Purchasing a car is a responsible procedure, because... it is difficult to argue with the fact that for most this type of transaction is quite large. People save and save money for a car for months, or even years, which means that proper registration is extremely important.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Of course, if the purchase of a vehicle is carried out at a specialized car dealership, then the document confirming the transfer of funds is a cash receipt.

But what to do when buying a used car second-hand? This is where you will need to prepare an additional document.

What is an advance?

According to paragraph 1 of Art. 487 of the Civil Code of the Russian Federation, advance payment is an advance payment for goods, services, and work against upcoming payments until the transfer of goods, provision of services, or performance of work.

Thus, the advance has the following functions:

- counted against future payments under the contract (payment function).

- serves as evidence certifying the fact of concluding a contract (evidential function). Carrying out actions to pay the advance is considered acceptance of the offer, i.e. consent to conclude a contract.

- is not a way to secure obligations - it does not perform a security function. Therefore, regardless of which party is responsible for the failure to fulfill the obligation, the party who received the advance is obliged to return it.

In the case of real estate, when buying/selling under a contract: if there is no contract, then, in fact, there cannot be an advance. To fix the price, transaction date and other important conditions, you need to conclude a preliminary purchase and sale agreement. An advance payment for an apartment is simply an advance payment, which will simply be taken into account in the full payment for the purchase object.

If the buyer changes his mind, the seller is obliged to return the advance. The only exceptions are cases when the advance agreement contains a clause on compensation for damage due to the failure of the transaction due to the fault of the purchasing party.

In everyday use, “advance” is the name given to depositing money to symbolically confirm the intention. However, it is worth remembering: “advance” does not provide any guarantees, in other words, the fact that the transaction must be concluded on the terms that you agreed on does not depend on the payment of the advance.

All this can lead to quite significant financial losses. For example, the buyer has already spent money on completing the transaction, and the seller at the last moment refuses and returns the “advance payment.” No one will compensate for possible losses to the buyer.

For example, a certain citizen Ivanov signed an “advance” agreement with the seller and transferred 100,000 rubles. Three days before the transaction, the seller stated that he wanted 300,000 rubles more for the apartment. Ivanov could have simply taken the “advance payment”, but he regretted the time and money already spent on registration, evaluation, and so on. As a result, the apartment was bought at an inflated price.

Receipt for receipt of money for house and land

Insist that the owner of the house write in the presence of you and your witnesses. If witnesses are present, be sure to enter their passport details and confirm their signatures. Then it will be impossible to challenge the transaction in the event of a lawsuit if the former owner suddenly decides to claim that the funds were not transferred to him.

- FULL NAME. seller, buyer and passport data;

- The transfer of the entire amount is recorded in numbers with a decoding in parentheses and the purpose of the transfer is indicated;

- Cadastral number, area of the house being purchased and area of the plot;

- Date of transaction and writing of the guarantor;

- Signature of the former owner of the property with transcript.

What is a deposit?

According to clause 1 of Article 380 of the Civil Code of the Russian Federation, a deposit is recognized as a sum of money given by one of the contracting parties in payment of payments due from it under the contract to the other party, as proof of the conclusion of the contract and to ensure its execution.

Based on this, the functions of the deposit are as follows:

- payment – money is transferred towards payments due under the agreement to the other party;

- certifying – money is deposited as proof of the conclusion of the contract

- security - a deposit is made to secure the execution of the contract.

The main purpose of the deposit is to prevent non-fulfillment of the contract.

For example, the parties agree to conclude a contract for the sale and purchase of residential premises. The seller and buyer are interested in completing the transaction and, to ensure the seriousness of the intentions of each of them, agree on a deposit.

The agreement on the deposit must be concluded in simple written form (Article 160 of the Civil Code of the Russian Federation). In this case, the amount of the deposit does not matter, it can be anything!

Failure to comply with the written form of the deposit agreement will entail consequences in the form of recognition of the transferred amount as an advance.

The deposit agreement must contain:

- indication of the specific obligation to secure which the deposit is transferred;

- deposit amount;

- details of the parties to the deposit agreement;

- procedure and timing of deposit transfer.

The consequences of failure to fulfill the contract will be as follows:

- if the buyer is to blame for failure to fulfill the contract, this deposit remains with the seller;

- If p is responsible for failure to fulfill the contract, he is obliged to pay the buyer double the amount of the deposit.

In addition to the deposit, the guilty party is also obliged to compensate for losses caused by failure to fulfill the contract, with the amount of the deposit offset, unless otherwise provided by the contract.

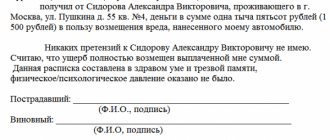

Receipt for receipt of deposit for apartment

The most successful option for recording the fact of transfer of funds as a deposit for the purchased housing, however, is to draw up a deposit agreement with a receipt attached to it for receipt of funds, since the deposit itself implies that the parties to the agreement have a special responsibility when concluding such a transaction.

If the buyer refuses the transaction, the entire amount of the deposit must become the property of the seller. When the refusal to complete the transaction is initiated by the seller, the latter will be obliged to reimburse the buyer twice the amount of the deposit paid.

What is a security deposit

A security deposit is essentially similar to a deposit, but it can contain almost any conditions for return or retention.

The security payment may or may not be refunded in whole or in part, depending on what the parties agreed upon. A security deposit guarantees the fulfillment of any obligations under the contract, and the earnest money serves largely to secure the signing of the underlying sales contract.

A security payment is not used very often, but nevertheless it is a very convenient legal instrument for protecting the interests of both parties.

Receipt Form for Receiving a Deposit for a House

By law, such a purchase and sale agreement is subject to mandatory state registration, for which the parties to the agreement apply to the Rosreestr Office, i.e. to the registration authority. It is important to remember that drawing up a receipt for receiving money does not entail a transfer of ownership of real estate, which is a residential building and a plot of land. A receipt for receipt of funds confirms that the seller has received the specified amount of money.

20…. d. inclusively at the place established by the preliminary agreement, or the principal for signing the agreement for the purchase and sale of Real Estate on the terms established by the preliminary agreement for the purchase and sale of Real Estate), the amount of the deposit in the amount remains with the Seller in accordance with Art.

What is the difference between an advance, a deposit and a security deposit when buying an apartment

When buying an apartment, in order to “book” the property they like, the buyer often makes a cash advance payment with the condition that the seller will not sell this property, otherwise he will be obliged to return the money. Let's look at how the types of prepayment differ from each other and which option is better.

From the point of view of a buyer who wants to retain the right to buy a specific apartment, a deposit is the most interesting and profitable option. It is he who creates the obligations that the buyer requires. In fact, if the owner refuses to sell the apartment to the buyer who paid this amount, he will have to not only return what he took, but also pay the same amount “on top.”

From the point of view of the seller/realtor, an advance payment is best: it can be returned at any time, it does not impose obligations or additional penalties.

A security deposit is convenient for both parties.

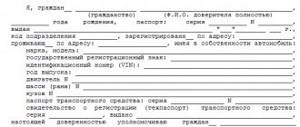

How to Write a Security Deposit Agreement

What must be included in the deposit agreement

- passport details of the seller and buyer;

- information about real estate, all owners and registered persons;

- what amount of money is paid as a security deposit and for how long. If the deal is alternative, it is better to pay the deposit for the same period

- list of documents that need to be prepared: an extract from the house register, certificates of no debt, permission from the guardianship authorities, consent of the spouse if the apartment was purchased during marriage, etc.

- it is necessary to specify how, in what cases and within what period the security payment is returned

- indicate in the agreement the date by which residents must deregister and physically vacate the apartment

IMPORTANT! If you buy an apartment with a mortgage, be sure to include a clause about the bank’s disapproval of the loan or the real estate itself.

The more conditions are specified, the better. Try to be as specific as possible.

How to write a receipt for receiving a deposit for a house and land

Before proceeding with the official part of concluding the transaction, it is worth making sure that the deposit agreement is not perceived as a pledge or an advance, since these terms carry different legal meanings. It is worth noting that the deposit differs in that it is not refundable, with the exception of a double return of its monetary amount in a situation in which the seller violated the terms of the agreement.

- make sure that there is a pre-drafted purchase and sale agreement with information about the procedure for crediting money for a residential building through a deposit;

- you need to check whether all owners appearing in the original papers are present and registered when transferring funds;

- the data in the receipt is written in exact accordance with their spelling in the source documents, taking into account abbreviations, if any;

- The owner writes the document in his own hand, directly in the presence of all interested parties who have the right of shared ownership, including the document filled out by them in accordance with the information about each person’s share.

We recommend reading: Regulated period for losing a passport

Do I need a receipt to transfer money?

It is not necessary to issue a receipt. Most often, a receipt is not issued separately: for convenience, the parties sign for receipt of money in the agreement itself.

However, if you decide to issue a receipt, the following conditions must be met:

- the seller writes the receipt with his own hand in the presence of the buyer, and does not sign it, but rather draws it up in writing. Proving the forgery of a signature is not so difficult, but proving the entire document is much more difficult.

- the receipt must contain: passport details of the parties, amount, basis for transferring money, date, signature of the seller - the same as in the passport.

In what cases is a receipt required?

In legal practice, there are several cases when writing a receipt simply cannot be done without. For clarity, each one should be examined in more detail:

- When making an advance payment. A rather important point, because until the person receives the full amount, the agreement will not be signed and will not come into force. And from this follows many unpleasant variations, as a result of which loss of funds can easily occur.

- Drawing up such a document is also relevant if the seller for some reason is not present at the transaction, and the sale is carried out through a proxy. In this case, the person representing the interests of the seller must clearly draw up a receipt stating that he received funds from the buyer. If there is no such document, then the money may simply not reach the seller, and then legal proceedings will not be avoided. As you understand, without a receipt, it will be almost impossible to prove the fact of transfer of money on your part.

- When selling vehicles that have not been deregistered with the traffic police. Drawing up a document in this case helps the buyer to protect himself if the seller is not the owner of the vehicle. In such a situation, the “unlucky” buyer may also be accused of theft.

- Often the seller insists on specifying a lower amount in the contract, this is especially common among resellers who save on taxes. If such a transaction is terminated, a receipt will help prove that you transferred a much larger amount to the seller.

Can the agreement be oral?

If the deposit agreement is concluded orally, the parties cannot rely on the testimony of witnesses, although they have the right to provide written evidence. If an agreement was drawn up to receive an advance or deposit, then this indicates the existence of an agreement. If doubts arise as to the purpose of the amounts paid under the contract, they will be considered an advance and not a deposit, that is, without the function of security, but only as a share of the payment that was to be made in the future. If the forms of the deposit agreement were violated, the consequences will be the same, unless otherwise proven.