What is the problem with obtaining an MTPL policy for nonresidents?

This is how our world works that we do not always live where we are registered at the place of residence according to the Russian Federation passport, which means that the car, in accordance with the vehicle registration certificate according to the owner of the car, is registered at the place of registration of the owner. Considering that, as citizens of the Russian Federation, vehicle owners have the right to free movement throughout Russia, no one violates the law. And owners of cars and other vehicles pay taxes to the federal budget on time before December 1 of the current year for the previous year (regardless of the location of the car owner, payment of taxes is accepted everywhere). All this functions until the owner is faced with the issue of issuing an MTPL policy not at the place of registration, but at the place of residence.

Is it possible to get a policy in another city?

Every car owner can freely take out an MTPL insurance policy anywhere throughout the Russian Federation - this is enshrined at the legislative level in Federal Law No. 40 “On compulsory motor third-party liability insurance of vehicle owners” dated April 25, 2002. The insurance company does not have the right to refuse to obtain a policy to a motorist if he does not have registration in a given region.

The need to purchase an MTPL policy in another region occurs for various reasons, namely:

- the policyholder does not have a residence permit, since he recently moved to permanent residence (the peculiarities of applying for a policy with a temporary residence permit are written here);

- purchasing a vehicle in a region other than your place of residence (for example, while on a long business trip);

- purchase of a car by a non-resident for the purpose of driving it to their place of permanent residence.

Note! Operating a vehicle without an MTPL policy is prohibited by law (in accordance with Federal Law No. 40 “On MTPL” and clause 2.1.1 of Article 2 of the Traffic Regulations of the Russian Federation). Therefore, the presence of a car owner in another region is not a valid reason for the lack of insurance.

Why is issuing an MTPL policy for non-residents a difficult task?

The problem of issuing an MTPL policy for non-residents is especially acute in the city of Moscow. What is this connected with? It seems that it should be quite the opposite: all the central offices of insurance companies are concentrated in the capital of our vast Motherland and supply, according to the law of the market, should far exceed demand. However, when applying for an MTPL policy for non-residents, the situation is not in favor of citizens living in the city of Moscow, who own a vehicle, but do not have permanent registration in the capital. What is this connected with? Exactly with the cost of the MTPL policy for non-resident citizens.

The cost of compulsory motor liability insurance consists of several components, the meaning of which is for each car owner and for all drivers allowed to drive the vehicle individually. However, the calculation involves the so-called territorial coefficient, which significantly distinguishes the cost of an MTPL policy for residents of federal cities, such as Moscow, from the cost of a MTPL policy for nonresidents, i.e. citizens who, according to their passport, are registered at their place of residence in settlements of the Russian Federation with little traffic flow.

This territorial coefficient at the federal level is included in the calculation for all insurance companies for fairness, as such. The point is that for cities where there are a lot of cars and the likelihood of an accident is higher, the compulsory motor liability insurance policy costs more, and for settlements where the population density is low, the cost of the compulsory motor liability insurance policy for car owners is correspondingly less. In life for insurance companies, vehicle owners registered at their place of residence in sparsely populated areas have become out-of-town clients with a low cost of OSAGO policy, which is no longer profitable. And the likelihood of them getting into an accident and traffic accident in Moscow is quite high, like all drivers driving a vehicle in the capital.

Thus, drivers and vehicle owners living in the city of Moscow, but having registration at their place of residence in other localities, became unprofitable for insurance companies. According to the law on compulsory motor liability insurance, insurance companies cannot refuse to issue a compulsory motor liability insurance policy when applying for its registration, therefore, in practice, branches have been allocated that are engaged in issuing compulsory motor liability insurance policies for non-residents. However, the number of MTPL policies for nonresidents arriving at these branches of insurance companies does not correspond to the number of nonresident citizens who want to take out a MTPL policy in Moscow.

Step-by-step instructions for applying for compulsory motor liability insurance in another region

The procedure for obtaining compulsory motor third party liability insurance in another region is similar throughout the country. There is no need to study any additional instructions for obtaining compulsory motor liability insurance. When contacting an insurance company other than your place of permanent registration, you should not be required to provide any additional documents or certificates other than those specified in the official list of MTPL rules.

Insurers are prohibited from violating the requirements of the list of motor vehicle rules and refusing to issue a policy to a driver for unjustifiable reasons.

Today, a vehicle owner can take out a compulsory motor liability insurance policy in another region in two ways:

- Purchasing a policy via the Internet;

- Personal visit followed by conclusion of a contract.

Purchasing a policy online is becoming increasingly popular due to its convenience and speed of registration. The owner only needs to do the following:

- Select an insurance company from the RGS list;

- Enter your personal passport information;

- Fill in information about your vehicle (year of manufacture, number of hp, make, model);

- Pay for the service using a bank card or any other available method;

- Print the policy on a printer.

The policy that you print out has the same legal force as the original document.

You can also obtain proof of insurance by visiting the insurance company in person. It is enough to have with you the necessary documents from the list of rules for compulsory motor liability insurance. You will receive a valid policy on the same day.

When purchasing a policy, remember that imposing additional services by the insurer is illegal!

Insurance for a car in another region of the Russian Federation can be obtained by both the owner of the vehicle and any citizen who is allowed to drive a vehicle.

Based on the above, it should be noted that when purchasing compulsory motor liability insurance in another region, the presence of the owner of this car in the insurance company is not necessary.

How to buy an MTPL policy for non-residents

Our company issues compulsory motor liability insurance policies for non-resident citizens for vehicles of all categories. Obtaining an MTPL policy for non-residents is simplified and built on the most favorable terms for the client with minimal loss of time. The client either comes to our company’s office himself, or, at the client’s request, the company’s specialists calculate and issue an MTPL policy for non-residents online. The company operates a courier service, ready to deliver or pick up documents at any time and place convenient for the client. Please note that the calculation of the MTPL policy for nonresidents is carried out according to the territorial coefficient of the owner of the vehicle (registration address at the place of residence indicated in the passport), taking into account all the discounts provided by law for accident-free experience available in the all-Russian database of RSA (Russian Union of Auto Insurers).

Problems with registration of compulsory motor liability insurance for regions.

In Moscow, it is problematic for the region to obtain an MTPL policy. Having called a dozen insurance companies, you will most likely receive refusal after refusal. The fact is that insurance companies do not like to sell policies to regions in Moscow, since it is not profitable for them, since the regional territorial coefficient is much lower than the Moscow one. So even if you contact a large insurance company with branches throughout the country, most likely they will agree to sell you insurance only along with an additional product, for example, life or property insurance. Then, at a minimum, it will become unprofitable for you, because the additional payment will be 4000-5000 rubles. There is a great risk that you will be forced to buy insurance according to the Moscow coefficient, then the cost of the policy will increase to 10,000 rubles, and you can immediately forget about the discount for accident-free driving. Another problem in obtaining insurance for the region in Moscow can be a long processing of the application, about 20-30 days. Or there may simply be no application forms for the regions.

List of required documents

Fig. 1 Documents for registration of compulsory motor liability insurance for non-residents

To apply for compulsory motor liability insurance for nonresidents, you will need the following package of documents:

- owner's passport (page spread with photo and registration);

- registration certificate (CTC) or vehicle passport (PTS);

- the rights of all drivers who will be allowed to drive a vehicle (if compulsory motor insurance for non-residents is without restrictions, then a driver’s license is not needed);

- a valid diagnostic card or technical inspection (if it is not available, it is possible to obtain one from our reliable partner - an accredited technical inspection operator).

Delivery

As we already mentioned above, when issuing an MTPL policy for both non-residents and Muscovites, our company provides the service of delivering the policy to any point not only in the capital, but throughout Russia. If you need the policy urgently, we will send it to you by express delivery and you will receive it as soon as possible.

So, if you have a problem with obtaining compulsory motor insurance for nonresidents in Moscow, our company will help solve this problem! Just call or leave a request! We will solve all your difficulties! (in the area of compulsory motor insurance for sure!).

Calculation of the cost of compulsory motor liability insurance for regions

How is the cost of compulsory motor liability insurance calculated?

At the moment, 10 coefficients are involved in calculating the cost of compulsory motor insurance.

The cost of the policy is calculated using the following formula: Policy amount = TB * CT * KBM * KVS * KO * KS * KP * KM * KPR * KN

, Where

TB

— The basic tariff is set by the insurance company in the corridor determined by the Central Bank.

CT

— Territory coefficient depends on the place of registration of the car owner.

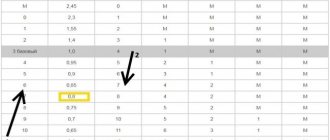

KBM

— Maximum KBM of vehicle drivers allowed to drive (depends on accident-free experience).

PIC

— The age-experience coefficient depends on the age and experience of drivers allowed to drive a car.

KO

— Factor limiting the number of drivers.

KS

— Seasonality coefficient (not yet used = 1).

KP

— The period coefficient depends on the number of months for which the policy is issued.

KM

— Power factor depends on the amount of horsepower.

KPR

— The trailer coefficient depends on the use of the vehicle with a trailer.

KN

— The rate of violations, or whether the driver had gross violations of insurance conditions.

Got it, close

Basic rates of insurance companies

| Insurance Company | Basic rate - individual | Base rate - legal entity |

| Alfa insurance | 4736 | 2058 |

| VSK | 4400 | 2573 |

| Zetta | 4118 | 2058 |

| Ingosstrakh | 4700 | 2058 |

| Renaissance | 3500 | 2058 |

| RESO | 4942 | 2058 |

| Rosgosstrakh | 4350 | 2058 |

| Agreement | 4400 | 2830 |

| Tinkoff | 4390 | 2911 |

Got it, close

Registration of E-OSAGO for agents

If you want to work with us in the field of issuing EOSAGO policies, then welcome to our platform.

Leave a request to register as an agent. And we will assign you a commission for issuing each UISAGO policy. If you have any questions, you can ask them by phone numbers listed on the website. REGISTRATION ON THE PLATFORM

Got it, close