November 25, 2019

Cases of adjustment

How to change data?

What can be changed?

New OSAGO policy

Today, every law-abiding driver, when stopped by a traffic police officer on the road, can present him with a contract. At the same time, not everyone can ensure its availability with the information that corresponds to reality (name or characteristics in the PTS, STS). In this article we will look at the question of how to adjust your insurance data, whether this can be done online or only in person.

When is it necessary to make changes to compulsory motor liability insurance?

A car insurance contract belongs to the category of legally significant documents. In this regard, all information contained in the policy must be updated in a timely manner.

Amendments to the MTPL policy, in accordance with the regulations of Federal Law No. 40, will be necessary if:

- The terms of the contract are changing. For example, the owner of a car initially insured it for the summer period, but then decided to drive it all year round.

- Lost or replaced driver's license. When receiving a new certificate or a duplicate, you also need to contact the insurer to make changes to the policy.

- The policyholder's passport details have been changed. For example, a female driver got married or divorced, returning her maiden name.

- Enrolling a new driver in the MTPL insurance.

- The identification documents of the car are changed - registration certificate, COP, new numbers are obtained.

If, upon the occurrence of the listed cases, changes are not made to the policy, it is considered invalid. It will not be possible to receive insurance compensation for it if the driver gets into an accident. When a document is checked by a traffic police officer, the owner of a policy with outdated information will be fined. This applies to both the traditional paper format of the form and its electronic analogue EOSAGO.

In a number of situations, making changes to the MTPL policy is not provided for by law:

- When replacing one policyholder with another, while maintaining the same car in the contract. For example, when changing the owner of a vehicle.

- Adding another vehicle to the contract while maintaining the same policyholder. This need arises if the owner sells his previous car and buys another.

In these cases, the old insurance contract is terminated and a new one is renewed. You can change information about the owner of a car when selling it if the policyholder is a third party.

It is necessary to conclude a new MTPL agreement when changing the driver's license

At the time of receiving a new driver's license, a person is issued a document series. Numbers that do not coincide with the previous license, and at the same time with the parameters specified in the current car insurance contract. This situation causes serious concern among vehicle owners.

However, the new license that is issued to the driver has a special section in which the data from the previous document is entered. This means that for traffic police officers such a change will not be a problem and a reason for imposing sanctions against the driver. Insurance companies also do not require the re-conclusion of a new contract, since they are quite satisfied that the client has paid for the policy and therefore updating the document is not important for them.

According to the law, replacing the MTPL policy when replacing rights is not a necessary action today. All the driver needs to do when replacing a driver’s license or, for example, changing his last name is to submit an application where the new data (numbers, series) will be indicated. Then he can continue to drive a car, using the policy concluded under the old document. At the same time, the driver needs to remember that the concluded contract contains a clause that obliges him to send a notification to the insurance company about acquiring a new license within five days after the end of the procedure. There are precedents when insurers ask a client to enter into a new MTPL insurance policy with them in order to avoid possible unforeseen situations in the future.

Although, as mentioned above, the exchange of temporary residence does not require the replacement of the contract. Many experienced drivers recommend renewing the MTPL policy agreement so that insurers do not even have grounds for freezing payments due to an “incorrectly executed document.”

How to make changes to an electronic policy, sample

To make changes to the electronic policy, you need to contact the employees of the insurer. Only the insurance agent has the right to correct the information specified in the policy, recording changes in a unified electronic register. In the insurance form, new information is certified by the employee’s personal signature and the organization’s stamp.

statements

Submitting an application for amendments to the MTPL policy is allowed only during a personal visit to the office of the auto insurer. It is not possible to correct the information contained in any insurance option – paper or electronic – remotely.

Through the RSA resource or the website of an insurance company, you can only purchase EOSAGO. In the case of data replacement, it is possible to make an appointment with an insurance agent in advance via the Internet so as not to waste time in queues.

How to make corrections correctly and do I need to pay extra for it?

When is it necessary to make changes to OSAGO? According to Article Federal Law No. 15, the owner of the vehicle for which the MTPL policy is issued is obliged to inform the insurer about any adjustments - not only about changes in the information specified in the contract, but also when changing the telephone number, information in the passport, marital status that were used in questionnaire when submitting an application. At the same time, the law does not stipulate deadlines for making changes and does not provide for penalties for inaction on the part of the policyholder.

Important! If inaccurate information was provided when signing the MTPL agreement, the policy will be invalidated. Not only the owner himself can make changes to the document, but also his legal representative with a notarized power of attorney.

There are two options for entering new information into your insurance:

- entry in the existing form in the “Special Notes” section;

- registration of a new form.

If an amendment is made as the first option, then the date and time of the new entry must be indicated, along with the insurer’s seal and the employee’s signature. MTPL with adjustments is returned to the owner, and the insurer keeps a copy and the policyholder’s application.

There are certain reasons for changing the policy:

- typos and errors in passport and personal data identified after signing the contract;

- incorrectly indicated cost of the “motor vehicle”;

- the policyholder's phone number has changed;

- changes in the intended use of the vehicle;

- change of name of the policyholder;

- change of status, for example, renaming an individual into a legal entity and vice versa;

- during the reconstruction of the vehicle, the engine size or make of the car has changed;

- VIN change;

- issuance/replacement of PTS;

- change of license plate;

- change of place of residence or registration;

- registration of a new driver (what is the fine if the driver is not registered in the MTPL?).

When these changes are made, the insurance policy is replaced with a new document.

But it is worth knowing the data that cannot be replaced:

- a vehicle that was insured (not a title or license plate, but the car itself);

- the policyholder (when the person changes, and not the owner’s details);

- the period for which the MTPL policy was concluded (the first column in the form).

To make corrections to these points, you will have to terminate the contract and re-enter it with new data.

Please note that the policyholder cannot change, but the owner can.

List of documents for application

When visiting the insurer's office, you need to have the established package of documentation with you. It will be required to confirm the identity of the policyholder and the authenticity of the changes being made.

- A free-form application.

- A photocopy of the personal passport of the owner (policyholder) of the vehicle.

- When re-issuing a policy by a trusted person, he needs to have his passport and a power of attorney from a notary.

- If you need to add a new person to the insurance, you must provide the original of his driving license and a photocopy of his personal passport. The presence of the driver himself is not necessary here.

How quickly do you need to notify the insurance company about the replacement of rights?

At the moment, the legislative norms on car insurance do not have a special section indicating the exact timing of notification of insurers by the owner of the car in the event of a change of driver's license. However, experts recommend doing this as quickly as possible. In this case, the owner of the car must have the following package of documents with him:

- Civil passport;

- Vehicle registration certificate;

- New driving license;

- A valid insurance contract.

Arriving at the company’s branch, the car owner will have to write a statement according to which in the future insurers will make changes without replacing the insurance contract in the electronic database. At the same time, no one will replace the MTPL insurance itself; all the specialist will do is enter the series and numbers of the newly acquired rights in a special column of the document, and also indicate the date when the changes were made.

If the insurance company specialists are satisfied with everything, then the necessary changes are entered into the policy immediately, after which the owner will be able to safely use the car.

How quickly new data is added to the database

Instructions for making changes to UISAGO

The process of making changes to the MTPL policy is thoroughly prescribed in regulations. There are three forms of this procedure:

- Registration. Applies if the adjustments made do not entail changes in the price of insurance, or are of a minor nature. New information is simply entered into the electronic database without changing the UISAGO form.

- Making adjustments to the policy. New data is entered into the insurance form itself if it is of a legally significant nature.

- Re-registration. Required if the changes are fundamental: the insured car or its insurer changes.

The algorithm looks like this step by step:

- First step. The MTPL policyholder notifies the company of the need to make changes to the current policy. You can notify the insurance agent about this during a personal visit to the office, by phone or online. After talking with an employee of the insurance company, you can find out additional information: a list of necessary documents, the cost of the procedure, waiting times.

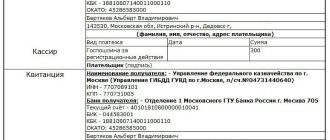

- Second step. Drawing up an application for adding new information to the insurance. It is written in free form, on a standard A-4 sheet, or on letterhead directly at the company’s office.

- Third step. Collection of the necessary set of documents. Their list may be different and depends on the specific reason for making adjustments. You can find out what papers are required on the insurer’s website, or by contacting the company’s employees by phone.

- Fourth step. The prepared package of documentation, when visiting the office, is submitted to the employees of the insurance company. After reviewing the submitted papers, they make a decision whether to grant the request or deny it. Reasons for refusal: insufficient documents, inaccurate information, expired documents provided, etc.

- Fifth step. If no inconsistencies are found in the submitted papers, the necessary adjustments are made to the policy and the unified register of the RSA. Changes are certified by the signature of the agent and the seal of the organization. After this, the amended policy acquires legal force. If new data entails a recalculation of the MTPL price, then the policyholder will need to pay the difference and present a receipt to the insurer.

Once you receive your new insurance document, carefully check that it is filled out correctly. Sometimes inaccuracies and obvious typos creep into the adjusted policy. As a result, it is de jure considered invalid.

Expert opinion

Maria Mirnaya

Insurance expert

OSAGO calculator

And this is fraught with problems with traffic police officers and difficulties with paying compensation for damage if the driver gets into an accident. If any errors have been replaced after the inspection, contact your insurer immediately and request that they be corrected.

How many people can be included in the policy?

It all depends on what type of insurance you have. They come in two types:

- Limited. In this case, you can enter more than five drivers into the document.

- Unlimited. You can enroll as many drivers as you need in your insurance. Despite the fact that there are only five fields to fill out (that is, it is designed for five people), the manager can continue the list from the reverse side. Even if this side is not enough, the company employee is obliged to make an addendum to the policy, where he will include the remaining drivers of the vehicle.

In addition, insurance organizations have a service - unlimited use of the car. It is used in cases where the driver himself does not know who will use the car. The cost of such a service is quite high; this is associated with a high risk for the insurance company.

It should be noted that only individuals can add drivers to insurance.

Adding a second driver to your insurance is quick and easy. The package of documents is minimal; it is possible not to come to the office yourself, for example, send a proxy or call the manager of an insurance organization to your home.

This must be done in order to receive financial compensation for the damage caused in the event of an accident, and also not to pay money to the other participants in the accident (regardless of who is right and who is wrong).

A traffic police officer can also issue a fine for driving without insurance. The cost of the registration process is calculated using a special formula and depends on many factors, the main ones being the person’s age and driving experience, as well as the number of accidents. You can enter not just one person, but several. The number of possible drivers depends on the type of insurance.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Free online consultation with a car lawyer

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Do I need to pay and how long to wait?

Changes to the MTPL policy are made both free of charge and with additional payment. There is no need to pay additional fees for:

- Changing the passport data of the vehicle owner or policyholder, if these are different persons.

- When the owner of the car is an organization, there is no need to pay for changes to the policy after changing its name.

- Change of registration number, technical passport, registration certificate.

- Changed passport details of drivers included in the policy will also not require additional payment.

Some adjustments made to MTPL insurance will require recalculation of the contract. They will be registered only after paying an additional amount and providing a bank receipt as confirmation.

Recalculation is carried out in the following cases:

- The validity period of the car insurance contract is changing. If this period increases, the policyholder must pay extra for additional months. If the validity period is shortened, he, on the contrary, has the right to demand the return of the overpaid amount from the insurance company.

- Adding one more driver to OSAGO, in addition to those already included in the policy. Here, the need for additional payment and its size depend on several criteria. This is the age and driving experience of the new driver. If he is under 22 years of age, with little driving experience, then the policyholder will have to pay an additional amount for insurance.

This is due to the increased risk of an inexperienced driver committing an accident, and, consequently, to the increased likelihood of the company’s expenses for paying compensation for the damage caused to them. The same applies to the class of the person being entered in the KBM system. The lower the class, the more expensive it will cost to reissue an insurance policy.

- Technical changes in the design, as a result of which the engine power, the number of passengers carried, and the maximum weight of the vehicle became different.

According to the standards established in Federal Law No. 40, the insurer is given a period of three days to review the received set of documentation. The time it takes to make changes to the MTPL policy and information base is usually one, less often two, working days. If you arrange an appointment with an insurance agent in advance, the entire procedure can take less than an hour, provided that the accompanying documents are completely complete.

What papers will be needed?

If you apply to the Investigative Committee with an application to make changes to the list of drivers allowed to drive a vehicle, you will need the following list of documents:

- Passport or other identification document of the policyholder.

- The policy itself and a receipt for payment of the insurance premium (in fact, the original form is provided only if the policy was issued in paper form, but if the policy is in electronic format, then it is not required to be provided).

- If you want to add a new person to the policy who will be allowed to drive the vehicle, you will need: a driver’s license of the person who will be added to the policy.

The amount of the insurance premium depends on the insurance history of each person included in your policy as a driver. That is why, when adding new drivers, the cost of your policy may increase or, conversely, decrease.

You can read about how to make changes to the electronic policy if an error is found in it.

If you apply to the Investigative Committee with an application to make changes to the information on your driver’s license, you will need :

- The policyholder's passport or a document replacing it.

- The contract form itself and the payment receipt (if the policy was issued on paper).

- Your new driver's license.

In the event that changes are made regarding the state number of your vehicle, you will need:

- Passport or other document that confirms your identity.

- If the insurance was issued on paper, then you need to provide a contract and a receipt for payment.

- Your vehicle registration certificate.

Article 1.3 of the rules governing liability insurance to other road users states that the person carrying out the insurance is obliged to inform the insurance company of the registration number of the car within 3 working days after the car is registered and the registration plate itself is received.

If the policyholder's last name has changed, then to make changes to the insurance you will need:

- Passport or other identification document.

- Receipt and policy form if a paper version of the policy was issued.

- Documents confirming the change of your last name.

If changes are made to the owner column of the policy, you will need the following documents:

- Passport or other form of identification document.

- Original compulsory motor liability insurance and a receipt for payment of the insurance premium (not necessary for an e-policy).

- Passport of your vehicle.

- An agreement confirming (sale, donation, etc.) of your vehicle.

- Passport details of the new vehicle owner.

If you want to change the validity period of your MTPL insurance coverage (if the insurance was issued not for 1 year, but for example for 3, 6, 10 months), you will need:

- Policyholder's passport.

- Your insurance and a receipt confirming payment for your contract (not required for e-OSAG).

- PTS or STS of your car.

The amount of the insurance premium depends on the period of insurance coverage, i.e. The cost of your insurance may change up or down.

Methods for registering changes

You cannot make any new information, notes or corrections to the form yourself - even if you find a typo. This may be considered by the auto insurer as document falsification. There are 3 official options for registering changes to the MTPL agreement:

- Registration of new data is carried out if as a result there is no need to recalculate the premium. The changed information is simply registered, and after 3-4 days it is entered into the database. The policy remains old.

- Changes to the form are entered into the “Special Notes” and are confirmed by the signature of an official representative and the seal of the auto insurer. The auto insurance company keeps a copy of the corrected document.

- In some cases, a complete re-issuance of the policy will be required. A mark is placed on the old and new documents about the re-issuance, recording their numbers and the date of re-issue. The duration of the contract and all its terms remain the same. In some companies, the replacement procedure may take a couple of days, but in most cases, policies are changed immediately.

You can also fill out an application yourself and submit changes to the insurance company through your personal manager.