Is it possible to insure a car for 3 months?

3.3 (66.67%) 12 vote[s]

The standard option for issuing compulsory motor liability insurance is a period of 12 months, after which it is mandatory to renew the policy. However, when calculating the cost of an MTPL insurance policy, a factor such as seasonality or the duration of the insurance is taken into account. This means that the insurance period can be chosen, and the minimum period is 3 months. But in order to verify such information, it is necessary to familiarize yourself with the legal provisions, and if this action is permitted, then how it can be implemented in practice.

Registration of compulsory motor liability insurance for 3 months

Even before 2008, the ability to take out insurance for less than 12 months was not allowed. This rule applied even to those motorists who used the car for only two months or less, but still had to pay for the entire year. Is it possible now to get a compulsory motor liability insurance policy for 3 months? According to Federal Law No. 40 “On Compulsory Insurance”, today all drivers have the right to obtain an MTPL insurance policy for a period of 20 days, 1, 3, 6, 9 and 12 months. The registration procedure is identical to that for annual insurance. The contract contains similar clauses, and the policy period is indicated in the certificate in the upper right corner.

Therefore, any driver can receive compulsory motor liability insurance for 3 months. This rule is enshrined in law and is regulated by Federal Law No. 40.

To obtain insurance for a short period, it is enough to submit the necessary documents to any office of a company that specializes in auto insurance. If three months is not enough for you, you can extend the policy on a general basis by simply paying the difference. This state of affairs is called “extra insurance”. But if you need to drive a car, but the 3-month term has already expired and you have not renewed the policy, then this action is considered a violation and entails administrative liability. The fine in 2021 is 800 rubles.

Which coefficients cannot be changed?

First of all, it is worth understanding what coefficient cannot be changed under any circumstances. It is called KM and denotes an indicator that depends on the power of the car’s engine. As a rule, its indicators are adjusted in the range from 0.6—the car’s engine has 50 horsepower, and up to 1.6—for engines that have 150 horsepower or more. For a domestically produced car, this coefficient is usually equal to 1.1. This is due to the fact that such machines have a motor whose power is 70-1000 “horses”. To save money on car insurance, some drivers begin to change the engine power using ECU programming or other methods. But solving the problem this way is not the best way. The best solution is to think in advance about how to save on insurance and buy a car with less engine power.

When is it worth buying insurance for 3 months?

Who might need short-term insurance? In what cases is it advisable to insure a car for several months? Firstly, the cost of such a MTPL policy will be cheaper, and secondly, you don’t always have to use the vehicle throughout the year. This can happen in the following cases:

- you are going to sell your car soon;

- you are going on vacation or a business trip;

- the car is transferred for permanent use to another driver;

- the vehicle requires serious repairs, you are going to take it to a service station in the near future;

- if the car is purchased in another locality and requires transportation (for transit purposes);

- in case of seasonal operation of the vehicle, for example, when using watering machines, agricultural machines, harvesting machines and others.

For those policyholders who have taken out insurance for three months, it is important to know that if it is necessary to renew it, you must notify the insurance company 30 days in advance, otherwise you will be denied additional insurance.

The last option – seasonal use of the car, is the most common reason for short-term vehicle insurance. By signing a contract for 3 months, you save significantly compared to the annual cost of compulsory motor liability insurance, however, if you need to extend the policy, you will have to pay a similar difference, which will lead to the same result. But as for 6 and 9 months of insurance, you will not feel the difference in price; then it is better to immediately conclude a contract for a year.

Validity

The law requires all car owners to obtain compulsory motor liability insurance . This can be done at any insurance company of your choice. Moreover, no matter which company the policyholder chooses, the procedure for concluding an MTPL agreement will be the same.

The rules for interaction between the parties in compulsory insurance are uniform and regulated by regulatory legal acts, in particular, the Federal Law “On Compulsory Insurance of Civil Liability of Vehicle Owners” (Federal Law on Compulsory Motor Liability Insurance).

Thus, paragraph 1 of Article 10 of this Law determines that the contract is valid for one year (how can you find out if the policy is valid?). The following cases are exceptions :

- If the car is registered in another state, but is in Russia temporarily, then the contract is drawn up for the period of its temporary use (minimum 5 days).

- If a person purchased a car in one city, but wants to register it in another, then they can make a temporary “automobile license” for the period of transportation of the car to the destination city.

In this case, the time cannot exceed 20 days. IMPORTANT : However, this provision does not mean that the driver does not need to purchase permanent insurance for 1 year. This must be done before registering the vehicle. - A temporary policy for a period of no more than 20 days can also be purchased when the vehicle is due for technical inspection and does not have a diagnostic card. This refers to a document that contains information confirming compliance with safety requirements. You can find out when you need to undergo a technical inspection for compulsory motor liability insurance and whether they will provide insurance without a coupon in this article.

However, insurance companies provide the opportunity to purchase a policy for a shorter period of time (what is the minimum policy period?), and then renew it for up to a year. We will discuss below whether it is possible to make a policy for a period of a month, 3 or 6, in standard cases, and for what period of time a contract can be concluded with limited use of the car.

Watch the video about the validity period of the Osago insurance policy:

1 month

When is it allowed?

For such a period, it is allowed to issue a policy only if you drive a car registered in another state, and if he arrived in the Russian Federation only for a month. In this case, the policy may provide for another period equal to the time the vehicle is present on the territory of Russia, but not less than 5 days.

If the driver is interested in the question of whether it is possible to take out a policy for a month in order to extend existing insurance, then the answer will also be positive . For example, when a person has a “motor citizen” issued for six months, but he needs insurance for 7 months, he can extend it for 1 month (through additional insurance).

In other circumstances, it will not be possible to conclude a contract for a month, since in normal cases the minimum duration of the policy is 3 months.

Price

The insurance premium that will have to be paid to the insurance company for a policy for a period of 1 month for temporary entry depends on a number of factors:

- vehicle brands and models;

- Year of release;

- age and length of service of the driver;

- the region in which insurance is produced;

- the number of drivers who are allowed to drive a vehicle.

For example: Ivan Ivanovich Ivanov is temporarily in Russia and travels using a vehicle registered in another country. It is planned that in a month he will leave the Russian Federation. In order to protect himself and others from unforeseen circumstances, he decided to purchase a temporary MTPL policy for 1 month. The insurance company may offer to take out insurance for his 2010 Volkswagen Sharan for 3,570 rubles. This is despite the fact that his driving experience is more than 3 years, and his age is more than 23 years.

Peculiarities

In financial terms, there will be no difference for the driver whether he takes out a policy for a month or for a period half as long. The amount of the insurance premium to the insurer is the same when purchasing compulsory motor liability insurance for a period of 16 days to a month.

3 months

When is it allowed?

Compulsory insurance for 3 months can be done in several cases:

- on the same basis as stated above - when making transit entry of a car, but for three months;

- during seasonal operation of the machine;

- when the vehicle is used exclusively by those drivers indicated by the policyholder.

The last two points relate to insurance for limited use of the vehicle. The rules for this type of insurance are established by Article 16 of the Federal Law on Compulsory Motor Liability Insurance.

It is possible to apply limited insurance not only for 3 months, but also for a longer period.

Price

Let's take, for example, the same Ivan Ivanovich Ivanov with the same 2010 Volkswagen Sharan. If he wishes to purchase a policy for 3 months, he will be required to pay :

- 5,951 rubles if he enters in transit;

- 8,895 rubles if he uses the car seasonally (without limiting the number of drivers);

- 4,942 rubles if the contract provides for a limited number of drivers.

Peculiarities

ATTENTION : The price of a three-month policy is equal to half the cost of annual insurance. It turns out that one month of insurance under a three-month contract costs more than under an annual one.

However, for those who actually travel no more than three months a year, concluding a contract for such a period will save money.

If it turns out that three months is not enough, and insurance is needed for the whole year, then the policyholder can pay the remaining half of the funds and get an annual policy without spending extra money. However, it may happen that by the time you need to pay the second half of the policy cost to renew it for a year, the rates will increase. Then the driver will pay more than 50% of the cost.

6 months

When is it allowed?

Is it possible to make a “motor citizen” for six months ? Of course, yes, and this can be done for individual policyholders on the same basis on which it is issued for 3 months:

- upon temporary entry;

- with limited use of the machine.

For legal entities, the limited use of cars is at least 6 months. Therefore, organizations cannot issue a policy for three months, but only for six months or more.

Price

If Ivan Ivanovich Ivanov wishes to take out a policy for his 2010 Volkswagen Sharan for a six-month period, he will pay the insurer:

- 8,332 rubles for temporary entry;

- 12,453 rubles for seasonal operation of the vehicle (with an unlimited number of drivers included in the insurance);

- 6,918 rubles with a limit on the number of drivers.

Wherein:

- The insurance premium to the insurer is 70% of the cost of annual insurance.

- It is allowed to use the car not only for 6 months in a row, but also intermittently.

- The policy form will indicate 1 year as its validity period, and below the clarification of the period of use will be reflected.

Policy cost

Do you need short-term insurance and how profitable is it? Having studied the policies of insurance companies, we can safely say that the cost of auto liability insurance for 3 months will be exactly half of the price of an insurance policy for a year. If you realize that the allotted time is not enough for you and you need a car, then you have the opportunity to extend the policy for a month, several months or a whole year. If you decide to extend your insurance until the end of the year, then you will only need to pay the difference from the full annual cost, that is, the remaining 50%, but if the price of compulsory motor liability insurance has not risen in price during this time.

For example, as of 2021, the current cost of an MTPL insurance policy for passenger cars (except for those used in taxis) is a maximum of 4,942 rubles, respectively, insurance for a period of three months will cost 2,491 rubles (without taking into account the individual characteristics of each policyholder). Such a policy is primarily related to the fact that drivers take out insurance on a standard basis, that is, for 12 months. You can find out the cost of MTPL for 3 months at a specific insurance company using the online calculator on the official website. In addition to filling out personal information and car data, you will need to select the desired period - 3 months.

What affects the price of compulsory motor insurance

Most drivers are sure that the price of compulsory motor liability insurance is fixed and only insurance companies can set it. But this is a misconception.

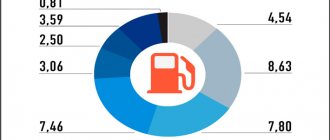

Insurance costs may well be less or more, and this depends on a number of reasons:

- Basic payment and its amount. It is simply impossible to change this factor; it is fixed.

- Type of car. What class the car belongs to can be found in the owner's license.

- The locality where the owner of the car permanently lives. As a rule, the larger the city in which the car is registered, the more expensive the insurance will be.

- How much driving experience does a person have? There are situations when the cost of compulsory motor liability insurance is influenced by the experience of driving a car.

- How the machines are used. Statistics show that insurance costs for cars owned by officials are much higher than for personal ones.

- Validity of the contract. In order to save at least a little on your MTPL policy, it is best to take it out for a longer period of time

Based on what has been listed, the cost of the policy depends on many factors. Insurance, which is considered to be the most expensive, applies to drivers who have a category B license and costs 41,000 rubles. Based on this price, it is quite logical to explain the desire of car owners to save at least a little on MTPL and reduce the final price to the maximum. But the question remains: “How to do this correctly?”

How to get insurance

If you are satisfied with the MTPL policy for several months, then you can apply for it at any insurance company. If you have already insured yourself before, then the option of online registration through the company’s official website is also available to you. However, both when contacting the office in person and via the Internet, you will need to present a mandatory package of documents, namely:

- passport;

- driver's license;

- vehicle registration certificate;

- diagnostic card if the car is older than 3 years;

- vehicle registration certificate.

If compulsory motor liability insurance is issued by a legal entity, then it is additionally required to provide an extract from the Unified State Register of Legal Entities. But it is worth noting that for legal entities. for persons, the insurance function is not available for 3 months, minimum 6 months.

An application in the prescribed form must be attached to the above documents. It is usually drawn up on the spot according to a sample, and when filling out an online application, it is generated automatically, based on the information specified in the application form. Having insured your vehicle for a short period, carefully monitor the terms and renew the policy in a timely manner if you no longer need to use the car.

TB

This coefficient indicates the basic insurance rate. It is almost impossible to change it, since it is the insurance company that establishes its indications. But there are still exceptions, in which TB can vary in a small range from 3432 to 4118 rubles. If the car is subject to taxation, then this coefficient becomes higher. We have already learned that each insurance company establishes its own TB. In order to save at least some money on it, the driver of the car must, before concluding an insurance contract, study the services of all proposed insurance companies and choose the most suitable one.

PIC

FAC is one of the important coefficients. It determines the age of the driver himself and the time he spent behind the wheel, or, more simply, his driving experience. The range of the coefficient ranges from 1.8 to 1. So, for example, a driver whose age, say, is 22 years old, has a driving experience of no more than three years, and in this case, he will pay the maximum for insurance, and the FIC will be 1.8. But drivers whose age has already passed the 22 year mark, and who have already had more than three years of driving experience, can hope that the FAC will be equal to 1. So, how can you save on compulsory motor liability insurance thanks to this coefficient? It is quite clear that it is simply impossible to change your age downwards, but as for length of service, everything is simpler here, it can be increased. Of course, car licenses are issued only after 18 years of age, but you can start learning to drive a car at 17. In this situation, your experience will be longer, and your insurance costs will be lower.