What is an assignment agreement

Not everyone knows what a cess is and how to use it. In short, this is a document by which the insured person agrees to give up his rights to receive payments under the insurance contract. All details of this kind of “power of attorney” are regulated by Art. 382 of the Civil Code of the Russian Federation. This agreement provides compensation solely for damage caused to the vehicle. No compensation is paid for personal injury.

In what cases is it needed in case of an accident?

The assignment of rights agreement has its advantages. First of all, it is much easier than arguing with an insurer, going to court and proving your case there. There are situations in which, after an accident, the best option would be to draw up an assignment agreement:

- A car enthusiast urgently needs money to restore his car and does not have time to argue with the insurer.

- There is a risk of litigation, and the insured person has no desire to participate in litigation and claims.

- The insurer is declared bankrupt or has lost its license and is therefore unable to fulfill its obligations.

Advice! Thus, the car enthusiast can save a significant amount of time and money. If the third party is a conscientious organization, and not a fraudulent structure, then the car after an accident will be repaired much faster and without nervous breakdowns.

Termination of an assignment agreement: procedure, consequences

According to clause 1.1.1 of the agreement (set out in the additional agreement), the amount of the right of claim transferred by the Assignor to the Assignee for funds not paid in full, arising from the obligation to compensate for damage, is 52,908 (fifty two thousand nine hundred eight) rubles 07 kopecks.

An estimate “by eye” is incorrect and cannot reflect all the damage received, which will also lead to a reduction in the amount of compensation.

- You should be extremely careful with companies offering to pay 100% insurance compensation. An organization that enters into a cession agreement with the policyholder receives remuneration precisely from the difference between the amount paid and the accrued insurance benefit.

- Before signing, you must carefully read all the clauses of the agreement being concluded. The assignment agreement provides for the right to demand full insurance payment from the insurance company, compensation for legal costs in the event of litigation and the right to collect penalties.

The procedure for satisfying compensation upon the occurrence of a risk may be different for MTPL and CASCO insurance. The fact is that federal regulations regulate the work of an insurance company in compulsory car insurance and set specific deadlines that cannot be violated, i.e.

the insurer may suffer significant financial losses in the form of fines from regulatory authorities. In the case of voluntary insurance, the terms and regulations for working with the client are fixed by the conditions reflected in the CASCO agreement, therefore, fraud with payments or partial compensation for damage occurs precisely in this part of the insurance business.

The initiator of termination is, accordingly, the party whose rights were violated;

- Based on a court decision, if there is a significant change in circumstances.

The sign of materiality is expressed:

- In the absence of an objective possibility of foreseeing them;

- When the party that did not fulfill, or improperly fulfilled, the terms of the contract tried to overcome such circumstances, but could not;

- The damage caused must be great, namely, excluding the possibility of receiving what the participant in the transaction was intended to receive;

- The contract should not contain a clause that records information about the risk of changes in circumstances being borne by this party.

In this case, you can count on the support of the judicial authority if all four criteria are met and there is no agreement regarding changes to the terms of the agreement.

The accident occurred during the insurance period, so the owner of the Volkswagen Sharan, whose property was damaged, applied to Rosgosstrakh LLC for insurance compensation. The defendant recognized the damage sustained by the Volkswagen Sharan in an accident as an insured event and made an insurance payment, which was insufficient to restore the car.

According to the conclusion of the forensic examination carried out in this case, the cost of restoration of the Volkswagen Sharan car, taking into account its wear and tear, is 81,803.61 rubles. On January 12, 2012, the victims submitted a notice to Rosgosstrakh LLC about the refusal of the agreement on the amount of insurance compensation paid with a request to recalculate the amount of insurance compensation in the amount of the actual cost of restoration repairs and make payment in full.

This is evidenced by the modern Russian practice of arbitration proceedings. Find out how to get the maximum payment under compulsory motor liability insurance from the insurance company. If you need to get an expert’s opinion, read more about conducting auto examinations and independent assessments HERE.

How to choose a reliable company for assigning the right to receive payment Many of us, when an insured event occurs, i.e. traffic accident, believe that they can receive full compensation for the damage caused without outside help.

When drawing up an agreement to terminate the assignment agreement, it is necessary to provide for:

- the issue of settlements (refund of money or reimbursement of payment for the right made in another way);

- the moment of termination of the contract (fundamentally important for a contract under which several rights of claim were transferred over a period of time, since part of the contractual obligations can be properly performed and cannot be terminated);

- the obligation to warn the debtor that the right of claim still belongs to the original creditor (if he was notified of the transfer of the right);

- issues of compensation for losses of one of the parties.

Termination of a contract in court, as mentioned above, is possible only if there are special grounds. Whereas to terminate the contract of assignment of the right of claim by agreement of the parties, their expression of will is sufficient.

At present, the practice of applying clause 1 of Resolution No. 54 has not yet developed, and therefore it is difficult to draw conclusions about which rules on the termination of certain types of contracts are convenient to apply to the assignment of the corresponding type. Previously, the courts refused to apply such grounds for termination, relying only on the general norms of Art. 450 (ruling of the Sverdlovsk Regional Court dated July 11, 2012 in case No. 33-7405/2012).

As a result, we can recommend:

- rely on general rules on the termination of contracts, in relation to which there has been a stable practice of applying them to assignment;

- when justifying the position with the rules on termination of the sales contract, etc., ensure that the proposed basis for termination does not contradict the legal essence of the assignment;

- provide for the grounds for termination in the contract in advance.

Debt sale options

If a problem arises with receiving payments from the insurance company, the car owner can give away the right to his debt. To do this, you should choose an organization that deals with such transactions at a professional level. There are two legal ways to receive compensation:

- Sell the debt completely. The parties to the assignment agreement can be both individuals and legal entities.

- An interest representation agreement issued for an organization. Such a power of attorney gives the company the right to protect the injured party. The name of this procedure is fictitious ransom.

Attention! At the same time, they resort to drawing up an assignment agreement more often. This is an opportunity to receive up to 30% of the compensation due to the car owner in the shortest possible time.

In what cases is

Concluding an assignment agreement under compulsory motor liability insurance is relevant in the following situations:

- The insurance company refuses to pay compensation to the insured, despite the fact that the circumstances of the accident do not correspond to the situations given in Art. 6 of the Law “On Compulsory Motor Liability Insurance”;

- to receive insurance payment, you have to go to court, which takes time (and this is a significant period of time, given the need to draw up a pre-trial claim in such situations);

- the insurer is trying to delay the fulfillment of its obligations under the contract, despite the fact that by law it is obliged to do this within 20 days from the date of submission of the request from the policyholder;

- bankruptcy or license revocation proceedings have been initiated or have already been completed in relation to the insurer's insurance company. In such a situation, the problem will have to be solved through RCA, which takes time.

When choosing a company or individual to enter into an assignment agreement, care must be taken. Increasingly, cases of deception of policyholders are being recorded in this area. You should not contact companies or people who are willing to pay more than 90% of the compensation amount. There is no need to rush into this matter and deal with it immediately after contacting the insurance company, especially before the examination is carried out. All provisions of the assignment agreement must be carefully studied.

Benefits for the car enthusiast

Subject to the basic rules

When transferring rights to insurance payments, the driver has a huge number of advantages: the car is repaired quickly and there is no need to argue with the insurance company. It is important to note that there is no need to participate in either judicial or preliminary proceedings. Often, after an accident, car owners find themselves in life situations where money is needed as quickly as possible, and the company either declares itself bankrupt or does not want to pay the promised compensation. It is also beneficial for the car owner to resell the debt if the amount of payments is significantly underestimated.

It is important to know! According to the law, such a contract can be drawn up without any consent from the insurance company. But it is necessary to notify her - in writing.

We send the car for repairs

Having received the direction, you need to transfer your car to the specified workshop or dealership (if the car is new). This is the second half of the matter, which has its own characteristics. We will talk about them further.

Deadline for contacting the service station

The referral usually indicates the number of days in which you are required to come to the service center and hand over the car for repair. Usually this is 5-21 days, but the period is not regulated in any way by law. Don't panic if you've missed this deadline. The driver can contact the insurance company to obtain a new valid referral. Insurance company employees do not have the right to refuse policy holders; this becomes a direct violation of the law when the insurer refuses to compensate for damages.

If no deadlines are specified, do not delay the matter and try to contact the service station within one week. For example, the term “reasonable period” is described in the Civil Code of the Russian Federation and is equal to 7 days. Of course, it is unacceptable to apply it to this issue.

How long does it take for repairs?

The period for restoring the car at a service station is also described similarly to the legally established period for consideration of the application. It is 30 working days. Drivers often have their car delayed due to queues, lack of spare parts or mechanics being busy. We emphasize that this should not worry you. When choosing a workshop for repairs, the insurance company must take into account all the difficulties and workload so that the workshop can cope with the task within the allotted 30 days. Your task is to make sure that the service station accepted the car for repairs, have confirmation of this and count 30 days.

If the service station requires an additional payment

A common situation is when a workshop requires additional funds from the driver due to a lack of insurance coverage or offers to supply used parts in such a situation. According to the current law under compulsory motor liability insurance, the insurance company must completely eliminate damage received as a result of an accident without any additional payments from the victim. It is very important that when using the method of sending the car for repair, the wear and tear of the vehicle is not taken into account, as is done when paying for money.

Lack of funds is purely a problem for insurance employees. You can record a video of the refusal in the workshop with justification for the reason, and then go to the insurer with this material. It is in the interests of the insurer to quickly find a new service station, and the 30-day period will not be paused.

Additional papers

Drivers can also encounter pitfalls in the workshop. This includes:

- Signing additional agreements. According to current legislation, to contact a service station you only need a referral. There is no need to sign any other documents. In most cases, they put drivers at a disadvantage.

- Additional inspection. The service station may request it to increase the insurance amount; the appraisers may well have missed any hidden damage. You can give consent if this does not increase the period of 30 days.

- Preparation of estimates. Don't sign because it's not your concern or problem. The main thing is to receive the restored car within the allotted 30 days.

Any additional documentation in a car service is a way to put you at a disadvantage. Remember that body work is guaranteed for 12 months and all other repair work is guaranteed for half a year.

What is needed to draw up a contract

First of all, you need to choose a company with which you can enter into such an agreement. The document on the assignment of rights to insurance payments requires state registration. It must also indicate that there is a transfer of rights to receive compensation for the purpose of compensation for damage. Otherwise, payments will be subject to taxation.

It is also necessary that the car owner has a valid MTPL policy in hand, and the accident itself must be documented in accordance with all rules and laws.

Documentation

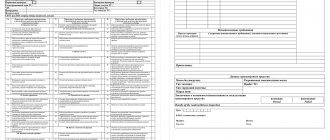

To fully conclude a contract, it is important to collect all the necessary documents. Ideally, you will need not only the original, but also copies. The package of mandatory documents for filing a recession includes the following:

- certificate of accident;

- protocol from the scene of the administrative offense;

- expertise;

- passport data of both parties to the accident;

- the license of the driver who was driving the vehicle at the time of the accident;

- vehicle registration certificate;

- valid MTPL policy.

Based on these documents, an agreement is drawn up, and the car owner receives payments under it within 2-3 days.

Buying out insurance cases for road accidents: what are the benefits?

Since 2002, on the basis of 40-FZ “On OSAGO”, a system of compulsory insurance of property obligations of those responsible for road accidents to victims has been successfully functioning in Russia. A motorist has the right to voluntarily insure damage that could potentially be caused to his vehicle due to the fault of another road user. There are two types of copyright holders for claims against the insurer:

- owner of the CASCO policy;

- victim in an accident due to the fault of the owner of the MTPL policy.

The first is a client of the insurance company, since he has entered into an insurance contract with it. Claims under the MTPL system are based on the law and “someone else’s” insurance contract. However, in both cases we are talking specifically about the right to claim. In the understanding of Art. 307 of the Civil Code, such relations are an obligation, where the copyright holder acts as a creditor and the insurance company as a debtor.

Important! A claim is an asset that can be bought, sold, gifted, inherited or pledged. “Marketability” is given to it by the insurance business - a set of documents and materials necessary to resolve the issue of receiving insurance compensation.

If the insured event is an accident, the insurance case is formed by the following package of documents.

- Notification of an accident. It is drawn up using a special form issued by representatives of the insurer at the conclusion of the transaction. According to the MTPL system, it is jointly filled out by the parties to the accident.

- An accident report drawn up by an authorized traffic police officer.

- A resolution in a case of an administrative violation or a ruling on the refusal to initiate administrative proceedings.

- State Traffic Safety Inspectorate certificate Form 12, containing information about the subjects of the insurance business, the car, and damage caused in an accident.

- Additional documents, depending on the specifics of the situation.

Insurance case materials are the basis for the insurer to make a decision on:

- payment of funds due to the recipient;

- issuing a referral for vehicle repair, if such a method of compensation for losses was previously agreed upon with the client.

Insurance must cover losses. For this, in fact, it is needed. Unfortunately, unscrupulous insurers often deny clients’ problems: they minimize compensation, delay payments, unreasonably refuse to satisfy legal claims, and ignore requests. In a problematic situation, the copyright holder has several options for behavior:

- try to defend your interests independently by looking for leverage over the insurer and filing complaints;

- hire lawyers for litigation;

- sell the right of claim to a third party.

Although both of the latter methods involve turning to professionals, they differ significantly. Hiring lawyers is a better idea than fighting the insurer's staff of trained employees on your own. But this option also has disadvantages:

- uncertainty of the final result;

- postponing the receipt of real money in hand for an indefinite period of time (claim settlement + litigation + enforcement proceedings);

- in case of loss, the invested money (lawyers' fees + state duty + cost of examination) will become uncompensated expenses.

Buying out insurance cases for road accidents as a way to resolve a dispute with the insurer does not have these disadvantages:

- the final result of the litigation with the insurer is not important, losing the case will not affect the interests of the victim in the accident;

- the amount is determined and issued or transferred to the beneficiary’s account immediately, repairs can begin immediately;

- minimum formalities - you can agree on the sale of the right of claim immediately after notifying the insurer of the insured event;

- free negotiation on the amount is possible;

- assignment is possible, including in case of refusal to pay the insurance premium or incomplete compensation for material damage.

In Russia, companies are appearing everywhere that buy out claims from motorists at various stages of litigation with the insurer. Why do they need this? This is not an idle question. To negotiate with a counterparty, you need to understand how he makes money.

Organizations that purchase insurance debts are professional participants in the insurance market. They pay the victim of an accident with their own funds, hoping in the future not only to cover expenses, but also to earn money from payments from the insurance company.

Companies that practice buying out insurance cases after an accident tell clients that their income in this business is penalties and fines collected from insurers in accordance with 40-FZ “On compulsory insurance of civil liability of vehicle owners” and Federal Law-2300-I “On the protection of consumer rights." This is partly true. Having professional lawyers on staff, the reseller can compete with the sharks of the insurance business on an equal footing. Moreover, he often manages to take advantage of the advantages that the state has endowed on ordinary people as the weaker side of insurance legal relations.

If possible, the reseller is not averse to making money at the expense of the policyholder, offering the car owner a smaller amount than the likely amount of compensation from the insurer. There are other nuances:

- the entrepreneur is not obliged to repay debts; it is impossible to force him to do so;

- defects in the legal registration of an accident may cause a refusal to conclude a transaction to buy out the right of claim (assignment) or the basis for a significant reduction in the price of this “good”;

- assignment is a civil contract that is not subject to consumer rights legislation;

- from the moment the insurer’s debt is assigned, the motorist loses any connection with the policyholder within the scope of the dispute about the accident and the insurance contract.

Important! The usual margin between the reseller's price and the insurance compensation that can be sued from the insurer is 10–30%. And this does not take into account sanctions (penalties, fines) for unlawful refusal or underestimation of payments. In case of assignment of the claim, these amounts will unconditionally go to the income of the reseller.

Based on the situation, the car owner can choose: wait for payments from the insurance company or immediately receive funds from the reseller. One way or another, the practice of concluding assignment agreements in the insurance industry is gaining momentum. A key role in this is played by the factor of time and procedural savings for the policyholder.

What to pay attention to when signing a contract

Care when reselling debt is very important. This is the only way to conclude an agreement without subsequent problems. To avoid a pitfall, you should pay attention to specific nuances:

- you should not conclude an assignment document on the first day after the accident;

- Only specialists should assess the damage;

- it is impossible to conclude a document on the assignment of rights if the organization promises to restore the damage in full;

- it is better to resort to the services of assignees after pre-trial proceedings with insurers;

- The contract should be carefully studied before signing.

This is the only way to get money for car repairs quickly and without subsequent problems.

Reduced cost of repairs when paid in cash

So we have come to the conclusion that no one was able to repair your car efficiently and on time, they failed to force the insurance company to carry out repairs, and they are paying you in money. There are two main ways to reduce your payment. The first is accounting for depreciation and it’s easy to deal with this, you just need to know that you should be paid according to the calculation according to the new rules without taking into account depreciation.

The second method of underestimating payments is based on understating the data in the RSA directories, which are used to calculate the cost of restoration work (CVR). In our previous article, we talked in detail about how RCA underestimates the cost of repairs and how difficult it is to fight it.

There is also an option with a “fake” examination, which does not take into account hidden damage and generally underestimates the damage due to expert errors, but in practice this does not happen so often, since the underestimated cost according to reference books allows you to be deceived more sophisticatedly.

How to avoid falling for scammers

Many car owners fall for the bait of deceivers who promise mountains of gold under an assignment agreement. This is why unpleasant situations arise when the car owner is left without money and with lost time. Companies cannot be trusted if they offer at least one of the following conditions:

- solve the problem in one day;

- return from 70% to 100% of damages;

- The assignee promises to pay not only damages for car repairs, but also damage to the health of victims of an accident.

If you fall for one of these tempting offers, you can easily become a victim of scammers and not receive any payments at all. Therefore, experts advise carefully reading the assignment document before signing.

Sometimes life situations force car owners to cede their rights to receive money for damage during an accident to authorized organizations. But in such cases, it is important that everything is carried out in accordance with current legislation. Otherwise, the car enthusiast can easily lose both money and time.

How to choose a reliable company for assigning the right to receive payment?

Before concluding an assignment agreement, you need to make sure that the company buying the debt can be trusted. To do this, you should focus on the following aspects:

- The mechanism of the organization. A reliable company does not conclude an assignment agreement on the first day. First, specialists study the nuances of disputes with the insurance company and conduct an independent assessment of the damage to the car. And only after that the financial terms of the transaction are presented to the client.

- The quality of the vehicle examination carried out. Almost every company offers independent expert assessment services for assessing damage to a car. This requires appropriate equipment and qualifications of the appraiser. If an organization determines the cost of damage by eye, it should not be trusted.

- The amount of compensation offered. The standard percentage that resellers keep for themselves for an assignment agreement ranges around 30. Any figure that differs significantly from this, up or down, should alert the client.

- Contents of the contract itself. Before signing, you must carefully read all the clauses of the agreement: the rights and obligations of the parties, the benefits that the assignee receives.

Automotive lawyers offer 2 types of debt repayment: under a power of attorney or under an agreement (assignment). Only the second option represents a full assignment and poses minimal risks for the driver.

Low-quality repairs “quietly”

Well, the last type of deception includes poor-quality repairs, when your car may not be completely repaired, not caring about hidden damage. Without any agreements, install low-quality, used or non-original parts, violate the technology of work, etc.

Only an independent examination of the quality of repairs can save you from this type of deception. And if you did have your car repaired under compulsory motor liability insurance, then you should not forget that a little more often than always, the amount from insurance in 2021 is not enough for a good repair and you should be wary of the quality; it is best to bring an expert with you to the service station and inspect the car before signing the work acceptance certificate.