Necessary documents and nuances of issuing a power of attorney

In order to issue a power of attorney for an MTPL policy, you will need to provide the notary with the following documents:

- certificate of ownership of the car;

- vehicle registration certificate;

- previous MTPL policy (if available);

- in the event of an insured event - a protocol from the traffic police;

- car diagnostic card.

The power of attorney is supported by copies of the identity card of the owner of the car and the authorized person.

At the time of drawing up the document, the principal has the opportunity to independently determine the permissible list of powers for the authorized person, which may include the right to receive insurance payments, participate in insurance procedures, and submit documentation on behalf of the principal.

To obtain a power of attorney at a notary's office or in the presence of insurance company employees, the presence of both parties is required: the authorized person and the principal with the following papers:

- A standard form of power of attorney completed by the principal for subsequent representation of interests in the insurance office.

- Documents confirming the identities of the parties - passports.

- For legal entities - registration documents that confirm the legality of the enterprise.

- An insurance policy on the basis of which the entrusted person will perform permitted and permissible legal actions.

- Papers for a vehicle.

Required documents

In order to issue a power of attorney to receive an MTPL policy, a citizen needs to collect a package of documents:

- Passport of the citizen who is the principal, or documents on registration of the company (legal entity).

- Passport of the third party who will act as a representative.

- Car registration certificate or PTS.

The notary does not have the right to demand additional documents from citizens, but, at the same time, he may refuse to provide the service if he has suspicions that the principal or authorized person is not aware of his actions, cannot be held responsible for them, or is in a state of disrepair. alcohol, drug intoxication.

Purpose of the power of attorney for registration of compulsory motor liability insurance

Many motorists are interested in why insurers ask for a power of attorney and why they cannot purchase a form without it. In fact, this requirement is enshrined in law. It is thanks to the power of attorney that the insurer can be sure that the applying motorist legally represents the interests of the owner.

The purpose of a power of attorney is to perform any actions on behalf of the owner of the vehicle legally.

Requirements for an attorney

To issue an MTPL policy, the authorized person must present documents to the insurance company specialist. Be prepared to prepare:

- passport to confirm identity;

- power of attorney (original);

- vehicle passport or state registration certificate.

If an employee of the company is involved in insurance issues, then the company’s statutory documents must additionally be presented.

As practice shows, in the insurance industry there are no clear requirements on how a power of attorney should be drawn up. That is why some insurers are ready to accept a regular handwritten document, while others are exclusively notarized. Unfortunately, the requirements are legal and the policyholder can only fulfill them or contact the office of another insurance company.

What information should be included

It doesn’t matter what kind of power of attorney is requested for an insurance company under compulsory motor liability insurance (handwritten or notarized), it must contain a number of mandatory requirements.

The power of attorney to receive the policy must contain:

- personal data of the car owner: full name, date of birth, passport details and registration address;

- personal information of the authorized representative (similar);

- characteristics of the vehicle: make and model, state registration plate, PTS data and identification number;

- powers of the trustee, for example: the right to issue compulsory motor liability insurance, make changes, receive payment in the event of an accident, etc.;

- date and place of issue;

- validity period (usually 3 years);

- notary's signature and seal.

Management by proxy. Vehicle insurance options

Almost anyone can insure a vehicle; the law does not require that only the owner of the car act as an insured. By and large, the policyholder may not have a driver’s license at all, or an organization may act as the policyholder.

The owner, by issuing one or another form of power of attorney to the authorized person, thereby determines and limits his powers.

There are three types of power of attorney:

General – for the management and disposal of the principal’s vehicle. A power of attorney provides for the right to withdraw and register, purchase and sell, lease and other actions - that is, the most complete form of a power of attorney.

Special – for performing actions in a certain area (only for the right to drive a car, representing interests in courts, and so on)\

One-time – to perform only one specific action (for example, the right to undergo state technical inspection)

Insurers usually recommend issuing a general power of attorney , in which a separate clause indicates the right to enter into an insurance contract and receive insurance compensation. This is due to the fact that in the absence of the specified clause in the power of attorney, only the owner himself, but not his authorized representative, can receive insurance compensation.

Another important point. According to the law, the legal force of a handwritten and notarized form of power of attorney is identical today. The exception is that a written power of attorney cannot be a legal document for transactions involving the transfer of a car, plus it is not valid in transactions requiring notarized documents.

A general power of attorney, certified by a notary, allows not only to drive and dispose of a vehicle, but also allows for the transfer of the car to a third party - but if there is a clause allowing this in the “primary” power of attorney. A power of attorney can be issued by both the owner and the person who owns the car by proxy.

If a power of attorney is issued for several persons (being in joint ownership), a power of attorney to drive a car is written in simple written form for the corresponding number of principals. Current legislation does not provide for any restrictions on the number of powers of attorney issued for the same vehicle. The presence of the person for whom the power of attorney is issued is not a prerequisite.

In case of car insurance under MTPL:

If you are not the owner of the car, you drive it on the basis of a power of attorney, but act on behalf of the policyholder, then you can limit yourself to only a written form of power of attorney. Having this power of attorney is quite enough to present to a traffic police officer.

It is important to remember that a person driving a car on the basis of a handwritten power of attorney must be included in the MTPL policy among the persons allowed to drive the vehicle. According to Art. 4 clause 2 of the Law of the Russian Federation No. 40-FZ “On compulsory insurance of civil liability of vehicle owners”, a person who has any, including a “handwritten” power of attorney, is obliged to conclude an insurance agreement within 5 days from the date of issuance of the power of attorney, if earlier liability was not insured. Failure to comply with this requirement entails administrative liability.

If you don’t know exactly who will be allowed to drive the car, you can indicate in the policy that access is provided without restrictions. However, please note that this option automatically increases the cost of the MTPL policy itself.

CASCO insurance:

You can insure a car under CASCO using a general power of attorney, as well as a special or one-time power of attorney for insuring a specific car. (Some, but very few, insurance companies allow a written power of attorney in this case)

But - attention! - if the agreement is concluded by proxy on behalf of the owner of the vehicle, then the authorized person who signed such an agreement does not have the right to appoint himself as a beneficiary (the one who receives payments) under the insurance agreement. (The law prohibits a person who has a general power of attorney from making transactions on behalf of the owner in relation to himself personally).

When concluding an insurance contract with a person who owns, uses and disposes of a vehicle on the basis of a notarized power of attorney (general power of attorney) or has a power of attorney from the owner for the right to drive in simple written form, several options for concluding an insurance contract are possible:

First : The insured and beneficiary under the insurance contract is the owner of the vehicle. A person who has a general power of attorney from the owner enters into and signs an insurance contract on behalf and in the interests of the owner. At the same time, when signing an insurance contract, in the “Signature of the policyholder” column, it is necessary to make a note that the person signing the contract acts on behalf of the owner on the basis of a power of attorney (indicating the details - number and date of issue).

Second : The policyholder is a person who has a general power of attorney or a power of attorney in simple written form, enters into an insurance contract on his own behalf. The beneficiary is the owner of the vehicle. Insurance compensation is received either by the Vehicle Owner, or a person who has a general power of attorney receives insurance compensation on behalf of the owner on the basis of a general power of attorney.

Third : The policyholder is the owner of the vehicle, who concludes and signs the insurance contract on his own behalf. Beneficiary is a person who owns, uses and disposes of a vehicle on the basis of a notarized power of attorney (general power of attorney). In this case, the person who has a general power of attorney receives insurance compensation on his own behalf, since he is the beneficiary under the insurance contract.

As for the TERM , the maximum period of a power of attorney for a car cannot exceed three years. If the period is not specified in the power of attorney, it has legal force for one year (clause 1 of Article 186 of the Civil Code of the Russian Federation). An exception is a notarized power of attorney intended to perform actions abroad. If it does not contain an indication of its validity period, it remains in force until it is canceled by the person who issued the power of attorney. A power of attorney that does not indicate the date of its execution is void.

The power of attorney form for a car must indicate:

• place and date of its preparation (signing), and the date is stated in words; • last names, first names, patronymics (indicated in full); • place of residence of the representative and the represented; • powers transferred to the representative (clearly and as fully as possible stated); • the possibility or impossibility of transferring the specified powers; • basic characteristics of the vehicle, i.e. make (type), state registration plate, VIN identification number, year of manufacture, engine number, body number, color, series, number, date of issue of the vehicle passport and registration document and the name of the organization that issued them; • validity period of the power of attorney - indicated in words and cannot exceed three years; • signature of the person who issued the power of attorney.

A few notes:

a) If the power of attorney or lease agreement has lost force during the validity period of the insurance agreement, then the latter can be re-registered in the name of the owner or terminated by agreement of the parties. The return of part of the unused insurance premium (contributions) is made under the conditions specified in the insurance contract.

b) If during the period of validity of the insurance contract the car was sold or donated, the insurance contract can be reissued to the new owner or terminated by agreement of the parties.

c) The policyholder also has the right to change the beneficiary specified in the insurance contract to another person, but you must notify your insurer about this in writing.

Registration of a power of attorney for the right to insure a car

It is necessary to take into account that the power of attorney to issue an MTPL policy can be one-time or special. As for the one-time one, in this case the name speaks for itself. This document is required solely to perform one action, namely the purchase of compulsory motor liability insurance.

If a power of attorney is needed for several actions and for a long period, then in this case a special one is drawn up, which specifies all the rights of the trustee and the validity period of the document.

It is important to take into account that the special owner of the car can revoke the special license at any time, before the expiration date, if he loses confidence in his representative or he violates his obligations.

Validity periods

As for the validity period for an individual, it directly depends on the type of document.

| One-time | As already mentioned, this document is issued to carry out a specific action. That is why deadlines are not taken into account when compiling. |

| Special | The term of such a power of attorney is regulated by the parties to the legal relationship and in most cases does not exceed one to 3 years. |

| General | For this type of power of attorney, the term is negotiated by the parties to the agreement and must be written down in the text of the document. |

A power of attorney for insurance under compulsory motor liability insurance can be issued in the following options:

- one-time;

- special;

- general

A one-time power of attorney is intended to assign to another person the authority to perform a specific single action, therefore such a document is relevant exactly until the specified operation is fully implemented. For example, such a document can be issued by the owner of the car to the policyholder to purchase a policy. A sample form of a one-time power of attorney can be downloaded from the link.

According to a special power of attorney, its recipient can perform the same action for a longer period specified in the document itself (maximum three years). If such a period is not indicated in the text, it is generally accepted that the document is issued for one year. For example, a car owner can authorize the policyholder to renew the contract with the company and purchase a policy every year for three years.

A general power of attorney is issued if the car owner plans to entrust another person to carry out a range of operations with his car: insure the object, leave it as collateral, sell it, etc. Such a document must be certified by a notary office. A general power of attorney, if necessary, may also provide for the right to delegate the implementation of certain actions to third parties. The form for filling out a general power of attorney can be downloaded from the link.

Every vehicle owner is required by law to insure the car, but if this is not possible, then an authorized person can carry out this operation. You can take out car insurance not only on the basis of a one-time targeted power of attorney with notarization, but also if you have a general power of attorney, which provides the right to perform any actions with the vehicle.

When drawing up a power of attorney for the right to insure a car, you must submit a standard set of documents and when drawing up the power of attorney form, indicate the following reliable data:

- The exact name of the document, place and date of its issue.

- Details of the principal and the trustee (passport data of individuals and registration data of legal institutions).

- The text of the power of attorney itself, which includes all the powers of the authorized representative - the right to insure a car.

- Validity period of the document.

- The clause on the existence of the right to formalize a transfer of trust.

- Signatures of the parties, seals.

Today, in many families, a car is purchased not only for one driver, but also for other family members.

Help: It is possible to register ownership in the name of only one person, but to drive this vehicle, other persons will need a special document called a power of attorney.

But how are such a document as a power of attorney and the insurance itself interconnected? In some situations, you simply cannot do without this document to obtain a motor vehicle license. These include:

- the situation when insurance is taken out by someone other than the owner of the vehicle;

- occurrence of insured events when representation of the car owner is necessary. Most often, in court you need to provide a certain package of documents and carry out certain actions confirming the insured event.

Types of power of attorney for insurance

The issuance of a power of attorney can be carried out either one-time (for example, for registration of compulsory motor liability insurance and no more) or in a special form (for any legal actions related to compulsory motor liability insurance for a certain period, which will not exceed 3 years).

A citizen can terminate the power of attorney at any time if he has lost confidence in his representative, or if he performs his duties poorly.

In addition, there is also a general power of attorney. The document applies not only to the MTPL insurance contract itself, but also to any other actions with the car.

This type of trust document is needed if the owner and the actual user of the vehicle are different people. Remember that with a general power of attorney, you can even sell or lease a car.

Documentation must be notarized. Any type is suitable for registration of compulsory motor liability insurance.

How to draw up a power of attorney on behalf of a legal entity

In the process of concluding a trust document for a car title or CASCO for a credit or regular car, the principal provides a standard list of papers and also supplements it with the following documents:

- internal passport, rights of a trusted person;

- vehicle registration documents;

- a valid diagnostic card (latest technical inspection coupon);

- a written statement from the owner of the vehicle regarding the desire to issue a power of attorney;

- copies of driver's licenses of persons who will be able to drive and operate a vehicle.

In legal practice, it is possible to execute trust documents on behalf of an individual. With this procedure, the applicant must collect a list of required documents and visit the insurance company or notary to fill out the appropriate form. The document must indicate the following information:

- place and date of execution of the power of attorney;

- your passport details: full name, date of birth, gender, series and number, date of receipt and organization that issued the passport;

- similar data must be indicated by the party of the trusted person;

- a list of powers that a trusted person can perform.

The procedure for issuing a power of attorney for the right to represent interests in an insurance company from a legal entity provides for a standard registration procedure. The applicant indicates the place and date of the manipulation, the name of the organizations in which representation is required and a list of powers. The following data is entered in the applicant's side column:

- Name of the organization;

- individual tax code;

- registration number of the commercial enterprise, the date of registration and the responsible person who recorded it;

- company address;

- passport details (full name, date of birth, number, series, date of receipt of passport, registration).

In accordance with current legislative acts, a power of attorney for the right to represent the interests of the principal in an insurance company, issued on behalf of a legal organization, must be certified by the company’s seal and the signature of the following persons:

- head of the institution;

- a person authorized to sign the relevant constituent documents.

Power of attorney from an individual

To draw up an MTPL agreement, the legislation does not provide for the obligation to have a power of attorney from the owner of the vehicle, who is an individual. In Art. 15, Part 2 of the Federal Law (FZ) of the Russian Federation No. 40-FZ states that the agreement is concluded in relation to the owner of the vehicle and persons (the number of which may be limited or unlimited) allowed to drive this vehicle. In Art. 1 of the said Federal Law specifies that the owner of the vehicle is:

Thus, any person from the above can become the policyholder. In Art. 15, part 3 indicates what documents the policyholder must provide. A power of attorney for drawing up an insurance contract is not included in this list.

If the owner of the vehicle wants him to be listed as the policyholder in the insurance, but cannot be present during the registration procedure, then in this situation a notarized power of attorney from the owner is required for any citizen chosen as a proxy. In this case, the trustee acts as the legal representative of his principal, and the same person will be indicated in the “Owner” and “Insured” columns, namely the owner of the vehicle.

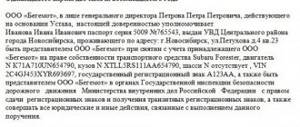

Sample power of attorney for car insurance

Registration procedure

To formalize a power of attorney, to purchase compulsory motor liability insurance, you must contact a notary. In this case, the document is drawn up exclusively in the presence of the car owner, an authorized representative and a notary.

Before drawing up a power of attorney, the notary is obliged not only to check the documents, but also to make sure that both parties are legally capable. If everything meets generally accepted requirements, then the text of the document is compiled. As a rule, each notary has special templates.

After the text has been agreed upon, a document is prepared on a special form with watermarks and certified with a signature and seal. It is important to take into account that the document is always drawn up in two copies, which have equal legal force. One copy will be kept by the notary, the second will be handed over to the owner of the car. In addition to the paper copy, the number is entered in a special notary book and the unified state register.

Required documents

To issue a power of attorney for car insurance, you need to prepare a small package of documents.

Be prepared to provide:

- passport of the principal, in this case the one in whose name the vehicle is registered;

- passport of the representative who receives the license for the car;

- document confirming ownership of the car: PTS or STS.

All documents are accepted only in originals. It should be borne in mind that the notary does not have the right to demand other documents.

If the power of attorney does not require notarization, the car owner has the right to write it out in his own hand or prepare a printed version. To do this, you can compose the text yourself according to the rules of office work, using a ready-made form, or online, using the document designer.

A power of attorney that needs to be certified must be drawn up directly at a notary’s office and always in the presence of the principal. If necessary, the second party in whose name the power of attorney is drawn up can also be invited. Before going to the notary, you should prepare the required package of documents.

The list of documents required to issue a power of attorney includes:

- driver's license and car owner's passport;

- driver's license and passport of the person in whose name the document will be issued;

- documents for the car (technical passport, certificate of registration with the traffic police).

If the principal or trustee is a legal entity, then for registration you will need the registration documents of the organization and the passport of the official representative authorized to represent the interests of his company. Powers of attorney issued on behalf of an individual and a legal entity differ in the set of data specified in the text. Organizations can use their own letterhead as the basis for the paper.

The completed power of attorney must contain the following information:

- date of issue of the document and its validity period;

- Full name, date of birth, address, passport details of the owner of the car (for legal entities - organization details);

- Full name, date of birth, full address, passport details of the person in whose name the document is issued (for legal entities - details of the organization);

- a detailed description of the car indicating the make, model, VIN number, year of manufacture, body and chassis numbers, license plate, details of the state registration certificate;

- a list of operations that the authorized person is allowed to carry out;

- visa of the principal (for legal entities - and seal of the organization);

- visa and notary stamp (if necessary).

Detailed step-by-step instructions

Sample of filling out a power of attorney. To issue an MTPL policy under a power of attorney, you must select a suitable insurance company. After choosing an insurance company, a package of necessary documents is collected, consisting of:

- car owner's passports;

- a power of attorney issued by the owner of the car in the name of the attorney;

- PTS and STS of the vehicle;

- the rights of a person who is allowed to drive a car;

- technical inspection certificate.

To issue compulsory motor vehicle liability insurance, a technical inspection of the car for which the policy is issued must be carried out.

After all the necessary papers have been collected, you can go to the office of the insurance organization and purchase insurance (read what to do if the insurance company imposes additional services here, and here we told you how to apply for compulsory motor third party liability insurance online without additional services from the insurer).

It should be noted that before you sign for an insurance policy, you need to check it carefully. If errors or corrections are found in the compulsory motor liability insurance policy, then the insurance agent must be informed about this so that all corrections can be made.

A car insurance policy is a strict reporting form, so making changes to it manually or in any other similar way is strictly prohibited. To change the information in the form, the damaged policy is canceled, and the client is given another form, filled out without errors or corrections.

This action must be carried out without fail, because driving a vehicle without documents or with incorrectly filled out documents entails a fine.

At the end of the insurance registration procedure, the client is returned the originals of his documents, and is also given the original auto insurance policy and a check confirming payment of the insurance premium.

Any document must be drawn up correctly. If the company agrees to accept a power of attorney in handwritten form, then we will consider in more detail how to draw it up correctly and what should be indicated.

You will need:

- Take a blank sheet of paper, A4 size and on top.

- Just below in the upper right corner you must indicate the city in which registration takes place and the date.

- Next will be the text of the document itself. In this section you must indicate all the details of the principal, authorized person and powers.

- Finally, you must indicate for what period the document was issued.

- Submit the signature and transcript of the principal and authorized representative.

A power of attorney drawn up by hand is accepted in most cases:

- to make changes to the contract form;

- in order to receive payment in the event of an insured event;

- to represent interests in an insurance company;

To make changes to the policy

If a power of attorney is needed only to make changes, then in the powers section you should write down: the authorized person, during the validity period of agreement No. “Specify number,” can make changes, namely:

- register a driver or do compulsory motor liability insurance without restrictions;

- extend the period of use;

- change data: full name of the owner, PTS data or state registration plate.

To receive insurance payment

In the event that the owner cannot personally contact the insurer’s office in order to receive payment, a document is prepared indicating: an authorized person, during the term of the contract, can contact the insurance company’s office in order to provide documents on the accident and receive compensation payment.

To represent interests in an insurance company

Such a power of attorney is drawn up so that the trusted person can contact the insurer’s office to resolve any issues. To do this, all powers should be clearly stated in the body of the document. Eg:

- driver registration;

- extension of validity period;

- termination.

Instructions for concluding a contract

When preparing a document yourself, you should follow a few simple rules:

- Download the power of attorney template for MTPL.

- Fill out a power of attorney only if you have the passports of the principal and the authorized person.

- After drawing up, give the document to the authorized person confirming ownership of the car.

Writing Instructions

The instructions for writing a power of attorney will have the following sequence of actions:

- The document is drawn up on an A4 sheet, with the name of the document POWER OF attorney written at the top center.

- Below in the right corner the date of the document is indicated, in the left corner the city is indicated, for example, Moscow.

- Further, the actual text of the document “This power of attorney, full name, passport data, hereinafter referred to as the Principal, authorizes the full name, passport data of the authorized person, to represent the interests of the insurance company (name of organization) of the vehicle (car data).

- The following is a description of the full list of powers.

- The validity period of the document is indicated.

- Signature of the authorized representative.

- Stamps.

- The name of the principal and his signature are indicated.

Before purchasing insurance, you can pre-calculate its cost online. This can be done simply, the process will take you no more than 5 minutes.

A power of attorney can be issued for the following cases:

- making changes to the insurance policy;

- receiving insurance payment in the event of an insured event;

- representing the interests of the principal on other issues;

- conclusion of an insurance contract.

To make changes to the policy

Such a document must contain the first three points of general instructions, then the list of powers indicates that the authorized person is given the authority to make changes to the policy when contacting the insurance company.

To receive insurance payment

Important! In order for a third party to have the right to receive insurance compensation, which is due in the event of a situation described in the insurance contract, he needs to include such powers in the power of attorney.

To represent interests in an insurance company

In order for the authorized person to act on the basis of a special document, he needs to provide it. The principal in paragraph 4 of the instructions for drawing up a power of attorney for representation of interests indicates powers, such as representing the interests of the owner of the vehicle in an insurance company. You can describe exactly which functions are included in this category.

Read about drawing up a power of attorney to represent interests in an insurance company from a legal entity here, and from an individual here.

Instructions for concluding a contract

If the principal instructs the authorized person to conclude an agreement with the insurance company, then the power of attorney must indicate the fact that the authorized person has all the grounds for this. In addition to the power of attorney, you will need to provide the necessary list of documents to issue the policy.

Certification methods

When drawing up a contract, insurers ask to present a certified power of attorney form to the office of the insurance company. In this case, as already mentioned, you can certify the document:

- personally, by signing the document on the part of the principal;

- notarized.

Often, companies only require a notarized power of attorney to enter into an MTPL agreement. This requirement can be explained very simply; insurers are trying to avoid the fact of fraud and issue or extend the contract “cleanly”, from a legal point of view.