Legislative regulation

On April 1, 2015, amendments were made to Federal Law No. 40, which concerned the maximum amount of compensation for damage caused to human health and life. Until this time, the amount of compensation was 160 thousand rubles.

25,000 rub. – a lump sum payment given for the funeral of a person killed in an accident. If more than one person died, then 25 thousand rubles were paid for each of them. The rest of the amount was distributed equally among other victims.

According to the current version of the law, the minimum amount for each victim is 500 thousand rubles.

The Government of the Russian Federation and the Ministry of Finance have compiled tables indicating the amounts of compensation paid to disabled people of three groups, children and other persons when they receive various injuries in an accident.

Attention! Victims will receive an insurance payment of 100% in the following situations:

- after the accident, the victim became disabled group I,

- the child injured in the accident was classified as a disabled child.

Citizens who, after an accident, became disabled group II, will receive compensation in the amount of 70% of the insurance amount, which is 350 thousand rubles. Victims who have been assigned group III will pay 50% of the insured amount. Individuals who have suffered various types of injuries will receive statutory compensation.

The document lists a list of injuries and percentages of the maximum amount of compensation under compulsory motor liability insurance:

- 7% (35 thousand rubles) will be received by victims with a head injury, when the brain is not affected, but there is a violation of the integrity of the skull bones,

- 3% for concussion, if the course of treatment was 7 days, 5% - 28 days, 15% - 28 days or longer,

- from 5 to 15% will be compensation for an injured eye (if vision is not lost),

- from 3 to 10% – hearing injuries,

- if the respiratory organs are injured, the amount of payments will range from 2% (if ribs are broken) to 60% (lung removed),

- problems of the cardiovascular system – from 5 to 30%.

Persons who were in the vehicle at the time of the accident and those who participated in road traffic are protected by current legislation.

The relatives of a pedestrian who intentionally threw himself in front of a car and died also have the right to sue the driver who was driving the car (as a civil action).

According to Art. 1079 of the Civil Code of the Russian Federation, a citizen who controls a source of increased danger, which is a car, is obliged to take all possible measures so as not to cause harm to others.

Challenging guilt in an accident.

How to receive payment to an injured pedestrian?

Just like in case of damage to a car, in case of harm to the health of a pedestrian, it is necessary to submit an insurance application with the necessary documents. The only thing is that the set of these documents will differ significantly – in a larger direction in terms of quantity.

First of all, immediately after an accident, at the first opportunity that arises, it is necessary to notify the insurer about the occurrence of an insured event, in accordance with clause 3.9 of the MTPL Insurance Rules. The consequences of failure to notify are not punishable - that is, if you do not do this, the organization will not refuse you compensation and, as of 2021, has no right to reduce or limit it in any way.

Almost always, if there are victims in an accident, traffic police officers order an administrative investigation. Next, the case may be transferred to the investigative committee if there are signs of criminal punishment for the culprit (such signs, in turn, appear in the event of serious harm to the health of a pedestrian or causing death). And in this case, the matter can drag on for up to a year. And only after that you will be able to receive the documents that the insurance company will definitely need.

In any case, the degree of harm is determined by a forensic medical examination, it is carried out after treatment and its result is an expert’s conclusion, on the basis of which the insurance company makes payments for part of the harm to health according to the table of compensation amounts or according to the actual costs incurred for recovery.

Thus, according to the complete list of documents to receive payment under compulsory motor liability insurance, you will need the following:

- the application itself, its form is established, but it is not mandatory; The main thing here is to provide all the necessary information for reimbursement, so it is better to fill out the official PCA form.

- in the application you must also indicate bank details or express a desire to receive money from the insurance company’s cash desk - your choice,

- documents from the traffic police: protocol/resolution on the violation by the culprit or a ruling on refusal to initiate (in any case, the violated clause of the traffic rules or other legal act must appear), information about the accident and its participants (can be a certificate of the incident, but not necessarily),

- documents from the hospital confirming the restoration of health (certificate, conclusion, discharge or others),

- conclusion of a forensic medical examination,

- if an ambulance was called to the scene of an accident, an issued certificate will be required,

- a certificate from your place of employment confirming your average monthly earnings for the last six months,

- all checks, receipts, acts and other documents that confirm your costs for treatment and are directly related to it, prescriptions for the appropriate medications are desirable; you can also collect tickets for travel to a medical facility (but not by taxi - such obviously more expensive alternative methods of transportation are not reimbursed by compulsory motor insurance).

Please note that you can also receive all medical services under your health insurance policy (CHI). By analogy, this is the same insurance as compulsory motor liability insurance - only the object is human health. In this case, you receive medical services for free, but then the organization of your compulsory medical insurance policy collects these costs from the insurance company at fault - this is an established practice.

Conditions for receiving insurance compensation

According to the Road Traffic Rules (adopted by RF PP No. 1090 dated October 23, 1993, as amended on September 10, 2021), there are three types of road traffic participants. These include: drivers, pedestrians and vehicle passengers.

What will be the amount of compensation under compulsory motor liability insurance in the event of death, first of all, depends on how guilty the person is of what happened. Every road user can exercise the right of civil action to recover from the culprit of an accident. Let's look at the table.

| Fatal accident | The driver died | Pedestrian killed | Passenger died |

| No guilt | Up to 500,000 rub. | Up to 500,000 rub. | Up to 500,000 rub. |

| Guilty | ___ | Civil action | There will be no compensation if the driver causes an accident due to his actions |

| Both are to blame | The decision is made by the court | Civil action | Civil action |

Important! Usually, when investigating a traffic accident, the degree of guilt of the passenger in the vehicle who caused the accident is not considered.

Although from practice we know of cases where passengers prevented the driver from keeping an eye on the road, tried to take the steering wheel away, or provoked a fight.

If the accident was caused by the passenger’s improper behavior, which ultimately led to his injuries or death, compensation for damage to health or life is not paid. In this case, the driver is recognized as the victim.

If we are talking about an insured event, traffic police officers are called to the scene of the accident. Based on the results of the inspection, a protocol or resolution is drawn up, and a certificate of accident is issued. If there are injured or dead citizens, the Euro Protocol does not apply.

Where to file a car theft report?

Who to sue in case of an accident, the culprit or the owner, read here.

I hit a dog with a car, what the danger is, read the link: https://novocom.org/avtotransport/chto-delat-esli-sbil-sobaku-na-mashine.html

Will the culprit get money?

According to the general rule, compensation under compulsory motor liability insurance is paid exclusively to those injured in a road accident. The policy itself insures the driver's civil liability to other road users, so compensation is not provided for the person responsible for the accident.

Note!

The law has the concept of mutual guilt. In this situation, each party to a road accident is considered both guilty and injured. Blame may be assigned to drivers 50/50 or some other proportion. This determines the amount of insurance compensation they can expect to receive.

Establishing the guilt of participants in an accident is the exclusive competence of the court. Traffic police officers, insurers and other persons do not have the right to do this.

If the accident was caused by the actions of a pedestrian, the court most often sides with the deceased driver or passenger of the vehicle.

Who is entitled to receive compensation in the event of the death of a victim?

When a person dies in an accident, compensation in accordance with the law is paid. In paragraph 6 of Art. 12 of the Law “On Compulsory Motor Liability Insurance” provides a list of persons who have the right to receive compensation in connection with the loss of a loved one who has become a victim of a traffic accident.

These persons include: husband/wife, father or mother, children, as well as persons who depended on the deceased (if he could not earn money on his own), that is, beneficiaries.

A similar right can be exercised by persons for whom the deceased was the only breadwinner..

The categories of citizens who have such a right are defined in Art. 1088 Civil Code of the Russian Federation:

- disabled citizens who were dependent on the deceased, as well as those who had the right to maintenance,

- child or children born after the death of the father,

- a relative of the deceased who cares for dependent persons (elderly or sick people),

- dependents who have lost their ability to work within 5 years from the date of his death,

- relatives caring for disabled persons.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

In the practice of paying compensation under compulsory motor liability insurance (for 2021), a case is considered when a person injured in an accident fell into a coma. At the same time, he cannot personally claim compensation for damage to health and cannot determine his legal representative.

This situation is practically insoluble. When a person dies, relatives receive an appropriate payment based on documents indicating family ties with the deceased.

Who has the right to receive money for someone who died in an accident?

Until April 2021, this could only be done by persons who were dependent on the deceased during his lifetime. For example, a disabled spouse. However, innovations in legislation have expanded this list.

According to paragraphs 6-7 of Art. 12 of the Federal Law “On Compulsory Insurance of Civil Liability of Vehicle Owners” No. 40-FZ, the following citizens have the right to count on receiving insurance compensation:

- children of the deceased;

- children who were born after the death of their father;

- persons who are dependent on the person whom the person who died in the accident was caring for;

- the dependents themselves;

- citizens who lost their ability to work within 5 years after the death of the breadwinner.

Note!

Refunds are not automatic. To receive money, the applicant must collect a complete package of documents and submit them to the insurance company within the deadlines established by law.

Procedure for receiving payment

Please note! Requirements for the actions of a person who intends to receive compensation:

- The first thing you need to do is notify the insurance company about the occurrence of an insurance situation. To do this, a statement of rights to insurance payment due to the death of the victim is written. It is transferred to the insurer of the person at fault for the accident. 15 working days are allotted for acceptance of the document,

- obtain from the driver at fault in the traffic accident information about insurance (insurance policy number, name of the insurer, address, contact telephone number),

- collect all the papers and hand them over to the insurer. The fact of transfer of documentation is registered with the company. The insurer's representative is obliged to give the person who submitted the application a list of accepted documents, certified by a seal,

- receive insurance compensation. Funds are transferred to the applicant's bank account or issued in cash at the cash desk.

Payment can be received within five working days after all applicants for compensation have submitted their applications. The compensation amount is distributed among applicants in equal shares.

In case of late payment, a penalty is charged (1% of the amount of insurance compensation).

Accident while driving in reverse.

Required documents

The total amount of assistance in case of death of a person in an accident consists of the amount of compensation and expenses associated with the funeral. To calculate this amount, you will need some documents.

They must be brought or sent to the insurer. Funeral costs are confirmed by documents (service agreement, receipts, checks, invoices, etc.).

victim's statements for insurance payment under compulsory motor liability insurance free in word format

To apply for compensation you will need:

- application (indicating information about family members),

- accident notification,

- certificate of accident issued by the traffic police,

- death document (copy),

- papers on the relationship of minor dependents with the deceased (birth certificate, adoption papers),

- documents confirming the dependent’s disability (if such a fact is known),

- a certificate from an educational institution confirming the fact that a dependent of the deceased is studying full-time,

- a document on the need to provide care for relatives of the deceased who are disabled,

- a certificate from the hospital stating that the dependent of the deceased must care for a sick or disabled person,

- marriage certificate, birth certificate - papers indicating relationship with the deceased.

In addition to the listed papers, bank details of the persons to whom compensation will be paid are provided. If a minor or a person with limited legal capacity is applying for payments, the consent of the guardianship and trusteeship authorities will be required.

If incomplete documentation is provided or additional information is required, insurers will notify the applicant.

ATTENTION! Look at the completed sample application of the victim for insurance payment under MTPL:

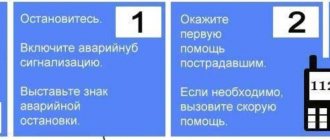

Watch the video. How to behave after an accident with victims:

Step-by-step algorithm for receiving compensation

Insurance companies try to minimize the amount to be paid or completely refuse it if there are violations in the document submission procedure. Therefore, it is important to act correctly.

Here is a step-by-step algorithm for obtaining insurance for relatives or dependents of a person killed in an accident:

- Make sure that the person at fault notifies his insurance company about the accident. You need to take the details of his OSAGO policy.

- Collect a package of documents and submit them to the insurance company of the person responsible for the accident. According to clause 8 of Article 12 of Law No. 40, the insurer is obliged to accept requests from other beneficiaries within 15 days from the date of filing the first application. Each person makes 2 copies of the package of documents.

- An insurance company employee takes the papers. He makes an acceptance mark on one of the copies. The applicant keeps this package for himself.

- If a citizen has not provided all documents, the insurer is obliged to provide the missing documents on the day of application. This is stated in clause 1, paragraph 5 of Article 12 of Law No. 40.

- Insurer employees conduct an inspection within 20 days, then issue a verdict on the transfer of compensation or refusal to pay. The applicant will be notified in writing of the decision.

- If the insurance company has agreed to pay the money, it should arrive in the beneficiaries’ accounts within five days.

If the insurance company violates the deadlines for transferring money, the beneficiary has the right to go to court. In addition to the principal amount, he may demand a penalty of 0.5% for each day of delay: clause 21 of article 12 of Law No. 40. But first you need to follow the pre-trial procedure - submit a written claim to the insurance company. The document indicates the personal information of the applicant, the insurer’s data, voices a request to transfer money, and sets deadlines for fulfilling the request.

The claim is submitted to the office of the insurance company by the claimant personally or sent by registered mail with return receipt requested. It is important to keep written confirmation of the claim, as this will be evidence of an attempt to resolve the dispute amicably in court.

Documentation

To receive money, the applicant must provide the following documents to the insurance company:

- Applicant's passport. If for some reason a citizen cannot interact with the insurer on his own, he has the right to use the services of a representative by issuing a notarized power of attorney for him.

- Application for payment transfer. It indicates all dependents who were in the care of the deceased citizen.

- A copy of the death certificate.

- Copies of birth certificate or adoption documents - if the deceased had children. Adopted children in this case are equal to biological ones.

- A copy of the marriage certificate - if the husband or wife is applying for payment.

- Documents confirming funeral expenses: copies of receipts and agreement with the funeral company.

- Certificates of disability from citizens who were dependent on the deceased.

- Certificate from the place of study, if the dependent is a student.

- Documents from a medical institution confirming the fact that the dependents of the deceased require constant care.

- A certificate stating that a family member of the deceased is unable to work due to the fact that he is forced to care for relatives of the deceased who were dependent on the latter.

- Certificate of income of the deceased for the last calendar year. The document can be obtained from the accounting department of the employing company.

- Bank details of the applicant for transfer of compensation.

- Documents received from traffic police officers.

Does the person at fault for an accident with fatalities receive insurance?

Each participant in an accident in which a person died is interested in the question of receiving insurance payments. Those responsible for the incident also want to know about it.

It should be noted that payments under compulsory motor liability insurance to those responsible for the accident are not provided for at the legislative level, since, first of all, insurers protect the rights and interests of persons who are victims of road accidents.

Thus, the person whose actions led to such serious consequences independently solves his financial problems related to the consequences of the accident.

Although in this case some questions arise. When several cars are involved in an accident, the drivers of which also violated traffic rules, the culprit simultaneously becomes the victim.

In the situation considered, compensation for damage is due to both the victims and the guilty-victim in accordance with the current standards.

Usually such situations are dealt with in court. The fact is that these types of accidents involve multiple drivers and multiple insurance companies. But if one culprit is determined, he is not entitled to insurance payments.

In addition, if the person responsible for the accident dies, his relatives are not paid compensation for the funeral.

When an accident occurred due to the fault of a pedestrian who violated traffic rules, and as a result he himself died, his relatives are paid compensation under compulsory motor liability insurance.

According to statistics, drivers are usually found guilty of road accidents. At the same time, attention is rarely paid to real circumstances.

Thus, we can conclude that compensation under compulsory motor liability insurance is paid only to victims of an accident. The perpetrators receive it in a separate case and only after the case is considered in court.

Relatives and family members of the breadwinner who died as a result of the accident are guaranteed to receive payments in the form of financial assistance and reimbursement of expenses associated with the funeral.

According to the current legislation, the amount of compensation to the relatives of the deceased is 500 thousand rubles.

Attention! Sometimes the amount of compensation does not cover the amount of damage from the accident. In this case, the remaining amount (by court decision) is paid by the person responsible for the traffic accident. The issue can be resolved without going to court if the parties were able to reach an agreement on their own.

What payments are due under compulsory motor liability insurance in case of injury to health?

Payments under compulsory motor liability insurance are aimed at compensating people involved in an accident, their suffering and physical damage received. There are two types of payments:

- Basic. Paid as a percentage of the maximum insurance amount.

- Additional. They are provided if the victim can prove that he did not have enough funds for treatment.

The maximum payment amount is 500,000 rubles. You can receive funds before the end of treatment if you have a preliminary medical report. In this case, the amount that is compensated based on the health insurance policy does not matter.

Injuries

In case of injury, compensation is calculated by multiplying the insured amount by a percentage determined by regulations in accordance with the degree of severity. If the victim received several injuries of a different nature, payments for each of them are summed up.

Example: a participant in an accident received abrasions and scratches with an area of up to 10 square meters. see and light bruises. The payment amount is calculated as follows: 500,000 rubles multiplied by 5% plus 500,000 rubles multiplied by 0.05 percent. 5% - compensation for mild soft tissue injuries, 0.05% - payment for bruises. Thus, compensation of 25,250 rubles is due.

Disability

If the accident results in a disability for the victim, the amount of compensation will depend on the degree of disability:

- When establishing the first group, the maximum compensation is 500,000 rubles.

- Second disability group – 350,000 rubles.

- Third disability group – 250,000 rubles.

If the accident caused the child’s disability, then in accordance with clause 5 of Resolution No. 1164, compensation in the amount of 2,000,000 rubles is due.

Treatment

The insurance provides compensation for recovery costs and compensation for earnings lost during the period of treatment at home or in a hospital.

The amount of payment is determined individually and depends on what harm was caused to the human body. If the insurer has already made a payment but later discovers that additional money is required for restoration, a recalculation must be made.

What else to read:

- My car was scratched in the yard, what should I do?

- Europrotocol 2021

- How to get money instead of repairs under compulsory motor liability insurance: a detailed review

Payments for treatment include coverage of the following costs:

- recovery from injuries;

- purchasing medicines;

- prosthetics;

- payment for care services for the victim.

A medical certificate is required to confirm expenses.

Lost earnings

To receive compensation for income lost during treatment and recovery, proof of disability, as well as the amount of monthly income, is required.

To receive compensation, you must provide a medical report, a medical examination report and income certificates. If the victim does not work, other documents confirming payments are required, such as a certificate of the amount of social benefits, pensions, scholarships.

The amount of compensation for the unemployed is determined on the basis of the subsistence level or a certificate of income from the last place of work. If the lost income exceeds the amount of compensation, the insurer must make an additional payment.

Death

If an accident causes the death of a person, his relatives can count on a maximum compensation of 500,000 rubles for the risk of death. To do this, you must contact the insurance company with a corresponding application.

Video on the topic:

Compensation for damage caused to the injured party by court decision

When a person dies in an accident, for his relatives this is not only a material loss, but also great moral suffering.

In a situation where insurers do not pay due compensation, relatives of the deceased file a claim in court. The demands they put forward are compensation for material damage under compulsory motor liability insurance.

Since compensation for moral damage is not the responsibility of insurers, this responsibility rests with the person at fault for the accident.

In most cases, compensation for moral damages is sought through the courts. In order to correctly fill out the papers and for greater confidence in their actions, citizens turn to a lawyer for help.

When a citizen who died as a result of an accident is also to blame for the incident, his relatives will still receive compensation for moral damages, but its amount will be reduced.

The same situation occurs when a person is intoxicated. Moral damages are paid by the owner of the vehicle that caused the accident. It does not matter whether he is an individual or a legal entity.

Do I need to undergo a technical inspection in case of an accident if I have insurance?

The following documentation is submitted to the court:

- document on the death of a loved one,

- certificates of relationship: marriage document, birth certificate, etc.

- certificate of an accident issued by the traffic police,

- a decision to bring the perpetrator to criminal liability,

- application to the court.

The court decides what the amount of moral damage will be. In doing so, the judge takes into account all the circumstances and nuances of the case. When deciding on the amount of moral compensation, the court pays attention to the difficult family and financial situation of the culprit, the form of his guilt (whether the accident was committed intentionally or through negligence). Compensation for moral damage may be lower or higher than the amount of material compensation.

How to file a claim

claim for compensation for moral damage in connection with death free of charge in word format

Important! The statement of claim must contain the following information:

- name of the court,

- plaintiff's name. Full name, residential address (for an individual), address details of a legal entity. In addition, there must be information about the authorized person who acts on behalf of the plaintiff (full name, address),

- full name of the defendant,

- what rights of the plaintiff are violated or may be violated, the applicant’s demands,

- cost of claim. This indicator includes the amount of collected and disputed amounts,

- a list of circumstances due to which the claims were made,

- documentary evidence of the facts stated in the application,

- list of documentation attached to the claim,

- date of writing the application.

The statement of claim is confirmed by the personal signature of the applicant. When an authorized person with the right to endorse a claim and submit it to court acts on his behalf, his signature is placed under the document.

ATTENTION! View a completed sample claim for compensation for moral damages in connection with death:

Which court to file a claim in?

Before filing a claim in court, you must pay a state fee.

Calculations are made independently. The procedure for calculating the fee in a court of general jurisdiction is determined by Art. 333.19 Tax Code of the Russian Federation.

If the claim is of a property nature, it has its own value. The amount of the state duty will be:

- the cost of the claim is up to 20,000 rubles. – the state duty will be 4% of the claim price, but not less than 400 rubles,

- claim for an amount from 20,001 to 100 thousand rubles. – 800 rub. and another 3% of the amount more than 20,000 rubles,

- claim worth from 100,001 rubles. up to 200 thousand rubles. – 3200 rub. and 2% of the amount exceeding 100 thousand rubles,

- for a claim worth from 200,001 rubles. up to 1 million rubles – 5200 rub. and 1% of the amount exceeding 200 thousand rubles,

- claims worth 1 million rubles. – 13,200 rub. plus 0.5% of the amount over 1 million rubles. In this case, the state duty cannot exceed 60 thousand rubles.

Having calculated the amount of the state duty, you need to choose the court where to file the claim. Civil proceedings are heard by magistrates' or district courts.

The claim is filed at the place of residence of the defendant. If the defendant is an organization and not an individual, you should go to court at the location of the defendant. So, you need to contact the district court at the address of the organization’s location, but not its owner.

Please note! The application is submitted to the court in the area where the defendant lives. If he lives in another locality, then the claim will have to be filed there. This is a rather important feature of the procedure for applying to the court.

After writing the application and collecting the documents, check everything again. Pay special attention to the little things. If you have no doubts about the correctness of the drafting, take the claim and the package of documents to the office of the selected court. When accepting such papers, their registration is required.

The absence of errors in the claim and selection of documentation is the basis for the court to accept the case for proceedings. As soon as the case is accepted for proceedings, the plaintiff is informed of the date of the preliminary hearing.