How to check an electronic OSAGO policy

All MTPL policies go directly to the RAMI database, and you receive the policy itself by mail. If you doubt its authenticity, you need to check the electronic MTPL policy through a special form on this page.

When checking your electronic policy, pay attention to the region of use, the number of drivers and vehicle parameters.

It is these parameters that are most often changed to affect the cost of third party insurance, but in this case the third party's policy becomes invalid!

In what cases is a compulsory motor liability insurance check necessary?

You need to check your MTPL policy details in any case. Situations are different. You can check the availability of the number in the database, the correspondence of the number to your car, and check who is included in the insurance through the official RSA website.

To check your insurance, visit the official website. Study the memo for car owners https://www.autoins.ru/osago/svedeniya-dlya-strakhovateley-i-poterpevshikh/v-pomoshch-strakhovatelyu/pamyatka-dlya-avtovladeltsev/

Use this direct link to check the data by series and policy number. https://dkbm-web.autoins.ru/dkbm-web-1.0/bsostate.htm

Just fill out the form and get accurate information about your insurance, car insurance company, and persons allowed to drive a car.

How is the RSA service useful?

The official service works around the clock, without failures, the databases are updated continuously. You have access to the latest information and easily receive the entire history - who is registered, who is the owner, the region of registration of the car, you can view the history, insurance payments, and clarify the details of insurers.

More on the topic: How I bought an MTPL policy online

Note. The update speed of the official RSA databases is 5 days. Don't be nervous if you don't find your number in the database after 3-4 days. Please allow 5 full business days.

How to check the authenticity of OSAGO by VIN and state license. number

Autocode" offers the opportunity to check your civil liability policy in the RAMI database. Our service allows you:

- Find out your insurance number and policy series;

- check until the policy becomes valid;

- find out which insurance company issued the OS;

- Find out the cost of liability and taxes.

To verify your insurance, you must provide your vehicle's VIN or license plate number. The information is presented in accordance with the RAMI database.

A fake MTPL policy does not belong to the insurance company or is listed as lost. Obviously, such a policy will not be considered valid. The Autocode service will detect a problematic situation and list the fraudulent insurer. This information will be useful not only for potential car buyers, but also for insurance agents.

Currently, you can check your third party insurance by entering your vehicle number (oc or vehicle number) in the box at the top of the page.

False forms

Counterfeit policies are sold by numerous “fixers” pretending to be reputable companies. Allegedly, they can issue documents without registration or in another region and at a better price. Quite often, scammers’ offers look convincing and logical, appealing to the driver’s benefit. For example, why overpay for an expensive Moscow policy if you can get exactly the same one, but just in a different region and for less money? The fact that the policy is fake is revealed after the fact.

Use unified computer databases online and be sure to check your insurance.

Reasons for the appearance of invalid policies

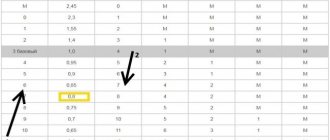

The cost of insurance is relatively high. This creates a desire to save money among the driver. For example, when the insurance bonus-malus coefficient increases as a result of two or more insurance payments per year, the cost of official insurance doubles. With a penalty factor, the price may be even higher. Many companies offer insurance cheaper or without taking into account penalty factors. Allegedly, they “burn out” when moving to another company. Actually no, all insurance policies are included in a single database. If the policy data is not in the database, the policy is invalid.

Differences and similarities between a real MTPL policy and a fake MTPL policy

A fake policy may look exactly the same as a real one. Modern printing makes it possible to print high-quality fakes. But there are some differences:

- This letterhead is a couple of millimeters longer than the usual office A4 format.

- Inside the paper there are inclusions of red fibers.

- The number is slightly convex; the form is protected on the back with a metal tape.

These signs are also easy to fake; real protection is provided only by checking against official databases.

Fake electronic policies

The most common fake policies do not even have a printed version. These are policies issued online through companies that do not have a real insurance license or through fraudulent websites that duplicate data from real insurance companies.

More on the topic: Cancellation of the KBM: what to do, how to restore it?

Theoretically, the online version is enough to present directly from the smartphone screen. But the rules clearly indicate the mandatory availability of insurance documents in hard copies. This creates some ambiguity.

Digital insurance owners get out of this situation by simply printing documents on a regular printer. If the e-MTPL was completed correctly, this is enough. But if you fall for the scam, expect fines for moving without compulsory motor insurance. In recent years, smart cameras have appeared on the roads that recognize car license plates, check them with a computer database and issue fines to the vehicle owner.

To find out if you have such fines, go to the State Services website, enter your data and go to the section for car owners. There are cases when it is through fines that the owner learns that insurance for the car was not issued.

It is also a good idea to check information on fines and taxes for car owners after selling the car. If the new owner does not register on time, fines will be sent to your name - formally the car belongs to you. In such cases, you can deregister the car or even scrap it.

Checking MTPL by VIN code

You can find out if your car is insured by the VIN number or body number. Using the VIN number, you can conduct a full check of the car's liability insurance, find out the name of the insurance company, type of policy and other data. To do this you need:

- On the official RAMI website, select the “Check insurance” section.

- Select check by VIN code.

- Enter the required information.

- Click "Check".

The system will automatically generate a detailed report for this vehicle and display it on a separate service page.

Thus, you can quickly and easily obtain information about the availability and validity period of an MTPL policy from a driver who has been involved in an accident or has filed an accident: information about auto insurance is not confidential and can be obtained on the RAMI portal. To do this, it is enough to know either the state number of the car or its VIN.

The information provided is free and allows you to quickly resolve any doubts that you may have when filing a claim for compensation for damages from an accident against the insurance company of the person at fault.

Checking MTPL by car VIN number

Car data may be needed not only when purchasing, but also after a traffic accident. Our website will tell you how to check the availability of an MTPL insurance policy by VIN code, as well as:

- find the OSAGO number using the vehicle registration number;

- the insurer who provided services to the car owner;

- view information about compulsory motor liability insurance, namely, the availability of insurance and terms.

The VIN is a unique vehicle identification number . Using the VIN code you can obtain the necessary information about the vehicle. It has a total of 17 characters that determine the country of manufacture, production period, characteristics, series, etc. Independent replacement of parts contained in the VIN code is prohibited. To perform any manipulations, you will need prior permission from the traffic police. Therefore, you should check the STS, PTS information and the original VIN code of the car.

Using car data, a citizen can quickly check the place of insurance, find out the number and type of policy (with or without restrictions). If you check the OSAGO by VIN number, the information will be more detailed and faster. For example, to obtain information on a state number, the insurance company needs to transfer this data, which is not always possible. To obtain complete information on a car on the website, an additional fee is charged.

The free report will provide the following data:

- car brand;

- year of issue;

- type with motor power;

- category;

- steering wheel location.

A paid service will allow you not only to find out the MTPL policy number by VIN code, but also to obtain the following information: summary data, information on PTS, registration actions, ownership periods, participation in an accident, repair work, mileage, VIN check symbol, traffic police restrictions, theft , taxi history, leasing, disposal, pledges, compulsory motor liability insurance, fines, technical inspection, customs.

If new drivers or other changes to the contents of the policy have only recently been added to the OSAGO policy, you need to take into account that to update the PCA database, the insurer needs 5 days according to the standards. Therefore, after 3 days, for example, a citizen may not see new data about the MTPL policy in the AIS RSA database.

How to determine the OSAGO contract number using the license plate number, body number or VIN?

Difficulties often arise in road accidents when the parties involved in the accident do not have information about each other’s liability insurance. How can you find the data you need? Our service will help you quickly find third party insurance contract details using the VIN number or registration number. Check if the driver is listed on the insurance policy according to the car number!

Our service will be useful for you:

- third party insurance policy number using the vehicle registration number;

- place of insurance of the car involved in the accident (insurance company);

- Availability of third party insurance for this vehicle.

It's simple: you enter the vehicle registration number (or VIN) into the form and indicate the date you want to search. You enter the number in the format A000AA777 (the last digits are the digital region code). Thus, you will accurately determine the place where the vehicle is insured, the details of the third party policy and the list of drivers allowed to drive under the contract.

Why do you need to know your MTPL insurance policy details?

The insurance policy data is a guarantee of insurance and is indicated in the documents that must be filled out when registering a traffic accident. It is very advisable to photograph the opponent’s documents and policy in order to be able to contact the insurance company. Many companies require copies of all documents of both parties involved in the accident. Documents must be submitted within the prescribed period. Do not hesitate to immediately photograph the protocol and policy.

In the absence of real insurance or expired documents, the insurance company will recover damages directly from the culprit through the court. Therefore, it is important to know your passport details, car number, insurance number. You have a convenient opportunity to check the authenticity of car documents.

More on the topic: The person at fault for the accident does not have insurance, how to recover damages 2020

Advantages of the Autocode service

Autocode provides a number of benefits to those who want to enter their third party insurance policy details before purchasing a car:

- Ability to check the insurance policy by VIN number or registration number;

- Toll-free, 24/7 customer support number;

- The functionality of the service is available without registration;

- obtaining the necessary information about the policy number, place of insurance online;

- fast data delivery within 5 minutes;

- the ability to check information about the policy yourself, without the help of an insurance agent;

- opportunity to find out the complete history of the car.

The Atvokod service checks an insurance policy only through a reliable source - the RSA (Russian Union of Auto Insurers) database. The service receives other information about the vehicle only from official sources: traffic police, EAISTO, taxi registries, Federal Tax Service, Federal Customs Service, Federal Customs Service, etc.

Check the authenticity of your OC now!