Good day, today I will tell you why drivers with experience have a KBM of 1 or does not change, we will look into the reasons for the small KBM and try to figure out why the bonus-malus is reset to zero. We will list the standard reasons and show with examples how your bonus malus can change.

Let me remind you once again that every time you insure yourself (for a year and do not terminate the policy early), the BMR should decrease by 0.05 points or increase by 1 class. Which ultimately gives a 5% discount on the MTPL policy. The maximum discount is 50%, which corresponds to KBM 0.5 or class 13.

Why MBM can grow or reset

- The break in insurance is more than 1 year. This rule is enshrined in the law on compulsory motor liability insurance. According to Note 10 to paragraph 2 of the Bank of Russia Directive on Tariffs, to determine the class, information on compulsory insurance contracts that expired no more than one year before the start date of the insurance period under the compulsory motor liability insurance contract is taken into account.

- Road accident. For which there was an insurance payment in favor of the other driver. Those. you were the culprit. See the table for how the bonus-malus ratio will change.

- The policy was terminated early. This does not result in a reset. But in this case there is no decrease in the BMF, i.e. it remains the same at the time of receipt of the policy.

How to restore a reset bonus-malus

If a bonus-malus discrepancy is detected, the driver is required to take some action, since the value of the BMC is reduced only after proceedings with the insurance company. First, you need to identify the reasons why the indicator was reset to zero. If the error is related to the insurer’s unlawful actions, negligence, or mistake, you should contact the company’s office with a written statement.

When returning the KBM to its previous level, in 2021 it is recommended to adhere to the following algorithm:

- It is necessary to determine the moment when the deviation according to the KBM occurred. It is necessary to find out from which particular insurance year the discrepancy appeared, starting from the last MTPL policy, up to the period when the discount expired.

- You need to scan the policy for the year in which the error occurred in the application of the CBM.

- A complaint is drawn up separately, in which the policyholder describes the identified violations and demands that the bonus-malus value be restored and the overpaid money returned. As a rule, each insurance company has its own ready-made forms for writing applications of this kind.

- The application, along with printed prepared documents (previous policies, incorrect and erroneous calculations) is sent to the insurance company that issued the erroneous compulsory motor liability insurance.

- If there is no response from the insurance company within 30 days, the complaint is sent to the Central Bank of the Russian Federation and the RSA. The basis for consideration of the application will be the driver’s application with the mandatory attachment of the documents described above.

The bonus-malus coefficient is one of the few indicators that can significantly reduce the cost of compulsory motorist insurance. The further discount may depend on how correctly the calculations are made when taking out the policy. When selling a car, cautious drivers with many years of accident-free driving experience who intend to subsequently purchase a new vehicle are advised to keep their insurance current. If the next insurance period expires, it will be possible to maintain the maximum possible discount on KBM in the future.

If the reduction in the discount occurred due to the fault of the motorist who caused an accident with subsequent insurance payment, only time will allow the CBM to be corrected. Since it will take years of accident-free driving to restore the maximum discount, it is better not to violate traffic rules at all and prevent the creation of emergency situations.

Reasons why KBM may not grow that are not described in laws and regulations

- Change of rights. Currently one of the most common reasons. Read how to avoid it here.

- Several policies. In this case, “doubling” of the CBM may occur. Example: 1 policy with KBM 1, another 0.8 - yes, this happens. The policy with a value of 0.8 ends first. The value 0.75 is transferred (you receive a 5% discount) to RSA. Then policy 1 ends, and the value 0.95 is transferred to RSA. And as a result, you will have an up-to-date KBM of 0.95.

- Errors in the RSA database. This could be any typo in your full name, date of birth or driver's license details.

- Insurance agent. You can intentionally or accidentally make a mistake in your data in order to receive KBM 1, for the maximum insurance premium. The easiest thing is to make a mistake in the date of birth; it is not included in the MTPL policy, so it is almost impossible to notice.

- The insurance company did not provide any data. At the moment this is practically irrelevant. Only in rare cases of bankrupt companies or periods of up to 13 years.

How to check KBM?

To determine that the KBM has flown off, it obviously needs to be checked correctly. So, today there is a small number of services that offer such verification. We recommend using only the database of the Russian Union of Auto Insurers (RUA) - this method is the only official one today; the RSA website gives accurate results.

Instructions for checking on the RSA website

Go to the official verification page at RSA. A verification form with data will open in front of you, the fields of which, marked with an asterisk, must be filled out.

- Select whether you are checking the KBM according to the owner or the driver (the first case, if you are included in a limited policy, the second - if you are the owner in an unlimited policy).

- Enter your full name, date of birth and fill out the series and passport number.

- Next, if in the first step you chose the owner, then enter the VIN code of the car, preferably fill in the license plate number too (in the format “X000XX000”); Also, be sure to fill in the policy start date field - without this information, KBM will show you a zero discount. If a driver has been selected, then you just need to enter 4 digits of the series and 6 digits of the license number and the start day of the MTPL insurance policy period.

- Confirm the security code and click the "Search" button

As a result of these actions, you will be shown information about your current KBM, as well as about the previous policy from which information was received and the current discount was assigned.

Examples of our clients' KBM history

Example 1

The client came with new rights with the current value of 1. How the BMC changed for the old rights can be seen above. Why this happened is too late to say.

Result: KBM 1 → 0.5 - 50% discount on the policy

Example 2

Here were new rights without data on the old ones, but with a check mark in our form for requesting old rights.

Result: KBM 0.85 → 0.5 - 50% discount on the policy

Example 3

The client came with new rights and the current value of 1. It was not possible to reduce more than for the old rights, but the discount from the old rights was transferred.

Result: KBM 0.1 → 0.85 - 15% discount on the policy

Example 4 - a case of a traffic accident

Here are the new rights and a checkmark for requesting old ones. The person insured the car with a new license, without particularly understanding the CBM with a value of 1. Then he got into an accident. The increasing CBM was applied by 1 and the result was a value of 1.55, as it should be according to the table. But the fact is that the value of the old rights was not taken into account. We submitted a request to the RSA and recalculated the KBM.

Result: KBM 1.55 → 1 - saving 55% of the overpayment for the policy

(16 votes, rating: 3,81)

KBM OSAGO table

This table regulates the determination of the coefficient and is the same for all insurance companies.

It was compiled in such a way that you can easily determine from it the coefficient that the driver will receive when insuring for the next year. It is enough to know the class of the motorist and the number of accidents that occurred due to his fault.

Table. KBM OSAGO

Legal cases of resetting

If the system reports that the KBM has disappeared or the standard driving class has been returned, this means that the size of the bonus-malus coefficient has been changed or is missing altogether.

Insurance companies assure that if a nullification is detected, there may be legal grounds for this. Indeed, there are several situations in which Russian drivers may lose their discount. These include:

- The MTPL discount is valid for only one year. If the driver has not insured the car and wishes to do so only after a year, the insurance will be paid without taking into account the CBM. Also in this case, there are illegal grounds for zeroing: if your insurance company did not submit your data to a single database, then the bonus-malus coefficient for the year is lost.

- If you took out a new policy and changed limited insurance to unlimited, then, in accordance with the law, it is issued with the BMI set to 1%.

- If you take out an MTPL policy, but the owner of the car has changed during the year, there will be no increase in the discount, regardless of how many years you have been insured. To calculate the bonus-malus coefficient, a full year of insurance is required; a shorter period is not counted, therefore, after the sale, it is better to renew the insurance for another vehicle, rather than stop it completely.

Also, discount data is often lost due to incorrect information about the driver being entered into the RSA. You can double-check it at the insurance company or on the website in the OSAGO data verification section. It contains information entered into a common database. When insuring yourself, it is better to double-check all the data yourself.

One of the rarest cases of resetting the KBM is the absence of publication in the RSA database about your discount for the year. This can happen when purchasing a fictitious MTPL.

Previously, many insurance companies considered it necessary to make money from their clients, so some insurance managers hid data and did not register KBM, which actually led to the loss of this indicator at the moment.

What to do in this case and how not to lose the accumulated discount

To solve the problem, you need to write a complaint to RSA, where you need to argue that the coefficient value does not correspond to reality.

Attach copies of previous policies to the claim, as well as certificates from the insurance company about accident-free driving.

If it so happens that you made a mistake when calculating the cost of your compulsory motor liability insurance policy (indicating a coefficient higher than it should be), you do not need to throw away the policy that has ceased to be valid. Because it contains the correct coefficient for the previous year.

There is no point in negotiating with the insurance agent to apply the correct ratio, since he works by the book. You shouldn’t call on the phone and prove something, seeking justice, because... it's useless.

In this current situation, immediately contact the main office of the company. Write a complaint by sending it by registered mail, or bring it in person to the company’s office.

If you are sending your complaint by registered mail, keep the mailing receipt as proof.

If you personally bring it to the company, ask for a registration mark on the copy of the application indicating that your complaint has been accepted by the company.

You keep this copy for yourself as confirmation of your request. In the complaint, describe in detail the circumstances confirming the incorrect application of the coefficient, indicating the name of the employee, time, and policy number.

Demand that you receive a correct written calculation of the premium (you have the right to this according to the MTPL Rules. Demand that the coefficient be recalculated and the money returned.

Indicate that if the requirements you specified are not met, you will contact the relevant authorities exercising control over financial settlements, i.e. in the Federal Financial Markets Service.

If the insurance company does not provide the documents you requested for two weeks and does not return the money, write a complaint to the Federal Financial Markets Service. Compulsory insurance is not a luxury, it is the responsibility of every driver.

You can find out what you need to do to terminate a compulsory motor liability insurance agreement in the article: termination of a compulsory motor liability insurance contract. The procedure for concluding a compulsory motor liability insurance contract is discussed in this article.

You can find detailed information about the terms of payments under compulsory motor liability insurance in case of an accident here.

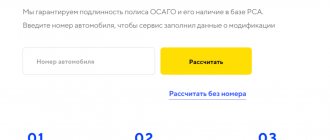

How to quickly restore KBM online

To restore KBM using a computer, you will need to use a special KBM Recovery Service. To restore the KBM in this way, you will only need to know your data, which you will fill out online - you do not need to attach any documents. The application is sent for processing immediately after payment. The result is usually sent by email the next day. And if, as a result of restoration, the KBM does not decrease, then the money paid will be returned to you automatically.