Any state wants to remain in a stable economic position, and for this its budget must necessarily have a positive value. This means that there should be much more income and infusions than expenses, which, unfortunately, does not happen in all countries and not always. The state is frantically looking for ways to qualitatively “patch” holes in the budget so as not to accumulate external debts, which again fall on the shoulders of taxpayers, which is why in 2014 it was decided to introduce a previously non-existent luxury tax. Since then, rates for this type of tax have regularly increased, and the rules have become stricter, so it wouldn’t hurt to find out which cars fall under the luxury tax in 2021 in order to finally clarify the situation.

Meaning and functions of luxury car tax

Many were bewildered by the fact that the Tax Code of the Russian Federation did not and still does not mention any law on luxury tax, but its actual effect can be felt by every citizen who purchases a certain type, category and brand of car. In 2014, there were only about three hundred models subject to the tax, then their number grew to seven hundred, and in 2021, about a thousand makes and models of vehicles can be found on the list of those that are rightfully considered luxury.

Important

In fact, there is no special and separate tax on luxury cars, it is a popular name. There are also increasing coefficients for the transport tax, which has long been the subject of debate and controversy in the government. The TN value for luxury cars is calculated by taking into account the power of the car, its cost, year of manufacture and brand, as well as the region in which it will be registered.

Vehicles that are subject to luxury tax include not only passenger cars, but also water and air vehicles (helicopters, airplanes, yachts, boats, motor boats, etc.). Previously, it was assumed that this type of state tax collection would be aimed at creating a kind of reserve financial fund, but at this time this idea is not supported by anything legislatively, and the tax under discussion performs the following functions:

- Anti-corruption activities are financed partly from these fees.

- Regulating the flow and distribution of budget funds, supporting the country’s economy in general.

- Improving the quality of taxes to fill government coffers.

- Maintenance, repair, maintenance, as well as construction of new infrastructure facilities.

The introduction of a new fee only has a positive effect on the economic situation of the state, in general. As for the rest, I would like to respond to those who are dissatisfied with the good old Russian proverb that if you love to ride, you should not forget that you will also have to carry the sled. It makes sense to present a list of cars to which the luxury tax applies and the formula for calculating it in order to dispel all the secrets and veils, this is what we will do in our article.

Latest transport tax calculations

Below is a list of the latest calculations that were made on our transport tax calculator, you can see the result.

- Calculation of transport tax for the city of Moscow, 2020, 410 hp.

- Calculation of transport tax Novgorod region, 2020, 106 hp.

- Calculation of transport tax Novgorod region, 2020, 300 hp.

- Calculation of transport tax Ryazan region, 2020, 160 hp.

- Calculation of transport tax for the city of Moscow, 2018, 143 hp.

- Calculation of transport tax for the city of Moscow, 2020, 178 hp.

- Calculation of transport tax Chuvash Republic, 2018, 224 hp.

- Calculation of transport tax Komi Republic, 2020, 249 hp.

- Calculation of transport tax Kursk region, 2020, 238 hp.

- Calculation of transport tax Samara region, 2020, 315 hp.

- Calculation of transport tax for the city of Moscow, 2020, 570 hp.

- Calculation of transport tax for the city of Moscow, 2020, 162 hp.

- Calculation of transport tax Bryansk region, 2020, 175 hp.

- Calculation of transport tax for the city of Moscow, 2020, 700 hp.

- Calculation of transport tax for the city of Moscow, 2020, 517 hp.

- Calculation of transport tax Novgorod region, 2020, 181 hp.

- Calculation of transport tax Kursk region, 2020, 180 hp.

- Calculation of transport tax Sverdlovsk region, 2020, 100 hp.

- Calculation of transport tax Ryazan region, 2020, 249 hp.

- Calculation of transport tax Ryazan region, 2020, 277 hp.

Pages: 1 … 366 Next.

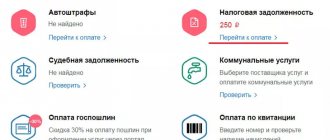

A transport tax calculator can be classified as a modern service that provides anyone with the opportunity to independently calculate the tax fee for a specific vehicle.

The Transport Tax (TN) was introduced as a replacement for the “road toll”, which happened in 2003. Tariff rates for transport tax are regulated by Article 361 of the Tax Code of the Russian Federation, and to calculate it you can use a simple and understandable transport tax calculator.

You need to calculate TN not only in cases where you do not receive a notice from the tax office. Knowing the size of the TN also allows you to understand whether the amount indicated on the receipt is correct.

What is TN for? Funds received from car owners are directed to the targeted needs of the industry: construction and repair of roads, infrastructure development, etc. At the same time, each subject of the Russian Federation has the right to independently decide where exactly the collection from car owners will be sent.

Our transport tax calculator takes into account the current tariff values for each region and region, and we also constantly update information about benefits for certain categories of citizens. You can use the online TN calculator completely free of charge.

What the system also takes into account:

- Category and type of vehicle

- Region of vehicle registration

- Determination of the tax period

- Number of complete months during which the vehicle is owned

In addition, you will need to enter some additional information. For example, the number of horsepower, car model, as well as manufacturer, year of production and cost. If we talk about the increasing coefficient of the car, then there is no need to select it; the system takes this indicator into account independently, focusing on other information about the transport.

Please take into account that the base rates for TN in Moscow and St. Petersburg are several times higher than in other regions. For example, in the southern regions of the Russian Federation, tariff rates are minimal. Also, the final amount of tax is influenced by the presence/absence of benefits, which affect the amount of collection (sometimes benefits can completely exempt a person from paying tax).

The main categories of vehicles for which the transport fee is calculated using the calculator:

- cars, trucks and buses

- towed watercraft

- boats and other hydraulic transport with an engine

- motorcycle transport

- air transport and jet-powered aircraft

- mechanical and tracked vehicles

- other navigational transport: motor and sailing vessels, including yachts, ships, etc.

Increasing coefficients

So, if the luxury tax is not a separate fee, which we have already found out, it would not hurt to find out how it can be calculated or at least roughly estimated. It’s worth starting with those same increasing coefficients to the basic transport tax rates, which we already mentioned just above. Just two factors-indicators will significantly influence the size of such a multiplier:

- Year of manufacture of the vehicle.

- The cost of the car, according to the official version, in a new form.

By analyzing the information that can easily be found on the website of the Ministry of Industry and Trade, you can easily understand these increasing coefficients and therefore calculate the required tax payment when purchasing and operating a particular luxury car.

From 3 to 5 million rubles

- The coefficient for vehicles less than one year old will be 1.5 units.

- For a car whose service life barely reaches two years – 1.3 units.

- For cars older than three years – 1.1 units.

5 to 10 million

- The size of the increasing coefficient will be exactly 2.0 units if its service life from the date of issue does not exceed five years.

From 10 to 15 million rubles

- If the vehicle is no more than ten years old, the increase coefficient will be 3 units.

Over 15 million rubles

- In this case, the increasing coefficient remains exactly the same as in the previous category and will be exactly three. However, you will have to pay luxury tax for such a car not for ten, but for two decades.

What is it and what are the purposes of its introduction?

Luxury tax (LRT) is a transport tax for foreign-made cars. Domestic cars do not fall under it. The tax was introduced on January 1, 2014, after changing paragraph 2 of Article 362 of the Tax Code of the Russian Federation, according to which all car owners who are subject to the said legislative act must pay an increased vehicle tax based on a special coefficient.

The objectives of introducing the tax are as follows:

- Import substitution. Only imported cars are subject to the tax.

- Replenishment of the regional budget through payments.

- Changing the priority of purchasing foreign cars to domestic ones.

In addition, the tax takes into account factors such as the cost of the vehicle and engine power.

Reference! In 2021, more than 900 vehicles were included in the luxury tax list. Compared to 2021, this figure is 200 vehicles more.

Formula for calculating luxury tax

Having at hand the above tariff schedule, or, rather, a list of increasing coefficients, as well as having found out the basic calculation formula and several criteria for the car itself, you can calculate how much you will have to pay annually, therefore, draw a conclusion whether it is worth purchasing such an expensive vehicle or better will limit itself to something simpler.

Mdv x NS x PC = PTN

Here's a detailed breakdown:

PTN is an increased transport tax, that is, the same luxury tax that you will have to pay in the end.

Mdv is the engine power of the car you have chosen in horsepower.

TS is the base tax rate, which can vary significantly and significantly in different regions.

PC is an increasing factor that should be taken into account based on the year the car was produced, as well as its real value, according to the Ministry of Industry and Trade.

Deadlines for paying transport tax on a car

Transport tax on a car is paid at the place of registration of the car, and in the absence of such, at the place of residence of the owner of the vehicle.

Individuals pay transport tax on cars no later than December 1 of each year (Article 363 of the Tax Code of the Russian Federation), based on a tax notice received from the Federal Tax Service along with a payment receipt. If the transport tax is not paid within the required period, a penalty is charged, and the tax amount increases by a certain percentage monthly.

Cars eligible for luxury tax in 2021

The main reason for increasing tax deductions lies in the financial plane, that is, the higher the price of a car, the more you will need to pay, at least one and a half, or even two or even three times. This means that even if you buy a car secondhand and its cost is no more than three million rubles, but the official price in the Ministry of Industry and Trade catalog turns out to be much higher, you will have to pay tax, there is no way to hide from this and there is no escape.

Therefore, it is very important to monitor the replenishment of the list of luxury cars, which is growing with every goal, due to soaring inflation and an increase in all prices, not to mention luxury vehicles. Most brands whose models are subject to luxury tax can be limited to a small list:

- Jaguar.

- Audi.

- Land Rover.

- Mercedes-Benz.

- Lamborghini.

- BMW.

- Chevrolet.

- Cadillac.

- Lexus.

- Aston Martin.

- Bugatti.

- Rolls-Royce and others.

You can directly visit our website and check it regularly before purchasing. For convenience, it first lists cars that cost three million and more, then those cars that cost five, ten and fifteen million rubles. The list is constantly being updated, so it is worth closely monitoring the changes so as not to fall into a network of debts, since if you are in debt, penalties may increase, although not large, but for large amounts, very noticeable.

Benefits, discounts and concessions

This type of tax turns out to be really significant and the amounts are far from childish. You can get rid of such extortions over time, when your car is no longer new, but will serve three, five or ten to twenty years faithfully. True, by then everything may change. It is, of course, possible to avoid paying luxury tax on cars in 2021, but to do this you need to belong to one of the population groups listed below, and also document your right to such a discount.

- Parents or guardians of large families do not pay luxury tax and, moreover, may not pay transport tax at all in most regions of our Motherland, about which there is a useful article on the website.

- Veterans of WWII and UBI do not pay luxury tax, even when they own expensive vehicles.

- Disabled people of the first and second groups.

- Recipients of the Order of Glory of any degree, as well as holders of the title of Hero of the Soviet Union and the Russian Federation.

- Liquidators of man-made and radiation accidents and disasters, as well as those affected by them.

- Persons with special services to the Motherland, astronauts and others.

In some regions of our huge country, pensioners are partially or completely exempt from transport tax; therefore, they will not pay luxury tax. This information needs to be constantly checked, because local authorities may change the rules and system for calculating subsidies and providing benefits annually.

Let's sum it up

There are several other cases where the luxury tax is not levied on car owners, and some of them are actively used by some financially unscrupulous individuals. So, taxes are not charged at all on a wanted car, that is, neither a transport tax nor one that relates to luxury. It is unlikely that you will be able to cheat here, since there must be official confirmation from the police that the car is indeed stolen and is wanted.

The second option is to register the car not to the real owner, but to an organization, for example, a society for the blind and similar groups. The third method is based on the fact that people with disabilities do not pay luxury taxes, and therefore vehicles converted for the needs of a person with special needs and disabilities are not subject to such taxes. It is clear that hiding income and evading taxes will not bring anything good and in the end, most likely, the truth will come out, then you can end up not only with serious debts, but also with a prison sentence, so it is better to avoid such incidents and live honestly.