Transport tax rate in St. Petersburg

The transport tax rate is determined by regional authorities at their discretion, and can change the rate at any time. The rate depends on the amount of horsepower in the car. There are 5 bets. The first is for cars up to 75 horsepower, it is equal to 0 (a nice moment), the second is for cars from 75 to 100 horsepower, the third is from 100 to 150, the fourth is for vehicles from 150 to 200, the fifth is from 200 to 250 horses and the last one is for cars over 250 horsepower. Data on base rates in the city of St. Petersburg (St. Petersburg) are presented in the table below.

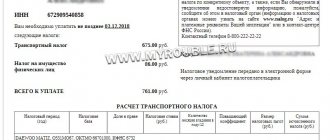

| Auto power range | Transport tax rate in rubles for 2021 | Transport tax rate in rubles for 2022 |

| up to 75 hp | 0 | 0 |

| from 75 to 100 hp | 24 | 24 |

| from 100 to 150 hp | 35 | 35 |

| from 150 to 200 hp | 50 | 50 |

| from 200 to 250 hp | 75 | 75 |

| over 250 hp | 150 | 150 |

Transport tax rates in St. Petersburg for 2021 and 2021

(Law of St. Petersburg dated November 4, 2002 No. 487-53 (as amended on November 12, 2012, dated November 13, 2014 No. 583-106, dated December 25, 2015 No. 887-178, dated June 21, 2016 No. 388-66, dated November 27, 2017 No. 706-122, dated November 29, 2019 No. 606-131)

as of 01/01/2021

Article 2 of the Law of St. Petersburg for 2021, 2021, 2021 and 2021 establishes the following transport tax rates (these rates apply from 01/01/2018):

| Name of taxable object | Tax rate (in rubles) |

| Passenger cars with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 24 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 35 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 50 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 75 |

| over 250 hp (over 183.9 kW) | 150 |

| Motorcycles and scooters with engine power (per horsepower): | |

| up to 20 hp (up to 14.7 kW) inclusive | 10 |

| over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive | 20 |

| over 35 hp up to 90 hp (over 25.74 kW to 66.20 kW) inclusive | 30 |

| over 90 hp (over 66.20 kW) | 50 |

| Buses with engine power (per horsepower): | |

| up to 200 hp (up to 147.1 kW) inclusive | 50 |

| over 200 hp (over 147.1 kW) | 65 |

| Trucks with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 25 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 40 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 50 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 55 |

| over 250 hp (over 183.9 kW): | |

| from the year of manufacture of which up to 3 years have passed inclusive | 45 |

| from the year of manufacture of which 3 to 5 years have passed inclusive | 65 |

| more than 5 years have passed since the year of manufacture | 85 |

| Other self-propelled vehicles, machines and mechanisms on pneumatic and caterpillar tracks (per horsepower): | 25 |

| Snowmobiles, motor sleighs with engine power (per horsepower): | |

| up to 50 hp (up to 36.77 kW) inclusive | 25 |

| over 50 hp (over 36.77 kW) | 50 |

| Boats, motor boats and other water vehicles with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 50 |

| over 100 hp (over 73.55 kW) | 100 200 |

| Yachts and other sailing-motor vessels with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 100 |

| over 100 hp (over 73.55 kW) | 200 400 |

| Jet skis with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 125 250 |

| over 100 hp (over 73.55 kW) | 250 500 |

| Non-self-propelled (towed) ships for which the gross tonnage is determined (for each registered ton or gross tonnage unit if the gross tonnage is determined without specifying the dimension) | 100 200 |

| Airplanes, helicopters and other aircraft with engines (per horsepower) | 125 250 |

| Airplanes with jet engines (per kilogram of thrust) | 100 200 |

| Other water and air vehicles without engines (per vehicle unit) | 1 000 |

The article was written and posted on October 7, 2021. Added - 01/04/2018, 09/17/2018, 01/13/2019, 12/11/2019, 12/29/2020

ATTENTION!

Copying the article without providing a direct link is prohibited. Changes to the article are possible only with the permission of the author.

Author: lawyer and tax consultant Alexander Shmelev © 2001 — 2021

Transport tax benefits for pensioners in St. Petersburg

In accordance with the legislation of the Russian Federation, some categories of citizens have the right to a 100% reduction in the payment of transport tax for one car, but at the moment the legislation does not say anything about pensioners, so there are no benefits for them. However, very often pensioners fall under the category of citizens to whom benefits apply. Such as Disabled people of groups 1 and 2, WWII participants, parents of large families, victims of the Chernobyl disaster, etc. All these persons are entitled to a full discount on the amount of transport tax. However, to obtain it, you must provide the relevant documents to the tax authorities.

Transport tax benefits in St. Petersburg

Tax benefits for transport tax to certain categories of taxpayers are provided in accordance with the Law of St. Petersburg dated June 28, 1995 N 81-11 “On Tax Benefits”.

The following categories of citizens registered at their place of residence in St. Petersburg are exempt from paying tax:

- Heroes of the Soviet Union, Heroes of the Russian Federation, Heroes of Socialist Labor, full holders of the Order of Glory, full holders of the Order of Labor Glory - for one vehicle registered to citizens of one of the specified categories, provided that this vehicle has an engine power of up to 200 hp. With. inclusive;

- Veterans of the Great Patriotic War, veterans of military operations on the territory of the USSR, on the territory of the Russian Federation and the territories of other states, disabled people of the Great Patriotic War, disabled combatants, disabled people of groups I and II, citizens from among the disabled with disabilities of ability to work II and III degrees recognized as disabled before January 1, 2010 without specifying the period for re-examination (the right to exemption from paying tax is retained without additional re-examination), citizens from among disabled people with disabilities of II and III degrees, recognized as disabled before January 1, 2010 with the determination of the period for re-examination (the right to tax exemption is retained until the date of the next re-examination), citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant, citizens who, as part of special risk units, took direct part in testing nuclear and thermonuclear weapons, liquidation of nuclear accidents installations on weapons and military facilities, citizens of the Russian Federation who were exposed to radiation as a result of nuclear tests at the Semipalatinsk test site, parents (guardians, trustees) of disabled children - for one vehicle registered for citizens of one of the specified categories, provided that this the vehicle has an engine power of up to 150 horsepower inclusive or more than 15 years have passed since the year of its manufacture;

- citizens in relation to one registered passenger car of domestic production (USSR) with an engine power of up to 80 horsepower inclusive and with a year of manufacture up to and including 1990, as well as in relation to one motorcycle or scooter of domestic production (USSR) registered on them with a year of manufacture up to 1990 inclusive;

- old-age pensioners or citizens who have reached the age of 60 and 55 years (for men and women, respectively) - for one vehicle registered to a citizen of the specified category, provided that the specified vehicle is a domestic-made passenger car (Russian Federation, USSR before 1991 year) with an engine power of up to 150 horsepower inclusive, a boat, motor boat or other water vehicle (except for yachts and other sail-motor vessels, jet skis) with an engine power of up to 30 horsepower inclusive. You can read about the benefits of pensioners for paying transport tax by following the link;

- spouses of military personnel, private and commanding personnel of internal affairs bodies, the State Fire Service and state security bodies who died in the performance of military service (official duties), who did not remarry - for one vehicle registered to a citizen of the specified category, with provided that the specified vehicle is a domestic passenger car (Russian Federation, USSR until 1991) with an engine power of up to 150 horsepower inclusive, a boat, motor boat or other water vehicle (except for yachts and other sailing-motor vessels, jet skis ) with engine power up to 30 horsepower inclusive;

- three or more children in the family - for one vehicle registered to a citizen of the specified category, provided that this vehicle has an engine power of up to 150 horsepower inclusive. Thus, large families have a tax benefit only for low-power cars. You can read about all the benefits for families with many children by following the link.

Additional benefits for the period from 01/01/2016 to January 1, 2020

- Organizations and individual entrepreneurs are exempt from paying transport tax in relation to vehicles using natural gas as a motor fuel. A mandatory condition for providing a tax benefit for individual entrepreneurs is that the average monthly salary of all employees exceeds three times the minimum wage in St. Petersburg, valid during the specified tax period.

- Organizations whose place of state registration is St. Petersburg and individuals registered at the place of residence (stay) in St. Petersburg are exempt from paying transport tax in relation to new (not previously used) passenger cars manufactured on the territory of the Russian Federation in 2021, provided that the specified vehicles were purchased under a purchase and sale (supply) agreement from organizations registered with tax authorities in St. Petersburg at the location or at the location of their separate divisions, and registered during the period from April 1 to December 31, 2021. The benefit is provided to organizations and individuals for a period of three tax periods in a row, starting from the date of registration of the vehicle in accordance with the procedure established by the legislation of the Russian Federation.

- Organizations and individuals are exempt from paying transport tax in relation to vehicles (except for water and air vehicles) equipped only with an electric motor (electric motors) with a capacity of up to 150 horsepower inclusive.

In order to receive benefits, it is necessary to provide the tax authority at the location of the taxable vehicle (vehicle) with documents confirming their right to the benefit.

Question answer

The “Question-Answer” section publishes information on the most interesting legal life situations. You can contact the editor in the comments to this article.

| Who is entitled to free medicines for coronavirus? |

| Does a traffic police inspector have the right to stop a car to check documents? |

| What is the liability for tax evasion? |

| What to do if you haven't received a tax notice |

| Stopping a vehicle by a traffic police inspector |

| The procedure for checking documents by a traffic police inspector when stopping a car |

| The procedure for sending a driver for a medical examination |

| In what cases does a traffic police inspector have the right to inspect a car? |

| Rules for moving parcels from abroad |

| How to correctly draw up a receipt for borrowing money |

| A civil servant rents out an apartment |

| Can a civil servant buy shares on the stock exchange? |

| Providing government officials with information about online accounts |

Prepared by Personal Rights.ru

Other benefits

1. Benefits for WWII veterans

The benefit is 100% of the transport tax and applies to passenger cars with a capacity of up to 200 horsepower.

2. Former minor prisoners of places of forced detention

The benefit is 100% of the transport tax and applies to passenger cars with a capacity of up to 200 horsepower.

3. Veterans and disabled combatants

The benefit is 100% of the transport tax and applies to passenger cars with a capacity of up to 200 horsepower.

4. Heroes of Russia or the Soviet Union, citizens awarded the Order of Glory of three degrees

The benefit is 100% of the transport tax and applies to passenger cars with a capacity of up to 200 horsepower.

5. Disabled people of the first and second groups

The benefit is 100% of the transport tax and applies to passenger cars with a capacity of up to 200 horsepower.

6. Persons whose vehicle power is less than 70 horsepower

The benefit is 100% of the transport tax and applies to passenger cars with a capacity of up to 70 horsepower.

7. One of the guardians of a disabled person since childhood, recognized by the court as incompetent

The benefit is 100% of the transport tax and applies to passenger cars with a capacity of up to 200 horsepower.

8. Victims of the disaster at the Chernobyl nuclear power plant

The benefit is 100% of the transport tax and applies to passenger cars with a capacity of up to 200 horsepower.

9. Individuals who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology

The benefit is 100% of the transport tax and applies to passenger cars with a capacity of up to 200 horsepower.

Other organizations

Uglich

Calculation of the amount of transport tax in the locality - Uglich. Calculation for any type of vehicle with any power. Luxury tax calculation.

Rostov

Calculation of the amount of transport tax in the locality - Rostov. Calculation for any type of vehicle with any power. Luxury tax calculation.

Pereslavl-Zalessky

Calculation of the amount of transport tax in the locality - Pereslavl-Zalessky. Calculation for any type of vehicle with any power. Luxury tax calculation.

Gavrilov-Yam

Calculation of the amount of transport tax in the locality - Gavrilov-Yam. Calculation for any type of vehicle with any power. Luxury tax calculation.

Rybinsk

Calculation of the amount of transport tax in the locality - Rybinsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Yaroslavl

Calculation of the amount of transport tax in the locality - Yaroslavl. Calculation for any type of vehicle with any power. Luxury tax calculation.

Salekhard

Calculation of the amount of transport tax in the locality - Salekhard. Calculation for any type of vehicle with any power. Luxury tax calculation.

Noyabrsk

Calculation of the amount of transport tax in the locality - Noyabrsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

New Urengoy

Calculation of the amount of transport tax in the locality - Novy Urengoy. Calculation for any type of vehicle with any power. Luxury tax calculation.

Shumerlya

Calculation of the amount of transport tax in the locality - Shumerlya. Calculation for any type of vehicle with any power. Luxury tax calculation.

Mariinsky Posad

Calculation of the amount of transport tax in the locality - Mariinsky Posad. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kanash

Calculation of the amount of transport tax in the locality - Kanash. Calculation for any type of vehicle with any power. Luxury tax calculation.

Alatyr

Calculation of the amount of transport tax in the locality - Alatyr. Calculation for any type of vehicle with any power. Luxury tax calculation.

Cheboksary

Calculation of the amount of transport tax in the locality - Cheboksary. Calculation for any type of vehicle with any power. Luxury tax calculation.

Shawls

Calculation of the amount of transport tax in the locality - Shali. Calculation for any type of vehicle with any power. Luxury tax calculation.

Urus-Martan

Calculation of the amount of transport tax in the locality - Urus-Martan. Calculation for any type of vehicle with any power. Luxury tax calculation.

Gudermes

Calculation of the amount of transport tax in the locality - Gudermes. Calculation for any type of vehicle with any power. Luxury tax calculation.

Argun

Calculation of the amount of transport tax in the locality - Argun. Calculation for any type of vehicle with any power. Luxury tax calculation.

Grozny

Calculation of the amount of transport tax in the locality - Grozny. Calculation for any type of vehicle with any power. Luxury tax calculation.

Yuryuzan

Calculation of the amount of transport tax in the locality - Yuryuzan. Calculation for any type of vehicle with any power. Luxury tax calculation.

Yuzhnouralsk

Calculation of the amount of transport tax in the locality - Yuzhnouralsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Chebarkul

Calculation of the amount of transport tax in the locality - Chebarkul. Calculation for any type of vehicle with any power. Luxury tax calculation.

Ust-Katav

Calculation of the amount of transport tax in the locality - Ust-Katav. Calculation for any type of vehicle with any power. Luxury tax calculation.

Satka

Calculation of the amount of transport tax in the locality - Satka. Calculation for any type of vehicle with any power. Luxury tax calculation.

Plast

Calculation of the amount of transport tax in a populated area - Plast. Calculation for any type of vehicle with any power. Luxury tax calculation.

Nyazepetrovsk

Calculation of the amount of transport tax in the locality - Nyazepetrovsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kyshtym

Calculation of the amount of transport tax in the locality - Kyshtym. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kusa

Calculation of the amount of transport tax in the locality - Kusa. Calculation for any type of vehicle with any power. Luxury tax calculation.

Katav-Ivanovsk

Calculation of the amount of transport tax in the locality - Katav-Ivanovsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kartaly

Calculation of the amount of transport tax in the locality - Kartaly. Calculation for any type of vehicle with any power. Luxury tax calculation.

Karabash

Calculation of the amount of transport tax in the locality - Karabash. Calculation for any type of vehicle with any power. Luxury tax calculation.

Yemanzhelinsk

Calculation of the amount of transport tax in the locality - Yemanzhelinsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Verkhniy Ufaley

Calculation of the amount of transport tax in the locality - Verkhniy Ufaley. Calculation for any type of vehicle with any power. Luxury tax calculation.

Asha

Calculation of the amount of transport tax in the locality - Asha. Calculation for any type of vehicle with any power. Luxury tax calculation.

Troitsk

Calculation of the amount of transport tax in the locality - Troitsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Miass

Calculation of the amount of transport tax in the locality - Miass. Calculation for any type of vehicle with any power. Luxury tax calculation.

Magnitogorsk

Calculation of the amount of transport tax in the locality - Magnitogorsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Korkino

Calculation of the amount of transport tax in the locality - Korkino. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kopeisk

Calculation of the amount of transport tax in the locality - Kopeysk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Zlatoust

Calculation of the amount of transport tax in the locality - Zlatoust. Calculation for any type of vehicle with any power. Luxury tax calculation.

Chelyabinsk

Calculation of the amount of transport tax in the locality - Chelyabinsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Yugorsk

Calculation of the amount of transport tax in the locality - Yugorsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Urai

Calculation of the amount of transport tax in the locality - Urai. Calculation for any type of vehicle with any power. Luxury tax calculation.

Surgut

Calculation of the amount of transport tax in the locality - Surgut. Calculation for any type of vehicle with any power. Luxury tax calculation.

Pyt-Yakh

Calculation of the amount of transport tax in the locality - Pyt-Yakh. Calculation for any type of vehicle with any power. Luxury tax calculation.

Nyagan

Calculation of the amount of transport tax in the locality - Nyagan. Calculation for any type of vehicle with any power. Luxury tax calculation.

Nizhnevartovsk

Calculation of the amount of transport tax in the locality - Nizhnevartovsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Soviet

Calculation of the amount of transport tax in a populated area - Sovetsky. Calculation for any type of vehicle with any power. Luxury tax calculation.

Khanty-Mansiysk

Calculation of the amount of transport tax in the locality - Khanty-Mansiysk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Chernogorsk

Calculation of the amount of transport tax in the locality - Chernogorsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Sayanogorsk

Calculation of the amount of transport tax in the locality - Sayanogorsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Abaza

Calculation of the amount of transport tax in the locality - Abaza. Calculation for any type of vehicle with any power. Luxury tax calculation.

Abakan

Calculation of the amount of transport tax in the locality - Abakan. Calculation for any type of vehicle with any power. Luxury tax calculation.

Sovetskaya Gavan

Calculation of the amount of transport tax in the locality - Sovetskaya Gavan. Calculation for any type of vehicle with any power. Luxury tax calculation.

Vyazemsky

Calculation of the amount of transport tax in the locality - Vyazemsky. Calculation for any type of vehicle with any power. Luxury tax calculation.

Bikin

Calculation of the amount of transport tax in the locality - Bikin. Calculation for any type of vehicle with any power. Luxury tax calculation.

Komsomolsk-on-Amur

Calculation of the amount of transport tax in the locality - Komsomolsk-on-Amur. Calculation for any type of vehicle with any power. Luxury tax calculation.

Khabarovsk

Calculation of the amount of transport tax in the locality - Khabarovsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Sengilei

Calculation of the amount of transport tax in the locality - Sengilei. Calculation for any type of vehicle with any power. Luxury tax calculation.

Inza

Calculation of the amount of transport tax in a locality - Inza. Calculation for any type of vehicle with any power. Luxury tax calculation.

Barysh

Calculation of the amount of transport tax in a locality - Barysh. Calculation for any type of vehicle with any power. Luxury tax calculation.

Dimitrovgrad

Calculation of the amount of transport tax in the locality - Dimitrovgrad. Calculation for any type of vehicle with any power. Luxury tax calculation.

Ulyanovsk

Calculation of the amount of transport tax in the locality - Ulyanovsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Sarapul

Calculation of the amount of transport tax in the locality - Sarapul. Calculation for any type of vehicle with any power. Luxury tax calculation.

Glazov

Calculation of the amount of transport tax in the locality - Glazov. Calculation for any type of vehicle with any power. Luxury tax calculation.

Mozhga

Calculation of the amount of transport tax in the locality - Mozhga. Calculation for any type of vehicle with any power. Luxury tax calculation.

Votkinsk

Calculation of the amount of transport tax in the locality - Votkinsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Izhevsk

Calculation of the amount of transport tax in the locality - Izhevsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Yalutorovsk

Calculation of the amount of transport tax in the locality - Yalutorovsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Zavodoukovsk

Calculation of the amount of transport tax in the locality - Zavodoukovsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Tobolsk

Calculation of the amount of transport tax in the locality - Tobolsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Ishim

Calculation of the amount of transport tax in the locality - Ishim. Calculation for any type of vehicle with any power. Luxury tax calculation.

Tyumen

Calculation of the amount of transport tax in the locality - Tyumen. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kyzyl

Calculation of the amount of transport tax in the locality - Kyzyl. Calculation for any type of vehicle with any power. Luxury tax calculation.

Yasnogorsk

Calculation of the amount of transport tax in the locality - Yasnogorsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Shchekino

Calculation of the amount of transport tax in the locality - Shchekino. Calculation for any type of vehicle with any power. Luxury tax calculation.

Nodal

Calculation of the amount of transport tax in the locality - Uzlovaya. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kireevsk

Calculation of the amount of transport tax in the locality - Kireevsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Efremov

Calculation of the amount of transport tax in a populated area - Efremov. Calculation for any type of vehicle with any power. Luxury tax calculation.

Bogoroditsk

Calculation of the amount of transport tax in the locality - Bogoroditsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Belev

Calculation of the amount of transport tax in a locality - Belev. Calculation for any type of vehicle with any power. Luxury tax calculation.

Aleksin

Calculation of the amount of transport tax in a locality - Aleksin. Calculation for any type of vehicle with any power. Luxury tax calculation.

Novomoskovsk

Calculation of the amount of transport tax in the locality - Novomoskovsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Tula

Calculation of the amount of transport tax in the locality - Tula. Calculation for any type of vehicle with any power. Luxury tax calculation.

Strezhevoy

Calculation of the amount of transport tax in the locality - Strezhevoy. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kolpashevo

Calculation of the amount of transport tax in the locality - Kolpashevo. Calculation for any type of vehicle with any power. Luxury tax calculation.

Asino

Calculation of the amount of transport tax in the locality - Asino. Calculation for any type of vehicle with any power. Luxury tax calculation.

Tomsk

Calculation of the amount of transport tax in the locality - Tomsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Toropets

Calculation of the amount of transport tax in the locality - Toropets. Calculation for any type of vehicle with any power. Luxury tax calculation.

Torzhok

Calculation of the amount of transport tax in the locality - Torzhok. Calculation for any type of vehicle with any power. Luxury tax calculation.

Ostashkov

Calculation of the amount of transport tax in the locality - Ostashkov. Calculation for any type of vehicle with any power. Luxury tax calculation.

Nelidovo

Calculation of the amount of transport tax in the locality - Nelidovo. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kuvshinovo

Calculation of the amount of transport tax in the locality - Kuvshinovo. Calculation for any type of vehicle with any power. Luxury tax calculation.

Konakovo

Calculation of the amount of transport tax in the locality - Konakovo. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kimry

Calculation of the amount of transport tax in the locality - Kimry. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kashin

Calculation of the amount of transport tax in the locality - Kashin. Calculation for any type of vehicle with any power. Luxury tax calculation.

Western Dvina

Calculation of the amount of transport tax in the locality - Western Dvina. Calculation for any type of vehicle with any power. Luxury tax calculation.

Vesyegonsk

Calculation of the amount of transport tax in the locality - Vesyegonsk. Calculation for any type of vehicle with any power. Luxury tax calculation.

Bezhetsk

Calculation of the amount of transport tax in the locality - Bezhetsk. Calculation for any type of vehicle with any power. Luxury tax calculation.