Car owners bear civil liability, insurance of which is established at the legislative level. This type of insurance is called compulsory motor liability insurance; the minimum period for its conclusion is six months. But there is also a voluntary type of vehicle insurance - comprehensive insurance, the validity period of this policy is not established, it can be purchased at the discretion of the parties for any time. CASCO for a month, quarter or six months is offered for those motorists who use their vehicle rarely or during a certain season.

For what period can a CASCO policy be issued?

A CASCO policy is rarely issued for a long term. The majority of those wishing to buy voluntary insurance policies for 3–5 years are fleet owners. Insurance companies provide them with special rates. Most motorists choose standard CASCO insurance – for a year. It is not profitable to apply for a longer period: it is impossible to predict the wear and tear of the car. Long-term insurance deprives the driver of the right to receive a discount when the Bonus-Malus coefficient (BMR) is reduced for accident-free driving.

Vehicle owners are interested in whether it is possible to issue a CASCO policy for only 3 months. There is such a possibility. CASCO for 3 months, or seasonal insurance, is often issued for the winter, when accidents on the roads increase. The policy is purchased by drivers who work during a specific season. Insurance for 3 or 6 months is popular among summer residents. The seasonal policy is valid during summer and autumn; at other times the car is not used. This is beneficial for motorists who plan to use their car only in the near future.

Insurance companies are reluctant to enter into short-term deals, although the insurance period is not limited by a time frame. The law does not establish a minimum period for which an insurance transaction can be issued, so the contract can be concluded for 5 years or only for a day.

What is CASCO insurance?

CASCO is car insurance that the driver takes out for a vehicle on a voluntary basis. With an extended policy, you can save time and money, since compulsory MTPL insurance only covers those cases when the insured person caused the accident and must compensate the victim for damage.

Apply for a policy

OSAGO has one more limitation - the amount of compensation is 400 thousand rubles for damage to a car and 500 thousand rubles for causing harm to the life and health of another person. These funds are not always enough to cover the damage incurred. But in such cases, when the accident occurred through your fault, your car was damaged and it needs to be towed, the MTPL policy will not help. You can solve the problem with the help of an insurer only if you have a comprehensive insurance policy.

Is it possible to do CASCO insurance for a month?

Insurance is issued not for a year, but for a shorter period, according to an individual plan. Based on the preferences of the car owner, CASCO policies can be issued not only for 3 months, but also for a shorter period of time:

- 1 month;

- 2 weeks;

- week.

When renting a car for a short time (car sharing), which provides for per-minute payment, you purchase per-minute CASCO insurance. To conclude an agreement, IC Inkor Insurance offers clients to use telematics equipment and connect the Start CASCO mobile application. The policy provides protection against theft and damage while parked and damage while driving.

Sometimes vehicle owners try to insure their car for a month in order to check the reliability and quality of work of the insurance company. Experts warn against irrational spending: the risk of circumstances that will demonstrate poor staff performance is minimal.

Risks covered by the transaction

Regardless of the duration of the agreement (CASCO for 6 months, for a month, for a year), the risks covered by the agreement cover:

- destruction (destruction) or damage to the insured vehicle due to a traffic accident, fire, or various types of natural disasters;

- damage to the car by animals or due to falling foreign objects (stones, snow, ice);

- theft of a car as a result of robbery, theft, robbery, theft;

- theft and/or damage to individual elements (parts) of the insured vehicle.

Why do you need short-term car insurance and in what cases can it be useful?

Insurance companies do not want to take financial risks, so they set high prices for policies. Sometimes car owners do not see the practicality of purchasing an annual policy. But when concluding an insurance deal for a short period, the policyholder pays a lot of money. Therefore, in order to obtain short-term CASCO insurance, there must be significant circumstances:

- The voluntary car insurance policy expires, and the owner of the vehicle is going to sell the car;

- the car was purchased recently, the owner is not entirely sure of the choice and wants to sell it in the near future;

- seasonal use of the machine;

- the driver is engaged in driving a car from one city to another;

- change of car owner;

- final payments on the loan (sometimes banks issuing car loans oblige you to insure your car with a specific company, where average rates are higher than city rates);

- signing an insurance contract with another organization.

Short-term car insurance is necessary if it is not financially possible to buy a policy for a longer period.

Price

| Price category of the car, thousand rubles | CASCO cost, rubles |

| 200-1000 | 9980 |

| 1001-2000 | 17750-23480 |

| 2001-3000 | 30819 |

| 3001-5000 | 45232 |

The cost of a CASCO policy for a year depends on the cost of the car, and is calculated as a percentage of its price.

How in practice subrogation under CASCO is carried out from the culprit of an accident can be found here.

Cost and conditions of CASCO policy for a month

Each insurance company compiles a list of insured events for which it will pay compensation. The annual contract includes more options for insurance risks. Therefore, in order not to be disappointed when purchasing a CASCO policy for a month, carefully study the terms of the contract. Most insurance companies compensate for losses associated with an accident and/or car theft.

The cost of a monthly insurance program is 30% of the annual CASCO policy. The amount of compensation after the incident will be minimal. Insurers explain this by saying that by selling short-term programs, they risk entering into an insurance contract with a fraudster. With long-term cooperation with the client, the risk is halved. To reduce the cost, personal discounts, installments or a franchise are used (but not all insurance companies do this).

To determine the cost of a monthly policy, insurance companies use the following data:

- information on the presence/absence of insured events under previous CASCO agreements;

- insurance region;

- area where the vehicle is used (city or village);

- information about the environmental class and type to which the machine belongs.

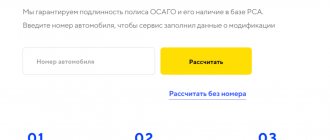

Complex formulas are used to calculate the cost of insurance. Ultimately, the cost of a monthly CASCO policy depends on different tariffs (not regulated by law, set by the insurance company) and coefficients, which may differ in different periods. On the official websites of many insurance companies you can calculate the cost of insurance using an online calculator. Companies set their own prices for policies. But prices are within standard limits, because in a competitive environment, insurers do not inflate the cost of their services.

Advantages and disadvantages of CASCO insurance

Advantages of CASCO car insurance:

- The owner of the car will receive compensation even if he violated traffic rules.

- Compensation is paid even for such major incidents as car theft. They will also compensate for damage if the car cannot be restored after an accident. In this case, the insurance company will pay an amount for which you can buy a new car to replace the lost one. But the purpose for which you spend the insurance money is not controlled; you can pay for anything, even a trip abroad or the purchase of goods.

Disadvantages of CASCO:

- Insurance companies set their own costs. The law does not limit the price. This means that the conditions and prices for the policy can vary greatly from company to company. Before applying, contact several insurers at once and compare conditions to choose the most advantageous offer for covering the same risks.

- If an insurance company goes bankrupt, no one guarantees payments for motor insurance. Under compulsory motor liability insurance there is no such risk, since companies make contributions to a special fund that will pay clients money in the event of bankruptcy of the policyholder.

To reduce the impact of the second drawback, pay attention to large rhinestone companies that have been operating on the market for a long time.

How to purchase CASCO insurance for a month

Having decided to insure a car for a short period, it is important to know what documents are needed to obtain CASCO car insurance for one month and which companies insure for a minimum period.

Which insurance companies insure cars for a month?

Many insurance companies offer monthly car insurance. When choosing an insurance company, they give preference to organizations whose reliability has been tested by time. CASCO policies for a period of 1–3 months on acceptable terms are issued by the following companies:

- “Intach” – pays compensation in case of an accident or damage without the possibility of recovery (there is no deductible);

- “Renaissance Insurance” makes payments in the event of an accident or theft; When purchasing, no installment plan is available;

- “Tinkoff Insurance” – one-time payment in case of theft or accident.

Required documents

To apply for short-term insurance, you will need the following documents:

- application (written in free form or on UK letterhead);

- vehicle owner's passport;

- car registration certificate;

- driver license;

- documents for drivers allowed to drive a car;

- power of attorney to issue a policy, if an authorized person is allowed to insure;

- documents for the anti-theft system.

A machine condition card may be required.

How to distinguish a reliable insurance company

Select a reliable insurance company based on several criteria:

- It is among the twenty best insurance companies in the Russian Federation.

- Has good reviews from clients on recommendation sites.

- The volume of payments for issuing comprehensive insurance policies and compulsory motor vehicle liability insurance constitutes no more than half of all company fees for the year.

- Helps clients understand the problem when rights are violated.

- Works stably and efficiently. Regulators have never suspended the insurance company.

In 2021, Tinkoff Insurance took 2nd place among institutions with the highest customer rating on the website banki.ru. In the same year, the rating agency RAEX assigned.

How to receive compensation under CASCO

To receive compensation, it is important to submit documents, the list of which is specified in the contract. The standard set includes:

- application for payment (must be written no later than 7 days after the occurrence of the insured event);

- contract;

- a check confirming payment for the policy;

- driver's license;

- inspection certificate;

- vehicle registration certificate.

The Investigative Committee also asks to provide documents from the traffic police:

- protocol on the offense;

- certificate of accident;

- resolution to initiate a criminal case.

The documents are transferred to the payment department of the Insurance Company. Based on them, they will issue a referral for a car inspection (carried out by an independent expert). After the inspection, a conclusion will be issued, on the basis of which the amount of payment is determined. Payments are usually made within 14 days after submitting documents.

A car involved in an accident should not change its location. Compensation may be denied if the participants in the accident do not act in accordance with the regulations: they try to reach an agreement among themselves, do not call the traffic police, or the car is transported by another vehicle.

Is it possible to replace a car during repairs?

Tinkoff Insurance offers compensation for car rental services at the time of repair of the insured car. But this is only available if you enable the additional option “Auto for replacement”. You can connect the service to such tariffs as “Damage” and “Damage + Theft”.

You can reimburse the costs using one of two options:

- car rental for an amount not exceeding 10 thousand rubles for 7 days of continuous use, but is allowed only 1 time during one insured event;

- car sharing services worth no more than 10 thousand rubles.

The insurance company will not compensate for anything that goes beyond the conditions.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Why is it unprofitable to buy a short-term CASCO policy?

Taking out a monthly CASCO policy is not always beneficial for the policyholder:

- if an insured event occurs, the amount may not be paid in full;

- The insurance company may not fulfill all the terms of the contract because it does not have time to study the situation in detail;

- insurance has no guarantees.

Due to the high cost, the policy is not available to all motorists. By concluding a short-term contract, the policyholder receives more restrictions than when purchasing a policy for a year: no right to buy in installments, apply a deductible; limited number of insurance cases.

If a car owner wants to buy a monthly policy, but does not have the required amount, insurers offer not a short-term contract, but insurance for a year in installments. But if an accident occurs, the car owner will have to pay the remaining amount to compensate for the losses.

Differences between CASCO and OSAGO

The main differences between CASCO and OSAGO insurance policies:

| CASCO | OSAGO |

| Covers only your personal vehicle | Protects the property and health of other people when rules are violated |

| Voluntary policy | Mandatory policy |

| They cannot issue a fine for not having a policy. | If you don’t have the insurance policy with you, the traffic police officer can fine the motorist up to 500 rubles, and if compulsory motor liability insurance is not issued at all - 800 rubles |

| The cost of motor insurance is at the discretion of the insurance company. | The cost of the policy is limited by the state |

| The insurer may change the terms | OSAGO conditions remain unchanged |

| In case of an accident, the driver receives money, even if he is the culprit of the accident | In the event of an accident, payments from the insurance company under the MTPL policy are received only by those who were injured as a result of the accident due to the fault of the driver |

Insurance companies cannot refuse to sell a MTPL policy to a client, but they can refuse comprehensive insurance without giving a reason.

Tinkoff CASCO calculator →