yourself from running into a fake. Even in the offices of large insurance companies there are scammers. The suspiciously low price of the service should alert you. It should be noted that if a fake is used, the person responsible for the accident will have to pay for the repair of someone else’s car.

You can contact the police to punish the scammers. Authorities will take the necessary operational measures to find the culprit. In this case, the defrauded buyer will meet with the fraudster in court. As a result of the trial, you can receive compensation for moral damages and already paid repairs in the event of an accident. The procedure for checking an MTPL policy using the RSA database is simple and takes a minimum of time. Therefore, this should be done in any case to make sure that everything is in order. If problems are discovered, it is necessary to take the necessary measures in a timely manner to avoid troubles in the future.

How to get money from insurance

If the car owner was involved in an accident not intentionally in order to receive payments, then he can fully count on compensation within the insurance limit. To do this, he needs to collect the papers specified in the contract and, within 5 days, submit it along with the car to the company that insured the culprit. Compensation is made by paying for repairs, treatment or transferring the amount of damage. In the event that the amount of damage to material assets exceeds the limit, the missing amount is recovered from the perpetrator through the court, and he himself may be subject to recourse.

Related article: Driving experience in MTPL and how it is calculated for insurance

Thus, if the PCA website writes that the policy is with the policyholder, this means that everything is in order with him. The document is genuine, you just need to figure out where it is.

What does the policy status “held by the policyholder” mean?

So, the owner of the car entered a search query, received an answer that the insurance policy was held by the policyholder and could not understand what this meant. First of all, you need to define the terms. In this case, it is assumed that the document was received by the driver, it is genuine and has been registered in the RSA electronic database.

The options for interpreting the result of the request, which means the policy form is in the hands of the policyholder, are as follows:

- The paper was received, lying at home or in the car, but the owner of the car simply forgot that he received it or where he put it. The way out of this situation is to print out the electronic version and certify it in the prescribed manner.

- Data about the agreement were transferred to the unified RSA database, but the document did not reach the recipient. This is a common occurrence when registration takes place online. You need to contact the company and clarify how to obtain the paper.

- The owner of the equipment has a copy in his hands. The original is available, but can be sent by mail or given to a courier. There is no way to speed up the process, since each policy is original with an individual number. If paper gets lost on the road, no problem. It will be canceled and a new one will be issued, but with a new identifier.

Related article: Calculation of the cost of compulsory motor vehicle insurance for a motorcycle in 2019

Important! It happens that the system writes that the MTPL policy is with the insurer and it is not clear what this means. Everything is simple here - the contract is real, forgery is excluded. It’s just that the operator did not have time to enter his details into a single database or some kind of failure occurred in it. After some time, the information will pass and the status of the document will change.

What to do if the compulsory motor liability insurance policy has not arrived in the mail, read more here.