Taxes

13.01.2021

388829

Author: Myfin.by editorial staff

Photo: Myfin.by

Transport tax in Belarus is the unofficial name of “State duties for issuing a permit to admit a vehicle to participate in road traffic.”

Last news:

KGC has opened a criminal case against TUT.by: they suspect tax evasion on a particularly large scale

The tax office discovered underpayment of VAT for 3 years by IT companies. They face millions in payments and penalties

Transport tax can also be called a “road tax”, and sometimes – a “technical inspection fee”, although the latter is incorrect; a technical inspection is a control procedure that is paid separately.

Payment of transport tax is regulated by law and is mandatory for most car owners. This is an important point - it is the vehicle owners who pay the tax (formerly state duty).

The House of Representatives on December 18, 2021 adopted amendments to the Tax Code of the Republic of Belarus dated December 19, 2002. According to the resolution, from January 1, 2021, the fee for issuing a permit to admit a vehicle to participate in road traffic is canceled. Instead of state duty, a transport tax will apply. As previously planned, the transport tax (road toll) will be decoupled from technical inspection. The amount of transport tax will be lower than the state duty, but all vehicle owners are required to pay it. Thus, it will not be possible to evade paying transport tax.

Instructions for paying transport tax online in 2021

The tax service sends out receipts with tax calculations in advance, so that by the deadline established by law, the payer can decide on the payment method and plan the required amount. You can pay the transport tax in any convenient way: online if you have access to the Internet from any device or during a personal visit.

Through Sberbank online

Sberbank cardholders are given the opportunity to make various payments through a mobile application or online on a computer. To pay transport tax, the payer must:

- Log in to the Sberbank website in the “Sberbank.Online” section or go to the application installed on your mobile device;

- in the Payments section, go to Taxes, fines, traffic police and search for taxes in the Federal Tax Service using the document details, TIN or scan the QR code;

- It is necessary to confirm the transaction for the payment to be made.

Public services

This payment method is available only to registered users of the ESIA (Government Services Portal) with an account in the “Confirmed” status. The algorithm of actions when making a tax payment is as follows:

- log into the portal with your personal login and password;

- in the top menu bar go to the “Payment” section;

- a debt on all your taxes, including the car, should automatically appear;

- if there is no amount, then instead of “Proceed to payment”, “Check” will appear. Click on it.

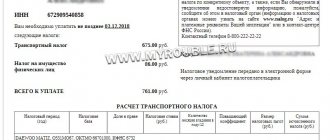

- enter a 20-25 digit code in the UIN field (it is located on the receipt from the tax authority at the top of the document in the “Document Index” column;

- After entering, click on “Pay”.

Then the system will prompt you to select a payment method: bank card, electronic money (Webmoney or Yandex) or mobile phone account.

Below in the video, you can also learn more about payment on the State Services portal.

Yandex money

If you have a Yandex wallet, the car owner can pay the transport tax directly through the Yandex payment system:

- go to Payment for services;

- go to the Taxes section;

- indicate your personal tax identification number or receipt index;

- when you click on the “Check” button, a search is carried out in the State Information System according to the specified parameters;

- then pay the tax amount.

Taxpayer's account on the Federal Tax Service website

The official website of the Federal Tax Service allows the payer to use the resource not only as an information interaction, but also to pay taxes online.

To do this you need:

- log in to the site using your Unified Identification of Significance (USIA) account or go to the tax authority to get your registration card (login will be done through the payer’s INN and password specified on the card);

- the “My Taxes” section displays all information about accruals;

- Online debiting occurs after clicking on the Payment button opposite the transport tax.

It is also proposed to download and install an application from the Federal Tax Service on your mobile device, the functionality of which is similar to the full version of the site.

Interesting : Will the tax be abolished in 2021?

Transport tax rates in Belarus for individuals

For many citizens of Belarus, the vehicle tax is one of the largest and most unpleasant mandatory expenses. Currently they are:

| Kind of transport | Duty amount (BYN ) |

| a vehicle weighing no more than 1.5 tons. | 61 |

| car weighing from 1.5 tons to 1.75 tons. | 81 |

| car weighing from 1.75 tons to 2 tons. | 102 |

| a car weighing from 2 tons to 2.25 tons. | 122 |

| car weighing from 2.25 tons to 2.5 tons. | 142 |

| a car weighing from 2.5 tons to 3 tons. | 162 |

| a vehicle weighing more than 3 tons. | 223 |

| motorbike | 40 |

State duty for individual entrepreneurs is calculated at the rates for individuals.

If you have any doubts regarding the state duty rate, you can use the calculator on the website of the State Institution “Beltechosmot”.

Transport tax rates for legal entities

For legal entities, special conditions for calculating state duty are assigned. They do not coincide with the rates for individuals in terms of size and the dependence of the fee on the weight of the vehicle.

| Kind of transport | Duty amount (BYN ) |

| a vehicle weighing no more than 3 tons. | 162 |

| a car weighing from 1 ton to 2 tons. | 209 |

| a car weighing from 2 tons to 3 tons. | 255 |

| a vehicle weighing more than 3 tons. | 325 |

| motorbike | 70 |

Legal entities, like citizens, have their own benefits and discounts when paying transport tax, but the grounds for benefits are fundamentally different. Let's consider them separately.

How to pay transport tax?

The algorithm for paying transport tax depends on the status of the car owner and his own choice.

Legal entities usually pay transport tax from their current accounts to the Main Directorate of the Ministry of Finance of the Republic of Belarus for the region or the city of Minsk. Other details can be found on the website of your tax office. Codes – 03005 and 03006.

A representative of a legal entity can make the same payment at the bank's cash desk. The money will go to the same details. But this is rarely done, for example, in case of problems with the account, in the absence of an accountant on site, etc.

Individuals pay tax in cash or by card:

- at the post office;

- at the bank's cash desk;

- via ERIP.

Payment at the post office or at a bank does not require any knowledge or effort; the cashiers themselves know the recipient of the tax and the procedure.

Payment through ERIP is not much more complicated. The procedure will be as follows:

- Log in to ERIP.

- Find the section “Other Republican Services”.

- Select “Beltechosmotr”.

- In it select “State duty”.

- The next step is to select the payer status, individual or legal entity.

- Next are the operations common to all payments: entering the amount, confirming payment, completing the operation.

You can pay through ERIP remotely, on the Internet or at information kiosks.

Who can receive transport tax benefits?

For those who count on benefits when paying transport tax, it is advisable to use up-to-date information, because There have been some changes here in recent years. Since 2021, benefits have appeared for pensioners and disabled people. At the same time, they must have documents confirming the right to drive a car, that is, they cannot register a car in the name of a relative of a pensioner.

Transport tax rates have been reduced:

- by 50% – for pensioners, veterans and disabled people of groups I and II;

- by 25% for disabled people of group III.

Vehicles whose year of manufacture is earlier than January 1, 1992, or for which the registration date cannot be determined, are not subject to taxation. Transport tax will not be levied on vehicles deregistered from January 1 to July 1, 2021. Thus, this will help bring the vehicle registration database up to date.

Other transport tax benefits apply equally to both individuals and legal entities:

- 50% pay for motor vehicles designed to carry dangerous goods.

Completely exempt from transport tax in accordance with Article 257 of the Tax Code of the Republic of Belarus:

- passenger vehicles for public use from the list of the Ministry of Transport;

- carriers obliged to carry out road transport by public transport;

- medical assistance vehicles;

- vehicles specially equipped for transporting disabled people;

- transport with the inscription “Social Service”, which actually provides social services to the population;

- republican government bodies, courts, prosecutors, local executive and administrative bodies;

- vehicles of the Armed Forces, other law enforcement agencies, as well as special transport of the Ministry of Emergency Situations.

Owners of electric vehicles do not need to pay tax. This benefit will be valid until December 31, 2025.

What does the law say?

- Article 249. Environmental tax rates

- Article 18.12. Violation of vehicle operation rules

- On changes to the tax code of the Republic of Belarus dated December 18, 2020

conclusions

In 2021, there was a change in the law on transport tax. From January 1, 2021, instead of the state duty for issuing a permit to allow a vehicle to participate in road traffic, a transport tax will be introduced. The tax was untied from passing the technical inspection.

In fact, this is no longer a tax for allowing a vehicle on the road, but a new tax that must be paid upon the fact of owning a car. Everyone will have to pay the tax, regardless of whether a person uses a car or not. All owners of vehicles registered in the traffic police database of the Ministry of Internal Affairs will be required to pay transport tax. If a person owns three cars, he must pay for all three.

The tax amount in comparison with the state duty is lower by 25% for individuals and 15% for organizations. In fact, the amount of tax depends on the weight and time of ownership of the car.

Popular questions about transport tax

How much is the transport duty?

The state duty for individuals ranges from 61 rubles, depending on the weight and age of the car. The maximum duty for individuals is 223 rubles, assigned to cars over 3 tons.

The maximum duty for legal entities is 325 rubles and is assigned for the same transport.

Are there any transport tax benefits for pensioners?

The categories of car owners who are entitled to benefits in the amount of 50% include veterans and disabled people of groups I and II, WWII veterans and pensioners. For disabled people of group III, the tax rate will be reduced to 25%. The reduced rate is given only to those who have the ability to drive a car and a medical certificate about it.

How do individual entrepreneurs pay transport tax?

Individual entrepreneurs do business as individuals and pay state duty as individuals.

Is it possible not to pay transport tax?

According to the new law, which came into force on January 1, 2021, all car owners are required to pay transport tax.

To obtain tax exemption or reduce its amount, citizens can apply to local authorities. This opportunity is provided for those who are in difficult life situations.

Until December 31, 2025, owners of electric vehicles are also exempt from paying tax.

Transport tax may not be paid:

- republican government bodies, courts, prosecutor's office, local authorities;

- carrier organizations that provide road transport using public transport, including social transport;

- troops and military formations.

To avoid paying vehicle tax for 2021, the car owner can deregister the vehicle before July 1, 2021.

What does the money from the transport tax go to?

When introducing the transport tax, it was stated that the money would be used to repair existing roads in Belarus and build new ones. Half of the funds collected go to local budgets, half to the central republican budget.

When and how to pay transport tax?

Transport tax must be paid once a year. For example, in 2021, all car owners must make a payment before December 15, 2021 in the amount of 1 base - 29 BYN. rub., in 2022 it is necessary to make an additional payment in accordance with current tariffs.

Those who have paid the “road toll” at existing rates are exempt from payment for the entire period of validity of the permit to participate in road traffic. If you paid the tax when passing the MOT and your permit to participate in road traffic is valid until June 1, 2021, then the tax will not be calculated for these months. You will have to pay not for a year, but for 7 months.

If you become the owner of a new car, then the transport tax must be paid from the 1st day of the month following the month of its registration. That is, if the car was purchased in August, then tax will be charged from September 1.

Payment of transport tax on a car upon personal visit

For citizens who, for various reasons, do not have access to online methods or do not want to use them, there remains the opportunity to pay the tax in cash. Then the citizen needs to personally appear with a receipt at a banking institution, tax office or Russian Post office.

Payment at the bank with the teller

The payment amount in cash or by bank card can be accepted by a bank employee. He must check the payer’s details with his passport and receipt from the tax authority. Some commercial banks have introduced a commission for this operation.

Payment via ATM

The preferred method for many is to pay taxes through an ATM. The terminals accept both banknotes and non-cash payments by card. If a citizen has difficulty entering data from a receipt, he can ask a bank employee for help or use a scanner that reads a barcode or QR code. Such a code must be printed on the receipt sent by the Federal Tax Service.

Russian Post Office

Tax payments are also accepted by post offices. You can contact any nearest one and make a payment. Please note that there is a commission fee.

Federal Tax Service Inspectorate

Tax officials do not have the right to refuse a transport tax payer to accept payment from him if he appears in person and provides a civil passport, tax identification number, and documents for the car.

Pros of applications

All applications take up a small amount of memory, they load quickly and do not affect the performance of the device. The programs have a simple interface. The programs do not require any special permissions when installing. To get the result, just fill in the required fields and click the “finish” button. At the same time, the application “Transport Tax of the Russian Federation” has some advantages over competitors, since it contains useful background information regarding the collection and carries out calculations by month. In addition, all applications allow you to calculate the amount of the fee for different tax periods, starting from 2013.

How to pay tax if I haven’t received a receipt?

The receipt contains not only the payer’s details, the amount of calculated tax, but also the details where it should be transferred. If the citizen has not received it by mail, then there are only two ways to receive it:

- Print from your personal account on the official website of the Federal Tax Service or pay online here, but this requires:

- registration on State Services with identification confirmation;

- or registration with the Federal Tax Service, but to receive the password you will need to be present in person at the tax office.

- Contact any tax office in person with your passport and TIN.

Only if there are complete details where the tax should be transferred, a citizen will be able to correctly direct the amount to a specific code. It is better not to make mistakes here.

TRANSPORT SAFETY

Identification of the operation in the ERIP is carried out by checking the series and number of the registration certificate (technical passport) entered into the AIS "Raschet" with the series and number of the registration certificate (technical passport) of the vehicle presented when applying for a permit to admit the vehicle to participation in road traffic for coincidence. Any discrepancy in letters, numbers, or their sequence is grounds for refusal to confirm payment.

instead of the registration plate of the vehicle on the payment page, only the series and number of the registration certificate (technical passport) of the vehicle and the amount of state duty determined in accordance with tax legislation should be entered;

We recommend reading: Is there a website where you can look up housing and communal services debts, telephone hotline

Payment deadline

For transport tax, the legislation sets the deadline for payment - December 1 of the year following the year of ownership of the property. Distribution of receipts begins in advance, approximately 3 months before the due date. If the document has not been received by October 1, you should worry about receiving it and go to the tax authority.

It is not prohibited to divide the tax amount into parts and make payments on different dates. But here it should be taken into account that the last payment must be made before December 1, otherwise penalties will be charged on the balance.

Is it possible to pay transport tax in installments?

It is not prohibited to divide the tax amount into parts and make payments on different dates and in different amounts. However, it should be borne in mind that the last payment must be made before December 1, otherwise penalties will be charged on the balance.

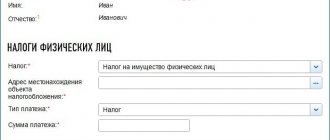

Transferring a payment to the budget through the Federal Tax Service website

The official website of the tax office offers two payment methods :

- using the service “Payment of tax for individuals.” persons";

- in your Personal Account.

In the first case, on the nalog.ru website you need to go to the specified section and select the category of fees . In the window that appears, fill in the document details. The payment amount is taken from the receipt ; if it is missing, you can calculate it yourself. It is important to calculate the tax correctly. If the amount paid is less than the actual amount , penalties will be charged . If the transfer amount is more than necessary, the excess funds will remain in the account and can be used when making the next payment.

At the end of the procedure, a payment method is selected. When paying in cash, the service will prepare a payment document with which you can contact any bank. Non-cash methods include: payment by bank card, Kiwi wallet.

It is very convenient to pay transport tax through the taxpayer’s personal account. There is nothing complicated about this procedure. To do this, the taxpayer must have a personal account, which means registering on the website. If such a page has not yet been created , you must contact your local tax office to obtain a login and password.

In your personal account, select the “objects of taxation” section - a car. Then you need to go to the “Accrued” tab, and if the tax has already arrived, pay the accruals. This can also be done by bank transfer or cash payment.

Cons of apps

Despite the fast operation and clear interface, the programs have several common disadvantages that minimize their useful properties. In particular, when testing applications, the same data was entered into their fields. That is, it was planned to find out what tax would be imposed on a car registered in the Moscow region, with a capacity of 80 horsepower and produced in 1998. The results were the same for only two of the presented programs. For example, the application “Transport Tax” calculated the tax rate in the amount of 800 rubles, “Transport Tax 1” - 560 rubles, “Transport Tax of the Russian Federation” - 960 rubles, “Auto.Tax” - 560 rubles. Users of these programs also note inaccuracies in the calculations, since their results differ significantly from the amount of tax calculated by the Tax Service. And the “Transport Tax 1” application does not take into account the age of the car when calculating. Another disadvantage of two of the four programs under study is the inability to calculate transport tax for the Republic of Crimea and the city of Sevastopol. This option is not available in the “Auto.Tax” and “Transport Tax of the Russian Federation” applications. Thus, you should not completely rely on the calculations of the programs under study.

“Transport tax of the Russian Federation” - 4 points, the rest - 2

The considered applications for calculating transport tax cannot receive the highest marks because they do not cope with their main function, that is, they do not provide reliable data. Therefore, each program receives two 2 out of 10 points for its convenient interface and fast operation. And the application “Transport Tax of the Russian Federation” deserved 4 points, since it contains background information and a function for calculating tax by month. To improve the programs reviewed, developers can be recommended to correct existing errors and bring applications into compliance with the current Tax Code of the Russian Federation.

Legal documents

- tax code