What does total mean after an accident?

In the most general and simple case, total loss of a car after an accident occurs when the vehicle is destroyed structurally:

- it was torn apart

- it burned down

- “wrapped” around a pole or tree,

- turned over onto the roof and tumbled until it was completely destroyed.

In this case, everyone understands that it will not be possible to restore the vehicle and its technical characteristics. There is only one way out - scrap metal.

But in some cases, even minor damage at first glance can lead to total liability under compulsory motor liability insurance, for example, if the car’s roof was damaged or the airbags fired.

But there is also an “economic total”!

This concept in most cases appears in insurance cases under compulsory motor liability insurance, since such an event occurs more often than constructive loss of a car.

The very concept of “economic” is a colloquial term intended to immediately draw the attention of the car owner to what is being discussed. And we are talking about the costs of restoring the vehicle. Thus, economic total loss is simply a procedure for calculating payment when it becomes unprofitable for the insurer to restore the car.

When determining whether a car “died” after an accident or not, the expert first approximately, when inspecting the vehicle, and then during the examination, decides whether it is economically feasible or inappropriate to repair and restore this car. If it is not practical to repair it, then they say that the car is a complete loss.

For the purposes of compulsory motor liability insurance, total loss refers to cases where repair of a damaged vehicle is impossible or the cost of repair is equal to or greater than the value of the car at the date of the accident.

Refund procedure. What to do and what will happen next?

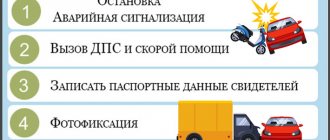

The procedure for applying for insurance compensation under MTPL remains the same.

- You submit an application to the insurance company for insurance compensation or direct compensation for losses (depending on the specific situation) with a full set of necessary documents.

- The insurer is obliged to inspect your car within 5 working days. Since we are talking about whether it is a total car or not, such a vehicle most likely cannot participate in road traffic, and therefore the insurer is obliged to inspect the car at its location, that is, somewhere near your house, in garage or parking lot. There is no obligation to transport the car to the insurer on a tow truck. Even if the insurer says that it will compensate for the costs, I would not do this, since the insurance company will simply deduct the costs of the tow truck from the amount of the payment (after all, the law actually allows them to underpay 10% of the damage).

- In general, within 20 calendar days, the insurer is obliged to organize restorative repairs of your car (issue you a referral for repairs, according to which the car will be repaired) or pay insurance compensation. If it is a total loss, then no repairs can be made and payment is made only in cash.

- Within the same period of 20 days, the insurance company is obliged to report a refusal if it makes such a decision. In this case, the refusal must be motivated.

As you can see, everything here is very simple and standard!

Options for receiving cash compensation

Insurance under this policy is a voluntary type of insurance. According to it, the car owner has the opportunity to personally choose insurance services provided by the insurance company. The CASCO package can be either full or partial.

The policyholder has the right to receive compensation in the form of:

- cash that makes up the total insurance amount, its calculation is carried out taking into account depreciation, that is, the gradual wear and tear of the brake system, engine, car parts during operation and its residual amount;

- a serviceable car, which is restored by a service station in agreement with the insurance company.

Usually, in the event of a total loss of a car, the insurance company may make offers to choose from the insured, so the responsibility will fall entirely on his shoulders:

- the policyholder keeps the unusable car, despite the proceeds received from the sale of suitable parts, this offer is not profitable for him;

- the remains of the damaged car are transferred to the insurance company based on the conclusion of an additional agreement.

Moreover, the policyholder is paid in full, regardless of whether he accepted the company’s offer.

The policyholder will receive some benefit if he accepts the second offer and transfers ownership to the insurance company.

How to calculate how much I will be paid?

We have already found out that in case of total compulsory motor liability insurance a payment is due, because this is directly stated in paragraph 16.1 of Article 12 of the Law on Compulsory Motor Liability Insurance. But how much will this payment be?

How much will I receive?

For all cases, we can immediately say with confidence that they will pay no more than the insured amount for compulsory motor liability insurance, which is established by paragraph b of Article 7 of the Law on Compulsory Motor Liability Insurance, that is, no more than 400,000 rubles. This amount cannot be increased, even if the damaged car was much more expensive.

Please note that we are talking specifically about compensation under OSAGO. The missing amount can still be recovered from the person at fault for the accident. More on this below.

How is the cost of a car calculated?

If the car was badly damaged, then it is possible that there were victims in the accident, and therefore you can wait a very long time for documents from the traffic police or the court. Accordingly, the price of cars may either increase or fall during this time.

However, the cost of the car is still calculated on the date of the accident. Even if it was a year ago or two.

This price is determined by the cost of analogue cars, which are taken from information and reference materials. If there are no such materials, then the expert has the right to independently calculate the cost of the analogue using the methods usually used for this type of examination. In practice, in most cases, experts make calculations based on data from sites selling used cars such as avito.ru, auto.ru, etc.

Payment calculation

In cases where the insurer has determined that the insured event is total, the payment is calculated in accordance with clause 18 of Art. 12 of the Law on Compulsory Motor Liability Insurance, namely the difference between the cost of the car at the time of the accident and the cost of the usable remains.

Let's give an example! At the date of the traffic accident, the victim’s car was 2 years old, and its market value was 1,500,000 rubles.

The victim was forced to sue the insurer due to the refusal of compensation. As a result of winning the court, the payment was made, but it was delayed due to litigation for 1 year. And the same three-year-old car costs on average 1,200,000 rubles.

As a result of the accident, the cost of all usable remains was calculated for a total of 600,000 rubles.

In this case, the victim receives... No, not 900,000 rubles, as many thought - 400 thousand.

The calculation here is simple:

- the market value of the car for calculating the total under compulsory motor liability insurance is taken as of the date of the accident - this is 1.5 million rubles,

- then we subtract the valid balances in the amount of 600 thousand and get 900 thousand payable,

- but the maximum insured amount of compensation cannot exceed 400,000 rubles, and therefore the victim receives exactly this limit.

Constructive loss of a vehicle under compulsory motor liability insurance

Abuses of insurance companies with total, why is it profitable for them? It is more profitable for an insurance company to admit the complete loss of a vehicle than to pay for its repair.

Repairs are expensive and economically unprofitable. What if there is no third party from whom you can recover funds for repairs? For an insurer, total is a way to minimize your financial losses. And the assigned auction price was then deducted from the total insurance amount. The determination of the total must be in accordance with the owner’s opinion.

Federal Law of April 25, 2002 No. 40-FZ “On OSAGO”, complete loss is a situation in which it is either impossible to repair the vehicle, or it is possible, but the amount of costs will be equal to the cost of the car itself or exceed it. It is impossible to immediately recognize a car as such, since determining the required restoration costs offhand is extremely difficult: detailed calculations are required.

However, the total destruction of a car does not mean the destruction of all spare parts. At the same time, the presence of surviving parts is not covered by this concept: the structural integrity of the car is important.

Filing a claim in court against an insurance company occurs in the following cases:

- Refusal to recognize the complete loss of the vehicle.

- Underestimation of insurance payments upon recognition of total loss.

- Wrongful acquisition or sale of a car (its usable remains) when it is recognized as a complete loss.

- Recognition of complete death in the absence of grounds.

Each of the cases typically arises when an insurance company seeks to reduce the amount of insurance payments. To begin the proceedings, the following package of documents must be submitted to the district court:

- Statement of claim. If the plaintiff has legal knowledge, he can draw it up independently, complying with the requirements provided for in Art. 131 Code of Civil Procedure of the Russian Federation. Otherwise, you should definitely contact professional lawyers.

CASCO: total loss of car

- Constructive loss of a vehicle under compulsory motor liability insurance

- What percentage of damage to the car is read by total compulsory motor insurance?

- Oldmiller › Blog › New rules for totals with insurance

- OSAGO: perhaps total, how is it determined?

- Death of a vehicle under compulsory motor liability insurance

- Death of a vehicle under compulsory motor liability insurance. If the car cannot be restored

- Structural death of the vehicle. What is this?

- Payment options for CASCO insurance in case of total loss of the car

- Total loss of the vehicle

- Total loss of a car with CASCO insurance

Total CASCO: total loss of the car Then another insured event occurred, for which an assessment was made, and in this case the amount was actually half less than it actually was (we independently carried out an independent examination).

With a high degree of probability, a controversial issue regarding CASCO payment will be a total of 50%. When the total loss of the car is recognized, the calculation of compensation under CASCO can be made in two different ways:

- Receipt of the full amount of compensation calculated according to the policy. Only depreciation charges are deducted from it, and the remainder of the vehicle in this case is transferred to the insurance company on the basis of ownership.

- Receipt of insurance compensation minus depreciation charges and the cost of GOTS (usable vehicle balances).

The procedure for insurance payments under CASCO in the event of the loss of a car is somewhat different. The differences arise from the very essence of the contract, since the vehicle is insured for a certain amount (the amount of the premium paid also depends on it). In addition, CASCO takes into account wear and tear: for each month it increases by approximately 1%.

There are two options for calculating payments for the complete loss of a car:

- Payment without taking into account valid balances. The cost of serviceable parts is calculated in the same way as for MTPL contracts.

Resolution of the Plenum of the Supreme Court of the Russian Federation dated January 29, 2015 N 2 “On the application by courts of the legislation on compulsory insurance of civil liability of vehicle owners” 20 days are counted from the date of acceptance of the documents. Federal Law of April 25, 2002 N 40-FZ (as amended on November 28, 2015) “On compulsory civil liability insurance of vehicle owners” Oldmiller › Blog › New rules for total insurance coverage And the moment of judgment has come. TOTAL!

(Total destruction) There is nothing to do, either hand it over to the insurance company or take away the usable balances and the remaining money. It was decided to hand over the conic and take the entire amount due to lack of time and desire to engage in restoration work. While everything was happening in the country, the regulations for registering and deregistering cars changed.

If this issue is not clearly reflected in the contract, then the matter comes to court proceedings. In this case, when making a decision, the practice of other insurers is analyzed, namely, the percentage of damages attributed to the total. With a high degree of probability, a controversial issue regarding CASCO payment will be a total of 50%.

When the total loss of the car is recognized, the calculation of compensation under CASCO can be made in two different ways:

- Receipt of the full amount of compensation calculated according to the policy. Only depreciation charges are deducted from it, and the remainder of the vehicle in this case is transferred to the insurance company on the basis of ownership.

- Receipt of insurance compensation minus depreciation charges and the cost of GOTS (usable vehicle balances). This concept refers to all serviceable parts and spare parts of the car that were not damaged during an accident.

From life, they did not recognize the death of the vehicle and underpaid me. I was cut off at a traffic light, there was a strong blow to the front right wheel and fender, as a result of which the car flew onto the lawn, jumping over the curb. The photo shows that the car is not that old (although it is from 1992), there is external damage to the wheel rim and the right side of the vehicle, and the automatic transmission pan is jammed against the curb on the bottom.

At the service station it turned out that the steering knuckle was broken, the steering rack was leaking and it could only be replaced as an assembly. That is, already at this stage it became clear that the machine would be totaled, since one complete rack, excluding wear and tear, cost 90 thousand rubles. The insurance company paid 85,400 rubles, then came for an additional examination, I organized my own experts, but the insurance company did not pay anything more. I think that during the first payment they did not recognize the “total”, why there was no additional payment after the 2nd inspection, only God knows.

But the situation may also develop in such a way that it will be much more profitable to take the car for yourself and consider the option of self-repair or self-sale of usable leftovers.

Especially if there are good connections in auto repair shops.

In any case, before concluding an additional agreement with the insurance company on “total” payment, you need to “analyze” the situation as much as possible and have an idea of the amount of payment, both under the first option and under the second.

It is worth considering that the maximum amount that a victim can receive under compulsory motor liability insurance is 120,000 rubles.

Everything else will have to be recovered from the culprit of the accident through the court (in the event that he does not compensate for the damage voluntarily).

If you do not agree with the insurer’s decision regarding the total loss of the car, you can conduct an independent examination, during which not only the damage will be assessed, but also the actual value of your car at the time of the accident.

In comprehensive insurance there is also such a thing as complete or total loss of a car, but here this issue is more complex and confusing.

There are cases when the contract does not indicate the specific size of the “total”, in which case the insurer can recognize the complete loss of the car at will (and does this every time in the case of more or less serious damage).

For example, a car is insured for 500,000 rubles, and the amount of depreciation specified in the contract is 1% per month.

Thus, if an accident occurred 10 months after purchasing the policy, then the damage will already be 50,000 rubles.

Maximum insurance payments under compulsory motor liability insurance 2021 Since the damage received as a result of an accident can be determined by millions, the maximum payment under compulsory motor liability insurance has been determined by law.

The amount transferred to the injured person is also limited. For property (hardware), a maximum payment of up to 400 thousand rubles is made. For compensation for health and damage to life - up to 500 thousand rubles. Regarding payments under compulsory motor liability insurance, it all depends on specific road conditions.

Federal Law of April 25, 2002 N 40-FZ (as amended on November 28, 2015)

Consultation with a car lawyer is free by phone. Representation in courts Compensation for damage to health Canal Griboyedov building 6, of.

415 Call now. We are ready to help you today!

By leaving a request, you AGREE to the processing of personal data.

For CASCO insurance, total loss means that the insurance company will pay an extremely significant insured amount. Therefore, very often, if a car is completely lost under CASCO, insurance companies underestimate the damage, deceive policyholders, or do not pay the amount under CASCO at all.

This can be done both personally and through examination carried out by various companies and specialists. In addition, you must definitely ask for all the details regarding the insurer’s calculations, documents and explanations for them. In our case, the legislation does not provide for any reductions. Therefore, the insurance company is obliged to pay the victim 300 thousand rubles. If complete loss is recognized, then all that remains is to determine the value of the automobile remains.

Is it possible to recover the missing amount of payment from the culprit?

The good news from the example above is that you can recover the rest of the amount of 500 thousand directly from the tortfeasor - the culprit of the accident.

The calculation of the payment was given above solely for the purposes of compulsory motor liability insurance, but as we know, the difference can be recovered from the at-fault driver if the payment under compulsory motor liability insurance does not cover the damage in full.

And here we have bad news for you. In this case, a new methodology of the Ministry of Justice is used to determine this damage. It describes the new rules for conducting forensic automotive technical examinations, which experts must follow in 2021.

According to this methodology, if the cost of restoration repairs plus the cost of loss of marketable value (LCV) is greater than or equal to the market value of the car before damage, then the damage is considered equal to this market value.

As you can see, there are contradictions. For the purposes of compulsory motor liability insurance, the value of the usable remains is deducted from the cost of the vehicle, and in cases of recovery of the difference from the culprit or damage (when the culprit did not have a compulsory motor liability insurance policy), the market value of the car is reimbursed.

But, fortunately or not, our courts smooth out this contradiction with their decisions and do not compensate the market value of the car in full if there are usable remains. They are motivated, in particular, by the fact that the owner of the damaged car will receive unjust enrichment. Judicial practice in such cases is, as a rule, unambiguous - here is one of such decisions, and here is another.

However, we cannot exclude the possibility that the court may decide to recover the full cost of the vehicle from the tortfeasor, but with the transfer of the usable remainder to the person responsible for the accident. And let him try to implement them. Such judicial practice also exists in 2021.

What is total?

The term “total,” used by insurers in relation to a vehicle damaged in an accident, means that the cost of repairing the damaged vehicle actually exceeds its value. But it is not always clear to an inconsolable car owner who has lost his iron horse whether his car is a total loss, and on what basis it can be considered as such. In the minds of the average person, a completely lost car is a pile of twisted iron. In fact, the picture may not look so terrible at all.

The definition of which vehicle can be considered lost is contained in the Law “On Compulsory Motor Liability Insurance” No. 40-FZ. According to the provisions of Article 18 of this document, a car can be considered a complete loss if it is impossible to restore it, or if repairs will cost an amount equal to or exceeding the market value of the car at the time of the accident. The cost of restoration work, reaching 70% of the market price of the car before the accident, is already a reason to talk about the inexpediency of repairs and the recognition of the vehicle as lost.

Often, it is impossible to determine by eye whether a car is irretrievably lost. In order for the damage to be recognized as total, it is necessary to conduct a thorough examination and make the appropriate calculations. The difficulty lies in the fact that even a very badly damaged car may contain components and parts suitable for further use or sale. Such surviving elements are called usable residues.

Will the car be taken?

Insurance under compulsory motor liability insurance differs from voluntary insurance under CASCO, including in that, if the car is recognized as total, no one will take away what is left of it.

But there are also disadvantages to this, because the victim receives less money, since the cost of the usable remains is deducted. And you stay with them and think for yourself how and to whom you will sell them!

What are usable leftovers?

If the car was damaged very badly, but not completely destroyed, then serviceable parts, components and assemblies remain in it, which have some value and can be used in the future, provided that they can be dismantled.

In order for components, components or assemblies to be classified as usable residues, the following conditions must be met:

- under total compulsory motor liability insurance, they should not have damage that violates their integrity,

- must be in marketable condition and in working condition;

- they should not have any holes, cutouts or other structural violations, including for attaching any non-standard equipment;

- the parts must not have been previously repaired.

What if I don't need leftovers?

There are situations when a car that is relatively intact is recognized as total, but due to its low market value and expensive original parts, it is considered completely lost for calculating damage. This often happens with old cars, for which the prices for spare parts and parts according to a single calculation method are expensive.

In this case, of course, it makes sense to repair the car and continue to use it further.

But if the car is structurally damaged or very seriously damaged, then it’s more expensive to deal with the remains. But, unfortunately, you will most likely have to deal with these balances, since the law does not provide for the transfer of usable balances to the insurer under compulsory motor liability insurance.

Thus, the victim is not given the right to choose - to keep intact parts and spare parts for himself and receive a smaller payment, or to give them to the insurer and receive money for them too. Unfortunately, the prerogative of choice belongs to the insurance company.

But you can try to recover their value from the culprit and transfer these balances to him, although no clear judicial practice has emerged on this issue in 2021, and it is not clear whether you will win such a case or not. After all, you can spend money, time and effort on court, but in the end you still have to sell the rest yourself.

If there are any usable car parts left

Useful car parts after an accident are spare parts and assemblies that you can use to repair another similar car or sell. As already mentioned, the policyholder has the right to completely refuse them in favor of the insurer, or to keep them for himself. Insurers try in various ways to inflate the value of these balances in order to significantly reduce the amount of insurance payments. All possible methods are used:

- selling the remaining spare parts through an auction, where a figurehead specifically increases the cost of each lot;

- recognizes as suitable those units that cannot be restored;

- sets obviously inflated prices for the remaining parts and components.

Insurance compensation is significantly reduced and you will no longer be able to purchase a similar car. To avoid getting into such a situation, you should contact a specialist - an expert who will determine the suitability of each part, unit and assembly, as well as their market value at the time of the accident.

As a last resort, you can sell the remainder of your car yourself. Resellers buy damaged cars well. Another way out of the situation is to use the salvage vehicle as a donor for another similar vehicle.

Is it possible to refuse and challenge total loss under compulsory motor liability insurance?

If you believe that the MTPL insurer incorrectly calculated the damage and unreasonably “totalized” your seemingly entire car, then you have the right to argue and disagree with this calculation of the insurer.

What if we do an independent examination?

When determining the amount of damage and the amount of payment or repair, the insurer will conduct an independent examination, in which the expert will make the appropriate calculation.

Accordingly, in order for you to have a reasoned argument with the insurer, you also need to have an independent examination, but due to new trends in the legislation on compulsory motor liability insurance, you may not be reimbursed for the costs.

In 2021, there is a mandatory procedure for contacting the insurer with a statement of disagreement, which does not imply the provision of an independent examination. And in the future, when contacting the financial ombudsman, there is also no obligation to provide an expert opinion, since the financial ombudsman himself has the right to conduct an examination and determine the amount of damage.

If you do carry out such an examination, then be prepared for the fact that the costs of conducting it will not be reimbursed to you.

As a result, it may turn out that the last word in your case will be with forensic experts, and then it is better that they have at their disposal not your independent examination, but at least photographs of the inspection of the car, from which they can correctly calculate everything.

Insurers usually do not conduct a detailed inspection of the damaged vehicle, and their calculation may not be objective, but if you do a high-quality inspection, which will record not only the damaged elements, but also whole usable remains, or, conversely, those that were not damaged in the accident , but they cannot be classified as valid balances, then the amounts may be different.

What should you do with your car after a total loss?

Transport, perishes according to documents if:

- An old car with an inexpensive price is considered invalid even with minor damage. Since replacing failed parts will be expensive;

- external damage - on the body, mirrors, parts of a fallen motorcycle. This does not prevent the car from being used, but the insurance company may declare it lost.

If the insurance company recognizes the car as total, then the driver can take out a new insurance policy, but with a different company. While the car is not deregistered, it can undergo technical inspection, and it is possible to issue an insurance policy for it. In the future, participation in an accident with recognition of the total will not bring any consequences for the client.

Can I request repairs?

If, according to the calculation of the insured event, the result is a complete loss, then it is pointless to demand that the car be repaired.

This rule is expressly stated in the MTPL Law, and payment must be made in money.

But you can always try to negotiate. For example, you can agree to use original used spare parts or new, but analogues that will be cheaper than the originals. In this case, perhaps the insurer and the service will agree to repair your car instead of recognizing the total.

But do not forget about the economic benefits of insurance companies. First of all, they will do what is most profitable for them in terms of money:

- if it makes more sense to pay, they will pay,

- If it is repaired, then it will be repaired.

Fortunately, they don’t have to worry about the client, since compulsory motor liability insurance is mandatory for everyone.

Is it possible to restore a car after a total and drive it?

Yes, you can, but as usual, with conditions. You need to not only repair the car in your own way, but you need to restore its technical characteristics so that it meets the safety requirements and requirements for its operation.

Otherwise, after its sale to the new owner, such a car may not be registered with the traffic police.

Will I get compulsory motor liability insurance for a total car?

Yes. You can even buy a damaged car from someone, which was considered total by the insurance company, and restore it to the desired condition. In this case, there should be no issues with concluding a compulsory motor liability insurance agreement. The insurer, among other things, can inspect the car before concluding a contract and make sure of its integrity and performance.

But in 2021, more and more policies are purchased electronically, so even a car inspection can be avoided.

Is it possible to cancel the insurance after the total?

If you do not plan to restore the car, then you can terminate the MTPL contract and return part of the amount for insurance, this is stated in paragraph 1.13 of the MTPL Rules.

It would be more correct to say that you cannot terminate, but the contract is terminated early and without your desire by force of law.

But in reality this does not always happen. After all, the rules indicate the destruction (loss) of a vehicle, and as we have already found out, a total car is not always completely lost. It may be unprofitable to restore it from the point of view of the legislation on compulsory motor liability insurance, but no one can limit your right to do this, even though it is expensive. And if the car can be restored, then it was not destroyed or lost, and therefore the contract cannot be terminated.

But in practice, if you want to terminate the contract and return part of the funds for the unused period, the insurer does not have the right to refuse you.

The insurance company itself terminated the policy - what should I do?

Insurers successfully take advantage of inconsistencies in wording when they benefit. They terminate the contract on their own, often without even informing the policyholder about it. They replace the concept of destruction (loss) with complete destruction, which is used only for the purpose of calculating the amount of damage and in no way indicates that the vehicle cannot be restored or cannot be used in the future for its intended purpose.

What to do if your insurance company has terminated your MTPL contract? The procedure is approximately this:

- receive written confirmation (response) from the insurer about when and on what basis the contract was terminated;

- submit a statement of disagreement to the insurance company and demand that the contract be recognized as valid - here the insurer most often either will not respond to such a letter or will send a refusal, citing the total amount for compulsory motor liability insurance;

- submit an appeal to the financial ombudsman regarding this dispute (but here, with a 99% probability, the financial ombudsman will answer that he does not consider non-financial claims against the insurer, but such an appeal will help save time if you are turned away in court and sent to the financial ombudsman);

- Then all that remains is to go to court to protect your rights - the statement of claim must indicate that the insurer is being forced to recognize the contract as valid.

Well, in any case, the insurer, if it recognized that the contract had terminated, was obliged to pay you the cost of insurance for the unused period. In this case, the date of termination of the contract for calculating days will be the date of the accident.

If you found out about the termination after a new accident?

This also happens in practice in 2021, when the insurer may not fulfill its obligations and not notify the policyholder that the compulsory motor liability insurance agreement has ceased to be valid after the total. And just terminate it.

And you will find out that his liability is not insured only after a new accident. In the best case, when you apply for payment under the PPV from your insurer, in the worst case, when the victim files a claim against you for damages, as against the culprit without compulsory motor liability insurance.

In the first case, you can use the algorithm described above, but demand everything as in the usual refusal of the insurer to make insurance compensation, that is:

- insurance compensation,

- penalty,

- fine,

- TCB...if you deserve all this.

Fortunately, there is already judicial practice in such cases. Here is an example of a case in which the cassation instance explained to the appellate judges that the victim was right and the insurer was wrong, and upheld the court's decision.

In the second case, you will immediately find yourself in court, bypassing all the pre-trial “dancing with a tambourine.” In court, it is absolutely tedious to involve your insurer as a third party and prove that the contract has not terminated and that the actions of the insurance company are not based on the law. The above-mentioned Definition 3 of the Court of Cassation of General Jurisdiction can be used as a guide.

Total loss (total) of a car under compulsory insurance

In all these cases, the vehicle is considered unrecoverable, lost or totaled. Total loss of the car under compulsory motor insurance and comprehensive insurance Attention When the insurer recognizes the total loss of the car, 2 options appear:

- Give the car into the ownership of the insurer with a reduction in the insurance payment by the amount of wear and tear.

- You can keep the car, but along with wear and tear, the cost of any remaining parts will be deducted from your insurance.

Of course, the cost of these leftovers will be greatly inflated.

It is worth keeping the car if it can still be restored or sold at a profit. If the wear is still small, for example, 2 months, then choose the first option.

Then only 2% of the cost will be subtracted from the amount of CASCO insurance. If you disagree with the insurer’s assessment of the recognition of the total, an independent examination can be appointed. If the difference is significant, feel free to file a lawsuit against the insurance company.

Options for payment under CASCO in case of total loss of a car In case of constructive loss of a vehicle, there are 2 main options for compensation under CASCO: Total loss of the vehicle. To avoid this, a car owner whose car was declared unfit for use should consider the following important points:

- Whether this car was repaired under the current insurance policy until it was completely damaged;

- How much time is left until the expiration of the insurance contract;

- This is how much all the parts needed to completely restore the vehicle will cost;

The listed points directly determine the amount of compensation that the driver will receive if the vehicle is declared a total loss.

The rules provided for in this chapter apply regardless of whether unjust enrichment was the result of the behavior of the acquirer of the property, the victim himself, third parties, or occurred against their will. Example for compulsory motor liability insurance 2021. Before the accident, the vehicle was worth 300,000 rubles. The cost of repairs to restore it is 350,000 rubles. Constructive death of a car under compulsory insurance According to the market, such a car, and naturally not in such a vehicle, cost no more than 130-140 thousand rubles.

However, let's try to understand this problem. For clarity, let’s take the following situation: You are a victim of an accident.

Before the accident, your car was worth 4,000 USD. As a result of the accident, the car was damaged; according to the results of an independent assessment, restoration repairs amount to 4100 USD. The cost of suitable remains is 700 USD. The insurance company wants to pay only 3300 USD.

(4000-700). The insurance company’s argument is as simple as 3 kopecks: if we pay you the full amount and you still have the remains of the vehicle (4000,700), then in total this will exceed what you had before the accident (4000), which means you cannot pay it that way.

- average market value (market) 500,000 rub.

- the cost of repairs with wear and tear is 300,000 rubles. without wear 520,000 rub.

- suitable remains - 150,000 rub.

That is, the insurance company has two payment options, and now you yourself will understand which one she will choose: A) 350,000 rubles. - recognize the “total” and pay according to the formula market - year-ends = 500,000-150,000 B) 300,000 rubles. If the car owner has no accidents and has a sufficiently long driving experience, then the MTPL agreement will cost him less.

Let's say this hardware is sold for 50 thousand rubles, the victim is in the black by 150 thousand.

rubles, but the insurance company is naturally in the red.

To clarify, we list the types of vehicles that are subject to this tariff:

- Motorcycles (sports, standard and heavy);

- Light and heavy ATVs;

- Scooter;

- Mopeds (even homemade ones);

- Motor scooters, etc.

How to find out the base rate of OSAGO? Below is a table from which any vehicle owner can determine the basic tariff for 2018.

There are, of course, certain reasonable limits, beyond which such a game will be meaningless, since the car is really a mess and any even more or less thinking person will understand that there is a “total” with no options.

Repair or payment under compulsory motor liability insurance after 04/28/2018 Search by topic Repair or payment after 04/28/2018 The damage to my car is extensive, probably a lot hidden, but it’s definitely far from total.

“Hidden” are indicated in the accident report. Car 2007 My policy was issued in May 2021, the culprit’s policy was issued in October 2021. Law “On OSAGO”, “OSAGO Rules” from the Central Bank of the Russian Federation, etc.

Weigh the advantages and disadvantages before you decide.

Insurance rules regulated by law do not provide for any deductions from this amount, however, in practice, insurance companies take every opportunity to significantly reduce the amount of insurance compensation. If the car is destroyed, the cost of repairs may exceed its cost many times, which will exceed the maximum insurance amount. Of course, insurers cannot agree to this.

Total for compulsory motor insurance how many percent 2018

Thus, for transport classified as “C” and “CE”, which has an acceptable cargo transportation rate of no more than 16 tons, the new tariffs provide for a range of 5284-6341 rubles.

For reference: until April 12, 2017. this tariff was in the range of 2495-2632 rubles.

The only difference is the size of the indicators from the tariff range. Here for transport that belongs to categories “A” and “M” (as well as their subcategories), starting from 04/12/2017.

the rate when concluding a car title agreement will be determined based on the size of the corridor 867-1579 rubles. The result is again: “without money and without a car.” Of course, the policyholder will receive some funds, but his CASCO insurance will not fulfill its main purpose - it will not maintain the client’s material well-being at the same decent level.

Calculation of the total for MTPL 2021 Calculation of the total for MTPL 2018 The policyholder receives the accrued amount and the balance of his car. 2. In this case, if you sell a car for spare parts, they can cost 3 times more than your car in disrepair. In all these cases, the vehicle is considered unrecoverable, lost or totaled.

Thus, the basic insurance rate is at a level that ensures that the amounts paid by car owners for issuing compulsory motor liability insurance slightly exceed the amounts paid by the companies that issued the policy when insured events occur.

- The inflation rate is important because this parameter varies somewhat from year to year.

After all, the law provides a corridor for this value, which means that in companies that take the lower limit of this range as the base coefficient, the price of a car license will be lower. Additionally, we remind you that you should choose an insurance company with a good reputation in order to protect yourself from the possibility of receiving a “fake policy.” You can additionally save on your car license by developing accident-free driving skills (you can get a discount for this).

As stated above, the owner can dispose of older vehicles at his own discretion, for example, sell or buy a similar car, and make a donor out of a damaged vehicle, especially if you have space to store a second car. By the way, we buy “bitishes”, if you are interested, here is the contact form.

And the payment itself under compulsory motor liability insurance in case of complete loss of the vehicle is calculated as the difference between the market value of the vehicle at the time of the accident and the age of the vehicle.

When it is beneficial for the insurer to recognize the constructive loss of a car under compulsory motor liability insurance. Everything is simple here, and the game with calculations is based on the statement that the younger the car, the higher the value of its usable remains. Therefore, in most cases, insurance companies are happy to recognize the car as total in order to pay less, because they pay according to the formula (the market is good). In addition, using our calculator, determine the exact price of a car insurance policy.

From life, they did not recognize the death of the vehicle and underpaid me. I was cut off at a traffic light, there was a strong blow to the front right wheel and fender, as a result of which the car flew onto the lawn, jumping over the curb. The insurance company paid 85,400 rubles, then came for an additional examination, I organized my own experts, but the insurance company did not pay anything more. I think that during the first payment they did not recognize the “total”, why there was no additional payment after the 2nd inspection, only God knows.

Then only 2% of the cost will be subtracted from the amount of CASCO insurance. Payments for the total loss of a car under compulsory motor liability insurance differ from payments under CASCO.

These differences are enshrined in Government Decree No. 263 of May 7, 2003 on the approval of the rules for civil liability insurance of motorists. It states that the amount of payments under compulsory motor liability insurance is determined by the actual value of the car at the time of death. Including if the cost of repairs exceeds the value of the car before the accident.

In other words, MTPL payments do not depend on the amount of wear and tear and other factors included in CASCO insurance.

The maximum amount of payments is set at 400 thousand rubles. Insurance companies may assign additional deductions, citing illegal enrichment (when the cost of payments exceeds the value of the vehicle).

But in this case, enrichment is approved by law and by the very terms of the insurance contract.

You can also challenge this amount through an independent expert. Ask him to calculate, in addition to the damage, the cost of the usable remains. Then send your claims to court.

In case of refusal to pay the vehicle insurance company, the insurance company may claim that in the event of a complete loss of the vehicle, the amount of the insurance payment is paid minus the cost of the usable remains.

However, let's try to understand this problem. For clarity, let’s take the following situation: You are a victim of an accident.

Before the accident, your car was worth 4,000 USD. As a result of the accident, the car was damaged; according to the results of an independent assessment, restoration repairs amount to 4100 USD.

The latest changes to this document came into force on April 12, 2015. The reason for abuses on the part of the insurance company in this case is the lack of a unified methodology for calculating usable balances. Since the determination of the amount of payment for such an insured event depends on the time of its occurrence, at the initial period of the policy the option of full payment may be beneficial for the car owner.

- or the market itself will make more than the cost of repairs without taking into account wear and tear (RUB 520,000)

- make the cost of repairs excluding wear and tear less than 500,000 rubles. (market)

- Clause 1, part 1, article 333.19 of the Tax Code of the Russian Federation determines the amount of duty as follows:

- “up to 20,000 rubles - 4 percent of the claim price, but not less than 400 rubles;

- from 20,001 rubles to 100,000 rubles - 800 rubles plus 3 percent of the amount exceeding 20,000 rubles;

- from 100,001 rubles to 200,000 rubles - 3,200 rubles plus 2 percent of the amount exceeding 100,000 rubles;

- from 200,001 rubles to 1,000,000 rubles - 5,200 rubles plus 1 percent of the amount exceeding 200,000 rubles;

- over 1,000,000 rubles - 13,200 rubles plus 0.5 percent of the amount exceeding 1,000,000 rubles, but not more than 60,000 rubles.”

- Copies of documents confirming ownership of the car.

- Registration of the incident.

- Submitting documents to the insurance company.

- Damage assessment.

- The insurance company's proposal regarding the amount of compensation.

- 1 The concept of “total”

- 2 Total according to OSAGO

- 3 Total under CASCO

- 4 Procedure

I have a comprehensive insurance policy - can I apply after submitting an application for compulsory motor liability insurance?

As was already said at the very beginning of our article, the conditions under CASCO agreements, as a rule, differ from the conditions of compulsory motor liability insurance. If the latter are prescribed primarily in the law, then the former depend largely on the contract itself. And in each specific situation it may be more profitable to apply either under CASCO or OSAGO.

If you find out that you will receive more money under CASCO after you have submitted an application under MTPL, you can refuse and withdraw this application, unless, of course, the insurer has not yet paid the insurance compensation. After all, it is legally impossible to receive money twice for the same car.

CASCO payments in case of total loss of a car

The procedure for receiving funds under CASCO when the car has become completely unusable and cannot be restored is always identical.

Here are the main steps of this procedure:

- a package of required documents is collected;

- the car is assessed by the insurance company;

- during an independent examination, the car is assessed and the amount of compensation is calculated;

- When the client agrees with the amount, a special agreement is signed, and then payment occurs within the terms specified in the contract.

There are also several options for how further events will develop regarding what will remain of a completely lost car.

Everything that remains can be transferred to the car owner, and the insurance company itself can give them away, since it is they who will then evaluate and sell all the surviving parts. The insurance company is always required to estimate the cost of the parts. If for some reason the owner of the car wants to keep the remaining parts, the cost of the remains will be removed from the monetary compensation.

In the event that the remains of the car remain with the insurance company, payments are made in full.

This feature should be covered in the company agreement. CASCO has a significant difference from compulsory motor liability insurance - it is a more lenient regulation of payment terms. And the standard time interval between transfers of compensation or its parts depends largely on the amount of compensation. Often all payments are not made in one payment.

Payments are usually divided equally, and the first part is transferred two weeks after the accident, the remaining amount after a short period of time. If you want to know the exact time of transfer of monetary compensation, it is best to consult with a representative of the insurance company or send a corresponding request to the company itself.