What is recalculation

Recalculation of the fee is a change in its amount as a result of some special circumstances. It is carried out both in a large and in a smaller zone.

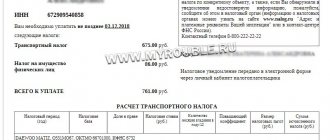

The message, which arrives at the address once a year, contains information about calculations for the last tax period and calculations of fees. The authority has the right to recalculate only for the last 3 reporting periods.

If a citizen has paid more than necessary, then the amount can be:

- Credit it against your tax for the next term.

- Give to a citizen or company.

The last option is only possible if a special application has been submitted with the details of a personal account to which the money can be transferred.

Who might need it

For individuals, transport tax recalculation is possible:

- If you made a mistake.

If an inaccuracy is found in the power of the machine that is subject to the fee, or if the wrong rate is indicated, or benefits are not applied, then you need to go to the inspection soon.

You must provide a passport and originals of all required documents that are needed to correct the error. You also need to write a statement.

Sometimes the service requests additional data from the traffic police or another authority that has the information necessary for clarification.

- If the car is sold, but the information was not received in a timely manner.

To prove the need for recalculation, you need to go to the tax office and hand over the original sales contract to the employee. After recalculation, the message is sent to your address a second time.

- If the car is stolen and there is a certificate from the traffic police about it.

Thus, recalculation will be done only for the time during which you used the vehicle. If there is evidence that the car has been stolen, then tax officials make a calculation based on the submitted papers.

- When changing your place of residence or registering your car.

The secondary calculation of the fee is made on the basis of the application and submitted documents that confirm this provision.

Where to send your application and when will it be considered?

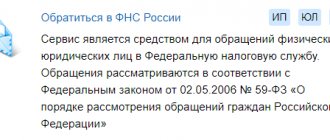

The procedure for considering applications from taxpayers is regulated by Federal Law No. 59 of May 2, 2006 (hereinafter referred to as the Federal Law). So that you don't have to worry about studying the whole document, below we will answer the most important questions.

Where should I send my application for recalculation of transport tax?

The appeal should be addressed to the tax office at your place of residence, that is, to the one that incorrectly calculated the road tax for you (Part 1 of Article 8 of the Federal Law).

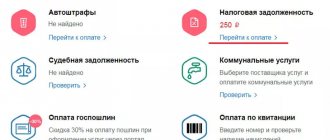

You can send an application:

- By mail;

- Via the Internet (using the online service “Contact the Federal Tax Service of Russia” on the website nalog.ru);

- In person (be sure to bring your passport with you).

You can find out the exact address of your Federal Tax Service here. To do this, enter your residential address in the special line and click the “Next” button.

When will the application be considered and where will the response come?

The decision on recalculation is made within 30 days (Part 1 of Article 12 of the Federal Law). In some cases, the consideration time may be extended, but not more than a month. The answer will come by mail or email if you indicated it in the application.

How do I know if my application has been accepted?

To make sure that the application was not lost on the way to the tax office and was accepted for consideration, use the “Find out about the complaint” service on the Federal Tax Service website. The search for requests is carried out by the taxpayer's last name or TIN. With its help, you can find out when the application was received, in what time frame a decision will be made on it, and at what stage of consideration it is now. If the search does not produce results, contact the INFS help desk at your place of registration and check the status of the application through the operator.

Remember, you have every right to contact the tax office for a recalculation. However, before you start filling out the application, make sure that there really is an error, otherwise you will simply waste your time. Read about the rules for calculating transport tax in this article.

Legal consultation

Get qualified help right now! Our lawyers will advise you on any issues out of turn.

Get advice from a car lawyer

Sometimes there is a need to recalculate the tax, which is assessed by the relevant inspection on the vehicle.

However, citizens may encounter ignorance of the procedure itself, especially when finding themselves in such a situation for the first time. In order to avoid loss of personal time, a citizen should immediately provide the necessary papers.

Recalculation of vehicle tax means a change in the calculated tax amount. The tax amount can be either increased or decreased.

The basis for recalculation may be certain newly discovered conditions (for example, the taxpayer made advance payments or the engine power was not taken into account, etc.).

A vehicle tax notice is sent to the responsible taxpayer at his place of residence. The document must contain information about the tax period and the tax amount itself.

If transport tax has been recalculated, this information must be indicated.

Recalculation for sold vehicles

The owner of the car, who sold the vehicle and received a message from the service for the period after the transaction, must request that this misunderstanding be resolved. In another situation, ignoring reports from the tax office may result in penalties for evading payment of fees.

Now you need to establish what is considered the real reason for sending a tax report in your direction. If this is a fee for the previous period, then it must be paid, but if not, the report must be sent to the current owner.

When answering the question regarding how to recalculate transport tax in connection with the sale of a car, many nuances should be taken into account. If this happened illegally, then you need to go to the service and the MREO in order to justify the refusal to pay the fee for sold vehicles.

If the message was sent by mistake, then you need to submit an application to the Federal Tax Service and the State Traffic Safety Inspectorate with a request to bring the data and papers into proper condition. When signing the contract, you should eliminate your mistakes. Avoiding unpleasant surprises when buying and selling is quite simple.

After 10 days have passed, you need to send a request for data about a specific car to the traffic police. This way you can find out whether it has been re-registered to the new owner.

If you succeed in contacting the new owner, you will need to request that the vehicle be registered. If this cannot be achieved, then you should contact the traffic police and submit an application for disposal or search for the vehicle. Naturally, the tax will not evaporate and will have to be paid. Therefore, you need to go to a qualified lawyer to restore the truth.

If you managed to re-register your car, then you should do the following:

- You need to get a certificate from the traffic police, which will confirm your registration.

- You need to go to the regional tax office with the original certificate.

- Next, you should draw up an application, indicating in it information about the new owner and the date of the contract.

- A copy of the purchase and sale agreement must be attached to the papers.

After these manipulations, a decision will be received stating that the payment has been withdrawn from you.

Letter dated November 12, 2020 No. SD-4-21/ [email protected]

The Federal Tax Service considered appeals from the Federal Tax Service of Russia for the Moscow Region dated October 20, 2020 No. 17-11/ [email protected] and the Federal Tax Service of Russia for Moscow dated October 23, 2020 No. 23-16/ [email protected] regarding the determination of periods for recalculation of transport tax in connection with the provision of a tax benefit to an individual taxpayer (hereinafter referred to as a tax benefit, taxpayer), and, taking into account the deadlines for consideration by the tax authorities of received requests from taxpayers on such issues, sends the following recommendations.

It is advisable to take into account that on November 11, 2020, Federal Law No. 1022670-7 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation” (hereinafter referred to as the Law) was adopted, according to which, if a taxpayer entitled to a tax benefit has not submitted an application for a tax benefit to the tax authority or has not reported a refusal to apply a tax benefit, the tax benefit is provided on the basis of information received by the tax authority in accordance with the Tax Code of the Russian Federation and federal laws, starting from the tax period in which the taxpayer acquired the right to a tax benefit (clause 43 of Article 2 of the Law).

This legal provision comes into force on the date of official publication of the Law (Part 1 of Article 9 of the Law).

According to the Federal Tax Service, based on paragraphs 1, 3 of Article 5 of the Tax Code of the Russian Federation, the planned date of entry into force of the legal provision in question is due to the establishment of additional guarantees for the protection of the rights of taxpayers to provide tax benefits, which entails the possibility of applying this legal provision from the tax period in which the taxpayer has the right to a tax benefit (subject to the entry into force of the Law).

These clarifications are for informational and reference purposes only (advisory, not mandatory) in nature, do not establish generally binding legal norms and do not interfere with the application of legal regulations and judicial acts in a meaning different from the above clarifications.

Acting State Advisor of the Russian Federation, 2nd class D.S. Satin

If the car is stolen

Cars that are wanted are not subject to taxation. At the owner's request, if the property is stolen, its registration will also be canceled.

Many people are concerned about the question of how to recalculate the transport tax on a stolen car. It is advisable to adhere to this order:

- Go to the police and file a report of the car being stolen.

A criminal case will be opened. The Ministry of Internal Affairs will provide you with a document about the theft or the initiation of a case. You also have the right to stop registering the car. A certain branch of the traffic police will notify the authority about this 10 days after the registration is stopped.

- You need to go to the tax office to carry out a secondary calculation.

You should submit a certificate from the traffic police, as well as an application for recalculation of the transport tax.

If you are not able to hand over the necessary papers, then you do not need to go to the police for them a second time. Based on the submitted application, the tax inspectorate itself will request information from the traffic police.

According to the certificate, if the car is decorated after the 15th of any month, then the payment will no longer be deducted from the next month. If the vehicle was stolen before the 15th, then this month is not taken into account when calculating the fee.

Actions of an individual

If a citizen disagrees with the calculations provided in the report (the report is delivered no later than 30 days before the payment period), he can act in two ways:

- Contact the tax office and verbally state your claims, showing the required evidence.

- Send an application by mail to the Federal Tax Service, which is attached to the message and is necessary for registering such claims.

After rechecking all the data, if the service agrees with the objections, the tax is recalculated and an updated report is sent to the citizen. Individuals who have not received a notification from the service about payment of transport tax must independently notify the tax office of the presence of a vehicle in 2021.

How to write a statement correctly

The re-calculation of the fee is carried out on the basis of papers that prove the existence of the right, and an application for recalculation of the tax on an individual’s vehicle. The form can be purchased at the inspection branch.

You can submit the document:

- Personally.

- By proxy.

- Russian Post.

However, for greater convenience, it is best to find out how to electronically submit an application for recalculation of transport tax. To do this, you need to use the main portal of the Federal Tax Service, in which you must have an account or a virtual signature.

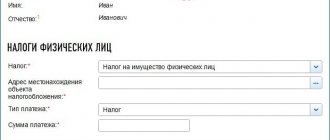

The forms must be filled out in this way:

- Submit a request for recalculation.

- Indicate articles of laws that confirm the right to petition.

- Provide information about the vehicle.

- Explain the reason for the recalculation.

- Write a method for obtaining information regarding the consideration of an application (by mail, etc.).

And be sure to attach the required papers.

Application for recalculation of transport tax

The application form can be obtained directly from the tax office where it is submitted. You can submit a request to the tax office by visiting a branch in person, using postal services, through the Federal Tax Service website or through a representative. In the latter case, it is necessary to additionally draw up a power of attorney for the representative.

The application has the following structure:

| Addressee details | Name of the territorial branch of the Federal Tax Service, its address |

| Applicant details | Information about an individual who wishes to receive a recalculation of the tax amount (full name, address elements, contact information) |

| Title and title | Title – “statement” Title – for example, about the recalculation of transport tax in connection with... (indicate the reason). |

| Text | The text states:

|

| Application | List of documentation attached to the application to confirm the need for recalculation. |

| date | The day of writing the application. |

| Signature | Signature of the taxpayer or his representative, to whom a power of attorney has been issued to transfer powers in this matter. |

Documentation

Not everyone understands what documents are needed to recalculate transport tax. It is curious that the package of papers that will be needed for recalculation depends on the case.

But you still need to give:

- Passport.

- TIN.

- Papers for the car.

In a separate case, you will need to transfer:

- A certificate from the traffic police in case of theft or deregistration.

- A document about the machine's power or the result of an examination.

- Documentation of rights to benefits (certificate of a pensioner, disabled person, etc.).

Submitted papers are submitted in their original form, as copies are not considered a reason for reviewing the fee.

What is needed for the procedure?

To carry out the recalculation procedure, you must write a corresponding application. There is no established application form at the legislative level, although earlier, when Federal Tax Service Order No. ММВ-7-11/479 was in force, which established the form of tax notification, the application form was also proposed by the legislator. in the current Order of the Federal Tax Service of Russia No. ММВ-7-11/ [email protected] dated December 25, 2014. Therefore, you can draw up the document yourself in free form or use a ready-made form by downloading it from the link. It must necessarily indicate:

- Name of the tax office;

- Tax notice number;

- Personal data of the car owner;

- Characteristics of the object of taxation;

- Incorrect data provided in the notification (in accordance with the numbers of sections, columns, lines);

- Additional information as the reason for recalculation;

- Email address, telephone;

- Date, signature.

In addition, the application can list the names of those documents that are provided as confirmation of the need for the recalculation procedure. This could be a certificate from the traffic police, PTS, certificates confirming the availability of benefits (veteran’s certificate, disability certificate, etc.). Along with the listed papers and application, at the request of the Federal Tax Service, the taxpayer must provide a passport, TIN and documents for the car (mandatory - a vehicle registration certificate).

The application and accompanying documents are submitted to the Federal Tax Service office at the place of registration of the car owner. If this department refuses to carry out the procedure, then the taxpayer has every right to file a claim in court. In this case, the collected package of documents will need to be accompanied by a receipt for payment of the state duty and an official response from the tax office regarding the refusal to recalculate. If the application to the Federal Tax Service was accepted, then the recalculation will be carried out within one month from the moment the citizen applied.