What documents is the driver required to carry with him according to the law?

First of all, it should be mentioned that according to clause 2.1 of the Road Traffic Rules (hereinafter referred to as the Traffic Regulations), the driver is required to have 3 main documents with him:

- driver's license;

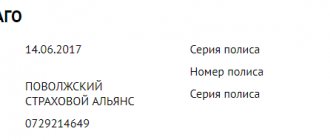

- a valid motor liability insurance policy;

- vehicle passport (hereinafter referred to as PTS).

At the first request of the traffic police officers, the driver is obliged to provide documents for verification. However, the difficulty in interpreting the laws lies in the fact that nowhere is it mentioned about providing copies or duplicates of the above-mentioned documents.

Article 32 of Federal Law No. 40 “On compulsory motor third-party liability insurance” regulates the mandatory availability of compulsory motor liability insurance. The lack of insurance for a motorist entails penalties in the amount of 500 rubles, based on Article 12.3 of the Code of Administrative Offenses of the Russian Federation.

What does the law say about this?

According to Article 32 of the Federal Law “On Compulsory Motor Liability Insurance”, the owner of the vehicle is required to have a printed compulsory motor liability insurance policy with him. RAMI claims that a printout is not at all necessary, but it is better to have it on hand, since a situation may arise when a traffic police officer simply does not have the opportunity to check the document number for technical reasons, lack of communication, etc.

It should also be noted that on July 3, 2015, the Road Safety Department of the Russian Ministry of Internal Affairs sent a letter to all regional branches of the State Traffic Safety Inspectorate stating that drivers cannot be punished for not having a copy of the insurance policy if the information provided is checked against the RAMI database. However, it is pointless to comment on this, since the position is reflected only in the letter and is not enshrined at the legislative level.

Is it possible to drive with a copy of the MTPL policy instead of the original?

As already mentioned, no regulatory legal acts mention the possibility of providing a copy of the above documents upon request of a traffic police officer.

Important! The presence of a copy of the insurance policy does not confirm the presence of the original, even if it is notarized. Existing legal norms nowhere regulate the legal value of such documents, therefore human rights activists do not recommend using them. Even if the driver is afraid of theft or loss of documents, it is unacceptable to carry a copy of the OSAGO.

Expert opinion

Mironova Anna Sergeevna

Lawyer and lawyer for automobile law. Specializes in administrative and civil law, insurance.

When asked whether to carry a copy with you instead of the original MTPL insurance, we gave a comprehensive answer. However, in modern realities, issuing an electronic policy is popular, which causes concern among vehicle drivers.

Is a copy of electronic OSAGO legal?

Federal Law No. 40, Art. 15, clause 7.2 speaks of the possibility of purchasing electronic OSAGO (hereinafter referred to as E-OSAGO), which raises a logical question - how to provide it to a traffic police officer if necessary.

Electronic insurance is issued by contacting the insurer via the Internet. The order of registration is approximately as follows:

- The driver fills out an electronic form on the Insurance Company website and pays for the policy.

- The insurer checks the data, confirms payment and sends a copy certified by its electronic signature to the policyholder by mail.

- The IC enters data about the registered document into its database, from where the information enters the registers of the RSA and the Ministry of Internal Affairs.

- At the client's request, the insurance company sends a paper original of the document by regular mail, which the car owner can take with him.

Several years ago, on the website of the Russian Union of Auto Insurers, drivers were recommended to print out a copy of the electronic insurance and carry it with them so as not to raise questions from traffic police officers.

Today there is no such need: all traffic police and traffic police officers are equipped with the technical ability to check electronic vehicle registration in the registers of the Ministry of Internal Affairs or the RSA online, so a copy of the e-MTPL is not needed. The only thing you need is your insurance details and car registration information.

Let's summarize! Registration of an electronic policy makes it possible not to provide it at the request of traffic police officers, however, when concluding an insurance contract in paper form, the driver is required to have it.

How to print an electronic MTPL policy?

If you issued an electronic MTPL policy yourself on the insurance company’s website, then in order to print the document, download the policy: usually a copy is sent by email or it can be downloaded from the insurance company’s personal account.

The resulting policy can be printed in either color or black and white. The main requirement: print in such a way that you do not accidentally cut off the necessary information; the text on the policy itself must be clear so that, if necessary, the inspector can check the policy with the electronic policy database.

We recommend that you additionally save your policy on your smartphone. If you lose the printed version, a police officer can, if necessary, check your policy using an electronic photo on your phone. In this case, there is a high probability of not receiving a fine of 500 rubles. for lack of a printed policy.

If you issued an electronic policy at the office of an insurance company, then you do not need to worry about how to print it - the office employees will print it themselves. If the insurance company employees refused to print an electronic policy, citing the non-compulsory procedure, insist on your opinion! The law directly states the driver’s obligation to carry a printed version of the policy with him. It would also be a good idea to pick up the accident notification forms from the insurance company representative. The form may be useful when registering an accident according to the European protocol.

Important: Be sure to check the printed version of the policy with the electronic one - count the number of pages and make sure that all pages are printed.

What to do if the original document is left at home

Legislative acts do not clearly state that for driving without documents, the violator is subject to penalties. For the absence of an insurance policy, in principle, a penalty of 800 rubles is expected; for failure to provide insurance or for a photocopy, the motorist will pay 500 rubles.

Drivers need to remember that the law is the same for everyone, so it is better not to forget important documents at home.

In case of loss or theft of documents, including voluntary car insurance, you should definitely contact the insurance company again and get a duplicate.

This is done on the day of application, the driver will receive a document with the same series and number, and the form will contain the appropriate mark.

If a duplicate of the insurance policy is presented upon request, no fines are imposed, since this document is equivalent to the original.

Advantages and disadvantages

The main advantage of an electronic document is its simplicity of execution , because to conclude such a car insurance contract you only need access to the Internet and data about the insured car.

The second advantage is saving time. To apply for a policy, you do not have to visit the office of the insurance company and waste time on the road, especially if the car owner lives in a remote region of the country and the nearest insurer’s office is located at a great distance.

Another advantage of remote policy issuance is the ability to choose additional services at your discretion and avoid the imposition of any options by an insurance agent. The disadvantages of e-OSAGO include the possibility of making mistakes when filling out data about the car and the driver, since even the slightest mistake can cause a refusal or delay in the payment of insurance compensation.

Another disadvantage: if a car owner insures his motor third-party liability for the first time or is insuring a new car, to conclude a compulsory motor liability insurance contract, he will have to personally visit the insurer’s office, since information about the driver must be entered into the RCA database.

Another significant drawback: the inability to register an accident using the Europrotocol , since without a traffic police officer it is difficult to check whether the participants in the incident actually have insurance.

You can find out more about the pros and cons of electronic compulsory motor liability insurance here.

When can a driver drive without an insurance policy?

It is also worth mentioning that, according to Art. 2 clause 2.1 of the Traffic Regulations, the owner of the vehicle is obliged to take out civil liability insurance within 10 days.

Important! Within 10 days after purchasing a car, the owner cannot be fined for not having a civil liability policy. However, experts recommend doing this as soon as possible, since in the event of an accident the insurance amount will not be paid, and if an uninsured driver causes an accident, then all compensation costs will fall on his shoulders.

Among other things, the absence of an insurance policy will not allow the driver to register the vehicle with the traffic police.

Fines for not having insurance

How to make changes to the electronic insurance policy

Today insurance has become mandatory.

All drivers know about this, but some people do not suspect what fines they have to pay if they do not have the appropriate paperwork when registering. You will have to prepare 800 rubles, which are transferred in accordance with the law.

A small amount does not scare car owners, so they continue to violate the requirements.

This approach leads not only to unnecessary costs, but also to frequent clashes with traffic inspectors. Having made such an oversight, drivers are subsequently in a hurry, because the deadline is coming to an end.

Is it possible to register a car without insurance? Process Features

Is it possible to sell a car without insurance? Deal Features

Is it possible to repair a car before insurance pays out?

Buying a vehicle is an important and responsible step in life for everyone. Not everyone has the opportunity to buy a brand new car, just off the assembly line. Some citizens decide to take out a loan to buy a car from a showroom, but the conditions for car loans are quite strict and are only beneficial for the bank. The solution to the problem in the current circumstances is to buy a used car. Many used cars are sold in excellent condition and at affordable prices. When the purchase and sale agreement is signed, the new owner is required to organize a number of important registration procedures - register the vehicle, obtain a registration certificate, enter new data into the vehicle passport and replace the MTPL insurance policy.

It will be impossible to re-register a car without insurance in 2021 and register it within the allotted time. However, there are several ways to simplify the procedure and reduce bureaucratic delays to a minimum. To understand when insurance is required, and under what circumstances an insurance contract is not required when registering a car, you need to delve into the basics of current legislation, consult with an experienced lawyer and develop an individual algorithm of actions for yourself.

Types and amounts of fines for the absence of a compulsory motor liability insurance policy

Constantly changing legislation requires clarification regarding the sanctions applied to drivers who do not have an insurance policy.

Until November 2014, if a driver was found to lack insurance, they were deprived of the opportunity to operate their vehicle. In other words, the motorist was threatened with deprivation of his license.

The types of fines and amounts are presented in the table:

| Type of fine: | Fine amount | Reference to law |

| Driving without insurance, driving with a copy of insurance, operating a car outside the validity period of compulsory motor liability insurance, the driver is not included in the policy | 500,00 | Code of Administrative Offenses of the Russian Federation, art. 12.3, part 2; Art. 12.37, part 1. |

| No insurance at all, expired policy | 800,00 | Code of Administrative Offenses of the Russian Federation Art. 12.37, part 2. |

Example: Ivanov took out an insurance policy, but for fear of losing the document, he carries with him a photocopy of the motor vehicle license. In the event of an inspection, the traffic police inspector has the right to impose penalties on the basis of the Code of Administrative Offenses of the Russian Federation, Article 12.3, Part 2 for driving without insurance in the amount of 500 rubles.

The modern Code of Administrative Offenses of the Russian Federation presupposes administrative material penalties that can be imposed repeatedly. For example, a driver fined for operating a car without insurance may be punished a second time.

Sources

- rbc.ru: In Russia it is allowed to show an electronic OSAGO policy during inspection

- rg.ru: You don’t have to carry a printout of the electronic OSAGO policy with you

- autonews.ru: Fines are issued for electronic compulsory motor liability insurance. What's happened?

Recommended for you

- How is the loss of marketable value of a car considered under compulsory motor liability insurance?

- How to change rights in the MTPL policy

- OSAGO is planned to be transferred to electronic format

Arthur Karaichev CEO #VZO. Since 2011, he has been closely studying the topic of finance, in 2021 he received a higher education in the field of

. Manages the project, manages heads of departments and is responsible for the creation of new services.

(10 ratings, average: 4.6 out of 5)

Summarizing

The amount of the insurance premium for an MTPL policy is available to every motorist in Russia, since tariffs are regulated by legislation and strictly controlled. Every driver should have an insurance policy, as this eliminates fines, problems with paying compensation in case of an accident, as well as the need to compensate the injured party.

When purchasing an E-OSAGO policy, the driver has the right to carry a printed copy in case of unforeseen circumstances, for example, lack of Internet or other breakdowns in equipment that allows checking the availability of insurance. When concluding a paper contract, the motorist must provide the original insurance, otherwise he will be fined.

Common problems

Despite the fact that the process of issuing and checking electronic MTPL policies has already been established and is working stably, certain problems cannot be ruled out. The most common is refusal to check the electronic policy or its printout. The inspector may not recognize such a document and fine you for not having a policy at all.

Please note that fines issued when attempting to present an electronic MTPL policy are illegal. You can appeal the actions of the inspector who fined you in court.

How do traffic police officers check your insurance policy in 2021?

It's very simple. The current clause 2.1.1 obliges you to transfer for verification (namely, transfer - hand over, and not just show):

- driver license,

- registration certificate,

- OSAGO policy.

If everything is quite clear with the first 2 points - although according to the new rules, electronic driver's licenses will soon appear, and behind them in IT format it will be possible to obtain an STS, then with electronic insurance, not everything is so clear.

Many drivers assume various ways to legally apply this section of the rules:

- show the traffic police inspector a photo of your electronic PTS,

- to submit the printed file,

- don't show anything because politics is an electronic medium!

But not all motorists from the above points are right. Moreover, on various forums you can often find false information that you don’t have to present anything at all, and that the inspector himself is obliged to check using the database whether you have insurance.

By the way, in 2021, almost every police officer on the road has access to the electronic database of insurance contracts of RAMI (Russian Union of Auto Insurers). And he (the employee) can check the insurance in this database.