Why do you need a waybill?

The main function of the waybill is to confirm the legality of driving a vehicle when carrying out commercial activities. A car is not only a means of transportation, but also a means of earning money. Therefore, organizations maintain accounting in order to reduce taxation. On the other hand, road safety is ensured by the traffic police services. For example, in Moscow, control over the operation of TAXI is partially entrusted to MADI. The waybill contains important information:

- about the transport company or individual entrepreneur - car owner: full name of the entrepreneur or name of the car company, contact details, address, OGRN (note: there is no need to put an organization stamp).

- on the validity period of the p/l (see new Order of the Ministry of Transport No. 368).

- about the driver: presence of a stamp (record) confirming the completion of the pre-trip medical examination, including the date and time of its conduct.

- on the technical condition of the car: the inspector’s mark in accordance with the requirements of Russian legislation for the qualifications of an auto mechanic.

- about the route, mileage, fuel consumption, etc.

Entrepreneurs or drivers whose work does not require a report to the Federal Tax Service are required to draw up a letter. Since no one relieved them of responsibility for road safety. For violation of the requirements for mandatory details or lack of a voucher, an administrative penalty is imposed in the form of a fine under several articles of the Code of Administrative Offenses of the Russian Federation. Therefore, it is many times higher than the minimum amount - 500 rubles.

Please note: According to the new Order of the Ministry of Transport No. 368 (11/09-20), the requirements for issuing a waybill have been changed.

Control over the driver’s work schedule, rest and travel voucher validity periods is being tightened. You can be fined for not having a license document if your time behind the wheel exceeds 8-12 hours—the period for which the document is issued.

Remember

- A waybill allows the driver to drive a company car, and the company to take into account expenses and reduce taxes.

- Anyone who professionally transports passengers, luggage and cargo is required to have it with them.

- The sheet is filled out in free form, the main thing is to indicate the mandatory information about the company, car, driver and flight.

- The fine for the lack of a waybill for the driver is 500 rubles.

- Companies are fined if the driver does not pass a medical examination and the car does not undergo technical control. The fine for an official is 5,000, for a company or individual entrepreneur - 30,000 rubles.

- The easiest way to check and pay fines is at the Traffic Police Fines.

All articles by the author: Ilya Novikov

What will you be fined for if you don’t have a waybill?

Based on the above, it is clear that the content of the letter includes information, without confirmation of which penalties are imposed on the organization, individual entrepreneur, officials, and citizens. Therefore, in the event of an inspection by the road inspectorate, a violation of several indirect articles of the Code of Administrative Offenses of the Russian Federation is assumed for the absence of:

- Vouchers or if you have an expired document, the validity of which is limited to an 8-hour working day and a rest of up to 4 hours.

- Pre-trip medical examination of an employee driving a vehicle. In addition to him, officials and the organization itself bear responsibility.

- Technical control of the vehicle before departure. Punishment for the offense is imposed, among other things, on the transport company.

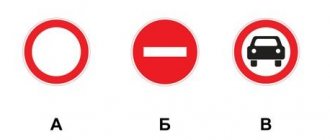

- The legal right to use vehicles when carrying out TAXI activities. In this case, the car may be taken to the impound lot.

In addition, if it is determined that the company does not conduct a pre-trip medical or technical inspection at all, the amount of the fine may be increased taking into account the number of drivers. In the absence of mandatory details in the waybill, the Federal Tax Service will refuse to write off income taxes, declaring the primary reporting document void.

Who needs it

It is legally approved that a waybill is mandatory in certain cases:

- When people are transported.

- When the activity is related to the transportation of goods or any cargo.

- When driving public vehicles.

The question often arises about the need for a DP; the employee is not listed as a driver, does not transport goods or passengers, but uses a company car to travel on work matters. Is there any liability for this, are there any penalties? This issue is extremely controversial, but judicial practice shows that a PL is not needed in this situation, i.e. a fine for driving without a waybill in such cases is unlawful. But inspectors often think differently, so sometimes they have to prove their case in court.

What form of waybill form can be used?

The law does not prohibit the forms approved by State Statistics Committee No. 78, developed in 1997. But they do not contain all the necessary fields that must be filled out in accordance with Order No. 368 of the Ministry of Transport (valid from 2021 to 2027) or Article 9 of Law No. 402-FZ “On Accounting” (06/12-11). ).

Therefore, it is recommended, based on them, to approve your own form in the company’s accounting policy. Add the missing details and accounting parameters related to the activities of the enterprise. You can use the unified form if, at a minimum, you reflect the data required by law so that in their absence, the document will not be invalidated.

How long can a waybill be kept?

It is legally required to store vouchers for at least 5 years. Organizations can increase the retention period for such documentation, but not reduce it. This is primary documentation, therefore the time of its storage is regulated by the tax authorities and the bill on accounting.

If there is no permit, then the person driving the vehicle and the enterprise face an impressive fine, the amount of which varies depending on the article charged by the traffic inspector when registering the violation. Since fines can be quite significant, it is recommended to ensure in advance that you have a voucher with a medical examination stamp and other necessary instructions.

Video on the topic:

For which drivers is a waybill required?

Within the framework of the automobile “Charter ...”, No. 256-FZ Art. 6; Clause 2 states that driving a vehicle without a license is prohibited for employees who:

- They are engaged in transporting cargo (goods, things) or persons who are passengers (note: this includes everyone except the driver).

- They manage public passenger cars and electric transport.

The Ministry of Transport (Order No. 368 1 p. Chapter II) is expressed more briefly: the letter is filled out for any vehicle that is operated by a legal entity or individual entrepreneur.

Who checks the waybill and when?

This paper is a mandatory document that can be repeatedly checked by the relevant authorities. His absence threatens to be held accountable under the second part of Article 12.3, that is, to a material penalty in the amount of 500 rubles. However, in some cases, the checking traffic inspector may only issue a warning.

In addition to representatives of the traffic police, the form may well be subject to verification by the following authorities:

- in case of suspicion of violation of labor legislation of the Russian Federation - the labor inspectorate;

- if it is necessary to carry out accounting and various types of monitoring of activities: checking the correctness of calculations of fuel consumption and all possible taxes - the Federal Tax Service;

- The State Road Safety Inspectorate checks the waybill for the following purposes: monitoring the general safety of the road situation;

- assessment of the technical condition and serviceability of the vehicle;

- approval of the correctness of the constructed route;

- checking whether the driver has a license;

- assessment of the safety of transportation of goods and passengers.

Taxi drivers also need to fill out a voucher. In this case, the position of the taxi driver (whether he is an individual entrepreneur or an ordinary taxi service employee) does not matter. Drivers of route vehicles have the right to create their own samples of submarines (subject to compliance with federal standards). It is worth pointing out that experts recommend that taxi drivers fill out a waybill every day.

This requirement is recorded in the official order of the Ministry of Transport of the Russian Federation under number 152, adopted on September 18, 2008. The order states the obligation to prepare the paper in question for all cars owned by the company. It does not matter for what purposes the car is used: for transporting goods, transporting passengers, etc.

Failure to comply with the paper in question is a punishable offence. In order to suppress this kind of disregard for laws, material measures of influence are used. It is also worth noting that in the absence of a waybill, authorities do not have the right to evacuate taxi drivers’ cars.

Lack of waybill for TAXI

Taxi drivers have the hardest time. They are almost always required to have a completed application form. If you drive your own taxi, it is more difficult to prove that the purpose of the trip is personal needs. Especially in the capital, where control can be carried out by traffic police officers together with MADI. In the absence of a waybill, there is a risk of losing your car, which may be sent to an impound lot. To prevent this from happening, follow a number of conditions:

- Remove any TAXI identification signs: remove the orange light from the roof, turn off the green signal - “free”.

- Move only in the general flow, and not in a dedicated lane.

- Do not board/disembark passengers. If video cameras record this, you won’t prove anything later.

- Do not take orders from aggregators or taxi fleet managers.

- When traffic police officers draw up a report, check under what articles the administrative offense was filed. If you do not agree with the decision, reflect this in the document next to your signature.

By observing these conditions, even if the car is seized, you will prove in court the illegality of the charges brought against you by canceling the fine. This applies only to those drivers who are car owners. In all other cases, taxi drivers are required to have a completed voucher. For them, personal trips without a written registration form do not exist.

Who is required to issue waybills?

According to the law, waybills for employee drivers are issued by companies and individual entrepreneurs that:

- transport passengers and luggage, for example, taxis;

- transport goods, for example, deliver documents;

- engaged in scheduled transportation on minibuses, buses, trams, and trolleybuses.

If employees drive a company car on their own business, a waybill is not required. The company's gasoline expenses are considered their personal income. On a personal car, a waybill is also not needed.

Validity period of the waybill according to the new rules

Since March 2021, the rules on the validity period of the travel permit have changed. The Ministry of Transport in the new Order No. 368 regulates that the document is drawn up:

- for the entire duration of the trip, if the flight exceeds (r/d) shift;

- on a working day when 1 or more trips are made during a shift;

Of course, the permit is issued before leaving the permanent parking space. For comparison: previously the maximum period for which a P/L could be issued was 1 month. No matter how long the business trip lasted. If it took more than (4 weeks), 2 sheets were required. Now one is enough.

The second difference is that, as was before, you cannot get a permit for a month if working on a car fits into a regular shift schedule. A separate waybill is required for each shift. We do not recommend presenting the so-called “foot wraps”, with a bunch of daily marks from a doctor and a mechanic, to traffic police inspectors. They can be fined as if they were missing a letter.

Under what circumstances is a waybill needed?

They have the right to fine a driver for not having a waybill when this document is required according to the rules. Basically, waybills are used in organizations for reporting - where this or that driver went, how many times, at what time, how much fuel he spent on it. Also, according to waybills, they calculate and calculate salaries for drivers of enterprises and write off (keep records of consumption) fuel and consumables for cars.

The waybill is issued to drivers engaged in commercial transportation. This includes both drivers working in organizations (they transport goods for a salary) and private owners carrying out commercial activities. In this context, commercial transport for which a waybill is required includes :

- Passenger transportation (rotation transport, minibuses, etc.).

- Transportation of goods.

- Urban passenger transportation on trams and trolleybuses.

In both the first option and the second, the procedure for issuing a waybill is the same for both trucks and cars.

The waybill has its own form, fixed by a separate law. But, starting from 2015 (according to N78 PG of the Russian Federation), organizations using this document can make their own adjustments to it, adapting it to their own needs. When making changes, it should be taken into account that the waybill is a document of strict accountability, and in order for it to retain legal significance, it must meet the criteria specified in the Law “On Accounting”. In addition, the waybill must contain information about the owner of the vehicle to which it was issued.

Below we provide a sample waybill intended for informational purposes only. It can certainly be used as a template when developing this document for the needs of an enterprise or private owner. You can slightly change the order and location of some blocks, but the general content of the waybill should remain unchanged.

When filling out the waybill, you should also be careful, and the driver, before leaving for the trip, must check its contents himself - so that everything meets the requirements and goals of the current trip. After all, a fine is imposed not only for driving without a waybill, but also for incorrectly issuing it.

Fine for driving without a waybill in 2021

The administrative penalty for the driver not having a waybill remains the same and is quite mild. A representative of the road inspection may impose a fine of 500 rubles or issue a Warning. We recommend that before you sign the protocol on the offense, you look at what article you are being held accountable for. If this is Art. 12.3 of the Code of Administrative Offences, which means you will not pay more than this amount.

Note: Administrative punishment in the form of a Warning is issued in writing. They can replace a fine with it only if the offense is committed for the first time (Article 4.3 of the Administrative Code).

Car owners - legal entities or individual entrepreneurs can be charged under Article 12.31.1. Code of Administrative Offenses of the Russian Federation. For example, for a car company whose drivers drive without permits, that is, they come to the attention of the traffic police, and in Moscow - to the development of MADI, the fines will be significant. It is the responsibility of the vehicle owner to provide employees with correctly completed documents in accordance with the requirements of Russian legislation. The release of a vehicle onto the line assumes:

- organizing a pre-trip medical examination;

- checking the technical condition of the vehicle before work;

- compliance of officials with qualification requirements.

In some situations, when a large fine is threatened, it is better for the driver to declare that the waybill has been lost. In this case, the enterprise (IP) must have information about the issuance of the document - registration in the waybill register.

Fines under Art. 12.31.1. Code of Administrative Offenses of the Russian Federation

| Administrative offense | Citizens | Officials | Legal entities and individual entrepreneurs |

| Qualification of workers (part 1) | 20,000 rub. | 100,000 rub. | |

| Lack of medical examinations (part 2) | 3,000 rub. | 5,000 rub. | 30,000 rub. |

| Lack of technical inspection (part 3) | 3,000 rub. | 5,000 rub. | 30,000 rub. |

Please note: According to Article 12.31.1. of the Code of Administrative Offenses of the Russian Federation, individual entrepreneurs and persons conducting activities without forming a legal entity bear responsibility on an equal basis with organizations.

Sanctions for absence

Information on the fine for the absence of a waybill for a passenger car and other vehicles provided by law is given in the table.

Penalty table

| Type of violation | Fine for the driver, rubles | Fine for an official, rubles | Fine for the organization, rubles |

| Lack of a permit for a passenger car | 500 (or warning) | 20 000 | 100 000 |

| Lack of a permit for a truck | 500 | 20 000 | 100 000 |

| Lack of waybill for individual entrepreneur (or expired) | 500 | 20 000 | 100 000 |

| Incorrect design | 3000 | 5000 | 30 000 |

| No medical examination stamp | 3000 (or removal from driving the vehicle) | 5000 | 30 000 |

If the car is not used for commercial activities, a voucher is not required. Traveling in a company car on personal business does not provide for the imposition of a fine. Although police officers periodically take a different point of view, and there is a high probability that the case of canceling the fine will be heard in court.

The Code of Administrative Offenses provides for a fine for the driver not having a permit in the amount of 500 rubles under Article 12.3 of Part 2. Punishment in the form of a fine is sometimes replaced by a warning at the discretion of law enforcement agencies.

Individual entrepreneurs are also required to monitor the condition of the vehicle for faults before travel and reflect this information on the travel itinerary. It is completely in vain that some individual entrepreneurs do not take this responsibly enough and consider issuing a voucher an unnecessary material and time expense. Fines for the absence of a waybill for individual entrepreneurs are significant and reach an amount of 100,000 rubles. In particular, a fine for the absence of a truck waybill in the amount of 500 to 20,000 rubles for a vehicle driver and up to 100,000 for an enterprise is provided for in Part 1 of Article 12.31.1 of the Administrative Code.

The fine for the absence of a taxi waybill in 2021 is applied to the responsible person and is imposed in the amount of 20,000 rubles. For taxi drivers, Form 4 is approved by State Statistics Committee Resolution No. 78.

Taxis and trucks that engage in commercial activities use the voucher to reduce taxation, since it justifies the costs of fuel and lubricants and documents this.

Deadline for payment of fine

The payment of the administrative fine is given 60 days from the date of the decision. To save money, use Art. 32.2 hours 1.3. Code of Administrative Offenses of the Russian Federation. According to the regulations, if you make payment in the first 20 days, the amount is halved.

If the notice is received later than twenty days, you can go to court to restore justice. If the fine is large, it is not worth losing this privilege. When the court allows a deferment or payment in installments, you will have to pay the full amount. In these circumstances the discount does not apply.

Advice: Save the details confirming payment until you are sure that the data has been entered into the database. Otherwise, a second notification will be sent. Then you will have to collect evidence of the payment made after the fact.

How and where to pay a fine for a waybill

It is better to pay such fines in the first 20 days to get a discount. Here are the services where debt can be checked and repaid.

"Traffic police fine" . Enter the license plate number, STS and license number and click “Check fines” - the service will show the driver’s debt. Then click “Pay”.

Check the driver information and click “Proceed to Payment”.

Enter your bank card details and click “Pay”.

If you want to regularly check fines for a legal entity, subscribe to the mass verification service.

Public services. To register for the service, select the nearest authorized center and go there with your passport and SNILS. After this, you can select, enter the car data and pay off the debt.

Traffic police website. On the main page, find the “Check fines” banner, click and enter the numbers - car registration and STS. The site will show fines and offer to pay through third-party services. At the same time, a warning will appear that the traffic police is not responsible for paying off fines.