Any car owner in Russia knows that according to insurance law, he must buy an MTPL policy. Since the adoption of the law on compulsory motor insurance, various amendments have been made several times.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Previously, in order to pass a technical inspection, you had to already have insurance. Now, to apply for a policy, you need to have a technical inspection document or diagnostic card with you, which must be valid at the time of signing the insurance contract.

Minimum periods for which compulsory motor liability insurance can be issued

In accordance with the law, the minimum period for compulsory motor liability insurance is three months . The car owner has access to insurance with the condition of limited use of the car. That is, the policy is issued for a year, but the driver uses the car during clearly specified time periods.

1 month

There is an exception that allows you to conclude a policy for a period of 20 days. This option is called transit, and it is available only to the following categories of drivers:

- Those who have to drive a car to the place of its final registration without documentation. This situation is possible if the car was purchased, received as a gift or inheritance in another region.

- For those who go by car for a technical inspection, in particular, a repeat one.

IMPORTANT! These cases are stipulated in the MTPL Law. In other cases, obtaining insurance for such a short period of time is not available to drivers.

The price of a transit policy is determined by the category of the car, region, engine power, as well as the age and experience of the drivers.

The policy can be issued to any person, regardless of whether he or she owns the car. It is issued for a year, although in fact the duration of the insurance is only 20 days.

You cannot drive a car without compulsory motor liability insurance - this could result in a fine or the car being placed in a penalty area. Both transit and regular policies are valid exclusively in Russia. If a driver is driving a car from abroad, he additionally needs a “Green Card” - an insurance policy that is valid in other countries.

3 months

Since 2008, drivers have had access to insurance called seasonal insurance. It involves limited use of the car. A seasonal policy is essentially the same as a standard one, but its validity period is indicated in the upper right part. The documents needed to purchase it are the same, but the price is different.

The cost of MTPL for 3 months will be 50% of the annual insurance. Purchasing such insurance is justified if the driver uses the car only at a specific time of the year.

What else to read:

- My car was scratched in the yard, what should I do?

- Europrotocol 2021

- How to get money instead of repairs under compulsory motor liability insurance: a detailed review

6 months

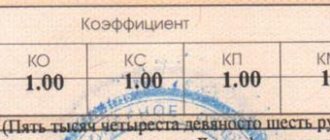

Registration of compulsory motor liability insurance for six months is also an option for seasonal insurance. The amount of the insurance premium is determined using a coefficient of 0.7. Thus, to find out how much such a policy will cost, you need to multiply the annual price of a car insurance policy by 0.7. The monthly rate in this case will be more expensive than when purchasing annual insurance.

However, the overall price you'll pay for insurance will be lower, so if you plan to use your car outside of the year, you may want to consider this option.

Insurance for six months is mainly chosen by legal entities - large enterprises working with special equipment. There is not always a need to use it throughout the year, so the law allows you to issue policies for them as needed.

Validity of the contract and insurance policy period (VIDEO)

How to buy an MTPL policy for a minimum period?

To purchase an MTPL policy with delivery in Moscow, the client needs to provide us with information using any of the options:

| Call us and our operator will help you place your order +7-499-110-38-43 |

| +7-985-991-20-24 |

Our actions:

- We calculate the cost of the policy;

- We agree on the details with the customer and issue a policy;

- we transfer the document to the delivery department.

We guarantee delivery of the policy within two hours or the next day after it is issued. The client signs the contract and two receipts presented by the courier with payment on the spot. We provide a signed copy of the MTPL policy and application to the insurance company.

Who can take out a policy for a short period

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 (495) 980-97-90(ext.589) Moscow,

Moscow region

+8 (812) 449-45-96(ext.928) St. Petersburg,

Leningrad region

+8 (800) 700-99-56 (ext. 590) Regions

(free call for all regions of Russia)

Any car owner can take out an MTPL policy for a period of 3 months or more. This insurance feature is usually used by the following categories of drivers:

- Car owners planning to sell a vehicle.

- Citizens who often travel abroad or are on business trips.

- Car owners engaged in seasonal gardening and other drivers who use the car only for a certain period of time.

A three-month policy is available only to individuals. Legal entities must enter into an insurance contract for a period of at least 6 months.

A transit policy is issued only in certain cases: when driving a car without documents and in a situation where the driver is sent for a technical inspection.

Choose an MTPL policy online

Use the convenient OSAGO selection form. There is no need to go anywhere! Everything can be done from a computer or your smartphone.

Super offers, great prices!

What documents are needed

The procedure for drawing up an agreement for a shorter period is not particularly different from the usual one. The only difference is the deadline and tariff. To purchase a policy, you need to present the following documents to the insurance company:

- identification document;

- digital code that needs to be obtained from the State Tax Inspectorate;

- driver's license (one or more drivers depending on the type of policy);

- title document for the car;

- application for a policy in accordance with the established form.

In the application, the client himself must indicate during what period he plans to use the car. The policyholder does not control this point - the owner himself must monitor the deadlines, since responsibility for non-compliance will also be with him. This is an important point, since inattention can cost the driver dearly - even a couple of overdue hours plays a role in the calculations.

For legal entities, the package of documents will be slightly different. It is supplemented by the following documents:

- power of attorney giving the opportunity to represent the interests of the company (requires a notary office);

- a document confirming the state registration of a legal entity;

- vehicle diagnostic card.

You will also need an original seal to certify the documentation.

You can apply for insurance either by visiting the insurance company office in person or via the Internet.

Can I apply again and when?

July 1, 2015 is the day when electronic and paper insurance contracts were introduced. You can take care of receiving it ahead of time, avoiding queues and last-minute cancellations due to office closures. It is easier to issue an electronic policy than a paper one.

Drivers often take out a new OSAGO policy in advance. By doing this, they do not violate any laws and regulations in force in Russia. They did not set a deadline for when you need to contact the insurance company for new car insurance. Clause 1.12 only says that the driver must apply for a new one as soon as the old one runs out. In accordance with Articles 426 and 445 of the Civil Code of the Russian Federation, the legislator established a 30-day period for agreeing on the conditions and the same number of days for resolving disputes over the conditions. In other words, sixty days before the end of the old policy, you can contact the policyholder for a new one, until the moment the insurance ends. At the beginning of February 2015, this period was revised downward, giving the driver a month to renew and resolve disputes under the insurance contract.

The regulatory documents nowhere regulated the deadline for issuing compulsory motor insurance for the new insurance year.

Policyholders recommend applying for it 30 days before the end. Sometimes they do it earlier due to certain life circumstances. Even if you issue it in advance, the new one will be valid from the date the old one expires.

Pros and cons of MTPL for 1, 3 and 6 months

When deciding to take out a policy for a minimum period, the car owner focuses on his needs and life circumstances. If you are planning a long trip or selling a car in the near future, this is an ideal option that will allow you to save money. This is also the best choice for individuals and legal entities who do not use a vehicle throughout the year - there is no point in overpaying for the time when the car is not used for its intended purpose.

You can pay attention to such a function as extending the insurance policy. It will resolve the issue with minimal losses and save your budget.

If we talk about the disadvantages of taking out such insurance, then this is its cost. Compared to an annual policy, it costs more if you count it on a monthly basis. But the total cost will still be less. Another point is the need to control the validity of the insurance, and this responsibility rests with the car owner. Missing deadlines can seriously hit your wallet.

Responsibility

In accordance with current legislation, driving a vehicle without issued auto insurance is prohibited. When driving a car during a period not covered by the MTPL policy, a fine of 300 rubles will be charged. For many car owners, this is a ridiculous amount, so they prefer not to renew the contract with insurers. Considering this fact, a bill has been submitted to the State Duma for consideration, according to which the amount of the fine for driving during a period not covered by the policy will be 5,400 rubles.

Thus, the minimum period of validity of compulsory motor liability insurance for individuals is 3 months, for legal entities – six months. There are also special conditions for obtaining car insurance. Reducing the policy period allows millions of drivers to save their own financial resources.

To what extent is the minimum insurance not profitable in comparison with standard MTPL?

If the driver has reasons for purchasing minimum insurance, for example, he uses the car only in the summer, spring or at other times of the year, this decision can really help him save, because the total cost of the policy will be less than when purchasing an annual compulsory motor liability insurance.

But if we compare the minimum insurance with the standard one, taking into account the fact that the owner needs the policy throughout the year, then it is better to immediately buy a policy for a year. Short-term insurance is significantly more expensive. Special coefficients are used to calculate costs. When purchasing a policy for 3 months, its cost will be 50% of the full price of the policy, for six months - 70%. And purchasing compulsory motor liability insurance for 10 and 11 months will cost the same as standard insurance. Thus, minimum insurance is more expensive and only makes sense in certain cases. If we are not talking about them, it is better to stay with the standard version.

Thus, the law allows you to issue compulsory motor liability insurance for a shorter period than standard insurance provides. But this doesn’t always make sense. Often drivers, wanting to save money, on the contrary, overpay a significant amount. Therefore, it is better to first evaluate which option is more appropriate. It is also important to remember that monitoring the validity of the policy is the responsibility of the driver.

When insurance for a period of less than 3 months may be required

You can apply for compulsory motor liability insurance for a period of less than 3 months. This is possible in two cases.

- For cars registered in other states, primary insurance in the territory of the country of temporary stay is issued for 5-15 days, subsequently the period is extended every 3 months.

- If the car is new, has transit plates and is being driven to a further location for registration, then you can take out insurance for a period of 20 days.

Video about OSAGO

Hidden facts about OSAGO.

Catalog of insurance companies in Russia

By following the link , you can familiarize yourself with the catalog of insurance companies in the Russian Federation offering compulsory motor vehicle insurance services. Description of organizations, current financial indicators, ratings, reviews and other information. If you have already had a positive or negative experience with compulsory motor liability insurance of any insurance company, leave your feedback. Thank you!

Link again. Also, be sure to write your comment below. What do you think about the topic of this material? Or maybe you have questions? Ask!