Good afternoon, dear reader.

Currently, there are several ways to transfer ownership of a car. Most often, car owners sell a vehicle using a car purchase and sale agreement.

However, this option is not always the most profitable, because... When selling a car, its owner is forced to pay the appropriate tax.

In practice, there are situations in which you can completely avoid paying tax if you use a gift agreement or deed of gift. We are talking about the transaction of donating a vehicle , which will be discussed within the article.

Paying taxes when donating a car in 2021

To begin with, I would like to note that only a deed of gift for a car concluded between close relatives . This follows from Part 2 of the Tax Code of the Russian Federation (Article 217, paragraph 18):

Income received as a gift is exempt from taxation if the donor and recipient are family members and (or) close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adoptive parents and adopted children, grandparents and grandchildren, full and half (having a common father or mother) brothers and sisters);

Thus, donating a car is not taxable if the parties to the transaction are:

- husband wife;

- father (mother) - son (daughter);

- adoptive parent - adopted person;

- grandfather (grandmother) - granddaughter (grandson);

- brother (sister) - sister (brother) (having at least one common parent).

Please note that in all other cases, when donating a car, the recipient is required to pay a tax of 13 percent of the value of the car.

For example, when donating a car worth 500,000 rubles, the tax amount will be 65,000 rubles.

Note. When receiving a car as a gift, tax deductions are not provided (Part 2 of Article 220 of the Tax Code of the Russian Federation), i.e. Tax will have to be paid on the entire cost of the donated car.

How to give a car to your daughter?

Donate a car

Donation is a free way of transferring property to a new owner.

Usually the fact of donation is not supported by anything other than verbal wording. But in a number of cases, it is necessary not only to notify the recipient orally about the gift, but also to confirm your desire and will in writing.

In order for the transfer of a car as a gift to a daughter, son, or other relative to be recognized as legal, the donor goes to a lawyer and draws up a special document with him - a deed of gift.

The presence of a deed of gift will protect the recipient and the gift itself from attacks from outside, including authorized bodies.

Gifting a car between distant relatives

In practice, there are situations when you need to transfer a car between people who are actually relatives, but are not included in the list of close relatives.

For example, a few common situations:

- mother-in-law (father-in-law) - daughter-in-law;

- mother-in-law (father-in-law) - son-in-law;

- ex-wife - ex-husband;

- common-law wife - common-law husband.

There are several options for completing a transaction with minimal costs:

- Use of a purchase and sale agreement.

- Use of several gift agreements through intermediate close relatives.

For example, let’s say you need to give a car from your mother-in-law to your son-in-law. In this case, the mother-in-law first gives the car to her daughter (a close relative). After this, the daughter gives the car to her husband (also a close relative).

In this case you will have to:

- Draw up 2 gift agreements.

- Contact the traffic police once to register your car.

What is a gift agreement?

A gift agreement is a transaction, the essence of which is to transfer the right to property from the owner to another person. A procedure of this nature is regulated by the rules of Chapter 32 of the Civil Code of the Russian Federation. The parties to the transaction are the donor and the recipient.

Distinctive features of this procedure are:

- Gratuitous. The fact of transfer of property rights does not imply the imposition of any property obligations on the recipient. Simply put, you don’t need to pay money for what you receive, or give anything in return.

- Implementation of the transaction during the life of the donor. If the terms of the agreement provide for the transfer of rights after the death of the owner, then the rules for the execution of a will are applicable.

- Any person can act as a recipient. That is, the parties to the transaction may not have kinship or family ties with each other.

Donating property is quite common because it has a number of advantages:

- unlike a will, this transaction cannot be annulled in court;

- the donated property is not divided upon dissolution of the marriage and family union;

- the procedure for registering a donation is not complicated;

- the donated property cannot be confiscated for the debts of the former owner.

Attention! If the contract contains a promise of a gift in the future, it must be in writing. Otherwise, the transaction will be invalid.

Tax return when donating a car

The recipient must file a tax return only if he received the car as a gift from someone other than a close relative. This follows from Article 228 of the Tax Code of the Russian Federation:

1. The calculation and payment of tax in accordance with this article is carried out by the following categories of taxpayers: ... 7) individuals receiving from individuals who are not individual entrepreneurs income in cash and in kind by way of gift, except for the cases provided for in paragraph 18.1 of Article 217 of this Code, when such income is not subject to taxation;

So, when giving a car as a gift to a close relative, you do not need to file .

Obviously, the operation of donating a car makes sense only when it is carried out between close relatives. In all other cases, I recommend using the purchase and sale scheme.

Let me remind you that when buying or selling, the tax will be paid by the seller, but its amount may be significantly less than when making a gift, because You can take advantage of the tax deduction. Well, if you own a car for more than 3 years, no tax is paid at all.

In what case do you not need to pay income tax?

Agreement for registration of donation

Before registering a deed of gift for a car, it is necessary to properly draw up the agreement. In accordance with paragraph 2 of Article 574 of the Civil Code of the Russian Federation

A donation agreement for movable property must be made in writing in cases where: the donor is a legal entity and the value of the gift exceeds three thousand rubles (as amended by Federal Law No. 280-FZ of December 25, 2008)

Form of car donation agreement between relatives

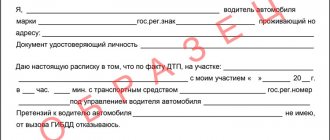

Let's proceed directly to the execution of the car donation agreement . Deed of gift form in the form of images (click to enlarge):

You can also find a car donation agreement in the form of a pdf file here.

Car donation agreement form

Tweet

Note. The deed of gift does not need to include information that the parties to the transaction are close relatives. Traffic police officers are not interested in this issue.

Can the recipient of the gift refuse the car deed of gift issued to him?

Until the actual transfer of the car and its registration with the owner (donor), anything can happen. In the event of his death, the rules of inheritance law come into force.

If you are the heir of the first stage, then you don’t have to worry about the fate of the car. The only thing is the fact that other heirs of the first priority will claim it in equal shares. However, if the car was donated to a complete stranger, and he did not have time to register the right with the traffic police, then the heirs can begin the process of canceling the gift agreement.

The heirs have the right to begin such a process in any case. There must be very good grounds to file a claim. For the donee, there is only one way out - to confirm in court his right to the car, citing the fact that the former owner signed the agreement in his right mind, without coercion, and being in a capable state.

The list of grounds for canceling a donation is contained in clause 5 of Art. 582 and art. 584 Civil Code of the Russian Federation. Among the main reasons why you can revoke a deed of gift:

- attempt on the life and health of the donor and/or his relatives;

- making a donation by a legal entity at the expense of business funds in circumvention of the Bankruptcy Law;

- improper treatment of the object of donation by the recipient;

- misuse of a gift, if it is donated property;

- if the donor survives the recipient (such a condition must be included in the content of the contract);

- other terms of the donation agreement.

Legal practice shows that despite the norms and conditions for the cancellation of deeds of gift specifically prescribed in legislation, in reality it is quite difficult to prove violations.

But if this is successful, then the consequence of the cancellation of the gift agreement is the return of the parties to their original position - that is, the donor again acquires the right to own the donated property. If the recipient does not have the opportunity to return the property, he compensates for its value in monetary terms.

Sample car donation agreement

In principle, it is quite simple to issue a deed of gift for a car, even without special knowledge. However, I recommend using a sample car donation agreement so as not to miss or confuse anything:

Sample agreement for donating a car to a relative in pdf format:

Sample deed of gift

In what cases is it recommended to issue a deed of gift?

A deed of gift is drawn up if necessary:

- securing the recipient's sole rights to property (if the daughter is married, the car given to her will not become part of the common property, and therefore will not be taken away during its division);

- avoid problems with the law (the car is the personal property of the recipient, therefore, if the daughter’s spouse has problems with the law, he goes bankrupt or owes a large amount of money, the car cannot be taken away by including it in the general bankruptcy estate at the end of the bankruptcy procedure).

If the daughter (son) is not the only child in the family, then in the event of the death of the father, other relatives - mother, brothers and sisters - will not be able to claim the car given to her.

How to issue a deed of gift for a car in 2021?

Let's consider point by point how to issue a deed of gift for a car:

1. At the beginning of the gift agreement, you must indicate the city of the transaction, its date, as well as the full name of the donor and the full name of the donee (detailed details of the parties will be filled in a little later).

2. In paragraph 1.1. You must provide as complete information as possible about the vehicle.

3. In paragraph 2.1. The deed of gift should include the address of the place where the vehicle is transferred to the donee.

4. Clause 2.2. required to be filled with additional things and items that are donated along with the car.

For example, these could be documents for a car and a set of winter tires.

5. In Section 4 of the agreement, it is necessary to enter complete information about the parties to the transaction (their passport details).

6. After the car donation agreement has been drawn up in triplicate, each participant in the transaction must sign in the appropriate field.

7. After handing over the keys to the car, the recipient must also sign in the “received the car” column.

Donating a car to a close relative - procedure

How to give a car to a close relative? In general, the whole procedure boils down to the following steps:

Stage 1. Prepare the documents that will be needed to complete the transaction:

- documents for the car: vehicle passport (PTS), vehicle registration certificate (VRC), MTPL insurance policy and others;

- power of attorney to complete a transaction if the donor acts through a representative;

- parental consent if the recipient of the gift is a minor.

Stage 2. Draw up and sign a gift agreement. There is no set form for this document.

The form for a car donation agreement between close relatives can be downloaded below.

Stage 3. Register the car with the traffic police.

Let's take a closer look at each stage.

Documents for the car

Documents for the car will be required not only to conclude a vehicle donation agreement between close relatives, but also to register it with the traffic police:

- Technical Product Passport (PTS). It will need to be transferred to the new owner. If the PTS is electronic, it will contain information that the car has a new owner.

- Vehicle Registration Certificate (VRC). The recipient submits the document to the traffic police. After registration, an STS is issued to the new owner.

- If design changes have been made to the car, then the documents (PTS and STS) must have a mark on the re-equipment and a brief description of the changes made (Resolution of the Government of the Russian Federation “On approval of the Rules for making changes to the design of wheeled vehicles in use...” dated 04/06/2019 No. 413).

- OSAGO insurance policy. The new owner must obtain his own insurance (before registering the vehicle). When registering a car, the policy does not have to be taken to the traffic police - the employee can find the document in the electronic database. But it wouldn’t hurt to have a paper copy with you.

Agreement to donate a car to a close relative in 2021

As mentioned above, the Civil Code of the Russian Federation does not oblige a car donation agreement between close relatives to be made in writing. However, to register a vehicle under the new owner, a written document must be submitted to the traffic police. Notarization of the deed of gift is not required; the signatures of the parties to the transaction are sufficient. But if the parties are not ready to draw up the document themselves or the donor wants to give the transaction special significance, then you can resort to the services of a notary office.

Note! When preparing documents with a notary, the parties will have to incur additional costs in the form of state fees and expenses for notary services.

A deed of gift for a car is similar in structure and content to any other deed of gift. It should contain the following information:

- Passport details of the parties.

- Date and place of document preparation.

- Information about the subject of the contract - a car according to PTS and STS: make, model;

- type (passenger car, truck, special);

- state sign;

- VIN;

- year of issue;

- numbers of engine, chassis, body (if any);

- color;

- PTS and STS numbers (with date and place of issue).

- Information about transferred documents and things:

- PTS;

- STS;

- keys.

- Conditions for the acceptance and transfer of vehicles, documents, keys.

- Signatures of the parties with transcripts.

Note! Often the reception and transfer of keys and documents are recorded in the act. But this is not necessary - you can include this condition in the contract.

The deed of gift is drawn up in 3 copies: one for the parties and the traffic police. You can view a sample car donation agreement between close relatives on our website.

Is it necessary to indicate the cost of the car in the contract?

There is no need to indicate the cost of the car in the contract; this information is optional .

However, in practice the following cases sometimes occur. The traffic police officer, who did not find anything to complain about, tells the driver that the contract is invalid, because it does not indicate the cost of the car. In this case, there are 2 options:

- Immediately file a complaint with a higher-ranking official at the traffic police.

- Just add the cost of the car to clause 1.1 of the contract.

The case is extremely rare, but you also need to be prepared for it.

How to register a car in your wife's name using a deed of gift

When concluding a written gift agreement, both parties can be legal entities or individuals. The only thing is that an agreement cannot be concluded if one of the parties is incapacitated or has limited legal capacity, and if a legal entity takes part in the agreement, then it must be legally capable.

And the main condition for concluding a transaction is the donor’s ownership of the donated car; accordingly, someone else’s car cannot be given as a gift. It should also be noted that it is impossible to limit the donee’s property rights, i.e. prohibiting the sale of a car, donating it, etc., however, other conditions that do not limit the right of ownership and do not impose obligations on the donee to the donor are possible. For example, a contract may come into force after the completion of any event, it could be a wedding, successful completion of studies, etc.

The essence of giving

A deed of gift for a vehicle is an important document for the new owner of a car . Based on it, he will be able to carry out all necessary financial transactions without the participation of the previous owner.

It is for this reason that the gift agreement, as a standard document, must be certified by a notary.

After all the necessary documents have been prepared, all the nuances have been agreed upon, a contract that is competent from a legal point of view is drawn up.

The following points should be indicated in his body:

- passport details of all parties;

- information about the vehicle;

- vehicle registration certificate number;

- date of the transaction;

- date and signatures of the donor and guarantor.

The process of drawing up an official contract for the gift of a car without papers confirming ownership of the vehicle will not be possible.

The main supporting document is the legal registration certificate of the vehicle.

A contract for donating a car to a loved one must be carried out based on a certain sequence of actions.

Initially, the car is removed from the official register with the traffic police, then an agreement is drawn up indicating information about the car, as well as contact information and details of all parties.

After signing the contract, the new owner registers the car, and this will need to be done within 120 hours from the signing and certification of the document.

The process of certifying a gift agreement does not fall into the category of necessary actions. This is done just in case, so that if necessary, all issues that arise can be quickly resolved.

To carry out certification, both parties to the transaction must provide passports and a vehicle registration document. As an addition, you can issue a certificate indicating the cost of the vehicle.

This paper can be provided by modern insurance companies, as well as organizations that specialize in providing professional technical servicing of cars. Such a company must have a special license to conduct such processes.

The act of acceptance and transfer of a car under a gift agreement

The act of acceptance and transfer of the car is a document that records information about the moment and full composition of the property transferred as part of the deed of gift for the car.

The law does not provide for the mandatory preparation of such a document. As a rule, it is prepared to solve the following problems:

- serves as evidence that the car was actually transferred to the donee

- it records the date of transfer of property

- expresses the absence of claims between the parties to the transaction (in controversial situations)

As a rule, the act of acceptance and transfer of a car within the framework of a deed of gift has a standard content. Includes the following sections:

- Details of the deed of gift, date and place of execution of the transaction.

- Full names of both parties.

- Comprehensive characteristics of the vehicle.

- A mark indicating that the car fully corresponds to its mileage and year of manufacture.

- List of documents that the donor gave to the recipient along with the car (PTS, STS, service book, etc.)

- List of components and tools supplied with the machine (fire extinguisher, first aid kit, jack, etc.).

- A note that the parties have no claims against each other.

At the end of the document, each party must indicate the date of receipt/transfer of the vehicle and put their signature.

Registration of a car received through the donation procedure

Registration of a car consists of registering it with the traffic police department. The car must be registered within 10 days from the date of the transaction.

To register, the new owner of the car must submit the following documents to the traffic police department:

- application for vehicle registration;

- your passport;

- gift agreement;

- receipt of payment of state duty;

- MTPL insurance policy;

- documents confirming the presence of family ties between the parties to the agreement (when a transaction is made by relatives).

If the car is owned for less than three years

Close relatives will also have to pay tax if they decide to sell a car that has been owned for less than 3 years.

Tax on a gift of a car will not be charged until 36 months have passed from the date of taking ownership.

If you need to sell a car urgently, paying tax cannot be avoided, but there are a couple of methods on how to reduce the amount of accrued tax.

Using a tax deduction

The recipient, who decided to sell the vehicle earlier than this time period, can use the standard property deduction, which currently amounts to 250 thousand rubles, to reduce his expenses.

In other words, if a person who received a car as a gift sells it before three years and at a cost of more than 250,000 rubles, then from the difference received from the sale amount and deduction, he will pay 13% to the state treasury.

To understand whether you need to pay tax under a car gift agreement and how it will be calculated in such a situation, it is worth considering the following situation.

For example, a father gave his car to his son in 2021, and the son decided to sell it the next year for 1,300,000 rubles. The son has the right to use a tax deduction, that is, pay tax on the difference of 1,300,000 - 250,000) * 13% = 136,500 rubles.

Decrease in profit received

If you need to reduce the tax on the gift of a car between relatives, you can go by reducing the profit received from the sale at the expense of expenses that were incurred during the operation of the car.

This may be a waste of money on car repairs, as well as on its improvement. In this situation, all additional expenses must be confirmed by receipts and checks.

The tax here is paid on the difference between the profit received from the sale of the car and the expenses incurred.

If, as a result of calculations, it turns out that the funds invested in the car significantly exceed the profit, the owner will be completely exempt from paying tax.

Car registration: do you need to go to Rosreestr?

There is no need to register the donation of a car with Rosreestr. This is not an apartment, which in this department, after donation, is necessarily re-registered to the new owner. Re-registration of a car and payment of the state duty are carried out at any registration department of the State Traffic Inspectorate of the Russian Federation. The entire procedure takes no more than three hours. This norm is established by law.

The law does not prohibit registration from being carried out by an authorized person. In addition to the main documents, you will also need a copy of the power of attorney; the registrar will take it for himself. The power of attorney itself is signed by the principal himself and certified by a notary office.

Is it possible to register a car through State Services?

It will not be possible to carry out the entire registration procedure on the public services portal. Here you can only submit an application to register a vehicle that has not yet been registered with the traffic police, change information about the owner of the car, and deregister the vehicle. Actions are available only to those citizens who have registered on the portal and passed personal identification. Regular registration is not enough to work with the portal.

After logging into your personal account on public services, go to the vehicle registration tab. We choose one of three categories: registration, deregistration, change of data. We fill in all required fields of the electronic application form. We enter information about the document due to which the data changes - about the gift agreement. We indicate the car insurance policy details. We choose a time at which it is convenient to drive up to the traffic police station to complete registration.

Do I need to get it certified by a notary, how much does it cost?

In Chapter 32 of the Civil Code of the Russian Federation, which regulates the relationship between the donor and the recipient, notarization of a deed of gift for a car is not a prerequisite. It is drawn up in simple written form and signed by both parties. The only exception is when the donor is a minor or incompetent person.

Thus, the parties can contact a notary if they wish. This service is not free and includes two main cost items:

- payment of state duty in accordance with the tariffs approved by law (this issue is described in more detail below)

- notarial actions - preparation of the text of the deed of gift, consultation, verification of some additional facts, etc. For such services, each notary sets the price independently.

The table below shows the prices for notary services (regarding the preparation of deeds of gift), valid in different cities of Russia.

| City | Cost of the service for registration of deed of gift, rubles |

| Moscow | from 4 to 11,000 |

| Saint Petersburg | from 5000 |

| Novosibirsk | from 3000 to 7000 |

| Ekaterinburg | from 2000 to 5,000 |

| Nizhny Novgorod | from 2000 to 6000 |

Separately, it is worth noting that many notaries, when setting the cost of the service for issuing a deed of gift, also apply a certain percentage of the market value of the car to the base price. Typically it varies between 01-03%.

Restrictions and conditions of the transaction: in what cases can a deed of gift not be issued?

Before you decide to give, you need to know who can give and who is prohibited by law (Art.—GKRF). There is no point in violating the current norms; the deed of gift is simply recognized as insignificant, and the gift will be returned back.

- Only an adult, legally capable owner of this property who has the appropriate documents for it has the right to donate any property.

- The legal representative of a minor or incapacitated person does not have the right to make a gift on his behalf.

- You cannot give your car to officials, municipal and civil servants.

- It will not be possible to sign an agreement to donate a car from one commercial organization to another.

Criteria for the legality of donating a car

The donation transaction is concluded only by mutual agreement of the parties and exclusively free of charge. No coercion is allowed. (.) The vehicle must not be encumbered: under arrest, pledged to a bank, etc. Is the donor married? Without the consent of his wife, he has no right to dispose of jointly acquired property. If the husband formalizes the donation of a car that is in common ownership, and the wife finds out about it after the fact, she will challenge the donation in court and the deal will be annulled. Does the car belong only to the spouse: was it given as a gift or inherited? There is no need to ask anyone.

The car donation agreement must be drawn up only in writing. It is not necessary to have it certified by a notary. Donation is also allowed by a trustee, if the latter has such a right, registered in a notary's office. After signing the deed of gift, you must register the car to the gift recipient within ten days. Otherwise you will be fined.

Only after the new owner is officially entered into the 2021 vehicle passport, the new owner can sell, give to someone else, or bequeath his car. Only a court can cancel a donation if there are compelling reasons for doing so.

Donating a car to a relative

Giving a gift - giving a car to a loved one is similar in procedure and content, terms and requirements to giving a gift to strangers. The agreement is drawn up and signed by all participants, after which the transfer of the right to the vehicle is registered with the traffic police. There is only one difference: half-relatives do not pay tax for enrichment through an accepted gift. Of all the expenses - only expenses for paperwork. The donor must remember that if he decides to immediately sell the car received as a gift, he will be charged a thirteen percent personal income tax, since he will receive income from the sale. It’s better not to rush and wait three years. The sale of property after three years of ownership is not subject to tax.

Gift to a minor child

Registration of a deed of gift for a child differs from a standard gift in that another participant appears in the case - the legal representative of the minor. He must make sure that the donation does not infringe on the rights of his ward.

We will answer your question in 5 minutes!

Gift between distant relatives

The views of the average person and the law on close kinship often do not coincide. According to the law, the closest relatives are parents (adoptive parents), children, including adopted and non-consanguineous ones, brothers and sisters, grandparents and grandchildren. Everyone else is distant, and they pay gift tax, unlike close ones.

How to avoid the need to share with the state when giving, for example, a nephew to an aunt? Option one: make two consecutive donations. The first donation is when a nephew donates a car to his mother, his aunt’s sister. The second donation - my mother writes a deed of gift for my sister. Woo-a-la! Nobody pays tax.

The nuances of donation between an organization and an individual

The organization has the right to gift an employee with a car. Such an agreement orally is not permitted. The paper is registered with the traffic police, adding a new owner to the PTS, who pays thirteen percent personal income tax to the country's budget.